Formulas for 312 Midterm

1/43

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

44 Terms

Face Value -A

F

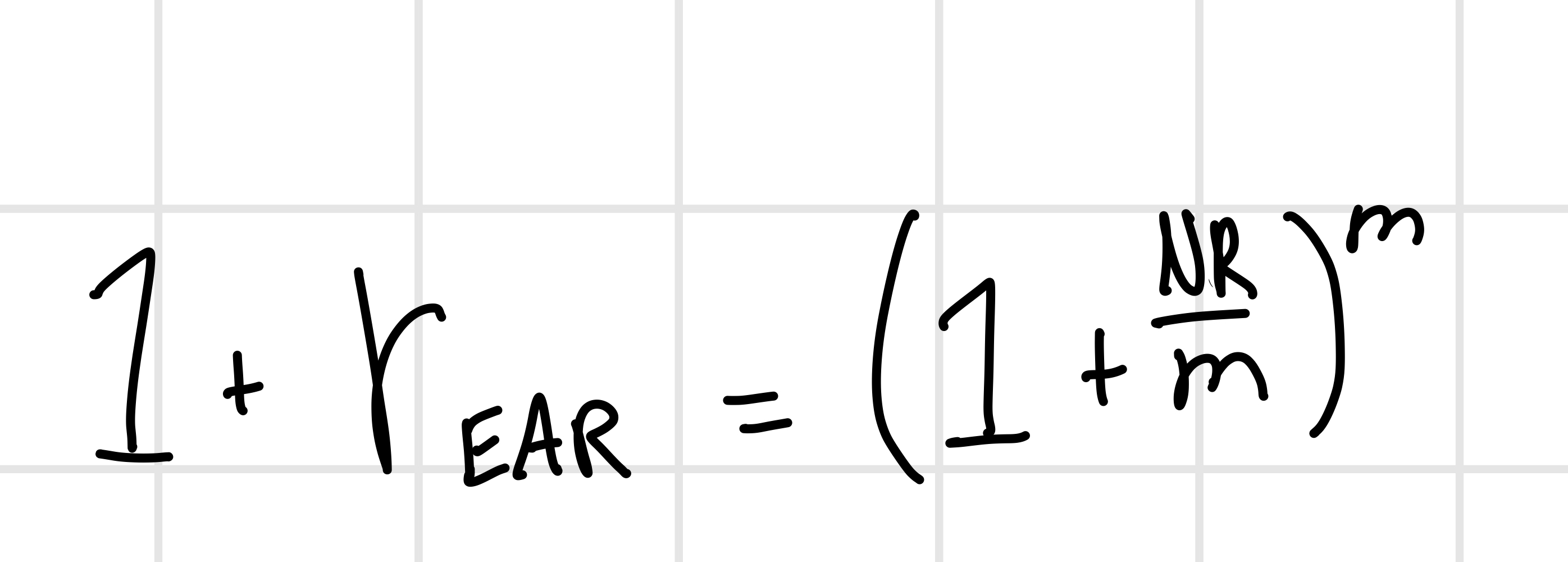

# of compounding periods in a year -A

m

# of years to maturity -A

N

# of periods to maturity -A

n

Annualized interest rate (YTM) -A

R

Periodic Interest rate -A

r

Coupon payments per period -A

c

Coupon payments per year -A

C

n-period rate at time t -A

yt^n

Bond Price -A

B

Dollars -A

C

Interest/annual rate -A

r

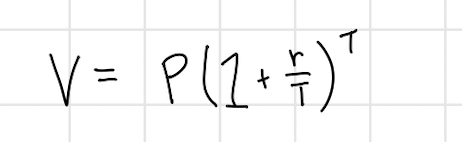

Years/frequency of compounding -A

T

Principle -A

P

Annual percentage rate -A

APR

Cash flow discounting

# of periods to maturity (n)

N x m

Periodic Interest rate (r)

