unit 5 market structures

1/74

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

75 Terms

allocative efficiency

where recourses follow consumer demand, where society surplus is maximised, where net social benefit is maximised

AR/P = MC

MSB = MSC

consumer benefit

resources follow consumer demand

low prices

maximisation of consumer surplus

high choice

high quality

producer benefit

retained/increased MS

more competitive

increased profit

productive efficiency

firm operating at the lowest point on AC curve - minimising costs, maximisation of output at the lowest AC

fully exploiting EOS

MC = AC

consumer benefit

lower prices

higher consumer surplus

producer benefit

more production at lower cost - greater profit

lower prices - more competitive - greater MS

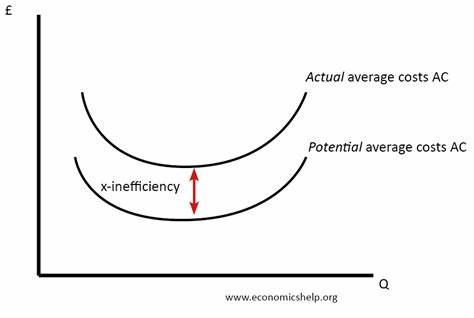

X efficiency

minimising waste, producing on AC curve

consumer benefit

lower prices - higher consumer surplus

producer benefit

lower costs

higher profit

more competitive, higher MS

X inefficiency = producing above AC curve

why

monopolist - no competition

public sector - not profit motivated, they maximise social welfare

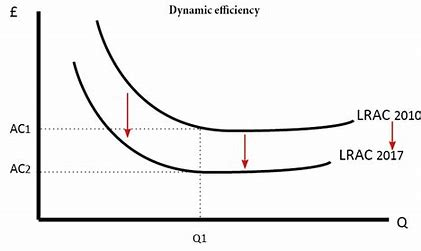

dynamic efficiency

reinvestment of long run supernormal profit back into the business in the form of better capital, R And D , innovation, new technology

MR = MC (supernormal profit in the long run)

consumer benefit

new products

lower prices over time because of new technology, production techniques more competition

high consumer surplus

producer benefit

long run profit maximisation

more competitive - price maker ability

lower costs over time

static efficiency

consist of these efficiency as they all occur at a specific production point, where as dynamic efficiency occurs over time

allocative efficiency

productive efficiency

X efficiency

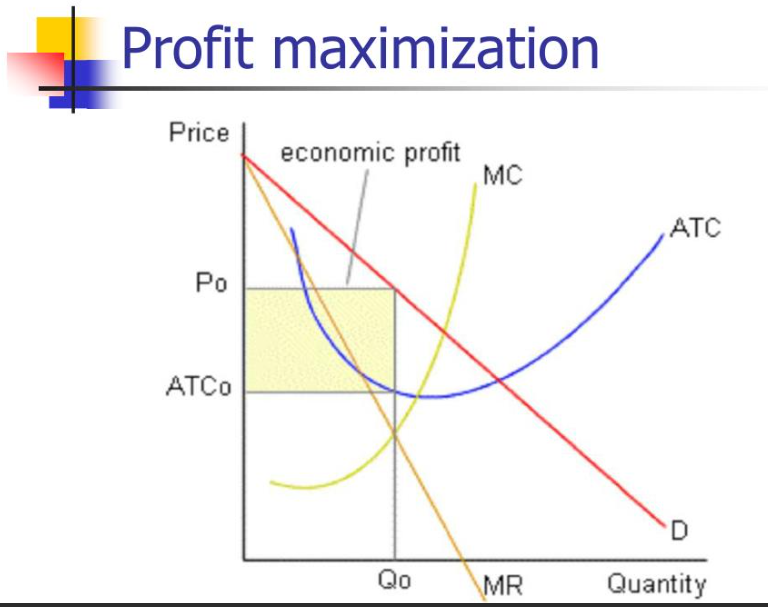

profit maximisation - objective of firms

MR= MC - no more extra profit can be made

why

reinvestment - innovation - lower costs

dividends for shareholders

lower costs and lower prices for consumers

why do some firms not profit maximise

don’t know MR/MC

avoid regulation/investigation

key stakeholders harmed - consumers, workers, government - environmental groups (anyone with interest in business)

other objectives

profit satisficing - objective of firms

anywhere between profit max and sales mx

a firm sacrifices profit to satisfy as many key stakeholders as possible

harming workers could cause a strike

harming consumers could create bad publicity

harming government could investigate

revenue maximisation - objective of firms

MR = 0

why

EOS benefits - higher quantity than profit max

predatory pricing - lower than profit max price

principle agent problem - divorce between ownership and control

predatory pricing

pricing strategy where a firm sets prices low, sacrificing profit with the intent to eliminate competition and gain market power

