HW 3

1/27

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

28 Terms

A café earns $200,000 in annual revenue. Costs, including rent, utilities, and wages, total $120,000. If the café owner would earn $50,000 per year by working for other jobs, what are the economic profits?

30,000

Hyeonjin buys a laptop at $1,000 and his surplus is $200. What is Hyeonjin willing to pay for the laptop?

$1,200

$1,300

$1,100

$1,000

1200

We can say that the allocation of resources is efficient if

consumer surplus is maximized.

producer surplus is maximized.

sellers' costs are minimized.

total surplus is maximized.

total surplus is maximized.

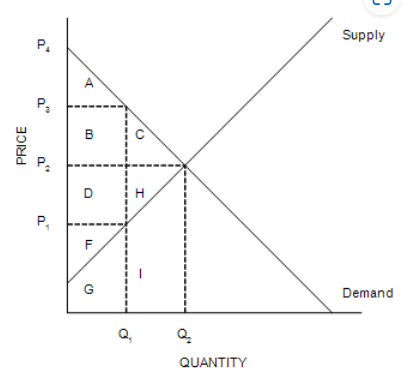

At equilibrium, consumer surplus is represented by the area

A+B+C+D+H+F.

A+B+C.

D+H+F.

A.

A+B+C.

A buyer is willing to buy a product at a price greater than or equal to their willingness to pay, but would refuse to buy a product at a price less than their willingness to pay. TRUE OR FALSE

false

If Jay values a ball at $40, and he pays $40 for it, consumer surplus is $80. TRUE OR FALSE

FALSE

Producer surplus is the cost of production minus the amount a seller is paid. TRUE OR FALSE

FALSE

An increase in price increases consumer surplus. TRUE OR FALSE

FALSE

A tax levied on the sellers of a good shifts the

demand curve downward by the size of the tax.

demand curve upward by the size of the tax.

supply curve downward by the size of the tax.

supply curve upward by the size of the tax.

supply curve upward by the size of the tax.

When a tax is imposed on a good, consumer surplus decreases and producer surplus remains unchanged. TRUE OR FALSE

FALSE

A tax on a good causes the size of the market to shrink. TRUE OR FALSE

TRUE

Demand curve is Qd = 10 - P and supply curve is Qs= P. Due to $2 tax, supply curve moves to left, as a result, supply curve after tax is Qs(Tax)= P - 2. What is the tax revenue?

8

When the government imposes taxes on buyers and sellers of a good, society loses some of the benefits of market efficiency. TRUE OR FALSE

TRUE

A tax on a good causes the size of the market to shrink. TRUE OR FALSE

TRUE

As the size of a tax increases, the government's tax revenue rises always. TRUE OR FALSE

FALSE

Taxes create deadweight losses. TRUE OR FALSE

True

The decrease in total surplus that results from a market distortion, such as a tax, is called a

wedge loss.

deadweight loss.

consumer surplus loss.

revenue loss.

deadweight loss

The government's benefit from a tax can be measured by

consumer surplus plus producer surplus.

consumer surplus.

producer surplus.

tax revenue

tax revenue

When a tax is imposed on the buyers of a good, the demand curve shifts

downward by the amount of the tax.

upward by the amount of the tax.

downward by less than the amount of the tax.

upward by more than the amount of the tax.

downward by the amount of the tax.

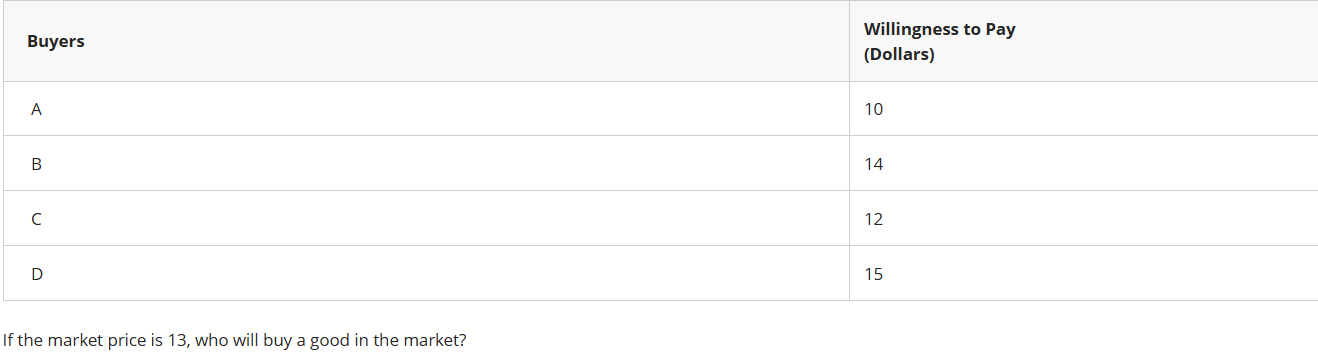

If the market price is 13, who will buy a good in the market?