R/m

Coupon payments per year (C)

Coupon rate x F

Coupon payments per period (c)

C/m

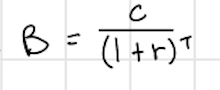

Zero coupon bond formulas - Method 1

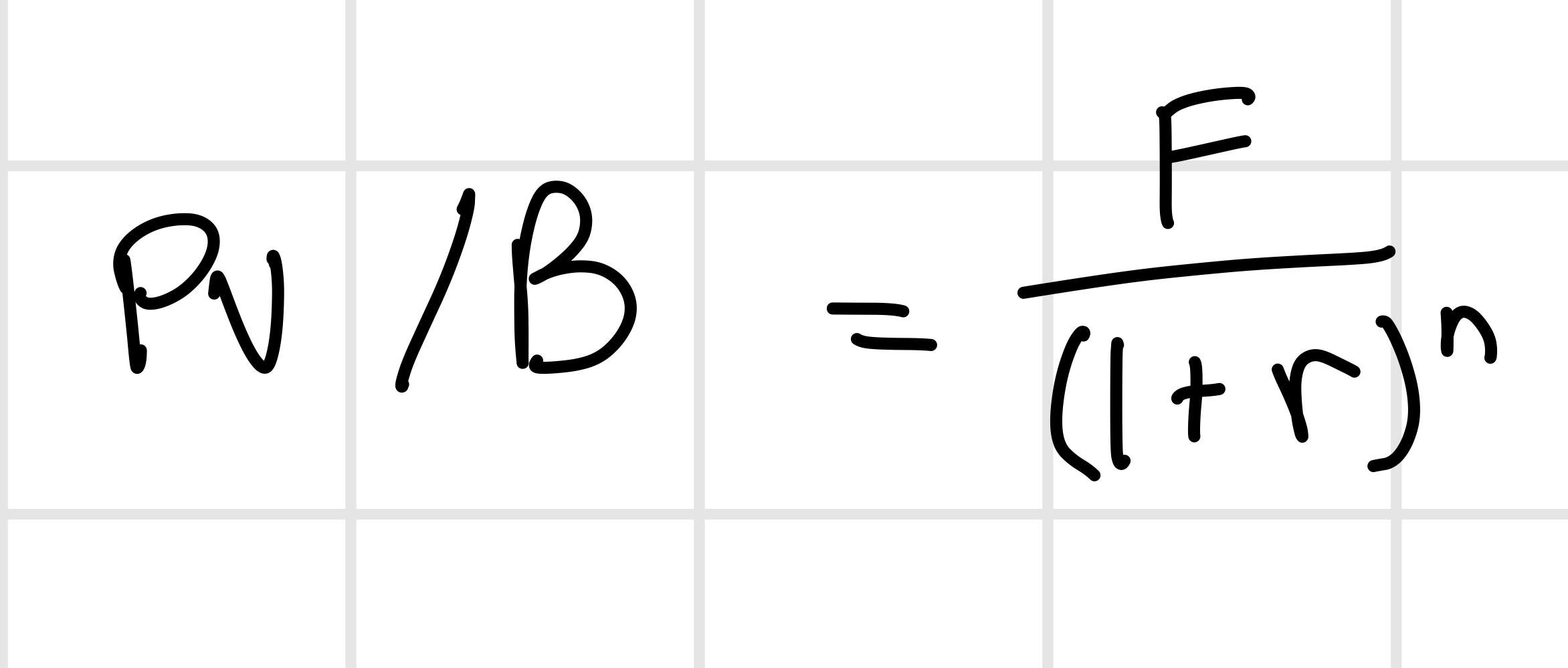

Zero coupon bond formulas - Method 2

ONLY when c = 0

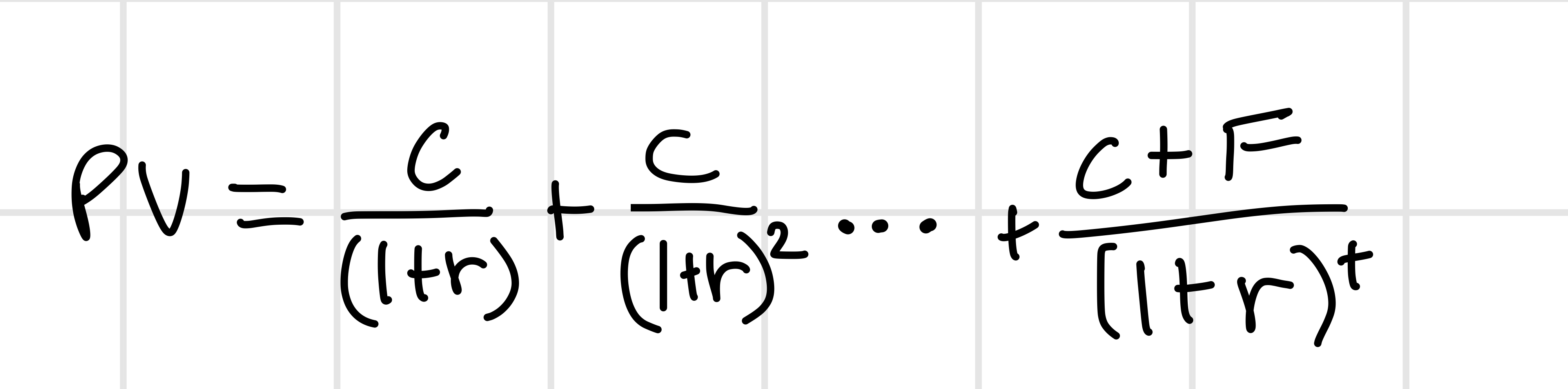

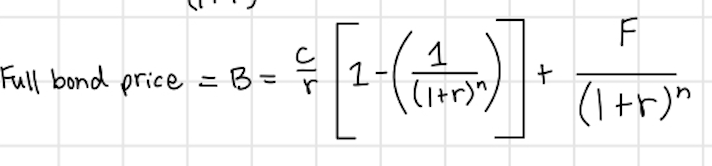

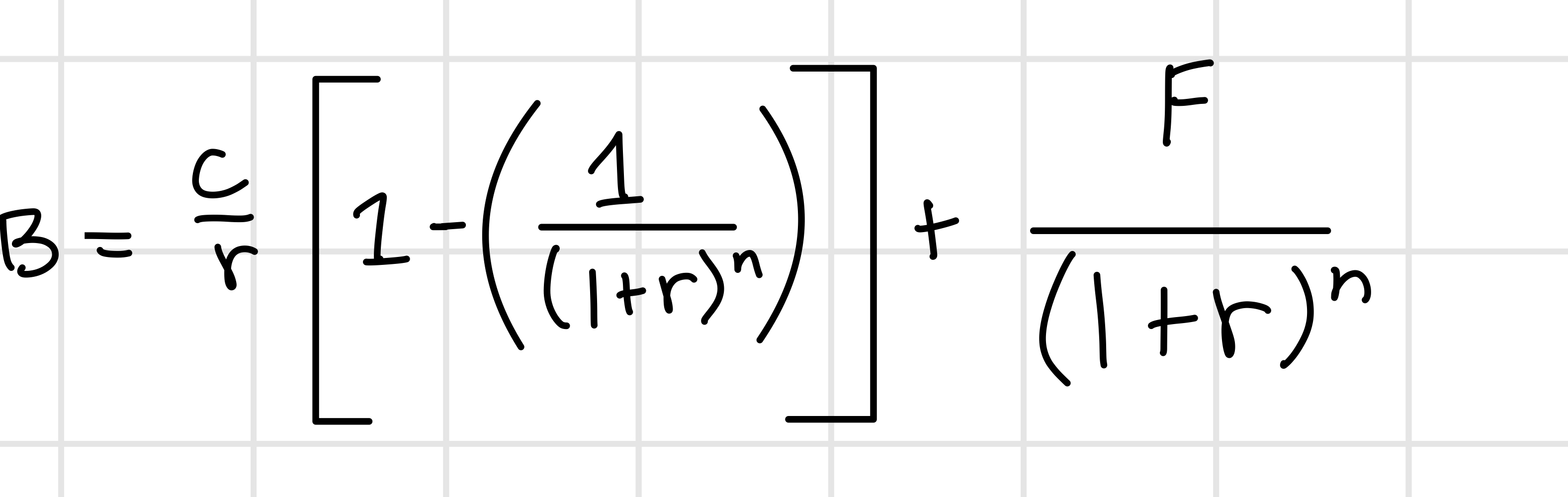

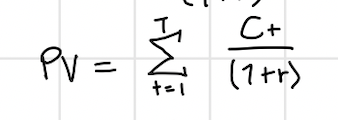

Full Bond price (B)

Coupon Bond = Annuity + Zero-Coupon Bond

Accrued Interest

(Days since Last payment / Days in coupon period) x Coupon Payment