divorce between ownership and control

a situation in which the owners of a firm (shareholders) are different from the managers (agents) who run the company, potentially leading to conflicts of interest

owners want profit maximisation

managers want to revenue maximise to inflate bonuses

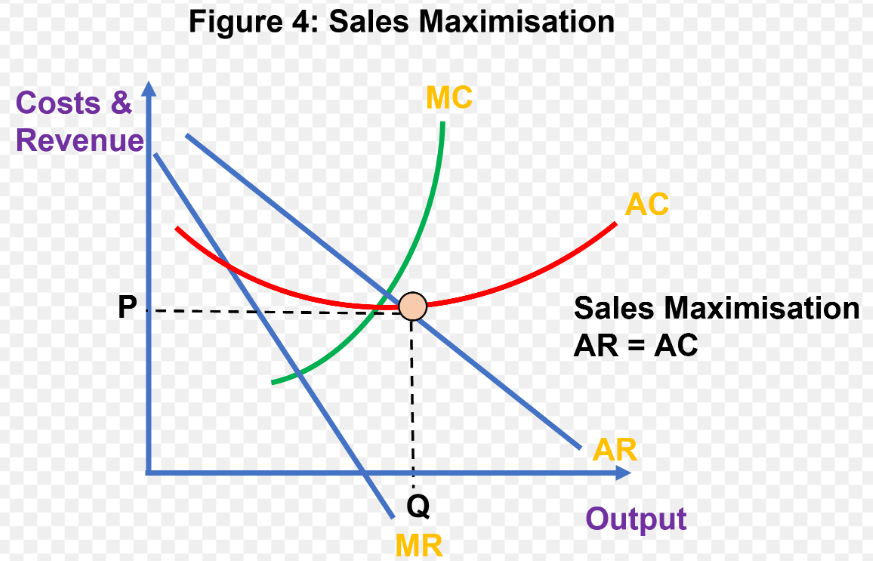

sales maximisation - objective of firms

growth maximisation

AC = AR

why

EOS - higher output

limit pricing - normal profit - no incentive for firms to enter market

principle agent problem - divorce between ownership an control

flood the market - increase brand loyalty

other objectives of firms

survival - short term to enter a competitive market

public sector organisation

P = MC, allocative efficiency

maximise society welfare

corporate social responsibility

charity, sustainability, ethical

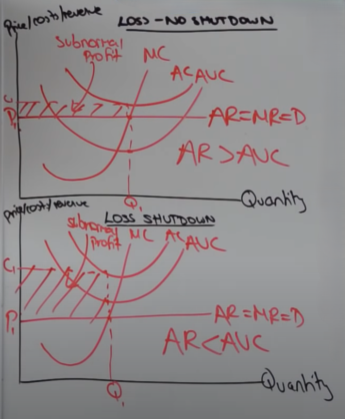

shutdown condition in perfect competition

a business needs to make at least normal profit in the long run to justify remaining in an industry

a firm will choose to operate if AR covers AVC, if AR falls below this level, the firm should shut down to minimize losses

shutdown condition = AR =< AVC

this loss can no be sustained so it makes since for the firm to leave the industry and move FOP elsewhere

process innovation

changes in the way in which production takes place or is organised

product innovation

small scale and frequent subtle changes to the characteristics and performance of a good or service

perfect competition characteristics

no barriers to entry / exit

many buyers and sellers

homogenous goods

price takers

perfect information

firms are profit maximisers

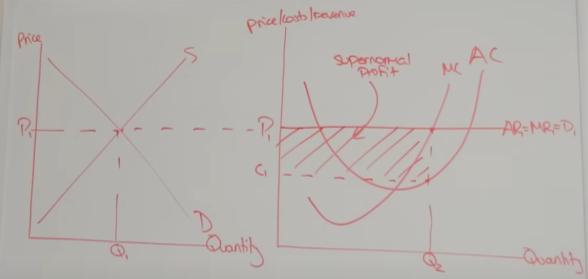

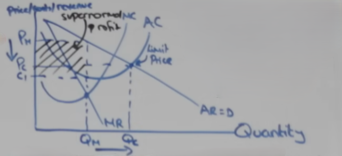

perfect competition in the short run

price is determined by the market as firms are price takers (S = D)

