Business Unit 1 (copy)

1/119

Earn XP

Description and Tags

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

120 Terms

business

any organization that seeks to provide goods and services to others while operating at a profit. takes input, adds labour and materials to make an output

consumer goods

Tangible items produced for personal use. Can be durable or non durable (used once alone or more than once)

customer

people or organizations that buy a product or service

consumer

A person or organization who purchases goods and services to USE

consumer services

Non-tangible products that are sold to the general public and include hotel accommodation, insurance services and train journeys

capital goods

goods that are used in producing other goods, rather than being bought by consumers.

land/physical (factor of production)

the type and amount of resources, space and machinery, and natural resources needed to run a business

Labour (factor of production)

including skilled and unskilled labourers that make up the workforce

capital/finance (factor of production)

the money needed to set up a business/operate it on a daily basis

Enterprise (factor of production)

the driving force behind the 3 other factors, including the ability to manage, direct, communicate, coordinate and risk take

marketing (business function)

involves the process of creating, designing, promoting and selling their product. they appeal to consumer desires

finance (business function)

manages the org money; planning, organizing, auditing, accounting for, and controlling its company's dollars; and produces statements.

human resources ( business function)

recruits, selects, evaluates, trains, motivates, schedules and dismesses employees.

Operations Management/Production (business function)

A specialized area in management that converts or transforms resources (including human resources) into goods and services.

Primary sector

The portion of the economy concerned with the direct extraction of materials from Earth's surface, generally through agriculture, although sometimes by mining, fishing, and forestry.

Secondary Sector

The portion of the economy concerned with manufacturing useful products through processing, transforming, and assembling raw materials. Like clothing, construction and phones

Tertiary Sector

The portion of the economy concerned with transportation, communications, and utilities, sometimes extended to the provision of all goods and services to people in exchange for payment. Ex) retail, transport, tourism, banking, telecommunications

Quaternary Sector

Service sector industries concerned with the collection, processing, and manipulation of information and capital. Examples include finance, administration, insurance, and legal services.

sectoral change advantages

GDP and standard of living increase, less imports and more outputs, more jobs, more taxes to government

sectoral change disadvantages

mass migration causing housing and social issues, factory pollution increase, walmart effect

enterpreneurship

individuals with the RISER abilities (risk taker, innovative, strategic, enthusiastic and resilient)

sourcing capital/finance for a business

-friends and family -banks, bank loans or liabilities -venture capitalists -government grants -personal loans

Issues when starting a business

-lack of finance -lack of research -location -poor cash flow -not developing a customer base or brand loyalty -lack of experience

business plan (bp)

an offical document detailing organization, its proposals for reaching its objectives and goals. Can be used to secure external finances

private sector

organizations owned by individuals and not the government. usually aims to make a profit

public sector

businesses run or directed by the government, that have no outside shareholders and do not publish their financial info. STILLS STRIVE FOR MONEY TO KEEP RUNNING. ex) infrastructure, healthcare, education and emergency services

sole trader/proprietor

A business owned by one person who provides all capital, other than loan capital; they have complete control over decisions and unlimited liability.

Sole trader advantages

-Owner keeps all the profit -Owner can make decisions quickly -complete control, financially, creatively and get to choose their work hours -easy setup with not a lot of legal formality -easier to establish personal relations with clients -can be based on interests and skills

Sole trader disadvantages

-Unlimited liability (held solely responsible, without excuse of the business) -Difficult to take holidays, longer hours -High risk so hard to borrow from banks -competition with multinational companies -if owners dies, business dies with them

Partnership

A business in which two or more persons combine their assets and skills. Caps at 20 unless specialized. A silent partner is one who only provides finance

Partnership Advantages

-partners may specialize, shared decision making -More capital available, losses are shared -Relatively easy to start -Income taxed once as personal income

