RMIN 5100S - CGL Insureds Limits

1/4

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

5 Terms

Who is an Insured?

Section II of the CGL indicates the individuals and organizations that are considered “insureds”

If designated in the declarations, insureds include:

Owner and spouse if a sole proprietorship

Partners, members, and their spouses if a partnership or joint venture

Members and managers if a limited liability company (LLC)

Officers, directors, and stockholders if a corporation

A trust and trustees, but only with respect to their duties as trustees

Insureds also include persons not named in the policy:

Volunteer workers acting for the organization

Employees acting within the scope of employment

Any person or organization acting as a real estate manager

A legal representative if the named insured should die

Any newly acquired or formed organization, other than a partnership, joint venture or LLC

Basically owners and spouses

Who is is an insured? NOT in these cases

Employees / Volunteers are INSUREDS…but not covered under these

Co-Employee and Related

Medical Professional Liability

Named Insured’s Employees’ or Partners’ property

Unnamed Partnerships, Joint Ventures or Limited Liability companies will ONLY be covered if they are named (usually $$)

NOTE: This is the only Professional Liability that is excluded in an unendorsed CGL Policy. Typically, the specific Professional Liability will be excluded via an endorsement, OR Coverage would not apply because it is not BI/PD or P&AI)

*Just a reminder: Applies to A, B & C

Supplementary Payments - Coverages A and B

We will pay, with respect to any claim we investigate or settle, or any "suit" against an insured we defend…These payments will not reduce the limits of insurance

CGL Supplementary Payments

All expenses we incur.

Up to $250 for bail bonds.

Cost of bonds to release attachments.

Reasonable expenses incurred by the insured at the insurer’s request

Court costs or other costs assessed against the insured.

Prejudgment interest awarded against the insured.

All interest…that accrues after entry of the judgment

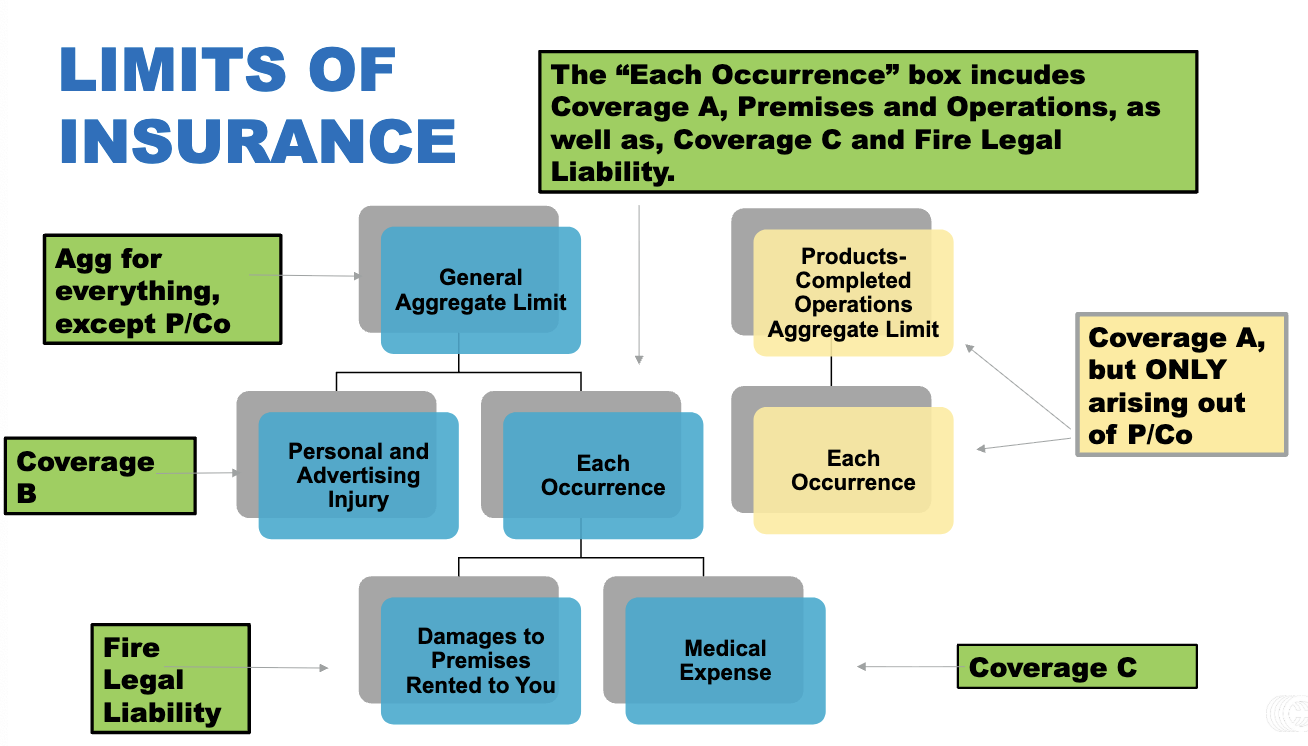

Limits of Insurance

Section III of the CGL contains the coverage limits

The general aggregate limit is the maximum amount that the insurer will pay for the sum of the following:

Damages under Coverage A (except for amounts paid for products-completed operations hazard), damages under Coverage B, and medical payments under Coverage C

The policy contains a separate products-completed operations hazard aggregate limit

A personal and advertising injury limit is the maximum paid under Coverage B

An each-occurrence limit is the maximum amount the insurer will pay for the sum of damages under Coverage A and medical expenses under Coverage C arising out of any one occurrence

The damage to rented premises limit is the maximum amount paid for damages under Coverage A due to a single fire

The medical expense limit is the maximum amount paid under Coverage C because of a bodily injury sustained by any one person