supernormal profit is made as AC is below AR

profit is greater than costs

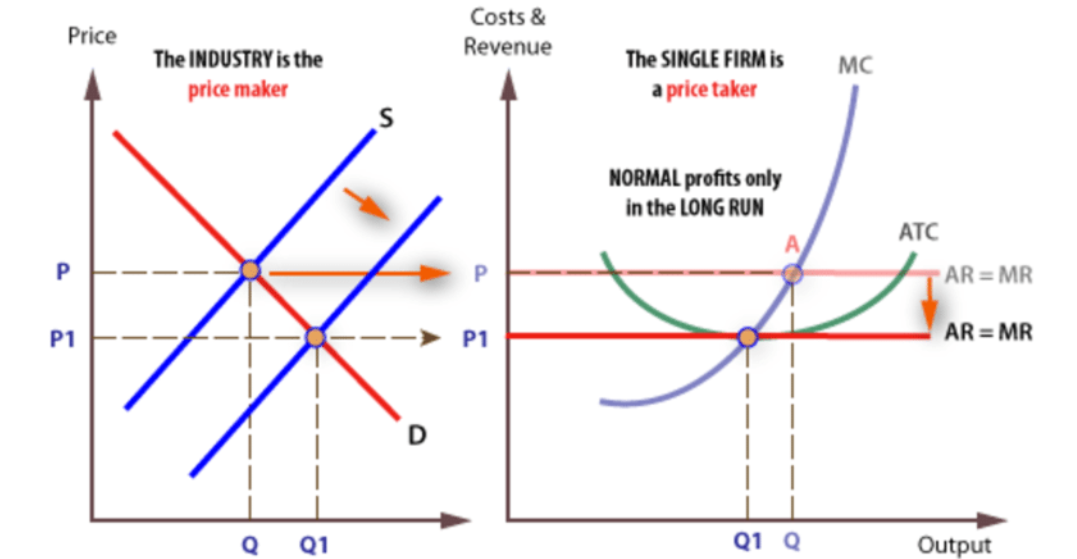

perfect competition in the long run

the supernormal profit made in the short run attracts new entrants into the market (signal), and due to no barriers to entry and perfect information they can enter easily

as these new firms enter the market, the market supply shifts to the right, lowering the price from P1 to P2

firms take this new price as they are price takers meaning that now AR = AC reducing supernormal profit down to normal profit

perfect competition evaluation

is allocatively efficient as AR/P = MC

highest consumer surplus

resources perfectly following consumer demand

is productively efficient, operating at lowest point on AC curve (MC = AC)

is X efficient as they are producing on the AC curve

is statically efficient

not dynamically efficient in the long run as there is no supernormal profit to reinvest

characteristics of monopolistic competition

many buyers and sellers

each firm selling slightly differentiated goods

price makers slightly

because of substitutes

so price elastic demand curves

low barriers to entry / exit

good information

non-price completion as firms cant raise price too much

firms are profit maximisers

example - clothing market, restaurants

monopolistic competition in the short run

firms are able to make supernormal profit in the short run as they exploit their price making power as they are selling a unique good

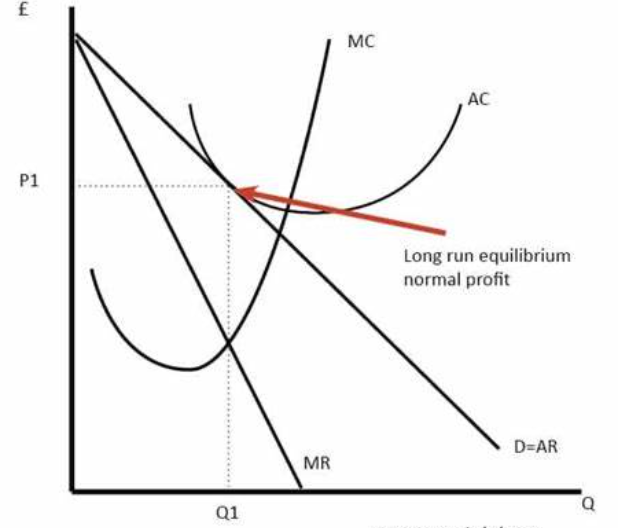

monopolistic competition in the long run

in the long run firms enter the market as they are attracted to the supernormal profit (signal), they can do do as there are low barriers to entry and good information of market conditions

this erodes away the supernormal profit made in the short run as new firms compete with established firms

as new firms enter the market, demand for individual firms shifts left as consumers are shared across a larger number of new firms, consumers buy substitutes from new firms, while AC doesn’t move

demand now = AC and normal profit is made

monopolistic competition evaluation

allocatively inefficient in the long run as price doesn’t equal MR, price is greater that MC, consumers are exploited, restricted output, less choice

however not as bad as a monopoly as firms don’t have as much price setting ability as there is lots of competition, loss of consumer surplus isn’t as bad as a monopoly

compered to perfect competition, allocative inefficiency can be considered desirable as there are not homogenous goods, consumers are willing to pay more and erode a bit of their consumer surplus for that