Parternship disadvantages

-unlimited liability unless an LLP (means one of the partners is held responsible alone) -profits are shared -bound by each others decisions -if one owner dies, it ends

limited company

A business organisation which has a separate legal identity from that of its owners. Ownership is divded into units called shares, thus granting limited liability. Required to post finance info publicly

private limited company

A small to medium sized business that is owned by a few shareholders. Shares must be sold privately and other shareholders must agree. Cannot be sold on stock market

private limited company advantages

-limited liability -more capital raised -cannot be lost to public -continues after death

private limited company disadvantages

-profit is shared -big legal procedure to setup -firms not allowed shares to raise capital -finance info public, so it can be inspected by the government and rivals. thus giving an advantage

public limited company

-STILL A PRIVATE COMPANY despite the name -can sell shares, if transitioned it must go through and IPO (initial public offer)

public limited company advantages

-lots of money can be raised -lower production costs -can dominate markets due to size -banks and other external financers are more willing to invest usually

public limited company disadvantages

-setting up is expensive and formal -possible for an outsider to take complete control -inability to deal with customers personally -inflexible due to size -guided by acts to protect shareholders, rather than consumer or employee rights

Non-profit social enterprises (NPO)

Social enterprises that do not aim to make a profit at all, instead they generate surpluses. ex) charities and pressure groups

non-governmental organization (NGO)

Private organizations that pursue activities to relieve suffering or other humanitarian issues

for profit social enterprises

Have a social mission but still aim to make a profit, and compete with rival businesses.

cooperatives (co-ops)

Organizations composed of individuals or small businesses that have banded together, through a membership program. includes financial, housing, worker, producer and consumer coops

microfinancers

Businesses in low income economies that provide small amounts of finance to those in need. Loans with restrictions and scheduled repayments

private-public partnership

A business venture created between private and public sectors in order to produce something. Usually, the public provides finance while private provides experient and expertise.

mission statement

outlines the day-to-day practices a business achieves in order to inspire employees and stand out from competition. More practical and leads to creation of goals, aims and objectives

vision statement

expresses what the organization should become, where it wants to go strategically. A dreamier, broader statement

aims

Long-term plans of the business from which its corporate objectives are derived. are general but can be measureable with results and success

objectives

Specific, short-term statements detailing how to achieve the organization's goals. Follows the SMART guidelines

Corporate objectives

More specific then aims, but act as a guide for management and strategy. Can be measured with numbers and usally involve growth, survival, profit, etc

strategies

Are the actions a business uses to reach its long-term organizational aims and corporate objectives. Decided by executives

tactics

Short term approaches to achieving tacial and operational objectives

the objective hierarchy

aims > objectives > strategies > tactics

STEEPLE

social, technological, economic, environmental, political, legal, ethical

ethics

the moral principles that guide decision making and strategy, whether used or not

Corporate Social Responsibility (CSR)

a business's concern for society's welfare and its actions to help with it.

CSR advantages

-can improve reputation -may attract dedicated employees -no target from pressure groups -increased goodwill of stakeholders -can factor into long term profit

CSR disadvantages

-short term cost increase, may make shareholders reluctant -if not properly executed, can have backlash -competitive disadvantage as spending money -ethical dilemmas internally and externally about whatever the CSR is demonstrating

social audits

Reports on ethical and social stance of a business. Essentially how its behaviours match with ethical objectives

Strength examples (SWOT)

INTERNALLY, things they do, well known for, make the most money, reputation, lead confidence in the market

Weaknesses examples (SWOT)

INTERNALLY, things they do poorly, poor reputation, losses, complaints, hardships, etc

Opportunity examples (SWOT)

EXTERNAL, directions created by their strengths, changing customer preferences, new tech, new laws, etc

Threat examples (SWOT)

EXTERNAL, activites of competitors, falling profits, change of customer preference, lack of rigour, lack of adapation

SWOT analysis advantages

-quick, simple and easy to create and understand -wide application range -encourages foresight and proactive thinking

SWOT analysis disadvantages

-simplistic, less detailed -short 'shelf life' -cannot be used, should be used in conjunction with other analysises to be effective -only works with pure honesty (esp weaknesses and threats)

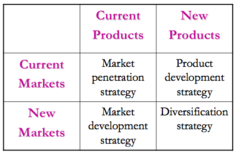

Ansoff's Matrix

A graph demonstrating 4 generic growth strategies for business growth

Ansoff's Matrix - market penetration

Growth focusing on developing existing products in existing markets, and is the least risky growth strategy. ex) loyalty reward cards, ad campaigns, sales

Ansoff's Matrix - market development

Growth focusing on selling existing products to new markets, and is around medium risk. ex) Nestle expanding into pet foods in India

