Looks like no one added any tags here yet for you.

define current expenditure

The current government expenditure is general government final consumption plus transfer payments plus interest payments.

define transfer payments

Transfer payments are government payments for which there is no corresponding output, where money is taken from one group and given to another, for example benefits and pensions.

define capital expenditure

spending on investment goods such as new roads, schools and hospitals which will be consumed in over a year.

define discretionary government spending

Discretionary government spending in the UK refers to the policy where the government deliberately changes tax rates and government spending to manage aggregate demand and achieve macroeconomic objectives

automatic stabilizers

Automatic stabilisers are automatic fiscal changes as the economy moves through stages of the business cycle

PPF diagram showing crowding out

reasons for changing size and composition of public expenditure in a global context

population and demographics: Changing demographics, such as an aging population, can lead to increased spending on healthcare and pensions.

policy focus:Political ideologies can influence the composition of public expenditure, with some governments favoring social welfare programs and others emphasizing defense or infrastructure

economic cycle: In response to economic crises or changing economic conditions, governments may increase spending to stimulate growth or reduce spending to control deficits

equality and equity: Public expenditure can reduce income inequality by providing social support to disadvantaged groups and funding education and healthcare accessible to all citizens.

correcting market failure: subsidizing merit goods, fixing externalities

define progressive taxation+ example

Progressive taxes are characterized by higher tax rates as income increases. In other words, individuals with higher incomes pay a higher percentage of their income in taxes.

Example: The income tax system in many countries, where tax rates increase as income brackets rise.

define proportional taxation + a country that uses it

Proportional taxes apply a constant tax rate to all income levels. This means that individuals pay the same percentage of their income in taxes, regardless of their income.

eg mongolia

define regressive taxation + example

Regressive taxes impose a higher tax burden on lower-income individuals compared to higher-income individuals. This occurs because the tax rate decreases as income increases.

Example: Sales taxes or consumption taxes, where everyone pays the same percentage of tax on purchases, regardless of income.

reasons for taxation

redistribute income: Progressive tax systems can help reduce income inequality by imposing higher tax rates on high-income individuals.

pay for gov. expenditure: Initially, as tax rates rise, tax revenues increase

manage macroeconomic performance: Changes in tax rates can affect real output and employment. Lower taxes on businesses and investments may stimulate economic growth and job creation.

correct market failures: Indirect taxes, such as sales taxes, can influence the price level by increasing the cost of goods and services.

the laffer curve + explanation

as taxes rise too high, the incentive to work and earn money decreases, so the government gets less tax revenue

supply demand diagram showing the impact of an increase in VAT

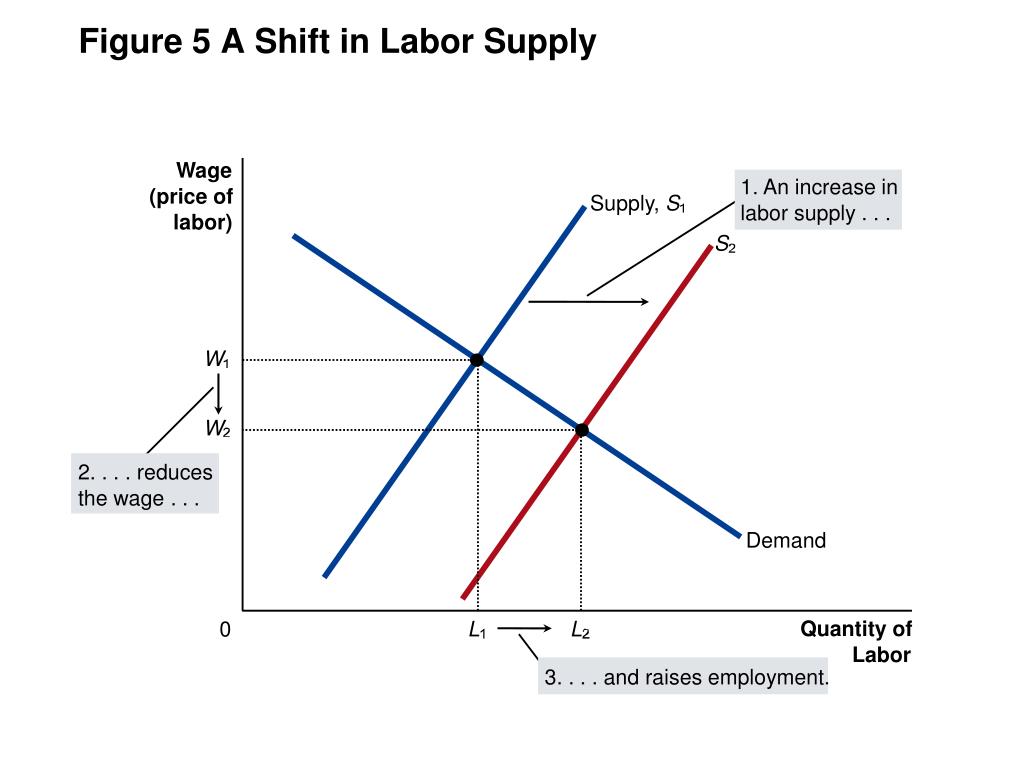

labour market diagram showing increase in personal allowance

diagram showing increase in corporation tax

what is international tax competitiveness

a country’s ability to maintain an attractive tax environment relative to others

diagram showing impact of automatic stabilisers

define fiscal deficit

when the government spends more than it receives that year.