productively inefficient - voluntarily forgoing EOS and costs are not being minimised, producing a range of products makes it harder to achieve purchasing and technical EOS

more EOS than in perfect competition, so prices may be lower

productive inefficiency may be due to the product differentiation demand of consumers

not dynamically efficient as there is no long run supernormal profit being made - cant be reinvested

however if short run supernormal profit is enough to reinvest we see dynamic efficiency

characteristics of an oligopoly

few firms dominate the market

high concentration ratio

differentiated goods

firms are price makers

high barriers to entry / exit

interdependence - firms don’t make decisions on their own - they make them off of actions/reactions of rival firms

price rigidity

non-price competition

profit maximisation is not the sole objective

examples of non-price competition

product differentiation

branding

advertising

quality of product / service

example - UK supermarket industry

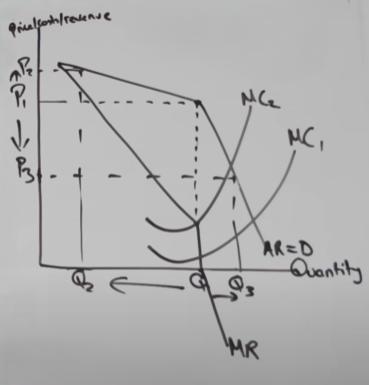

oligopoly kinked demand curve

firms don’t want to change their price - price rigidity

above P1 demand is price elastic

below P1 demand is inelastic

if a firms raises their price above P1, QD falls proportionality more that the increase in price

why, interdependence, other firms want to gain MS so keep their price at P1 and undercut this firm

so the firm that raised their price suffers and MS and total revenue decreases

if a firm reduces price, demand increases proportionally less than the decrease in price as PED is inelastic

other firms follow the price decrease to retain MS and possibly get into a price war

total revenue falls and overtime there will be no change in MS

as long as costs change within the vertical part of MR and the firm is a profit maximises (producing where MC = MR), they are going to be charging P1

as long as quantity is Q1, price is P1

oligopoly evalutation

could be price competition in order to gain MS (price war)

lots of non-price competition as prices stay rigid at P1, to attract consumers

temptation to collude allows firms to act like a monopoly, fix prices and make supernormal profit

concentration ratio

A measure of the market share held by the largest firms in an industry, indicating the level of competition

used to assess market power

CR4 = combined market share (sales) of the 4 largest firms

predatory pricing

focuses on eliminating existing competitors

prices are deliberately and temporarily set very low to restrict competition

P < AVC, shutdown point

illegal

limit pricing

preventing potential competitors from entering market

incumbent firms set price at AR = AC removing supernormal profit to remove the incentive for new firms to enter the market

collusion

anti-competitive agreement between rivals that attempts to disrupt the markets equilibrium

occurs when firms collaborate to set prices or output levels in order to maximize joint profits and reduce competition

illegal

cartel

group of firms that decide to cooperate and collude with each other

illegal

factors promoting a competitive oligopoly

large number of firms - harder to organise collusions

new market entry is possible - making high profit from collusion incentivises entry to the market, taking away supernormal profit

one firm with significant cost advantages - makes it hard to fix prices or quantity

homogenous goods - firms don’t have price making power

saturated market - only way to get ahead of firms is to take MS, high incentive to cheat on collusion

factors promoting a collusive oligopoly

small number of firms - easier to organise collusive agreements

similar costs - easy to fix prices and quantity

high entry barriers - the supernormal profits being made from collusion wont attract new entrants

ineffective competition policy - easier to get away with it

consumer loyalty - firms wont cheat on collusion if other firms have loyal customers

consumer inertia - consumers aren’t willing to switch suppliers

competitive oligopoly evaluation

allocative efficiency

X efficiency

productive efficiency

however no dynamic efficiency or EOS

collusive oligopoly evaluation

dynamic efficiency - supernormal profit - profit max point

not allocatively efficient

not productively efficient

not X efficient

EOS benefits

overt collusion

open and formal agreements, is when cartels formally arrange to collude with each other

tacit collusion

competitors coordinate their actions without explicitly agreeing to do so

more difficult for the CMA to prove

price leadership - firms copy the behaviour off the leading (dominant) oligopolist

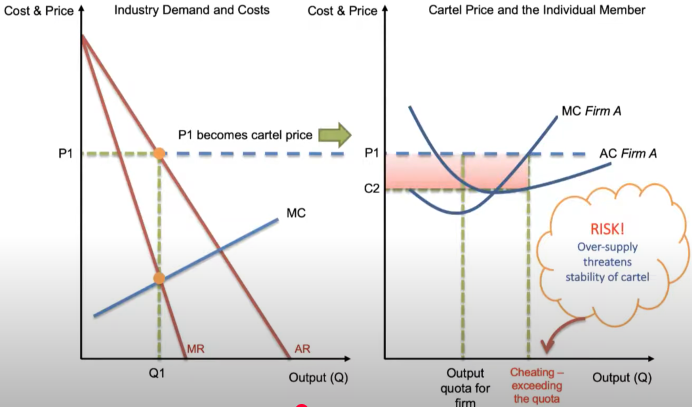

price fixing in an oligopoly diagram

in the industry firms are profit maximising producing where MC =MR, resulting in P1, Q1

