Chapter 12 Options

1/138

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

139 Terms

OPTION TERMINOLOGY

Is the buyer of an options contract long or short?

Does the buyer pay or receive the premium on a contract?

Is the premium the buyers max gain or max loss?

Long

Pay

Max loss

Is the seller of an options contract long or short?

Does the seller pay or receive the premium on a contract?

Is the premium the sellers max gain or max loss?

Short

Receive

Max gain

What does a call option provide?

It give the owner the right to purchase the security and the seller the obligation to deliver the security at the agreed upon strike price

What does a put option provide?

It give the owner the right to deliver the security and the seller the obligation to purchase the security at the agreed upon strike price

What does a class of options mean?

Provide an example?

What is a series?

Provide and example?

A class means they are all of the same underlying asset and direction

GE calls are one class and GE puts are another

Represents all options of the same class with the same expiration and price

GE Jan 140 calls is a single series while GE Jan 150 calls is a separate series

What is a covered versus an uncovered option?

Which is more risky?

If the seller of an option already owns the underlying asset they may need to deliver they are covered, if not then they are uncovered

Uncovered option writing is far more risky

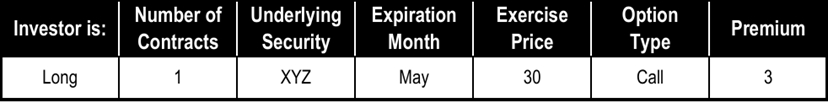

Explain the following option listing?

Long: This means that the investor is the buyer of the contract

1: They bought 1 contract which is worth 100 underlying shares

XYZ: This is the underlying security

May: This is the month the option expires

30: This is the strike price the buyer is able to buy the underling asset at

Call: Signifies this is a call option

3: This is the “insurance fee” the investor is paying to have the rights to the contract, it is multiplied by 100 ($300)

What day of the month do options contracts expire?

What are the timelines for that day?

The 3rd Friday

At 4:00PM trading stops, 5:30PM the exercise instructions need to be issued, 11:59 the contract officially expires

When does an options contract have intrinsic value?

Is there ever negative intrinsic value?

When the options contract is in the money

No, the contract would just have no intrinsic value

What is time value?

When is there more time value?

This is the portion of an options premium that exceeds the intrinsic value

There is more time value when there is more time till its expiration

What is the options premium formula?

Option premium = Time Value + Intrinsic value

What is the main factor in determining if an option contract is in, at, or out of the money?

This is determined by the underlying securities market price, in relation to the strike price

For a call option when is the option…

In the money?

At the money?

Out of the money?

In the money: The stock’s market price is above the strike price

At the money: The stock’s market price is equal to the strike price

Out of the money: The stock’s market price if below the strike price

For a put option when is the option…

In the money?

At the money?

Out of the money?

In the money: The stock’s market price is below the strike price

At the money: The stock’s market price is equal to the strike price

Out of the money: The stock’s market price if above the strike price

If an options contract has a premium, but is out of the money, what kind of value does it have?

Only time value, there is no intrinsic value

Let’s assume the XYZ May 30 call has a premium of 3 at a time when the stock is trading at $32 per share, provide a breakdown of the value here?

There is $2 of intrinsic value and another $1 of time value

If there is intrinsic value, does this guarantee profitability?

No, there can be intrinsic value, but if it does not exceed the premium as well (past the breakeven), then it still is not profitable

BREAKEVEN

What is the breakeven point?

This is the point where the underlying stock must be trading so that the investor does not make or lose money, inclusive of the premium

What does the breakeven mean to the buyer?

What does it mean to the seller?

For the buyer, it is the the amount they need the underlying stock to move in their favor to make back the premium they paid

For the seller, it is the amount they can afford the underlying stock to move against them before they begin losing money

ADJUSTMENTS TO AN OPTION CONTRACT

What happens if a stock split or stock dividend occurs?

What if it is a cash dividend?

The number of options contracts or underlying shares is changed and the exercise prices adjusts proportionately

There is no change

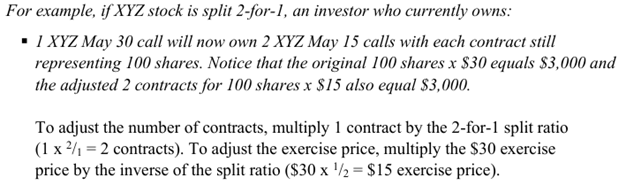

What is an even stock split?