Ansoff's Matrix - product development

Growth focusing on selling new markets to the same markets, and is medium risk as it relies on the differentiation between products to be worth it. ex) Apple releasing iPhones each year

Ansoff's Matrix - Diversification

Growth by selling new products in new markets, making it the riskiest form of growth. There are 2 types, related and unrelated. Related = in the same industry but new product, like Coke moving to energy drinks. Unrelated is a new industry, like HK McDonald weddings.

stakeholders

people or groups who can be affected by an organizations actions, and therefore have an interest in them. there are two types.

internal stakeholders

-employees (dependent on business and pay) -managers, directors -owners, shareholders, execs

external shareholders

-customers -suppliers -banks -pressure groups -competitors -government

stakeholder conflict

When different stakeholder groups have different aims and objectives, which conflicts will arise as decisions cannot satify all stakeholders.

stakeholder conflict - compromise

stakeholders making considerations for others. ex) workers improve productivity for higher wages ^ this is also called profit related pay

stakeholder conflict - conciliation

a service that aligns the needs of stakeholders

stakeholder conflict - arbitration

a 3rd party that listens to conflicts, and forms a decisions. all parties agree to listen to the party

stakeholder conflict - worker participation

involves employees having a direct voice in how things are operated. similar to share ownership schemes

stakeholder conflict - public relations

communicates news about the organization through the media, keeping them informed and faster as well

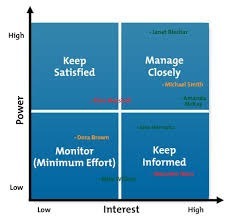

stakeholder mapping

provides a systematic way to identify the expectations, needs, importance, and relative power of various stakeholders

stakeholder mapping - monitor (Group A)

Neither powerful or with a high level of interest it is therefore only necessary to make a minimum amount of effort with this group

Low power/Low interest

stakeholder mapping - inform (Group B)

Make this group feel included, which is vital. Newsletters, events, ads and more are useful

low pwr/ high interest

stakeholder mapping - satisfy (Group C)

Must keep satifised, as they have power to influence all other groups. Flatter them!

high pwr/ low interest

stakeholder mapping - key players (Group D)

Most important, so communicating and consulting is critical before major decisions. Focus on their needs and priorities the most

high pwr / high interest

fiscal policy tax increases

an economic factor in which higher taxes are placed on consumers buying luxury based products. also includes possibility of increased corporate tax

interest rates

an economic factor that may increase or lessen the chance of a customer buying a product, as interest rates influence a customers money

economies of scale

when is a business benefits from lower average costs (costs per unit) from increasing in size. think of MORE BANG FOR YOUR BUCK! ex) if a business orders a lot from a supplier, they may get a bulk purchase discount. works better if the business knows they can sell all of it with the bonus included!

optimal output level

When average cost is at its lowest value, because profit is maximised

average cost = total cost/quantity produced (AC=TC/Q)

total cost of production

the sum of fixed and variable costs TC= TFC + TVC

internal economies of scale

Occurs in specific organizations as it grows, not the entire industry ex) banks giving low interests to big businesses as they are lower risk

External economies of scale

The cost benefits that all firms in the industry can enjoy when the industry expands as a whole. ex) locations w/ specialist labours, like NYC Wall Street for bankers, financers and investors.

diseconomies of scale

the situation in which a firm's long-run average costs rise as the firm increases output.

internal diseconomies of scale examples

-communication becoming non-personal and harder to speak to all stakeholders -workforce alienation, meaning employees feel less connected and valued, lowering morale and productivity -coordination difficulties

external diseconomies of scale examples

-overcrowding, causing traffic congestion and delays -rent increasing as land is in high demand, and with much more land than average -labour having higher costs due to shortages in urban areas

Internal (organic) growth

When a business grows internally, using its own resources to increase the scale of its operations and sales revenue

External growth

Business expansion achieved by means of merging with or taking over another business, from either the same or a different industry. Faster than organic growth, but riskier and more expensive

Acquistion

Involves one business buying controlling interest (majority shares) in another company.

Takeover

Is an acquisition but is often hostile, or a publicly traded company gets swept lol

Merger

Combination of two or more companies into a single, larger firm. Benefits from economies of scale

horizonal integration (M&A)

When a merger, acquisition or takeover occurs between companies within the same industry ex) Facebook buying Instagram in 2012