Chapter 7: Corporate Taxation: Nonliquidating Distributions

1/31

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

32 Terms

Taxation of Property Distributions

The characterization of a distribution from a C corporation to a shareholder has important tax consequences to both the shareholders and the corporation

If a distribution is characterized as a dividend, the corporation may not deduct the amount paid in computing its taxable income

In addition, the shareholder must include the dividend in gross income

The nondeductibility of the distribution by the corporation, coupled with the taxation of the distribution to the shareholder, creates double taxation of the corporation’s income, first at the corporate level and then at the shareholder level

Overview of Distributions

When a corporation distributes property to shareholders in their capacity as shareholders, the distributions are characterized as dividend income, return of capital, and/or capital gain

Dividend distributions are included in the shareholder’s gross income

Return of capital (nondividend distributions) reduce the shareholder’s tax basis in the corporation’s stock

Nondividend distributions in excess of the shareholder’s stock tax basis constitute a capital gain from sale or exchange of the stock

Dividend income is subject to double taxation because these distributions are not deductible by the corporation and are also taxed to shareholders

Some payments to shareholders are deductible by the corporation, depending on the nature of the payment

Examples Payments for services (salary), loans (interest), and use of property (rent)

To be deductible, payments to shareholders must be reasonable in amount

Unreasonable payments (e.g., excessive salary) are taxed as “constructive” dividends to shareholders

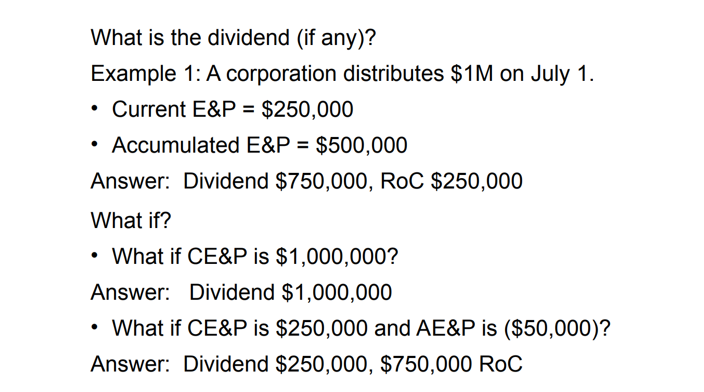

Determining the Dividend

A dividend for tax purposes is any distribution of property made by a corporation to its shareholders out of its earnings and profits (E&P)

Two separate E&P accounts to be maintained:

Current earnings and profits (CE&P) are a year-to-year calculation maintained by a corporation to determine if a distribution is a dividend

Earnings and profits are computed for the current year by adjusting taxable income to make it more closely resemble economic income

Determined on the last day of the year

Accumulated earnings and profits (AE&P) are undistributed earnings and profits from years prior to the current year

Computing Earnings and Profits (E&P)

E&P is supposed to represent the economic income eligible for distribution to shareholders

Includes both taxable and nontaxable income

E&P can be negative (a deficit) but this is only created through losses, not through distributions