How does this effect the option ownership?

This is when the company does something for 1, could be 2 for 1 or 3 for 1

There would be an increase in the number of option contracts the investor owns and a decrease in the exercise price

Even Stock Split Example

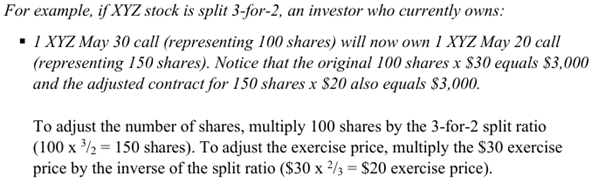

What is an odd stock split?

How does this effect the option ownership?

This is when the company does an uneven stock split like 3 for 2 or 5 for 4

There will be an increase to the number of underlying stock per contract, and the exercise price will adjust proportionately

Odd Stock Split Example

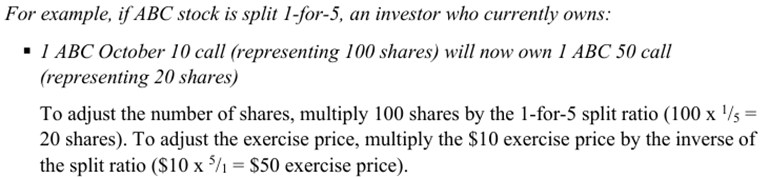

What happens when a company does a reverse stock split?

How does this effect the option ownership?

The company tries to raise their price by merging shares

There will be a reduction in the number of underling shares per contract and an increase in the exercise price of the contract

Reverse Stock Split Example

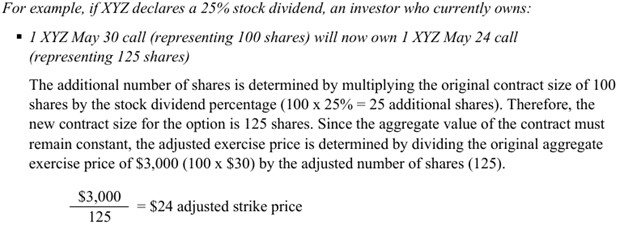

What happens when a company does a stock dividend?

How does this effect the option ownership?

Company issues additional stock to shareholders in the form of a dividend

There will be an increase to the number of underlying stock per contract, and the exercise price will adjust proportionately (same as odd stock split)

Stock Dividend Example

THE OPTIONS CLEARING CORPORATION

What does the Options Clearing Corporation do?

When a customer of a BD enters into an option contract, how long does the BD have to settle with the OCC?

They act similar to GSCC, they guarantee the other end of the transaction and eliminate counter party risk

Must be done within 1 business day

What is a position limit?

What is an exercise limit?

The OCC and the options exchanges limit the number of contracts a single investor or group of investors acting together can accumulate on the same underlying security

It is the max number of contracts that can be exercised within 5 consecutive business days

Do these limitations apply to trades that are on the same side on the market?

Yes

Bullish: Long calls and short puts

Bearish: Short puts and long calls

Long-Term Equity Anticipation Securities

What are LEAPS?

Long term options contracts with expirations up to 39 months

What are the advantages to these?

Lose time value slower

Provide a longer term horizon to participate in price changes

OPTION EVENTS

What does it mean to liquidate an options contract?

If I opened a long position what would need to be done?

If I opened a short position what would need to be done?

The buyer or the seller can liquidate a position by executing the opposing transaction

I would need to sell the equivalent contract

I would need to buy the equivalent contract

When liquidating a contract what needs to be marked on the ticket?

When trading in and out of option contracts, they need to be marked as “opening a new position” and “closing a previously opened position”

They may also be marked at buy or sell depending on the direction of the contract

Who has the right to exercise an option contract?

If a contract is exercised, how long does it take for the underlying stock settle?

The buyer of the contract

One business day

What is American option exercise?

What is European option exercise?

American: May be exercised at any time up to the day they expire

European: May only be exercised at a specified point in time, usually on expiration

Why would a contract owner let an option expire?

Who makes money when a contract expires?

If there is no value, there is no point in exercising

The seller receives the premium

OPTIONS STRATEGIES

Why might an investor buy a call?

What is the max profit?

What is the max loss?

How would you find the breakeven?

