Linear Regression - Practice Questions (1&2 EMF)

1/30

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

31 Terms

What does β₁ mean in

y = β₀ + β₁x + u

Change in y for a 1-unit change in x, ceteris paribus

What does β₁ mean in

wage = β₀ + β₁mast + u?

(mast is a dummy variable, where 1= have master, 0=no master)

Average wage difference between those with and without master’s degree

If wage = 1500 + 500mast, what is wage with master? Any issue?

Predicted wage = 2000

Issue: may omit factors correlated with mast → bias risk

What is a dummy variable in regression?

Variable coded 0 or 1 to indicate membership in a category

Example: mast = 1 if a person has a master’s degree, 0 otherwise

Does unbiasedness require high R²?

No. Unbiasedness relies on assumptions, not on fit

R² measures fit (Proportion of variation in y explained by the model)

How to read coefficients when the dependent variable is ln(y)?

Continuous x: +1 in x → ≈ 100·β% change in y

Dummy D (0/1): D=1 vs 0 → ≈ 100·δ% difference in y

Quick feel: β = 0.05 ⇒ ≈ 5% (exact 5.13%)

What is the base group in a regression with dummies?

The group where all dummy variables = 0

Example: wage = β₀ + β₁IQ + β₂south + β₃(IQ×south), the base group is non-southerners (south=0)

What does a p-value measure in regression output?

Probability of seeing an estimate as extreme as β^ if the true β = 0

Small p (<0.05): strong evidence against H₀ → effect significant

Large p: no strong evidence → cannot reject H₀ → not significant

p-value does not measure size or importance of effect, only evidence against H₀

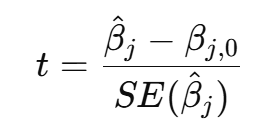

What is the formula for the t-test on a regression coefficient?

Usually test H₀: βⱼ = 0, so denominator is the standard error of βⱼ

How do you test whether a group of regressors has no effect?

Use the F-test

Null hypothesis: all coefficients in the group = 0

If F is large and p-value is small, reject the null

Why does multivariate regression provide a better ceteris paribus interpretation than univariate regression?

In univariate models, β₁ may capture both x’s effect and effects of omitted correlated variables

In multivariate models, including controls separates effects, so β₁ reflects only the effect of x

What is the population regression model in simple linear regression?

y = β₀ + β₁x + u

β₀ = intercept, β₁ = slope, u = error term

Interpret β₁ in:

wage = β₀ + β₁Female + u

while: β₁ = –5 and female is dummy (1=female, 0=male)

β₁ = –5 → women earn 5 less on average than men, cetris paribus

What happens if you rescale dependent variable (income € → thousands €)?

Coefficients and SE shrink by factor 1000

t-statistics unchanged

Two algebraic properties of OLS residuals

Residuals sum to 0: Σû=0

Residuals uncorrelated with regressors: Σx·û=0

Population Regression Function (PRFs) for

y = β₀ + β₁D + u

D=0: E[y|D=0]=β₀

D=1: E[y|D=1]=β₀+β₁

Interpret R²=0.25 in exam scores vs hours studied

25% of variation in scores explained by hours studied

Interpret β₁ in y = β₀ + β₁ln(x) + u

β₁/100 = change in y for 1% ↑ in x

Example: β₁=2 → 1% ↑ in x raises y by 0.02

State variance decomposition

TSS = ESS + RSS (total = explained + residual variation)

fe = β₀ + β₁Tech + u

β̂₁=0.025

se=0.010

=> Interpret & test

Tech firms’ forecast error 2.5% higher

t=2.5 → significant at 5%

R²=0.02. Interpret & relevance

Only 2% of y variation explained

Still fine for causal inference if regressors exogenous

Why log(y) can reduce heteroskedasticity?

Compresses scale of y

Stabilizes variance of errors

Compare log vs level wage regressions

log(wage)=β₀+β₁Education+u → β₁ ≈ % effect of education

wage=β₀+β₁Education+u → β₁ = absolute wage change per education year

Reading regression output

Variable significant if p<α (1%,5%,10%)

Significant coefficient → effect different from 0

Non-significant → cannot reject H₀

Why high R² may be useless

Spurious regression: x and y both trend but no causality

What is an exogenous variable?

A regressor uncorrelated with the error term (E[u|x]=0)

Ensures OLS is unbiased and consistent

Example: randomized treatment in an experiment

What is an endogenous variable?

A regressor correlated with the error term (E[u|x]≠0)

Causes OVB and biased OLS estimates

Sources: omitted variables, simultaneity, measurement error

Why can a high R² be useless?

R² only measures % of y’s variation explained by x

It does not prove unbiasedness or causality

Example: time-series data where GDP and global temperature both trend upward → regression shows high R² but relationship is spurious (driven by common trend, not causal link)

Give two endogeneity threats.

Omitted variable (e.g. ability with education)

Simultaneity (e.g. price & demand)

What are omitted variables?

Relevant factors affecting y but excluded from regression

If correlated with regressors → E[u|x]≠0 → OLS biased

Example: Ability omitted in wage–education regression biases education effect

What is the Population Regression Function (PRF)?