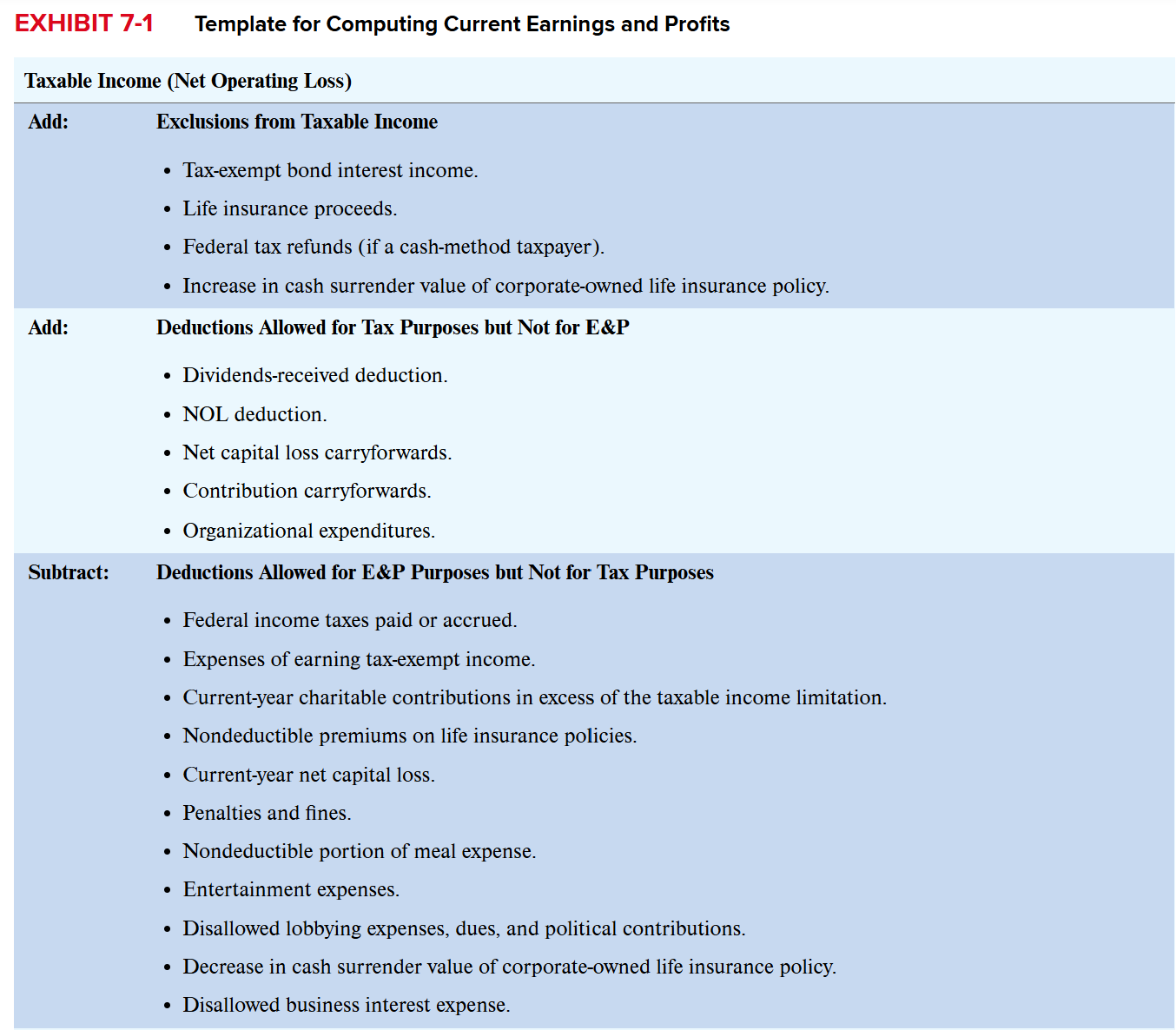

Taxable income is adjusted as follows (see Exhibit 07-1):

Include in E&P certain excluded income

Disallow some deductions that do not require an economic outflow

Deduct certain expenses that require an economic outflow but are not deducted for computing taxable income

Adjust the timing for certain deductions and income because certain accounting methods are required for computing E&P

1. Nontaxable Income Included in Current E&P

Although it is not taken into account in determining taxable income, tax-exempt income increases a corporation’s ability to make distributions to shareholders and, accordingly, must be factored into a corporation’s E&P calculations as an economic accession to wealth

Add certain exclusions that represent real economic income:

Tax-exempt income municipal bond interest

Tax-exempt life insurance proceeds

Federal tax refunds (if a cash-basis taxpayer)

Increase in cash surrender value of corporate-owned life insurance policy

2. Deductible Expenses that Do Not Reduce Current E&P

Add deductions not allowed for computing current E&P

Examples of deductions that do not represent real economic outflows in the current year:

DRD

NOL deduction carrybacks and carryforwards

Net capital loss carryforwards

Charitable contribution carryforwards

3. Nondeductible Expenses that Reduce Current E&P

Expenditures of various types that are recognized for financial accounting purposes, yet are nondeductible and noncapitalizable for income tax purposes, will impair a corporation’s ability to make distributions and, therefore, must be deducted in computing E&P

Subtract expenses allowed for computing current E&P but not deductible for computing income tax

Federal income taxes paid or accrued

Nondeductible premiums on life insurance policies

Current-year charitable contributions limitation (10% MTI limit)

Current-year net capital loss

Entertainment expenses

Nondeductible penalties and fines

Interest expense related to tax-exempt income

4. Items Requiring Separate Accounting Methods for E&P Purposes

Add or subtract accounting differences between computing taxable income and computing current E&P

Separate accounting methods are often required for computing current E&P and examples include:

Deferred gain on installment sales

Increase in cash surrender value of corporate-owned life insurance policies

Regular tax depreciation that differs from E&P depreciation (plus or minus)

E&P Depreciation

To compute E&P, depreciation deductions generally must be determined under the alternative depreciation system (ADS)

Under the ADS, depreciation calculations use a straight-line method and depreciable lives that are generally longer than the accelerated depreciable lives permitted for regular tax purposes

If corporations use the accelerated cost recovery system (ACRS) or the modified accelerated cost recovery system (MACRS) method in computing depreciation for regular taxable income purposes, Sec. 312(k) requires them to adjust E&P for the difference between the two methods