Allows for bullish speculation on a stock with leverage

Unlimited, stock could go to infinity

The premium paid to the seller

Take the strike price and add the premium

Why might an investor sell a call?

What is the max profit?

What is the max loss?

How would you find the breakeven?

They believe the stock price will remain the same or decrease (bearish)

The premium that is paid by the buyer

Could be infinite if the position is uncovered

Strike price plus premium, same as buying a call

Can selling calls uncovered be done in any account?

No, it is just as risk as taking a short position so they can only be done in margin accounts

Why might an investor buy a put?

What is the max profit?

What is the max loss?

How would you find the breakeven?

The investor would be bearish and believes the stock will decline in value

It is limited to if the stock plummets to $0

The premium paid

Strike price minus the premium paid

Why might an investor sell a put?

What is the max profit?

What is the max loss?

How would you find the breakeven?

An investor is bullish on the stock and wants to generate some income

The premium that was received from the buyer

If the stock price drops to $0 (would be the strike price minus the premium)

Strike price minus the premium amount

MULTIPLE OPTION STRATEGIES

What is an option straddle?

Involves simultaneously buying and selling a call/put together

Buying a call and put together

Selling a call and put together

What is a long straddle?

Why would an investor buy this?

This is buying a call and put together

They are speculating in a lot of price movement, direction doesn’t matter, just volatility

What needs to be accounted for in a long straddle in terms of premium and breakeven?

Provide an example?

There are now 2 premiums being paid and both will need to be recovered for the breakeven point

EX: If I buy a call with a premium of 3 and put with a premium of 2, my new break even is 5

What is the maximum gain for each leg of a long straddle?

What is the max loss of a long straddle?

If the stock moves in favor of the call it will be infinite

If the stock moves in favor with the put, it will be if the stock goes to $0

The premiums paid on both legs

What is a short straddle?

Why would an investor buy this?

The sale of a call and put simultaneously

They are expecting the stock to remain stable, not bullish or bearish

What needs to be accounted for in a short straddle in terms of premium and breakeven?

Provide an example?

There are now 2 premiums being received which gives the seller room in either direction

EX: If I buy a call with a premium of 3 and put with a premium of 2, my new break even is 5

What is the maximum gain for each leg of a short straddle?

What is the max loss of a short straddle?

The premium received for both legs

If the stock moves in favor of the call it will be infinite

If the stock moves in favor with the put, it will be if the stock goes to $0

What is a combination straddle?

A straddle where the two legs have different strikes and/or different expirations

SPREADS

What is a spread trade?

What is the point of a spread trade?

The purchase and sale of a call or put

Allows the minimization of losses but also profits

How do you identify the dominant leg?

When is an investor a buyer?

Seller?

It is the leg with the larger premium

The buy leg is dominant

The sell leg is dominant

What is a call spread?

What is a put spread?

Both legs are calls

Both legs are puts

What is a price spread?

Are these vertical or horizontal?

Both options have the same expirations but different strike prices

Vertical

What is a time spread?

Are these vertical or horizontal?

Both options have the same strike price but different expirations

Horizontal

What is a diagonal spread?

When both legs have different strikes and expiration months

NET CREDIT SPREADS

What is the net premium in a spread trade?

Since the investor is buying and selling options, they are both paying and receiving premiums so it is the difference between the two

What is a net debit spread?

When does this occur?

This is when the investor pays more in premium then they receive

The buy leg is dominant (has larger premium)

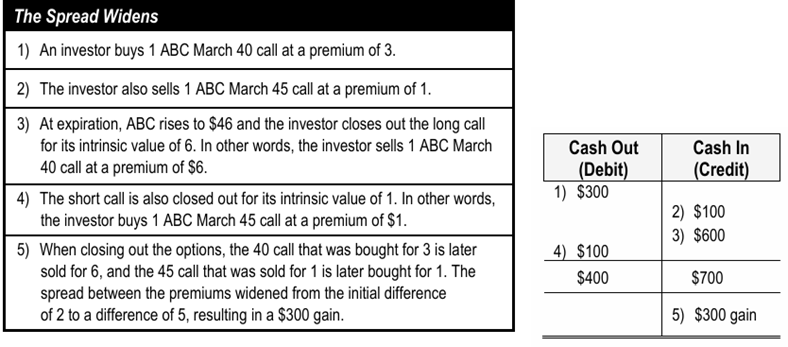

In a net debit spread, does the investor want the spread to widen or narrow?

