4.2.2.E - Circular Flow of Income & Multiplier

1/24

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

25 Terms

National Income/Output/Product

The flow of new output produced by the economy in a given time period

Measures of National Income

Income, Expenditure, Output

National Wealth

The stock of all goods that exist at a point in time that have value in the economy

National Capital Stock

The stock of capital goods (e.g. machinery) that has accumulated over time and is measured at a point in time

Nominal Income

Total amount of money received in a given time period

Nominal National Income =

Real National Income x Average Price Level

Real Income

Total amount of money received in a given time period, AND ADJUSTED FOR INFLATION

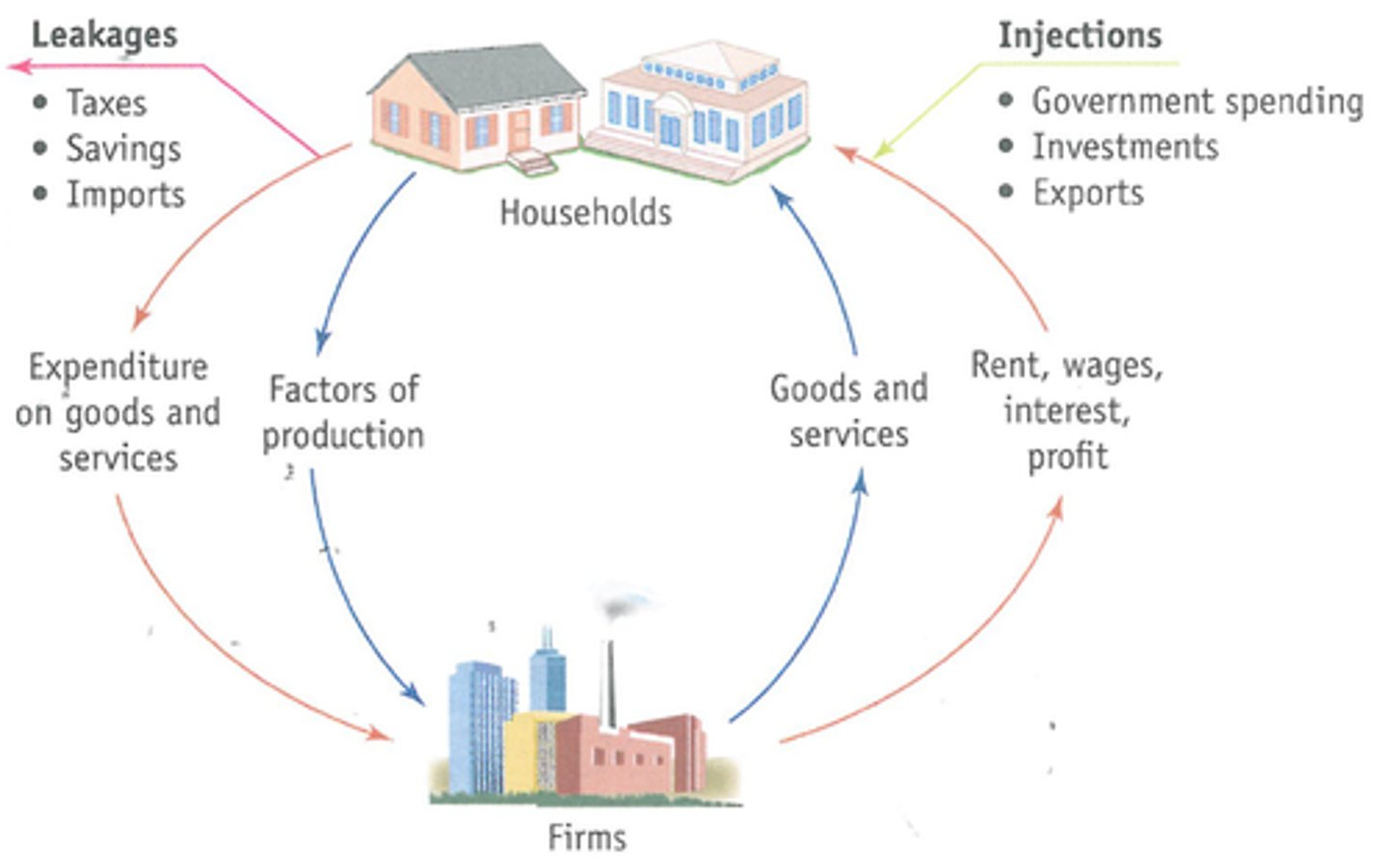

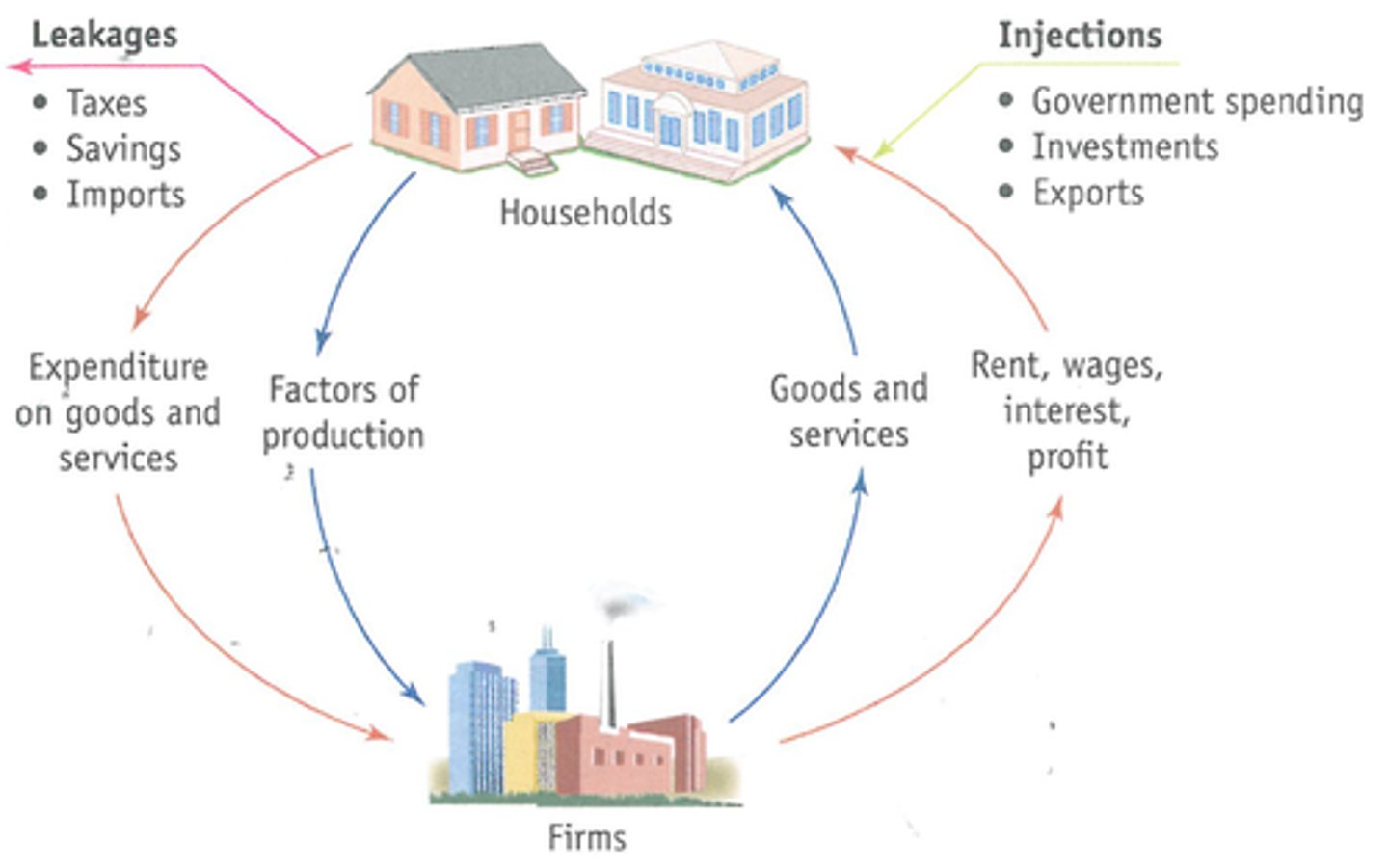

Circular Flow of Income

The movement of spending and income and output throughout the economy

CFOI Diagram

Households ---> Firms:

- Factor Services

- Expenditure

Firms ---> Households:

- Factor income

- Goods & services

Injections into Firms: GIX

Leakages out of Households: SIT

Closed Economy

An economy with no international trade

Open Economy

An economy open to international trade

Macroeconomic Equilibrium

The level of real output at which aggregate demand equals aggregate supply and Real GDP is not changing.

OR

The level of income at which leakages from the CFOI equals injections (S+I+T = G+I+X)

Injections (+sources)

When funds are added to an economy from a source other than households & firms.

Sources (GIX):

- Government Spending

- Investment

- eXports

Withdrawals/Leakages (+where to)

A leakage of spending power out of the CFOI into SIT:

- Savings

- Imports

- Taxation

Savings

Income which is not spent

Investment

Total planned spending by firms on capital goods produced within the economy

Taxes

Charges levied by the government on various economic activies (e.g. income tax, corporation tax)