P1 take P1 as they are price takers

the cartel member accepts the output quota other the price charged by the cartel will be distorted

the results in supernormal profit for the cartel

is a cartel cheats (incentive) and exceeds the quota, they will earn excessive supernormal profit, producing at the cheating quantity - P1 still covers AC

however cheating cartel quantity = oversupply, threatening the stability of the cartel

for the cartel to be success is for every member to keep price at P1

example of anti competitive behavior

in 2015 apple was fined 450 for conspiring with 5 publishers to increase e-book prices

real world advantages of oligopolies

price stability - firms often avoid price wars, leading to more stable prices for consumers

economies of scale - large firms can produce goods more efficiently, reducing costs and potentially lowering prices.

innovation and r&d - competition among few large firms can drive significant investment in research, leading to better products and services

consumer choice - despite few firms, product differentiation (e.g., branding, features) can offer consumers various options

real world disadvantages of oligopolies

collusion risk - firms might collude (tacitly or overtly), fixing prices or output, which harms consumers

restricted competition - new firms face high barriers to entry, reducing market dynamism and innovation over time

higher prices - lack of genuine competition can keep prices artificially high compared to more competitive markets

inefficiency - without competitive pressure, firms may become complacent, leading to productive and allocative inefficiency

manipulative marketing - heavy focus on advertising and brand loyalty can lead consumers to make irrational decisions

issues with cartel

enforcement problems - each firm finds it profitable to raise its own production - difficult for the cartel to enforce output quotas

successful entry of a non-cartel firm - undercut a cartel price and control the market

risk of severe penalties

cos of collusive behaviour

damage to consumer welfare

higher prices, lost consumer surplus

loss of allocative efficiency

hits lower income households

lack of competition

no incentive for X efficiency

no incentive to innovate - dynamic inefficiency

reenforces cartels monopoly power

harder for new businesses to enter market

reduces contestability

characteristics of a monopoly

one seller

unique product

high barriers to entry

imperfect information

price makers

profit maximisers

supernormal profit

different barriers to entry

EOS

brand loyalty

patent

geographical barriers

legal monopoly

firm has more than 25% market share

pure monoply

single seller in the market

natural monopoly

in order to reach productive efficiency, its better for production to be dominated by a single firm