Why?

They want the spread to widen

Since I now own the leg i paid more for in the beginning, i would want the spread to increase, so the value foes up, then I could sell for a larger profit and make back my net debit from the initial transaction

How do you find the breakeven point for call spreads?

How do you find the breakeven point for put spreads?

(Same for Credit/Debit Spreads)

(Probably don’t need to memorize, just know how to do the math in an example to figure out)

Lower strike + the net premium

Higher strike - the net premium

What is the maximum gain?

What is the maximum loss?

(Probably don’t need to memorize, just know how to do the math in an example to figure out)

The max gain will be limited by the non-dominant leg, the investor will be profitable past the breakeven but only up until the strike of the non-dominant

The difference in strikes minus the net premium paid

The net premium paid

Net debit example?

NET CREDIT SPREADS

What is a net credit spread?

When does this occur?

This is when the investor receives more in premium then they pay

The sell leg is dominant (has larger premium)

In a net credit spread, does the investor want the spread to widen or narrow?

Why?

Narrow

If the spread narrows to zero where they are trading for the same premium, you can close out both positions and keep the initial premium received as profit

How do you find the breakeven point for call spreads?

How do you find the breakeven point for put spreads?

(Same for Credit/Debit Spreads)

(Probably don’t need to memorize, just know how to do the math in an example to figure out)

Lower strike + the net premium

Higher strike - the net premium

What is the maximum gain?

What is the maximum loss?

(Probably don’t need to memorize, just know how to do the math in an example to figure out)

The net premium

The difference between strike prices minus the net premium

SPREAD STRATEGIES/TIPS

What should be the first thing done when assessing a spread?

What is the dominant leg?

Identify the dominant leg

The leg with the higher premium

How could you find the dominant leg is the question does not mention premiums?

The lower strike price call spread will have a higher premium

The higher strike put spread will have a higher premium

BUTTERFLY SPREADS

What is a butterfly spread trade?

Which way do the legs face, bullish or bearish?

This is when two spreads are established simultaneously

One spread is bullish while the other is bearish

What is the point a butterfly trade?

The investor is looking for neutrality, they benefit if the stock price stays stable

What is the breakeven point?

There are two break even points since there are two spreads placed

What is a downside to the butterfly trade?

There can be high commissions due to the multiple positions that need to be placed

USING OPTIONS AS A HEDGE (PROTECTION)

What is the long stock + long put method?

What does it do?

This is when the investor has a long cash stock position and also purchases a put

It provides protection to the investor if the stock moves to the downside

How does buying a protective put effect the customer’s basis?

They are now not only paying for the stock but also the premium

What is the short stock + long call method?

What does it do?

This is when the investor has a short cash stock position and also purchases a call

It provides protection to the investor if the stock moves to the upside

How does buying a protective call effect the customer’s basis?

They need to account for the premium on the call when calculating net profits and loss

USING OPTIONS TO GENERATE INCOME

How are options used to generate income?

Investors may use their current long/short positions to sell calls against them to generate income off of the premiums

What is a Long Stock + Short Call method?

What is another name for this?

This involves owning the underlying stock cash position while simultaneously selling a call

Covered call writing

What is a limitation to covered call writing?

What does it do?

It limits the potential returns if the stock moves to the upside

As long as the stock price does not move above the breakeven during the option contracts life, the seller will get the premium

What is the breakeven for the seller of the covered call?

What is the maximum gain?

What is the maximum loss?

It is the price they bought the cash stock position at minus the premium they received

The capital gains up to the strike price of the contract plus the premium received

If the stock goes to $0 minus whatever they receive in premium

Is the covered call writer bullish or bearish?

They would be mildly bullish during the life of the option since they want the stock to go up but only to a certain point

What is ratio writing?

What is an advantage to this?

What is a disadvantage to this?

This is an aggressive covered call writing strategy where there is an unequal number of calls written against the long position

It give the seller the opportunity to double their income on premiums

The seller is now open to unlimited losses since both calls sold are not covered

How do you find the breakeven of a ratio?

What is the max gain?

What is the max loss?

Take the purchase price of the stock and subtract the premiums received

The difference between the strike price of the call sold and the price the securities were purchased at plus the premiums received

Since the investor is uncovered on one of the calls, it is unlimited

What is a Short Stock + Short Put method?

What is another name for this?

This is when an investor sell stock short and also sells a put

Covered put writing