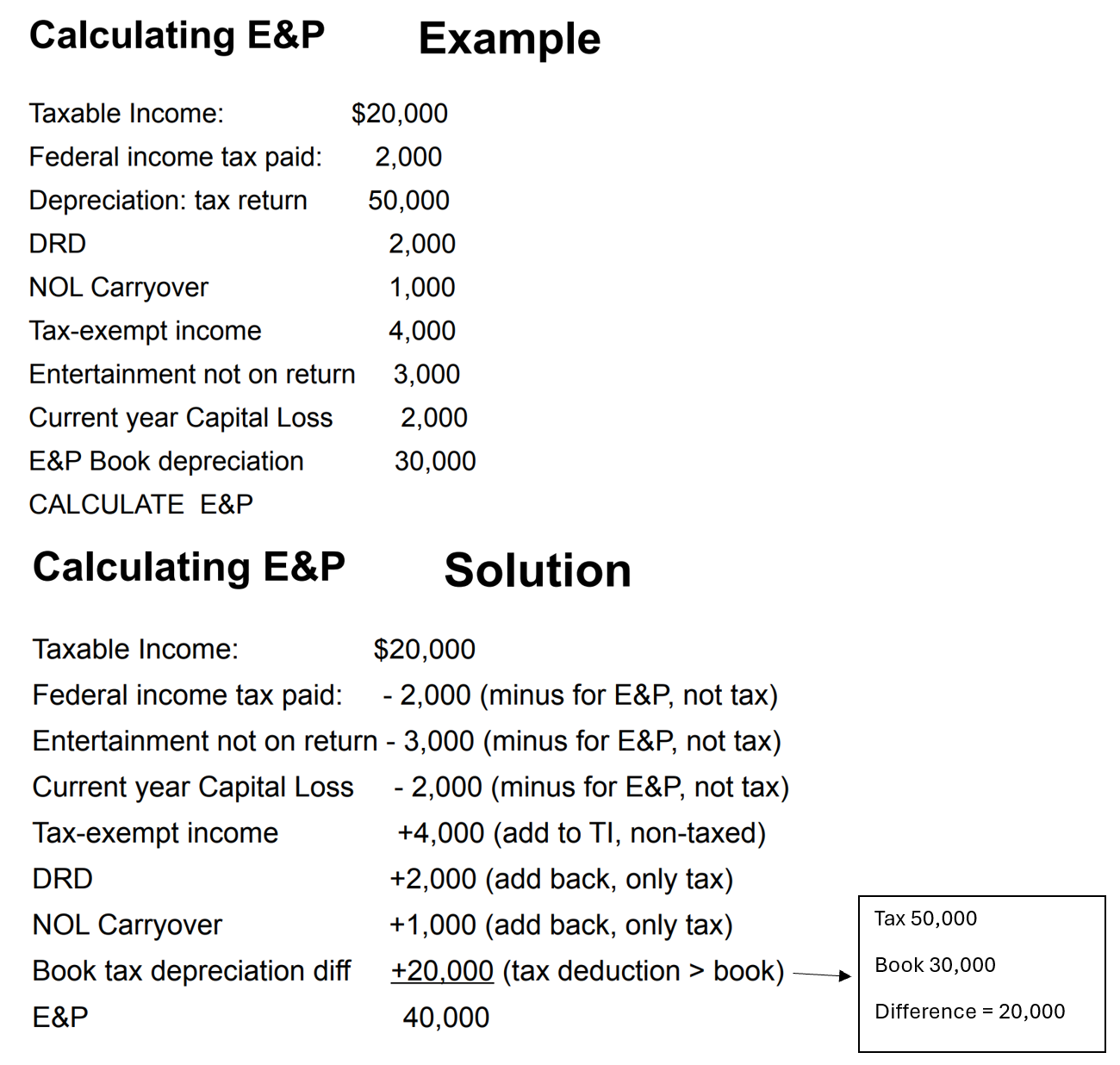

Calculating E&P [Example]

E&P Computation

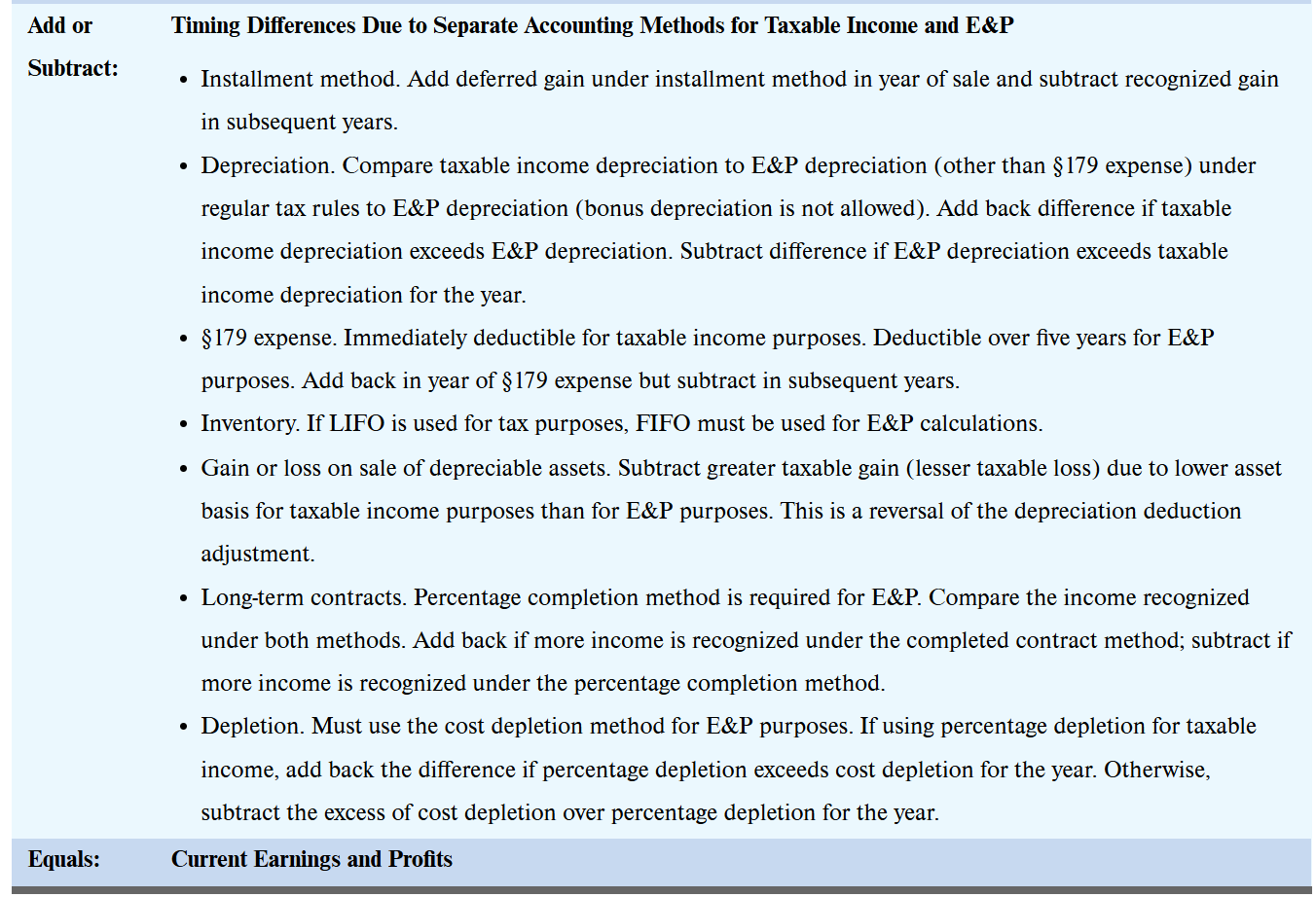

Ordering of E&P Distributions

Corporations must refer to both current and accumulated E&P accounts in determining the amount of distributions that are deemed to be dividends

