SPTE 440

1/24

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

25 Terms

Financial Statments

The primary source of information used to evaluate the financial health and performance of an organization.

Balance sheet

Income statement

Statement of cash flow

Balance Sheet

A picture or snapshot of the financial condition of an organization at a specific point in time.

Assets

Liabilities

Owners equity

Income Statement

Also called a statement of earnings, operating statement, or profit-and-loss statement. Shows the organizations income (or loss) over a specified period of time, often on an annual or quarterly basis.

Statement of Cash Flows

Tracks the actual movement of cash into and out of an organization over a period of time. Provides a simpler explanation of cash generated and spent.

Operating activities

Investing

Financing

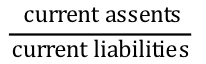

Current ratio

The organizations ability to meet its current liabilities (those due within a year) with its current assets

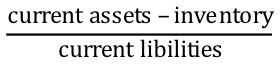

Quick ratio

The organizations ability to meet its current liabilities with current assets other than inventory

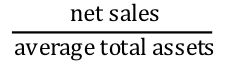

Total assets turnover ratio

How efficiently the organization is utilizing its assets to make money

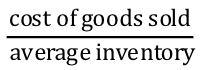

Inventory turnover ratio

How often the organization sells and replaces its inventory over a specified period of time

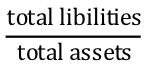

Debt ratio

How the organization finances its operation with debt and equity

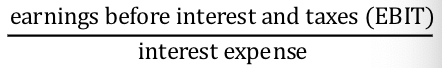

Interest coverage ratio

The organization ability to pay the interest on its debt owned

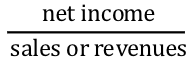

Net profit margin

The percentage of the organization’s total sales or revenues that was net profit or income

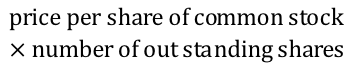

Market value

An estimate of the organization s worth according to the stock market

Price-to-earnings ratio

An estimate of how much money investors will pay for each dollar of the organizations earnings

Sole Proprietorship

One single owner and the most common business structure.

Advantages:

Easy to form, manage, and sell

Low startup cost

Total control by a single owner

No shared profits

Disadvantages:

Limited ability to raise capital

Owners take on all losses

Unlimited personal liability against the owner

The owner must be multi-talented

Limited long-term stability for employees

Example: Small fitness studio

General Partnership

An equal division in ownership. Owners share business operation and management. They also share profits and liabilities.

Advantages:

Revenues are taxed only core

Flexibility

Enhanced decision making

Easy to form and sell

Disadvantages:

Liability is significant

The ability to raise capital is limited

Possible limited managerial capability

Example: Local law firm — similar to a sole proprietorship

Limited Partnership

Same as a general partnership, except the one owner acts as the decision maker, and the rest of the owners provide only financial support

Advantages:

Revenues are taxed only core

Flexibility

Enhanced decision making

Easy to form and sell

Disadvantages:

Liability is significant

The ability to raise capital is limited

Possible limited managerial capability

Example: Fitness club — One owner has a greater “working knowledge”

C-Corporation

Must comply with state laws based on the state in which it is headquartered. They must develop and follow corporation bylaws. “Shareholders” are owners of the corporation and expect to see a return on investment through dividends. The Board of Directors determine police of the corporation and issue stock.

Advantages:

Liability protection for shareholders

Ownership interest easily transferable

Easier ability to hire talent

Disadvantages:

Double taxation

Complex to legally form

Corporation answers to shareholders

More stringent government regulation for corporations relative to previous examples

S-Corporation

Can have up to 100 shareholders, own subsidiaries, are tax-exempt organizations, and issue stock. Has seen a reduction in popularity as a business structure.

Advantages:

No double taxation for shareholders

Ability to own other companies

Disadvantages

Must be based in the United States

Limited potential sources of income

Limited Liability Corporation (LLC)

Raising in popularity, mainly due to simplicity of formation. Formed based on state guidelines and can be owned by other corporations.

Advantages:

Classified as a partnership for federal tax purposes, which reduces overall income tac payments

Similar liability protections as seen in corporations

Disadvantages:

New in nature, so legal issues are determined by state laws, which vary

Example: Any conceivable type of sports-based business

How is public funding awarded?

The majority of public stadoum subsides have come from political legislation with no public vote.

1) Politicians can simply legislate a public stadium subsidy for a franchise

2) The potential for the award of the public subsidy can be placed up for public vote

Since 200

50 publicly funded projects awarded using legislation

15 stadium subsidy projects brought to a public vote

Public vs. Private Financing

Team owners are being subsidized by local governments (indirectly though taxpayers/consumers) by having their venues paid through public (taxpayer) contributions.

Why?

Local governments feel pressure to keep the franchise in their local market

Fans do not want their local team to move

Politicians do not want to be “the one in office” when the team decided to relocate

Public Financing

Contribues through:

Higher property taxes

Higher standard sales taxes

Additional new taxes on specific items (tax rate essentially increases)

Rental car tax

Alcohol tax

Tobacco tax

Gaming tax

Diversion of taxes from the general fund to the stadium construction fund

City/state simply takes funds from the reserve to help pay for a new venue

The “Arms Race” Argument

It is commonly accepted that Athletic Directors are caught in an expenditure arms race in an effort to outspend each other. The arms race logic states that there is only one winner and the rest of the participants in the contest are financial losers.

Suggest inefficiency and financial waste

Suggest less then optimal welfare for participants

Originates from the Cold War

How do you account for income from interest and dividents?

1) Businesses can earn income from interest payments received from collecting on dividends.

2) Income from interest receives is counted as ordinary income.

3) Income from dividends (received by a corporation) are subject to 70% exclusion for tax purposes and the remaining 30% is added to ordinary income and is taxable.

Depreciation

A tax loophole that is important from both the individual and firm perspective. This is a common term for the loss of capital value over time. Is considered an operational expense or a cost of doing business.