C and D

B and C

B and D

A and C

B and D

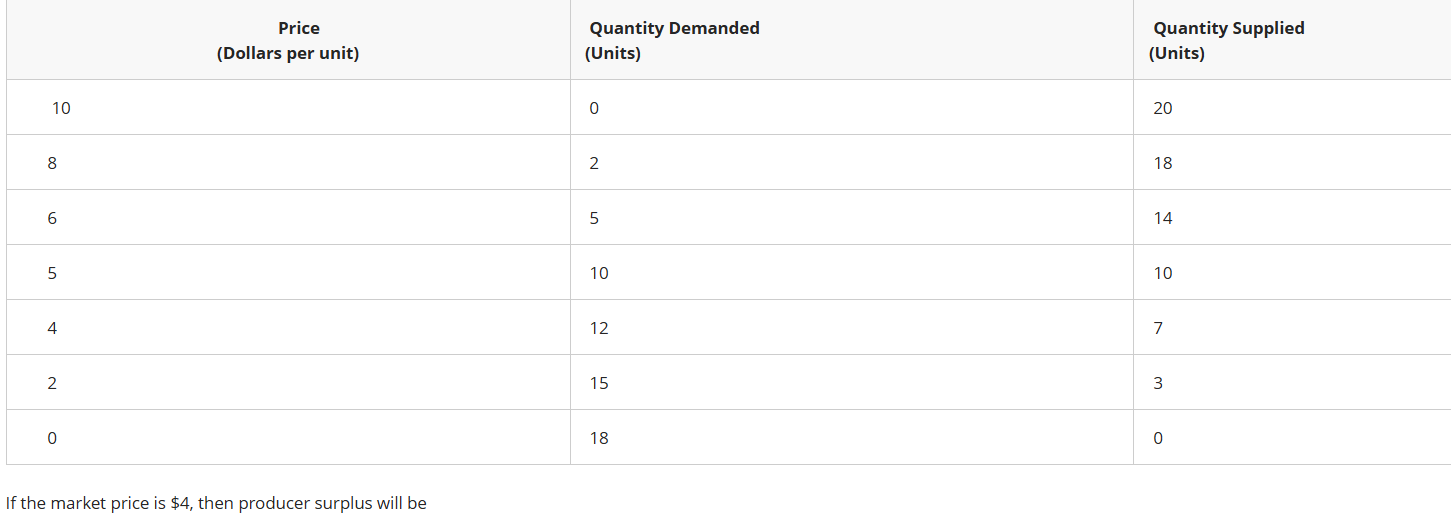

If the market price is $4, then producer surplus will be

$18.

$24.

$14.

$25.

14

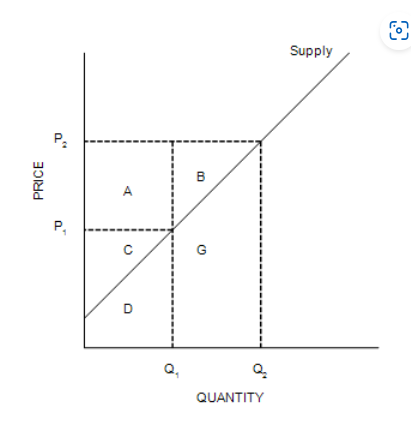

If the price increases from P1 to P2, producer surplus

decreases by an amount equal to C.

decreases by an amount equal to A+B.

increases by an amount equal to A+B.

Increases by an amount equal to A+C.

increases by an amount equal to A+B.

Producer surplus is

the market price minus willingness to sell.

willingness to buy minus the market price.

the market price plus the cost of production.

willinegess to sell minus the cost of production.

the market price minus willingness to sell.

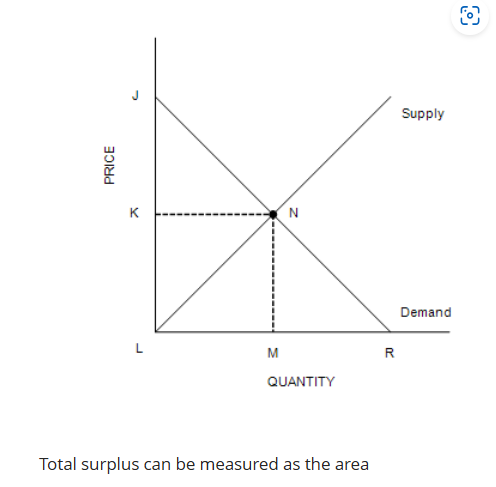

Total surplus can be measured as the area

JNK.