Distributions are designated as dividends in the following order:

Distributions are dividends to the extent of current E&P

Distributions in excess of current E&P are dividends to the extent of accumulated E&P

Four possible balances of CE&P and AE&P:

Positive current E&P, positive accumulated E&P

Positive current E&P, negative accumulated E&P

Negative current E&P, positive accumulated E&P

Negative current E&P, negative accumulated E&P

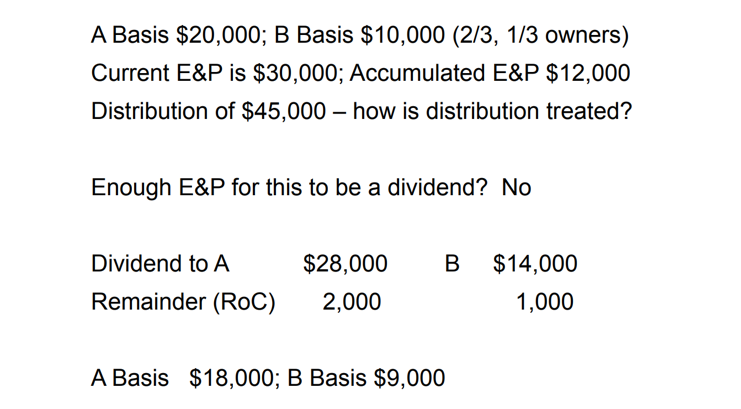

Scenario 1: Positive Current E&P and Positive Accumulated E&P

Corporate distributions are deemed to be paid out of current E&P first

If distributions exceed current E&P, the amount distributed from current E&P is allocated pro rata to all the distributions made during the year

The amount of distributions in excess of current E&P come from accumulated E&P and distributions are allocated to the accumulated E&P in the chronological order in which the distributions were made

This ordering of distributions is particularly important when distributions exceed current E&P and either the identity of the shareholders receiving the distributions changes or a shareholder’s percentage ownership changes during the year

Because current E&P is calculated at year-end, it can be difficult to determine the dividend status of a distribution at the time of the distribution

A corporation that makes a distribution in excess of its available E&P (i.e., a return of capital and/or capital gain to shareholders) must report the distribution on Form 5452 (Corporate Report of Nondividend Distributions) and include a calculation of its E&P balance to support the tax treatment

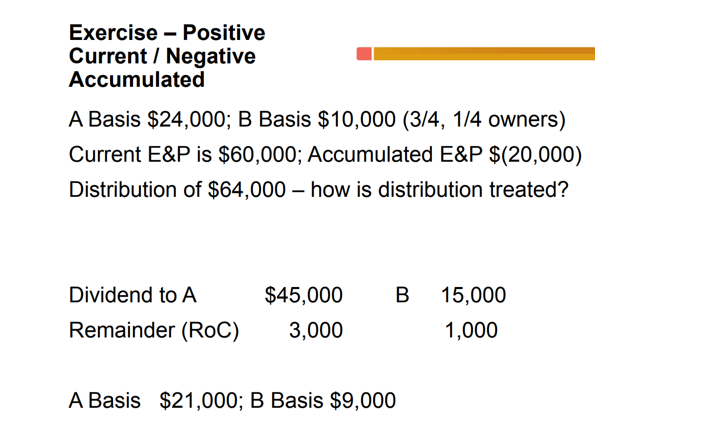

Scenario 2: Positive Current E&P and Negative Accumulated E&P

In this scenario, distributions deemed paid out of current E&P are taxable as dividends

Because accumulated E&P has a negative balance, distributions in excess of current E&P will be treated as a return of capital

If the nondividend distribution exceeds the stock basis, the excess is then treated as a capital gain