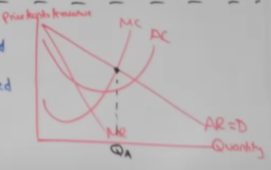

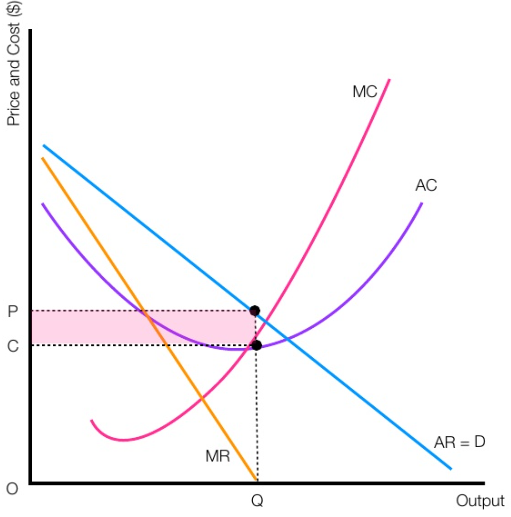

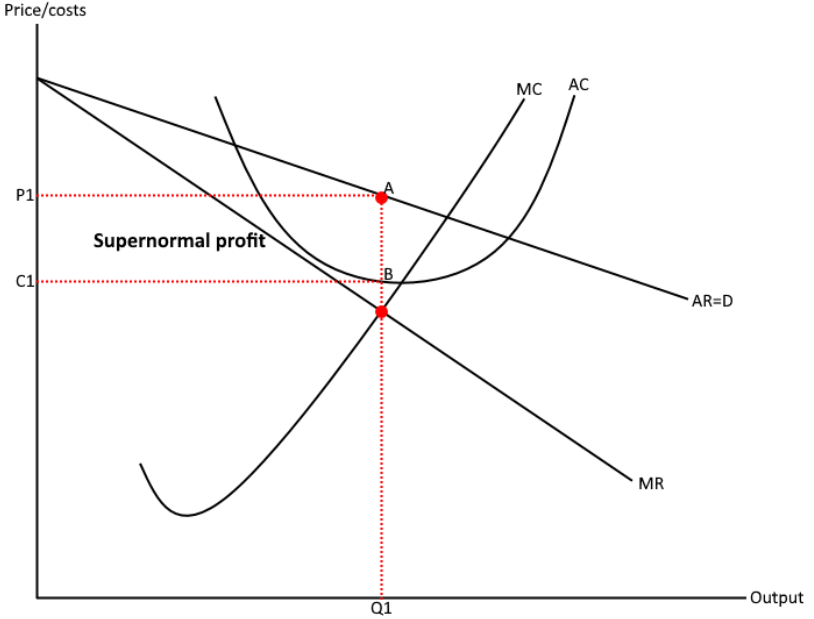

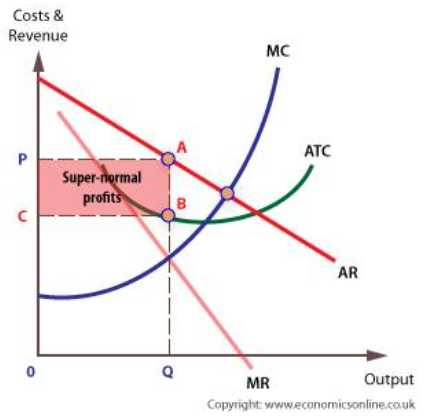

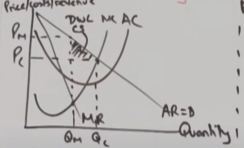

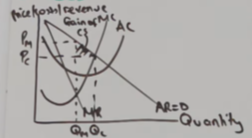

monopoly graph

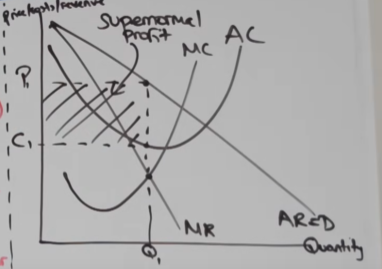

the firm is a profit maximiser meaning it produces at MR = MC (Q1, P1), price is read from AR

at Q1 AC is below P1, the difference between them is the unit level of supernormal profit, multiplied by the quantity gives us the total supernormal profit

efficiencies in a monopoly

not allocatively efficient as they are not producing at AR/P = MC

misallocation of recourses, exploiting consumers with high prices, restricted output an low consumer surplus, choice and quality also low as there are no competitors

not productively efficient as the monopoly is not producing where MC = AC

monopolist could also be too big casing diseconomies of sale, producing on the rising part of AC

not X efficient as as they are producing above their AC curve allowing for waste because there is no competitive drive

statically inefficient

potential for dynamic efficiency as there are long run supernormal profits being made in the long term as there are high barriers to entry and imperfect information keeping other firms out the market

profits reinvested in innovation and new technology, capital investment

benefits consumers

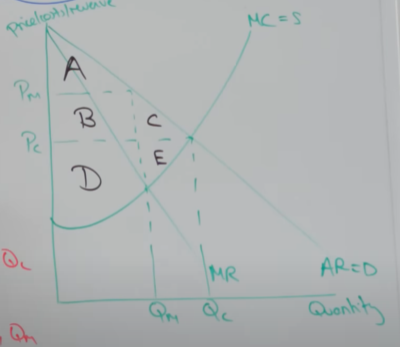

monopoly deadweight welfare loss

PM, QM is taken from the monopolies profit maximising point

PC, QC is a competitive firms quantity taken from the allocatively efficient point of production

monopoly reduces consumer surplus from ABC TO A

monopoly increases producer surplus from DE to DB

monopoly reduces society surplus (producer + consumer surplus) from ABCDE TO ABD

advantages of monopolies

dynamic efficiency

reinvesting profit can result in better quality for consumers and possibly lower prices

greater EOS

exploit greater EOS than competitive markets due to their size

natural monopoly

a regulated natural monopoly can give society desirable outcomes and stop the wasteful duplication of resources

cross substitution

use supernormal profits to subsidies a loss making good they are producing, socially desirable

disadvantages of monopolies

allocative inefficiency, price is higher than marginal cost meaning consumers are exploited, paying more than what it costs to produce, lower consumer surplus

deadweight welfare loss of consumer surplus show on diagram

productive inefficiency

voluntarily forgoes EOS by not operating where MC = AC, lower part of AC curve

X inefficiency

allow waste in the production process due to a lack of competitive drive, producing beyond the AC curve