Dirty Price

Clean price + Accrued interest

Clean Price

Dirty price - Accrued interest

YTM (R) of a Coupon Bond

Solve for r by using the full bond price formula

then multiply by m

FOR: R (YTM) = m x r

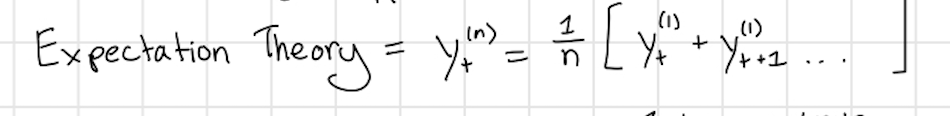

Expectation Theory

Fisher Equation

(1 + Real rate) = (1+ nominal rate)/(1+Inflation)

Compounding & Future Value

C(1+r)^T

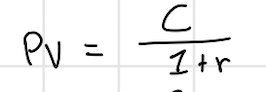

Present Value (One period)

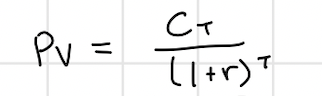

Discounting & Present Value (multiple periods)

Discounting Multiple Cash Flows

Perpetuities

PV = C/r

Growing Perpetuities

PV = C / (r-g)

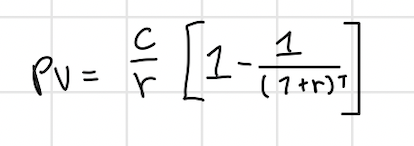

Annuity

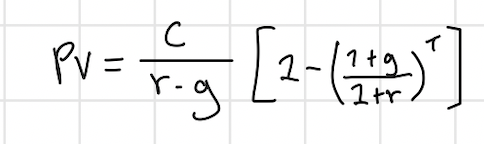

Growing Annuity

General Formula

Effective Annual Rate (EAR)

Net Present Value (NPV)

PV (benefits) - PV (costs)

Growing Rate - A

g

Total Inflation

= (1+r1) x (1+r2) x (1+r3)…..

where r = Inflation rate

Price of Coupon Bond (PV cash flow)

Cash Flow x (Zero Price/Face Value)

→ Then: Add the sums up

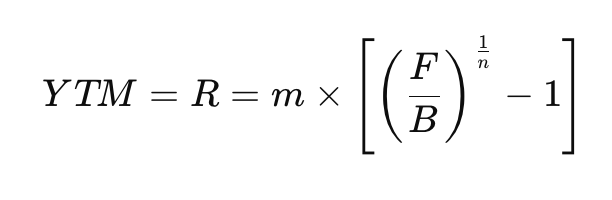

YTM (R) of a Zero Coupon Bond