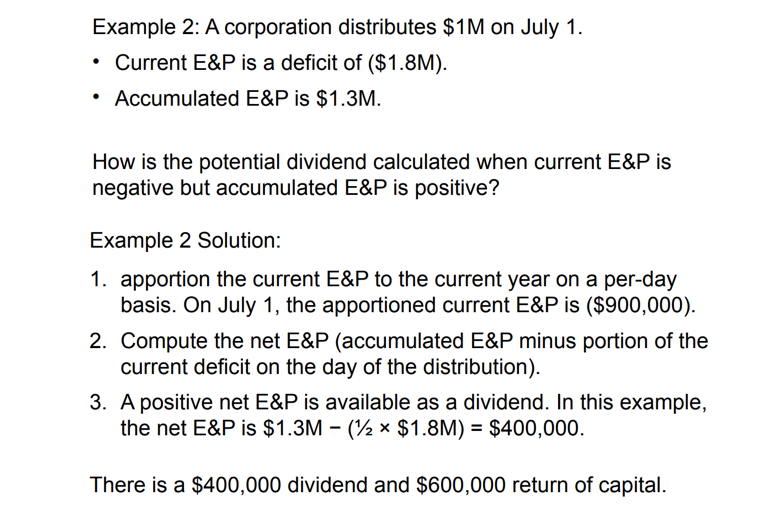

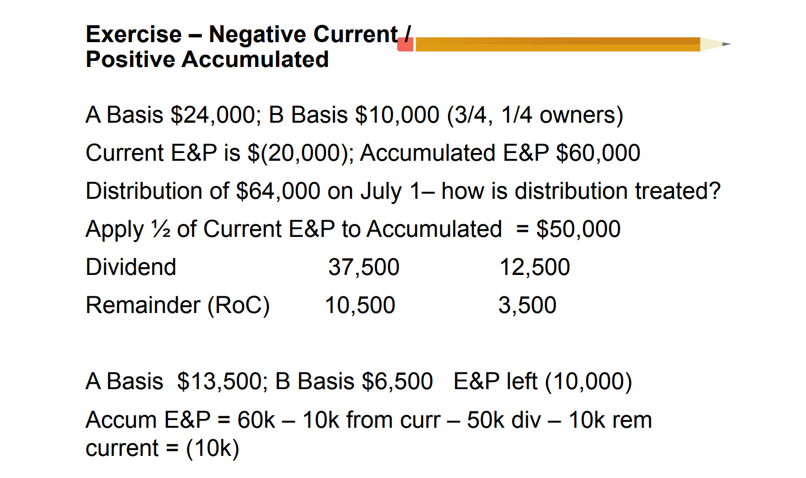

Scenario 3: Negative Current E&P and Positive Accumulated E&P

When current E&P is negative, the tax status of a distribution is determined by the available accumulated E&P on the date of the distribution

The available accumulated E&P is computed by allocating the negative current E&P up to the distribution date (but not including the distribution date) and then subtracting the allocated amount from accumulated E&P at the beginning of the year

The deficit in current earnings and profits can be prorated throughout the year using months or days, or the allocation can be made by closing the books and specifically identifying when the current earnings and profits was incurred

Distributions in excess of available E&P in this scenario are treated as return of capital, and any nondividend distribution in excess of stock basis is treated as a capital gain

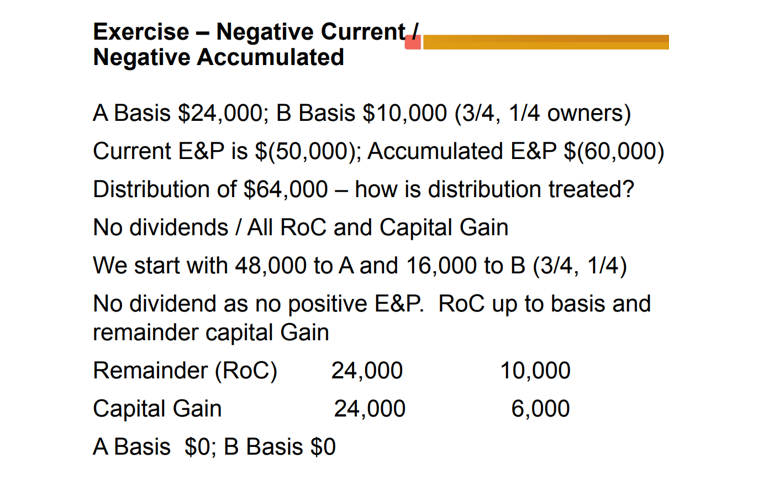

Scenario 4: Negative Current E&P and Negative Accumulated E&P

When current E&P and accumulated E&P are both negative, none of the distribution is treated as a dividend

Distributions will be return of capital to extent of stock basis

Any distribution in excess of stock basis is treated as capital gain

Distributions of Noncash Property to Shareholders

On occasion, a shareholder will receive a distribution of property other than cash

Noncash distributions can be more complex for three reasons

Any liability attached to the property affects the amount distributed

Any difference between the value and the tax basis of the property affects the calculation of E&P

Noncash distributions can have income tax consequences to the distributing corporation

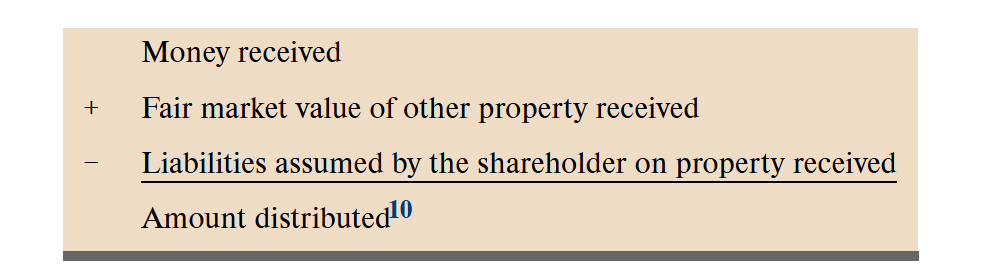

To begin, when noncash property is received, the shareholder determines the amount distributed as follows:

As a general rule, a shareholder’s tax basis in noncash property received as a dividend equals the property’s FMV

Although liabilities affect the amount of the distribution, liabilities do not affect the new basis of the distributed property

In other words, the basis of the property received consists of the taxable distribution plus the liabilities assumed by the shareholder