Where Macroeconomic Disequilibrium occurs in CFOI

- SIT (leakages) > GIX (injections) and National Incomes decrease

- GIX > SIT and National Incomes increase

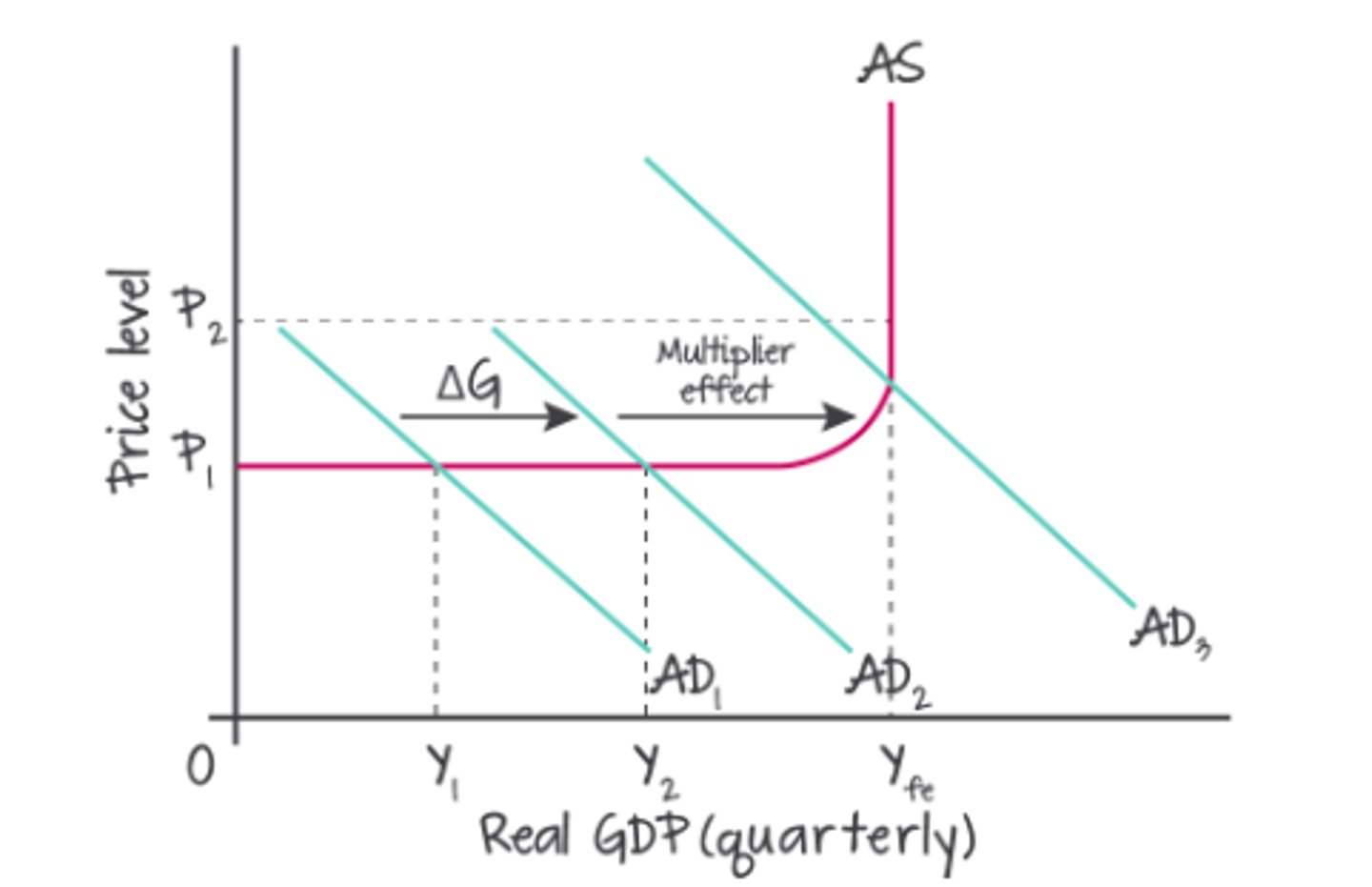

Multiplier

The relationship between a change in aggregate demand and the resulting (usually larger) change in national income (real gdp)

How does the multiplier work

- An injection into the CFOI leads to higher income

- A proportion of that income is spent

- Thus the injection generates income and successively multipler further increases in income

- Adding up the successive stages of income generation (total increase in income) is a multiplier of the initial spending increase

Multiplier Diagram

Successively smaller shifts of AD to the right

Multiplier (k) formula 1 =

Change in National Income / Initial change in Government Spending

Multiplier (k) formula 2 =

1 / (1 - MPC)

OR

1 / MPW

which is same as

1 / MPS + MPI + MPT

because Marginal Propensity to Withdraw = MP to Save + MP to Import + MP to Tax

MPC (Marginal Propensity to Conume) =

The proportion of an increase in income that people spend on domestically produced consumer goods

MPC = Amount spent / Extra income

9 marker CFOI & Multiplier Analysis

- In the circular flow model, when an injection is made into the economy (in the form of an autonomous change in AD), then that spending flows from firms to households

- Some is 'leaked' away in the form of savings, imports and taxation.

- But the remainder is re-spent and thus increases AD further.

- This cycle continues with multiple but successively smaller rounds of spending, with AD and real GDP increasing each time

- The initial injection can be shown by AD1 to AD2

- The further rounds of spending is 'induced consumption' shown by AD2 to AD2+K

- Correspondingly, the real GDP also increases and some may be deflected into a rise in the price-level.