define national debt

The national debt is the sum of all government debts built up over many years

define cyclical deficit

A cyclical deficit is the part of the deficit that occurs because government spending and tax fluctuates around the trade cycle. When the economy is in recession, tax revenues are low and spending is high creating a larger deficit.

define structural deficit

At the peak of the boom, there is no cyclical deficit; any deficit at this point is a structural deficit. The structural deficit is the fiscal deficit which occurs when the cyclical deficit is zero; it is long term and not related to the state of the economy.

factors influencing the size of a fiscal deficit

economic cycle: During a downturn, government tax revenue decreases whilst government spending increases and so the deficit increases.

level of interest payments: If interest rates on government debt increase, the amount the government pays in interest repayments increases and this is likely to increase the deficit.

one-off receipts: Events like privatisation provide one-off payments to the government which will decrease the deficit in the short term; it will depend on the value of the company sold.

fiscal policy: government aims are important in the size of the deficit, as this will influence their fiscal policy, for example the austerity aim has helped to decrease the size of the deficit but attempting to increase AD would increase spending.

link between budget balance and national debt levels

If the government is continuously running a deficit, then the national debt will increase overtime

arguments for austerity

1.Reducing debt in long run interests of economy – helps to keep UK taxes lower

2.Shrinking state encourages private sector growth

3.High opportunity cost from £billions on debt interest

4.Cutting deficits increases investor confidence – attracts FDI into the UK

5.Upturn of cycle is time for government to borrow less – ahead of another downturn

arguments against austerity

1.Austerity is self-defeating e.g. increase in welfare payments & lower growth (fiscal dividend/debt:GDP)

2.Government bond yields are low – a time to invest more

3.Infrastructure investment will increase AD and LRAS

4.Wrong to cut spending when economy is in liquidity trap

5.Economic growth is needed to pay back the debt and fiscal austerity makes this harder to achieve

fiscal policy definition

use of gov spending and taxation to achieve macroeconomic objectives

define monetary policy

control of money supply and interest rates to control inflation while promoting growth

define direct controls

“Direct controls” refer to any measure of governmental intervention which is directly aimed at increasing or decreasing some particular group of payments or receipts in the balance of payment.

define quantitative easing

This involves the Central Bank increasing the money supply and using these electronically created funds to buy government bonds or other securities. usually used in a liquidity trap

define exchange rate policy

where countries influence the exchange rate to improve the BoP or make the economy more competitive

diagram showing expansionary fiscal policy

why are supply side reforms good at helping an economy deal with external shocks?

they avoid inflationary pressure unlike demand-side.

transfer pricing definition

Transfer pricing is one way for firms to engage in tax avoidance. This can occur if a firm produces a good in one country and then transfers it to another to make it into another good which it then sells.

tax evasion definition

the illegal non-payment or underpayment of tax

tax avoidance definition

the arrangement of one's financial affairs to minimize tax liability within the law

measures to control MNCs

Resource Regulations: Some governments make it a requirement that TNCs employ local factors of production, such as labour and local component suppliers.

Regulations can also limit natural resource depletion.

Joint Ventures: Governments may require TNCs to set up joint ventures with domestic businesses, incurring a technology transfer to the domestic firm.

JVs also limit the extent to which profits flow overseas.

Export limits: Governments may limit the proportion of a TNC’s output that is exported.

This is to ensure that the domestic citizens can enjoy the fruits of their labour for the TNC.

challenges with controlling MNCs

Measures to control TNCs are hard for countries to enact.

Many TNCs are ‘footloose’, they can move to another country easily and with little cost.

Thus there is always an incentive for governments to be lenient to TNCs.

what is the ‘arm’s length’ price?

The Transfer Pricing Guidelines were introduced by the OECD in 1995, providing guidelines on cross-border services, intangibles, cost contribution arrangements and advance pricing guidelines; these were modified in 2010. They aim for the price to be the same as if the two parties were independent of each other; the ‘arm’s length’ principle.

problems facing policy makers

Inaccurate information: If the government don’t have full information it can be difficult to determine the optimal policy responses

For example, GDP and BoP current account figures and expectations are often revised.

Information needed: spare capacity (elasticity of AS), size of multiplier/accelerator, ability to forecast, expectations/confidence & the effectiveness/speed of the transmission mechanism.

All of which are hard to judge!

Risks & uncertainties: The impacts of a given policy can vary greatly as surrounding economic conditions are not static.

Inability to control external shocks: Sometimes the government needs to respond quickly to shocks which it may not have the immediate capacity to do