The FMV is determined as of the date of the distribution

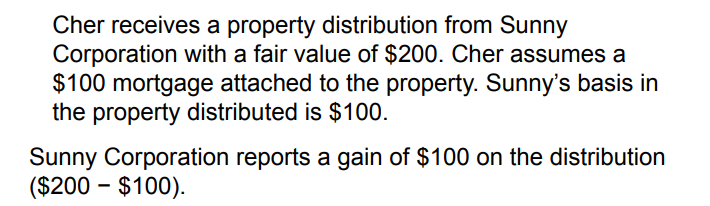

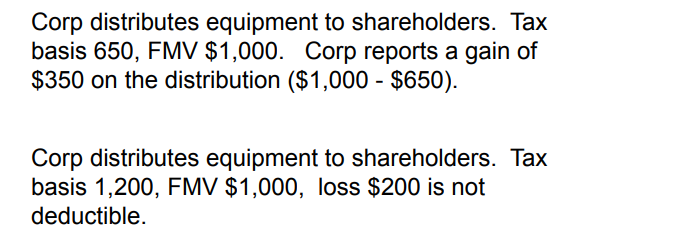

Tax Consequences to a Corporation Paying Noncash Property as a Dividend

The corporation recognizes gains (but not losses) on the distribution of noncash property as a dividend

Taxable Gain = FMV property distributed > Adjusted tax basis in property

Nondeductible Loss = FMV property distributed < Adjusted tax basis in property

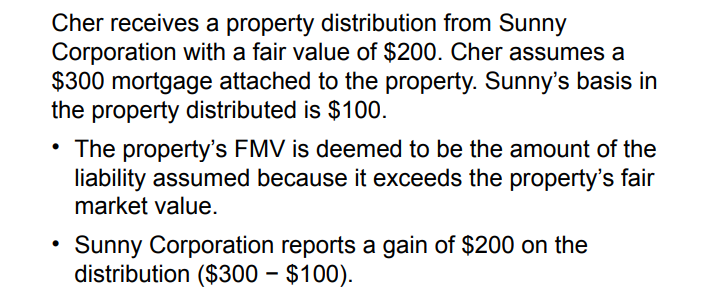

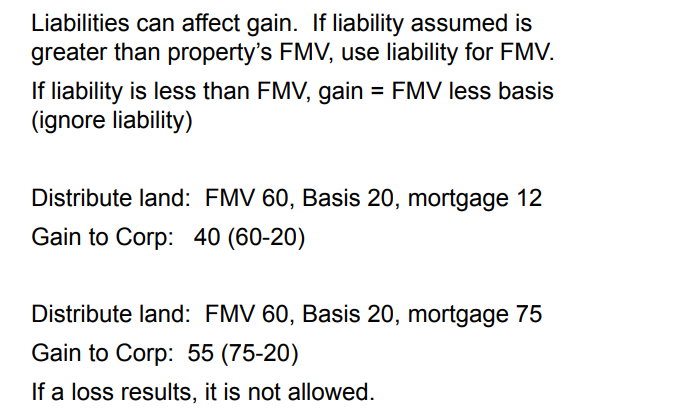

Liabilities

Under some circumstances, the amount of any liability assumed by the shareholder can also affect the gain recognized by the corporation

When a liability assumed by the shareholder is greater than the distributed property’s FMV, the property’s FMV is deemed to be the amount of the liability assumed by the shareholder

If the liability assumed is less than the property’s FMV, the gain recognized on the distribution is still the excess of the property’s fair market value over its tax basis (i.e., the liability is ignored by the distributing corporation for purposes of computing the FMV of the property)

Noncash Property Distribution & Liabilities [Examples]

Effect of Noncash Property Distributions on E&P

Current E&P

Current E&P must be adjusted if the E&P basis in the distributed property differs from the corporation’s taxable income basis AND the distributed property is appreciated (fair market value of property distributed in excess of the property’s E&P adjusted tax basis)

Current E&P must reflect the E&P gain on distributions of appreciated property (E&P losses on property distributions can be ignored because they are not recognized)

The adjustment is necessary because taxable income includes the taxable gain (not the E&P gain)

Accumulated E&P

To reflect that a distribution reduces a corporation’s economic resources to pay dividends in future years, a corporation reduces its accumulated E&P at the end of the current year

The amount of the reduction depends on whether the distributed property was appreciated or depreciated for E&P purposes

When a corporation distributes appreciated property, the distribution reduces accumulated E&P at year-end by the FMV of the property distributed

When a corporation distributes depreciated property, the distribution reduces accumulated E&P at the end of the year by the E&P adjusted tax basis of the property

When the distributed property is subject to a liability, the amount of the liability assumed by the shareholder(s) increases accumulated E&P, essentially netting the liability against the distribution of the property

Recall, however, distributions cannot cause accumulated E&P to drop below zero and cannot cause a negative balance in E&P to become more negative (i.e., increase a deficit)

Stock Distributions

Rather than distribute cash to its shareholders, a corporation may instead distribute additional shares of its own stock (or rights to acquire additional shares) to shareholders

A stock distribution increases the number of shares outstanding

Stock distributions can also take the form of a stock split, a stock redemption in which a corporation exchanges a ratio of shares of stock (e.g., 2 for 1) for each share held by the shareholder

Nontaxable Stock Distributions

Stock distributions are nontaxable to shareholders if two conditions are met

Made with respect to common stock (ex: stock splits)

Pro-rata stock dividends (proportionate interests maintained)

Example Assume a shareholder owns 100 shares of Acme Corporation stock, for which they paid $3,000. Acme declares a 100 percent stock distribution and sends the shareholder an additional 100 shares of stock. The shareholder will now own 200 shares of stock with the same tax basis of $3,000. The basis of each share of stock decreases from its original $30 per share ($3,000/100) to $15 per share ($3,000/200).

Taxable Stock Distributions

Non-pro rata (disproportionate) stock distributions usually are taxable as dividends

This makes sense because the recipient has now received something of value: an increase in the shareholder’s claim on the corporation’s income and assets

Receiving cash along with a stock distribution makes it disproportionate

Example A distribution where shareholders are offered the option of receiving cash in lieu of stock. In this case, shareholders who elect to receive stock in lieu of money will be treated as having received a property distribution equal to the cash (presumably this is the fair market value of the stock), and the shareholder will have a tax basis in the new stock equal to its fair market value.

