Macro Unit 2: Economic Indicators and the Business Cycle

1/68

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

69 Terms

GDP

C + I + G + (X-M)

GDP Deflator

(nominal GDP/real GDP) x 100

GDP per capita

GDP/population

Labor force participation rate

(Labor force/population age 16 and older) x 100

Unemployment rate

Number of unemployed workers/ Labor force ) x 100

Actual Unemployment

Natural Unemployment + Cyclical Unemployment

Natural Unemployment

Frictional Unemployment + Cyclical Unemployment

Inflation rate

(Price level Year 2 - Price Level Year 1)/Price level year 1) X 100

Price Index in Year Y

(Cost of Market Basket in Year Y )/Cost of Market Basket in Base Year) x 100

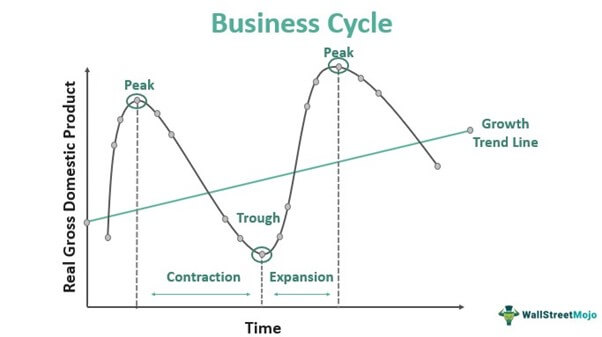

Business Cycle Graph

National income and product accounts

keeps track of the flows of money among different sectors of the economy

Product Markets

Where goods and sercices are bought and sold

Consumer Spending

household spending on goods and services

Factor markets

where (capital and labor) are bought and sold

Government Spending

total expenditures on goods and services by federal state and local governments

Taxes

required payments to the government

Tax revenue

total amount of funds the government receives from taxes

Disposable Income

equal to income + government transfers - taxes

Government Transfers

payments that the government makes to individuals without expecting a good or service in return

Private Savings

equal to disposable income minus consumer spending, is a houeholds disposable income that is not spend on consumption

Financial Markets

channel private savings into investment spending and government borrowing

Government Borrowing

amount of funds borrowed by the government in the financial markets

Investment Spending

spending by firms on new productive physical capital, like machinery and structures or changes in inventories

Inventories

stocks of goods and raw materials

Exports

goods and services sold to other countries

Imports

Goods and services purchased from other countries

Gross domestic product

total value of all final goods and sercices produced in the economy during a given year

Expenditure approach

the sum of consumer spending, investment spending, government purchases of goods and services, and exports, minus imports

Income approach

adds up the total factor income earned by households from firms in the economy, including rent, wages, interest, and profit

Value Added approach

surveys firms and adds their indivual contributions to the value of each good and service

Final goods and services

Goods, and services sold to the final or end user

Intermediate goods and services

bought from one firm by another firm to be used as inputs into the production of final goods and services

Net exports

the difference between the value of exports and the value of imports OR (X-M)

Employed

Currently holding a job in the economy - full or part time

Unemployed

Actively looking for work but arent currently employed

Discouraged Workers

Nonworking people who are capable of working but have given up looking for a job due to the state of the job market

Underemployed

workers who would like to work more hours or are overqualified for their jobs

Frictional Unemployment

Unemployment due to the time it takes to get a new job

Structural Unemployment

unemployment because workers lack the skills required for the available jobs OR more people seeking jobs in a labor market than there are jobs available at the current wage rate

Natural rate of unemployment

unemployment rate as a result of frictional plus structural unemployment

Cyclical Unemployment

deviation of the actual rate of unemployment from the natural rate

Inflation

rise in overall level of prices

Deflation

Fall in the overall level of prices

Price Stability

overall price is unchanging, or changing slowly

Real Wage

wage divided by price level to adjust for the effects of inflation or deflation

Real Income

income divided by the price level to adjust for the effects of inflation or deflation

Inflation Rate

percentage increase in the overall level of prices each year

Aggregate price level

Measure of the overall level of prices in the economy

Market Basket

Hypothetical set of consumer purchases of goods and services

Base Year

year arbitratily chosen for the comparison when calculating a price index

Price index

measures the cost of purchasing a given market basket in a given year — the index value is always equal to 100 in the base year

Consumer Price Index

measures the cost of the market basket for average family

Substitution Bias

occurs in cpi because items with prices that have risen the most will skew the cpi despite consumers substituting them

Producer Price Index

measures the prices of goods and services purchased by producers

Nominal interest rate

stated interest rate

real interest rate

nominal interest rate - rate of inflation

Disinflation

process of bringing inflation rate down

Aggregate output

total quantity of final goods and services produced within an economy

Real GDP

total value of all final goods and sercies produced in a given year, calculated using the prices of a selected base year to remove the effects of price changes

Nominal GDP

total value of all final goods and services produced in the economy during a given year, calculated with current prices

Business Cycle

alteration between economic recessions and expansions

Trough

lowest point of a recession before the economy starts expanding

Expansions

periods of economic upturns when output and employment are rising

peak

highest point of the buisness cycle before recession

depression

deep and prolonged downturn

Economic Growth

increase in the maximum amount of goods and services an economy can produce

Full employment levels of output

level of real GDP the economy can produce when all resources are fully employed

potential output

what an economy can produce when operating at maximum sustainable employment (Natural rate of unemployment)

output gap

difference between actual output and potential output