JNL.

JRL.

JNML.

JNL

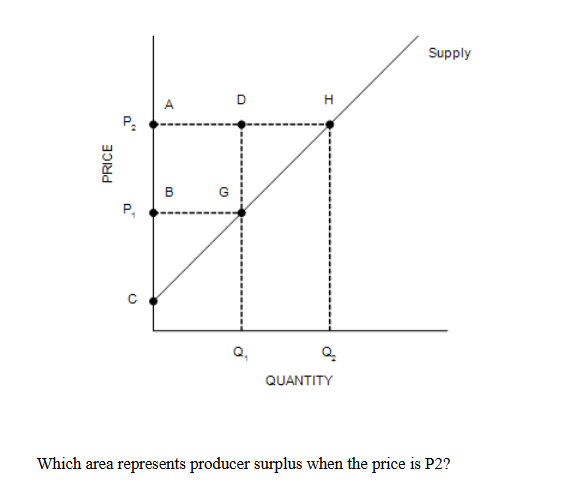

Which area represents producer surplus when the price is P2?

BCG

ACH

DGH

ABGD

ACH

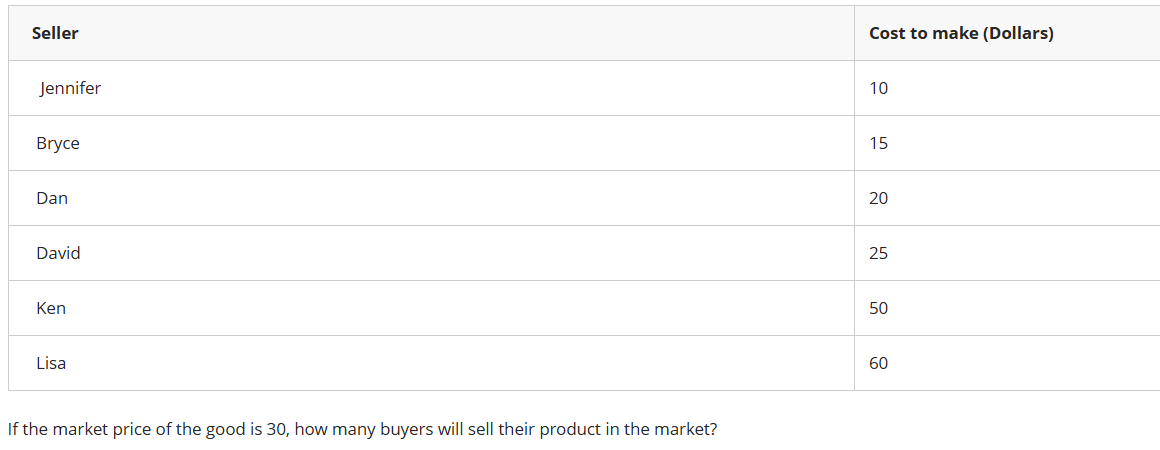

If the market price of the good is 30, how many buyers will sell their product in the market?

3

5

4

2

4

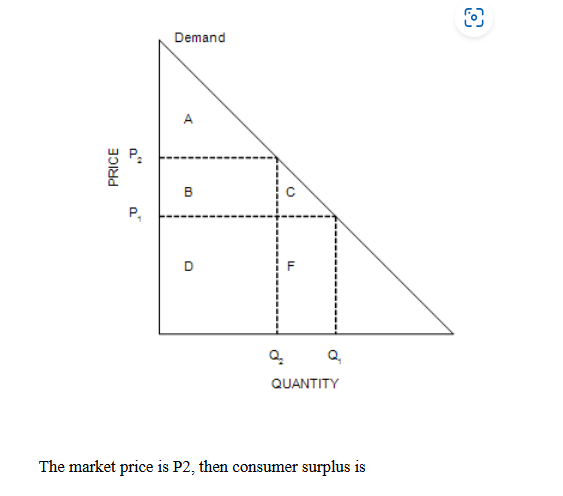

The market price is P2, then consumer surplus is

A+B+C

A.

A+B+D.

A+B.

A

Demand curve is Qd = 10 - P and supply curve is Qs= P. What is the total surplus?

25