Reasons for Stock Redemption

Public Companies

Have excess cash and limited investment opportunities

Management may feel the stock is undervalued

Management may see a large redemption as a way to get shareholders or stock analysts to reconsider their valuation of the company or as a way to selectively buy out dissenting shareholders who have become disruptive

Reducing the number of outstanding shares also increases EPS (by decreasing the denominator) and potentially increases the stock’s market price

Private Companies

To shift ownership control from older to younger family members who do not have the resources to purchase shares directly or to buy out dissatisfied, disinterested, or deceased shareholders

Redemptions of an ex-spouse’s stock can provide liquidity in a divorce agreement and eliminate the individual from management or ownership in the company

Can provide cash to satisfy estate taxes imposed on the estate of a deceased shareholder of the company

The Form of a Stock Redemption

A stock redemption is a property distribution (cash and noncash) made to shareholders in return for some or all of their stock in the distributing corporation that is not in partial or complete liquidation of the corporation

If the form of the transaction is respected, shareholders compute gain or loss (capital gain or loss if the stock is held as an investment) by comparing the amount realized (money and the FMV of other property received) with their tax basis in the stock exchanged

The Internal Revenue Code provides both objective/mechanical tests (bright-line tests) and subjective/judgmental tests to distinguish when a redemption should be treated as an exchange or a potential dividend

A redemption results in either a dividend or a sale of the redeemed shares

Individuals generally prefer exchange/sale treatment because of the preferential tax rates for capital gains

Corporate shareholders generally prefer dividend treatment because of the DRD

Redemptions that Reduce a Shareholder’s Ownership Interest

— Three types of redemptions are treated as exchanges:

Redemptions that are substantially disproportionate are treated as sales

Redemptions in complete redemption of all of the stock of the corporation owned by the shareholder

Redemptions that are not essentially equivalent to a dividend

— In determining whether a change in ownership test is met, a shareholder must take into account the constructive ownership, or stock attribution rules found in §318

There are four types of stock attribution:

Family attribution

Attribution from entities to owners or beneficiaries

Attribution from owners or beneficiaries to entities

Option attribution

The purpose of the attribution rules is to prevent shareholders from dispersing stock ownership to either family members who have similar economic interests or entities controlled by the shareholder to avoid having a stock redemption characterized as a dividend

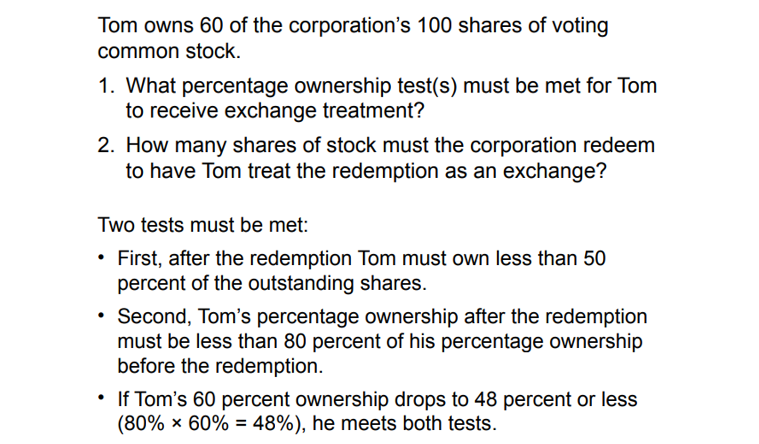

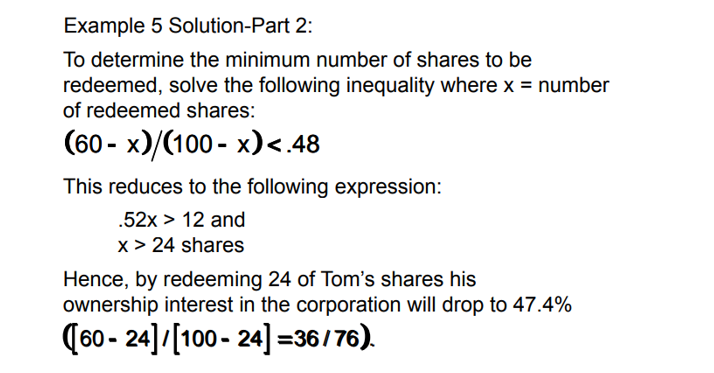

1. Redemptions that are Substantially Disproportionate

— Stock ownership tests are required for treatment as substantially disproportionate

Immediately after the exchange, the shareholder owns < 50% of the total combined voting power of all classes of stock entitled to vote

The shareholder’s percentage ownership of voting stock after the redemption is < 80% of their percentage ownership before the redemption

The shareholder’s percentage ownership of the common stock (voting and nonvoting) after the redemption is < 80% of their percentage ownership before the redemption

(1) Family Attribution

Individuals are treated as indirectly owning the shares of stock owned by their spouse, children, grandchildren, and parents

Stock owned constructively through the family attribution rule cannot be reattributed to another family member through the family attribution rule

(2) Attribution from Entities to Owners or Beneficiaries

Partners are deemed to own % shares owned by partnership

Beneficiaries are deemed to own % of estates and trusts

Shareholders are deemed to own % of corporation’s stock, if they own at least 50% of value of stock

(3) Attribution from Owners or Beneficiaries to Entities

The entities listed above are deemed to own 100% of the shares owned by their partners / beneficiaries / shareholders

