ACYMANS11: Working Capital Management

1/16

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No study sessions yet.

17 Terms

The following are desirable in cash management except

a. Cash is collected at the earliest time possible

b. Most sales are on cash basis

c. Post-dated checks are not deposited on time upon maturity

d. All sales are properly receipted and promptly deposited intact

C

The level of accounts receivable will most likely increase as

a. Cash sales increase

b. Credit limits are expanded, credit sales increase, and credit terms remain the same

c. Credit limits are expanded, cash sales increase, and aging of the receivables is improving

d. Cash sales increase, current receivables ratio to past due increases, credit limits remain the same

B

Which of the following is not one of the assumptions of the EOQ model?

a. Demand occurs at a constant rate throughout the year

b. Lead time on the receipt of the orders is constant

c. The entire quantity ordered is received at one time

d. The unit costs of the items ordered are constant; thus, there can be no quantity discounts

e. There are no limitations on the size of the inventory

f. All of the above are assumptions of the EOQ model

F

A company obtaining short-term financing with trade credit will pay a higher percentage financing cost, everything else being equal, when

a. The discount percentage is lower.

b. The items purchased have a higher price.

c. The items purchased have a lower price.

d. The supplier offers a longer discount period.

D

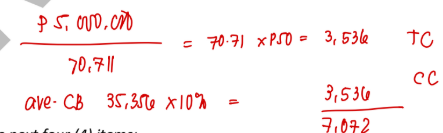

BAA Company is trying to determine its optimal average cash balance. The firm has determined that it will need P5,000,000 net new cash during the coming year. The fixed transaction cost is P50, and the firm earns 10 percent on its marketable securities investments.

According to the Baumol model, what is the optimal cash balance?

a. P7,071

b. P38,357

c. 70,711

d. P102,956

C

BAA Company is trying to determine its optimal average cash balance. The firm has determined that it will need P5,000,000 net new cash during the coming year. The fixed transaction cost is P50, and the firm earns 10 percent on its marketable securities investments.

According to the Baumol model, what should be the average cash balance?

a. P35,356

b. P3,536

c. P22,157

d. P70,711

A

BAA Company is trying to determine its optimal average cash balance. The firm has determined that it will need P5,000,000 net new cash during the coming year. The fixed transaction cost is P50, and the firm earns 10 percent on its marketable securities investments.

What will be the total cost of maintaining the optimal average cash balance, as determined by the Baumol model?

a. P35,356

b. P 7,072

c. P18,493

d. P70,711

B

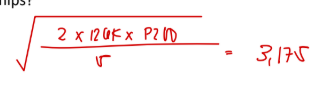

ABC Corporation expects to order 126,000 memory chips for inventory during the coming year, and it will use this inventory at a constant rate. Fixed ordering costs are P200 per order; the purchase price per chip is P25; and the firm’s inventory carrying costs is equal to 20 percent of the purchase price. (Assume a 360-day year.)

What is the economic ordering quantity for chips?

a. 12,088

b. 3,175

c. 6,243

d. 13,675

B

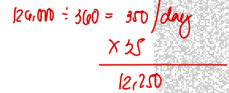

ABC Corporation expects to order 126,000 memory chips for inventory during the coming year, and it will use this inventory at a constant rate. Fixed ordering costs are P200 per order; the purchase price per chip is P25; and the firm’s inventory carrying costs is equal to 20 percent of the purchase price. (Assume a 360-day year.)

How many orders should ABC place during the year?

a. 12

b. 25

c. 30

d. 40

D

ABC Corporation expects to order 126,000 memory chips for inventory during the coming year, and it will use this inventory at a constant rate. Fixed ordering costs are P200 per order; the purchase price per chip is P25; and the firm’s inventory carrying costs is equal to 20 percent of the purchase price. (Assume a 360-day year.)

If the lead time for placing an order is 5 days, and ABC holds a safety stock equal to a 30-day supply of chips, then at what inventory level should an order be placed?

a. 15,570

b. 3,175

c. 12,250

d. 13,675

C

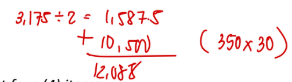

ABC Corporation expects to order 126,000 memory chips for inventory during the coming year, and it will use this inventory at a constant rate. Fixed ordering costs are P200 per order; the purchase price per chip is P25; and the firm’s inventory carrying costs is equal to 20 percent of the purchase price. (Assume a 360-day year.)