can cause inequalities

especially in necessity markets

as prices are higher at MR = MC

monopoly evaluation

supernormal profit may not be reinvested - dynamic inefficiency

profits may be given to shareholders as dividends, or pay debts

EOS or DOS depending on size of the firm

regulated monopoly can reduce inefficiencies

price discrimination can exaggerate monopoly inefficiencies and inequalities

competition threat can reduce inefficiencies

type of goods or service

if good is a necessity it is bad however is the monopoly is producing a luxury good it may not be as harmful

price discrimination

where a firm charges different prices to different consumers for an identical good/service with no differences in cost of production

conditions for price discrimination

price making ability - need monopoly power

information to sperate the market into different PEDs

prevent re-sale, stop people buying low and selling high (market seepage)

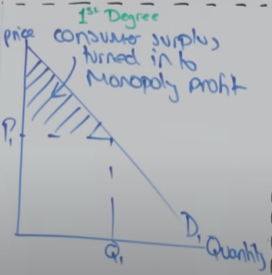

1st degree price discrimination

consumers are charged the exact price they are willing to pay for a good/service

eroding all consumer surplus and turning it into monopoly profit

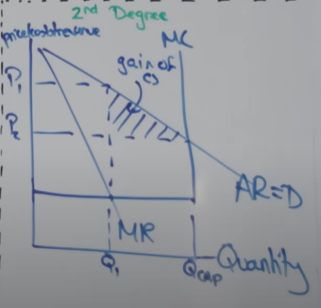

2nd degree price discrimination

firms with fixed capacity

last minute, firms lower their prices in order to fill capacity and contribute towards fixed costs

airline company

MC curve is horizontal (constant) up to their capacity where it becomes vertical where they cant produce anything more

firm produces at MR = MC (Q1) maximising profits

results in excess capacity from Q1 to Qcap

firm lowers price to fill capacity to bring in revenue to contribute towards fixed costs (P2), all capacity is filled

consumers that buy last minute tickets gain consumer surplus

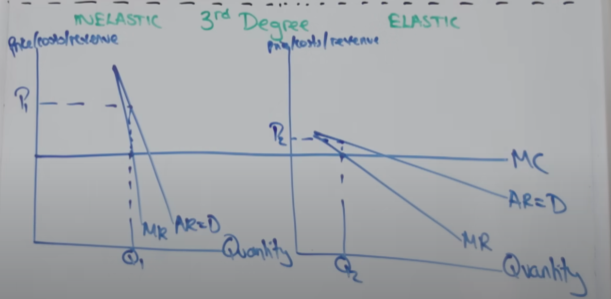

3rd degree price discimination

occurs when a firm can segment the market into different PEDs

based on time, age, geography or income differences and will charge different prices to different groups

rail company

inelastic, people who need to get to work

elastic, leisure travellers, off peek times

MC is constant as it costs the same to fill 1 more seat on the train

higher prices in an inelastic demand, exploiting consumers

advantages of price discrimination

greater profits can result in dynamic efficiency

higher quantity in 2nd and 3rd degree allows for greater EOS - lower prices

some consumers benefit for price discrimination

cross subsidisation - profits may be used to subsidies loss making goods elsewhere in the business allowing them to still be provided to consumers

disadvantages of price discrimination

allocative inefficiency

prices higher than MC, exploiting consumers

inequalities

widens income inequality

anti-competitive pricing

lower prices diving out competitors, pure monopoly power

characteristics of natural monopolies

high fixed/sunk costs

high potential for EOS

rational for 1 firm to supply the entire market

to avoid the wasteful duplication of resources and non exploitation of full EOS - allocative and productive inefficiency

competition is undesirable

examples - water, gas distribution

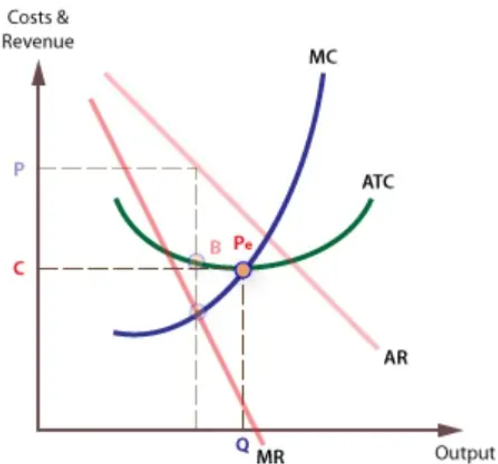

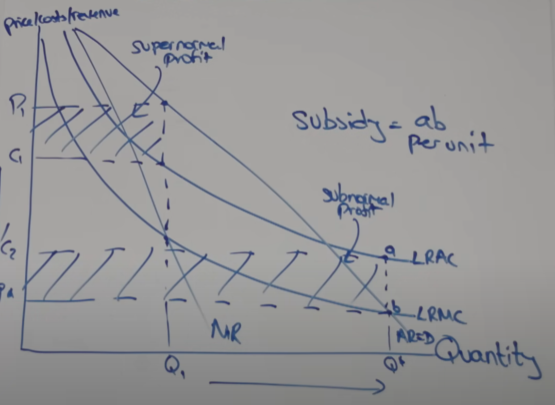

natural monopoly graph

producing at the profit maximising point of MR = MC, Q1, P1 generates supernormal profit as P1 is above LRAC