Stock that is deemed owned by an entity cannot be reattributed to the other owners in the entity

(4) Option Attribution

Owning an option to purchase stock is considered indirectly owning a share

2. Complete Redemption of the Stock Owned by a Shareholder

Similar to the substantially disproportionate test, but the family attribution rules apply differently

Parents who have all their stock redeemed will not be able to qualify for sale or exchange treatment if their children or grandchildren continue to own the remaining stock in the corporation because of the operation of the family attribution rules

To provide family members with relief in these situations, shareholders can waive (ignore) the family attribution rules in a complete redemption of their stock

Shareholders can waive (ignore) the family attribution rules in a complete redemption of their stock if all three requirements are met:

The shareholder has no interest (prohibited interests) in the corporation immediately after the exchange as a shareholder, employee, director, officer or consultant

The shareholder does not acquire a prohibited interest within 10 years after the redemption, unless by inheritance (10-year look-forward rule)

The shareholder must agree to notify the IRS district director within 30 days if a prohibited interest is acquired within 10 years after the redemption

The shareholder can still be a creditor of the corporation (e.g., the parents can receive a corporate note in return for their stock if the corporation does not have the cash on hand to finance the redemption)

3. Redemptions that are Not Essentially Equivalent to a Dividend

Subjective determination that turns on the facts and circumstances of each case

To satisfy this requirement, there must be a “meaningful” reduction in the shareholder’s ownership interest in the corporation as a result of the redemption

Neither the IRS nor the courts provide any mechanical tests to make this determination

The courts generally look at the substance of the transaction to determine if the redemption is a sale or a disguised dividend

Although the courts have held that a shareholder’s interest can include the right to vote and exercise control, participate in current and accumulated earnings, and share in net assets on liquidation, the IRS generally looks at the change in voting power as the key factor

The IRS requires that the shareholder’s voting power must decrease and be < 50% as a result of the exchange before this test can be considered

As before, the stock attribution rules apply to these types of redemptions

Shareholders generally turn to this test to provide exchange treatment for redemptions when they cannot meet any of the other tests

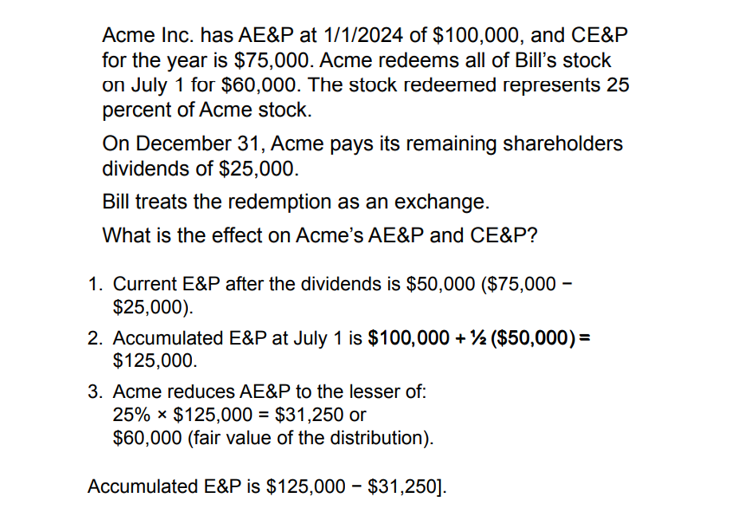

Tax Consequences to the Distributing Corporation

The corporation distributing property to shareholders in a redemption generally recognizes gain on the distribution of appreciated property but is not permitted to recognize loss on the distribution of property with a fair market value less than its tax basis

If the redemption is treated as a distribution, the corporation reduces its accumulated E&P at the end of the year by the cash distributed and either the fair market value or the E&P adjusted tax basis of other property distributed

If the redemption is treated as an exchange, the shareholder tax consequences are as follows:

Gain is always recognized

Loss is recognized unless the shareholder is a related person to the corporation

The redeemed shareholder may be related if they own more than 50 percent of the stock’s value

Note that ownership is determined using the §267(c) attribution rule

CE&P is reduced by dividend distributions (cash and fair market value of other property adjusted for gain recognized and liabilities distributed)

For an exchange, E&P is reduced by the percentage of stock redeemed (limited to the fair market value of the property distributed)

CE&P is reduced by dividends before reducing E&P for redemptions treated as exchanges

Stock Redemption [Examples]

Partial Liquidations

A partial liquidation a distribution made by a corporation to shareholders that results from a contraction of the corporation’s activities

Corporations can contract by either:

Distributing stock of a subsidiary to shareholders, or

Selling a business and distributing the proceeds to shareholders in partial liquidation

The tax treatment of a distribution received in a partial liquidation depends on the type of entity receiving the distribution

Distributions may require the shareholders to exchange some shares of stock or may be pro rata to all the shareholders without an actual exchange of stock

Noncorporate shareholders (partnerships, LLCs, individuals) receive exchange treatment

Corporate shareholders determine their tax consequences using the change-in-stock ownership rules that apply to stock redemptions

This usually results in dividend treatment because partial liquidations almost always involve pro rata distributions

Corporate shareholders generally prefer dividend treatment because of the availability of the DRD

However, the benefit of the DRD is mitigated because a partial liquidating distribution to a corporate shareholder is treated as an extraordinary dividend under §1059, which requires corporations to reduce their stock basis by the amount of the dividends-received deduction

For a distribution to be in partial liquidation of the corporation, it must be either “not essentially equivalent to a dividend” (as determined at the corporate level) or the result of the termination of a “qualified trade or business