If ABC holds a safety stock equal to a 30-day supply of chips, what is its average inventory level?

a. 12,088

b. 3,175

c. 15,750

d. 13,675

A

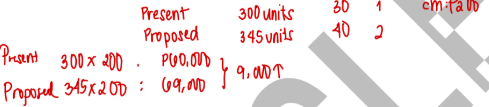

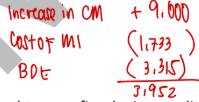

BSA Corporation is considering relaxing its credit standards to encourage more sales. As a result, sales are expected to increase 15 percent from 300 units per year to 345 units per year. The average collection period is expected to increase to 40 days from 30 days and bad debts are expected to double the current 1 percent level. The price per unit is P850, the variable cost per unit is P650 and the average cost per unit at the 300-unit level is P700. The firm's required return on investment is 20 percent.

What is the additional profit contribution from sales under the proposed relaxation of credit standards?

a. P2,250

b. P6,750

c. P9,000

d. P69,000

C

BSA Corporation is considering relaxing its credit standards to encourage more sales. As a result, sales are expected to increase 15 percent from 300 units per year to 345 units per year. The average collection period is expected to increase to 40 days from 30 days and bad debts are expected to double the current 1 percent level. The price per unit is P850, the variable cost per unit is P650 and the average cost per unit at the 300-unit level is P700. The firm's required return on investment is 20 percent.

What is the cost of marginal investments in accounts receivable under the proposed plan?

a. P1,817

b. P1,733

c. P1,867

d. P1,617

B

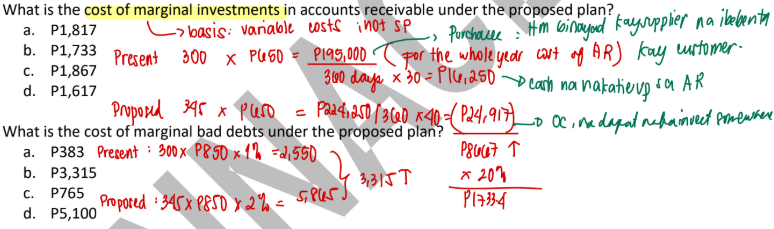

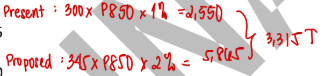

BSA Corporation is considering relaxing its credit standards to encourage more sales. As a result, sales are expected to increase 15 percent from 300 units per year to 345 units per year. The average collection period is expected to increase to 40 days from 30 days and bad debts are expected to double the current 1 percent level. The price per unit is P850, the variable cost per unit is P650 and the average cost per unit at the 300-unit level is P700. The firm's required return on investment is 20 percent.

What is the cost of marginal bad debts under the proposed plan?

a. P383

b. P3,315

c. P765

d. P5,100

B

BSA Corporation is considering relaxing its credit standards to encourage more sales. As a result, sales are expected to increase 15 percent from 300 units per year to 345 units per year. The average collection period is expected to increase to 40 days from 30 days and bad debts are expected to double the current 1 percent level. The price per unit is P850, the variable cost per unit is P650 and the average cost per unit at the 300-unit level is P700. The firm's required return on investment is 20 percent.

What is the net result of implementing the proposed plan?

a. P3,952

b. P2,083

c. (P3,868)

d. (P2,083)

A

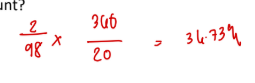

Suppose the credit terms offered to your firm by its suppliers are 2/10 net 30 days. Your firm is not taking discounts but is paying after 25 days instead of waiting until Day 30. What is the annual cost of giving up the cash discount?

a. 36.73%

b. 66.7%

c. 63.5%

d. 70.0%

A

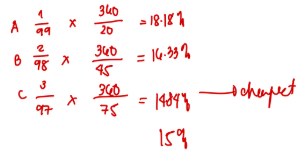

ABC Corp. has a temporary need for funds. Management is trying to decide between not taking discounts from one of their three biggest suppliers, or a 15% per annum renewable discount loan from its bank for 3 months. The suppliers' terms are as follows:

Supplier A 1/10, net 30

Supplier B 2/15, net 60

Supplier C 3/15, net 90

Using a 360-day year, the cheapest source of short-term financing in this situation is

a. The bank

b. Supplier A

c. Supplier B

d. Supplier C

D