Macroeconomics Chapter 8: The Federal Reserve System

1/19

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

20 Terms

Federal Reserve System (the Fed)

Central bank of the US

Central bank

public authority that regulates a nation’s depository institutions and controls the quantity of money

Fed’s goals:

To moderate the business cycle and contribute toward achieving long-tern growth by keeping inflation in check and maintaining full employment

In pursuit of its goals, the Fed pays close attention to

Federal funds rate

Federal funds rate

the interest rate that banks charge each other on overnight loans of reserves

Key elements in the structure of the Fed

The Board of Governors - 7 members, The 12 regional Federal Reserve banks, The Federal Open Market Committee

The Board of Governors (pt.1)

7 members appointed by the president of the US and confirmed by the Senate, board terms are for 14 years and terms are staggered so that one position becomes vacant every 2 years

The Board of Governors (pt.2)

The president appoints one member to a renewable four-year term as chairman, each of the 12 Federal Reserve Regional Banks has a 9 board of directors and a president

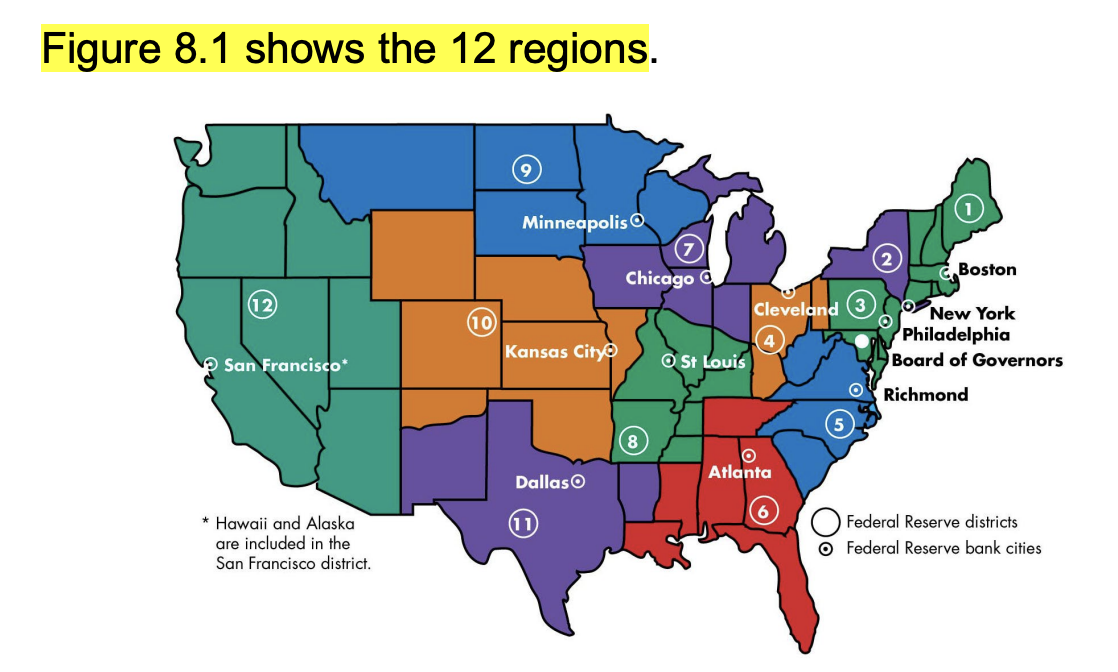

The 12 regions

The Federal Open Market Commitee (FOMC)

the main policy-making group in the Federal Reserve System

FOMC consists

members of Board of Governors, president of Fed Reserve bank of NY, 11 presidents of other regional Fed reserve banks of whom (on a rotating basis) 4 are voting members,

FOMC meets

every 6 weeks to formula monetary policy

Chair of the Board of Governors

Jerome Powell who has the largest influence on the Fed’s policy

Jerome Powell controls

the agenda of the Board and is the Fed’s spokesperson and point of contact with federal government and with foreign central banks and governments

The Fed influences the economy

through the size and composition of its balance sheet

Balance sheet

the assets that the Fed owns and the liabilities that it owes

The Fed’s two main assets

U.S. government securities and mortgage-backed securities

The Fed’s two liabiltiies

Currency and reserves of depository insitutions

Monetary base

The Fed’s total liabilities (currency and depository institutions’ deposits at the Fed)

Fed’s three main policy tools

Open market operations, last resort loans, required reserve ratios