Econ 102 - CHAPTER 14: Market Structure and Degrees of Market Power

1/18

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

19 Terms

Market Structure

The type of competitive environment in which a business operates.

It determines market power — your ability to charge higher prices without losing many customers.

Market Power

The extent to which a seller can charge a higher price without losing many sales to competing businesses.

Market power informs yourpricing strategy.

Ex:

Only gas station in town: high market power.

One of many gas stations: little or no market power.

The ability to charge a higher price without losing many customers.

If your business has market power, then you are NOT a price taker

Perfect Competition:

Markets in which...

1. All businesses in an industry sell identical

goods.

2. There are many sellers and many buyers,

each of whom is small relatively to the size

of the market.

# of sellers - Many

Type of product - Identical

Market Power - None

Relatively flat curve → Highly elastic

ex:

Corn farmers

stock market

Monopolistic Competition

A market with many small businesses competing, each

selling differentiated products.

# of sellers - Many

Type of product - Differentiated

Market Power - some

some market power → more inelastic

ex:

clothing brands

restaurants

Oligopoly

A market with only a handful of

large sellers.

Products can be somewhat different or

somewhat similar.

# of sellers - Few

Type of product - similar or different

Market Power - some

some market power → more inelastic

ex:

cell phone carriers

airlines

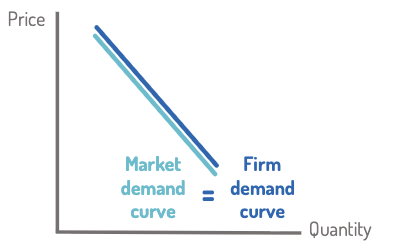

Monopoly

When there is only one seller in

the market.

No other businesses are selling the same

thing as you

# of sellers - one

Type of product - unique

Market Power - high

relatively steep (inelastic) → Your firm’s demand curve IS the market demand

curve.

ex:

Utilities

local water company

Spectrum of Market Power

Perfect competition → Imperfect competition (monopolistic & oligopoly) → Monopoly

Most real-world businesses fall somewhere in between — imperfect competition.

Least market power to most →

Five Key Insights into Imperfect Competition

More competitors → less market power.

Market power → price-setting ability.

Product differentiation → more market power.

Few buyers → more buyer bargaining power.

Interdependence: your choices depend on rivals’ actions (pricing, products, entry).

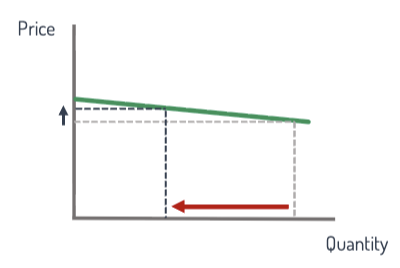

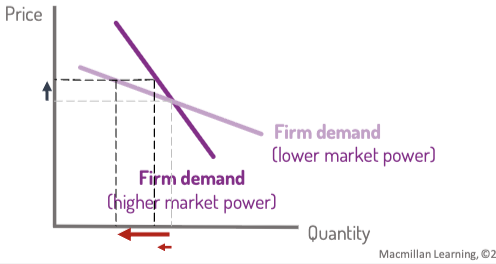

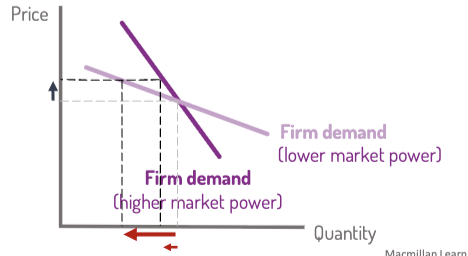

Firm demand curve

Illustrates how the quantity that buyers demand from an individual business varies as it changes the price it charges

Focuses on YOUR specific firm or

businessesSummarizes the market power of

your firm

Market Power | Demand Curve Shape | Elasticity |

|---|

Low | Flat | Elastic (many substitutes) |

High | Steep | Inelastic (few substitutes) |

Marginal cost

The cost of producing one more unit

Marginal Revenue (MR)

The addition to total revenue you get from selling one more unit.

The change in total revenue from selling one more unit.

Formula:

MR = ΔTR = P×Q

Rule:

When you lower price to sell more, two effects happen:

Output Effect: You gain revenue from selling a larger quantity of items

Discount Effect: You lose revenue because all units now sell at the lower price.

MR = Output Effect − Discount Effect

Output Effect (MR)

You gain revenue from selling a larger quantity of items

Selling this extra unit of output boosts revenue by an amount equal to the price of that item

Output effect on revenue = Price

The price of the extra item you sell

Discount Effect

You lose revenue because all units now sell at the lower price.

To sell the extra item, you lower your price a bit. This lower price applies to ALL the units you sell.

Discount effect on revenue = ∆P x Q

The price cut you have to offer x the quantity subject to that price cut

Marginal Revenue Curve

Always below the demand curve (because of discount effect).

Declines faster than the demand curve as quantity increases.

Rational Rule for Sellers

Sell one more unit if MR ≥ MC.

Four Consequences of Market Power

Higher Prices: Price > MC.

Underproduction: Quantity < efficient level (MC < MB → missed surplus).

Higher Profits: Firms restrict output to increase price.

Inefficiency: Less pressure to reduce costs or innovate.

The Policy Trade-off

More competition → better outcomes for society as a whole

Less competition → more market power and larger profits for incumbent firms

Governments regulate to balance innovation incentives with fairness.

Policies to Ensure Competition (Antitrust Laws)

Anti-Collusion Laws | Prevent competitors from agreeing not to compete. | Airlines fixing prices; companies agreeing to split markets. |

Merger Laws | Prevent mergers that reduce competition. | AT&T + T-Mobile blocked (2011); Staples + Office Depot (1997). |

Ban on Monopolization | Illegal to attempt to monopolize (predatory pricing, exclusivity deals). | Forcing suppliers to avoid competitors. |

Encouraging International Trade | Imports increase competition & reduce power of domestic monopolies. | Car imports increased competition for U.S. automakers. |

Policies to Minimize Harm from Market Power

Price Ceilings | Caps how much monopolies can charge → prevents abuse. | Utility pricing regulations. |

Regulating Natural Monopolies | When one firm can serve the market cheapest, the gov’t regulates price instead of breaking it up. | Electricity, water, gas services. |