Microfinance W9

1/21

Earn XP

Description and Tags

Risk Management

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

22 Terms

Risk

possibility of something bad will happen

this can be controllable or uncontrollable

things will go unplanned

any outcome that is uncertain.

Risk Management

measurement and the control of risks (expected & unexpected changes) in order to price the investment correctly and to reduce losses determined by changes in future events or outcomes

Why does risk management matter in MF?

more complex as it offers diverse products and services

need for sustainability

growing competition because some traditional banks also approach the customers like MF

ethical responsibility as they’re willing to take a risk that’s why the interest rate is high

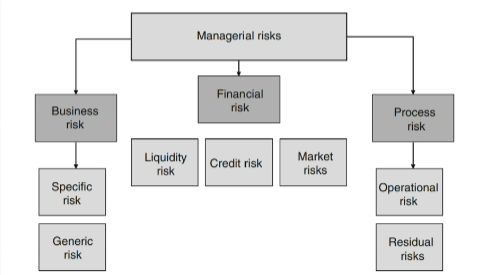

Taxonomy of Risks

Business Risk

Specific Risk

Generic Risk

risk comes from the microfinance activity itself

example of this: nasira yung equipment, hindi nagbayad yung customer mo

Financial Risk

Liquidity Risk

Credit Risk

Market Risk

risk that comes from how you manage your money

example: don’t have enough cash

Process Risk

Operational Risk

Residual Risk

risk that comes from how you run your microfinance business

example: problem within the organizational structure or staffing

Specific Risk

product

low level of standardization in terms of

geographical context

beneficiaries

product and services

Generic Risk

environment (broader sense)

location and development policy:

financial policy

fiscal policy

regulatory policy

juridical environment

Business Risk Management

Single project - small MFIs with one branch

provisions for future losses

risk sharing

MFIs - multiple branches

provisions for future losses

portfolio diversification - lend different borrowers in different location

risk sharing

LIquidity Risk

risk of not having enough cash on hand to meet your obligation

causes:

expected changes - predictable

unexpected changes - unpredictable

Credit Risk

risk that borrowers won’t repay their loans

types:

expected loss - average amount of loss that is expected to have

unexpected loss - risk is higher than expected

Market Risk

risk that changes in the market that will negatively impact your finances

types:

interest rate risk

currency risk

Liquidity Risk Management

Single Project Approach

simpler cash flow

focus on timing

limited options

Pool of Funds Approach

more complex cash flow

balancing act

more tools

Credit Risk Management

Single Loan

Loan Portfolio

CRM - Single Loan

EL

creditworthiness analysis:

qualitative credit

scoring models

risk sharing

UL

monitoring process risk transfer

CRM - Loan Portfolio

EL

creditworthiness analysis

portfolio size

risk sharing

UL

monitoring process

portfolio size

portfolio diversification

risk transfer

Market Risk Management

Micro-Hedging - smaller projects

Macro-Hedging - larger MFIs

Operational Risks

internal factors

process

people

system

external events

legal risks

coup d’etat

others

Residual Risks

external events not included in operational risks:

catastrophic risks

terrorist risks

reputational risks

Process Risks Management

Auditing Procedures

Risk Sharing

Hedging

risk management strategy to offset losses in investments by taking an opposite position in a related asset