high prices and low quantitates

bad outcomes for essential services such as water (excluding poorer consumers), compared to the allocatively efficient point (P = MC)

charging these excessively high prices is deemed not good enough by regulators

with regulation at the allocatively efficient point, means a reduction in price and costs to P2, C2

here there is subnormal profit being made as costs are now high than prices

this incentivises to the natural monopoly to leave the industry, and so private natural monopolies are often subsidised

subsidy given is equivalent to to the loss per unit (a, b per unit) allowing them to make normal profit

natural monopoly evauation

as long as the market is dominated by 1 firm and there is regulation, there is allocative (P=MC) and productive efficiency (lowest point on AC)

better outcome that a competitive market

if regulated, there will be no more supernormal profit so dynamic efficiency isn’t possible

characteristics of a contestable market

low barriers to entry/exit

large pool of potential entrants

good information

incumbent firms (already in the market) subject to hit and run competition

firms quickly enter the market, take supernormal profit then leave again before incumbent firms can lower profit margins

how has technology increased barriers to entry

decreased barriers to entry

lower sunk costs, easier to achieve EOS, easier to advertise

increased pool of potential applicants

easier to innovate

cheaper ways of producing things

improved information

contestability in a monopoly

a monopoly prices at PM, QM, the profit maximising point, making supernormal profit

if the market is contestable the monopoly would move to PC, QC where AR = AC the limit price, making normal profit, break even point, removing the incentive for firms to enter the market

this lowers the price and increases the quantity - competitive outcome

limits threat

then price can be increased when the threat goes away

advantages of contestable markets

movements towards competitive outcomes give similar benefits to a competitive markets

allocative efficiency

lower price, higher quality, more consumer surplus, better choice

productive efficiency

better exploitation of EOS, lower costs, lower prices for consumers

x efficiency

minimising waste, lower costs, lower prices for consumers

job creation because of higher quantity - labour is in derived demand

disadvantages of contestable markets

lack of dynamic efficiency

lower profit margins, less progress over time

however if new firms come into the market with innovative ideas, that is the benefit of dynamic efficiency

cost cutting in dangerous areas

safety, environment impacted

creative destruction

new innovation destroys existing firms - job losses

however overall if market is greater workers who have lost jobs can move to newer firms

anti-competitive strategies

overtime if businesses use anti-competitive strategies like limit or predatory pricing, flooding the market or mergers, contestability will not last overtime

results in static inefficiencies in long run

contestable markets evauation

length of contestability

if new firms can patent ideas or use anti-competitive strategies, the market wont be contestable overtime

role of technology

patents

makes it easier for firms to price discriminate as they have access to more information - not statically efficient

regulation

minimise cost cutting in dangerous areas and anti-competitive strategies

negates other disadvantages

dynamic efficiency

competitive markets

a market structure characterised by many buyers and sellers, where no single buyer or seller has the power to influence the market price

advantages of competitive markets

allocative efficiency

P=MC consumers pay what it costs top produce, lower prices, higher consumer surplus, resources will be following consumer demand, more choice

productive efficiency

minimising average costs, exploiting EOS, passing on lower costs to consumer in the form of lower prices

x efficient

minimising waste and producing on the AC curve resulting in lower prices for the consumer

job creation

labour is in derived demand - link to employment and living standards

disadvantages of competitive markets

lack of dynamic efficiency

only normal profit left so there is no room for reinvestment, no progress over time, loss for consumers

lack of EOS

even if firms are productively efficient, they may not have the potential of EOS as they have lower output

cost cutting in dangerous areas

environment, health and safety, wages

creative destruction

when new firms enter the market, their creativity/innovation can destroy incumbent firms - unemployment, worse living standards

however those workers may be able to move to other new firms in the industry

competitive markets evaluation

still may have enough profits for a small investment, reinvestment may be a part of competition in these markets - dynamic efficiency

level of EOS

where is cost cutting taking place

role for regulation

static vs dynamic efficiency

static efficiency (lower prices and higher quantity) is more desirable in some markets where as in some markets dynamic efficiency is preferred as consumers are willing to pay for for innovation