Quizam 1

1/35

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

36 Terms

Standardized recipies

a recipe producing a known quality and quantity of food for a specific operation

It specifies (1) the type and amount of each ingredient, (2) the preparation + cooking procedures and (3) the yield + portion size

Have specific operation attached: cooking time, temperatures and utensils

Recipie costing basics

Cost per unit equation = A.P. cost/number of units = cost per unit

Unit cost: the price paid to acquire one of the specific units

Cost per portion

total recipe cost/number of portions = cost per portion

Total recipe cost

The total cost of ingredients for a particular recipe; it does not reflect overhead, labor, fixed expenses or profit

Overhead costs

expenses related to operating a business, including but not limited to costs for advertising, equipment, leasing, insurance, property rent, supplies and utilities

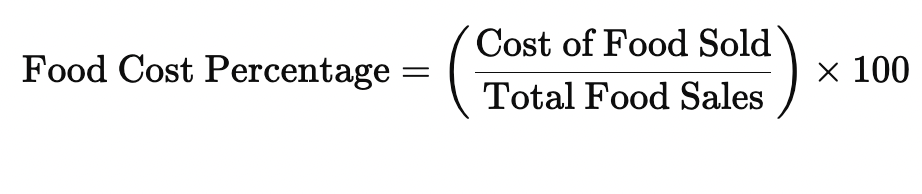

Food cost percentage

The ratio of the cost of foods used to the total food sales during a set period, calculated by dividing the cost of food used by the total sales in a restaurant

Selling price

Plate cost/desired cost % = selling price

A.P. cost

the condition or cost of an item as it is purchased or received from the supplier

E.P. cost

The amount of a food item available for consumption or use after trimming or fabrication; a smaller, more convenient portion of a larger or bulk unit

Yield percentage

Formula: E.P. weight/A.P. weight = yield percentage

Definition: the ratio of the unusable weight of an ingredient after cleaning and trimming for the quantity purchased, calculated by dividing the trimmed weight by the as-purchased weight of an ingredient

How to factor a recipe and cost individual ingredients (including the use of yield % and weights and equivalent measures)

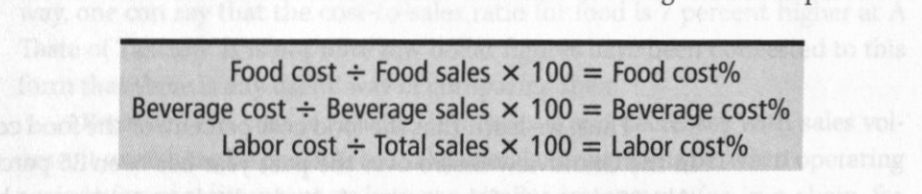

How to calculate and interpret cost percentages (Cost/sales=cost%)

Take the overall total sales if specific sales are not available

You can find really every kind of percentage you need by taking the cost you are looking at dividing it by total sales and multiplying it by 100

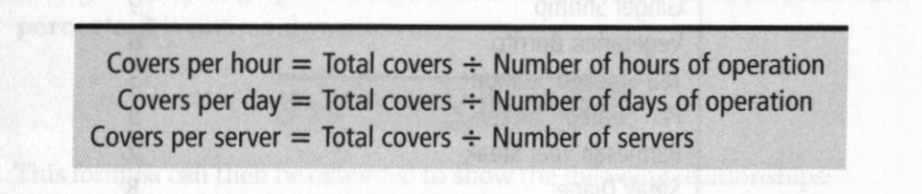

Covers

One diner (person) = a cover

Seat turnover

Seat turnover = number of customers served/number of seats

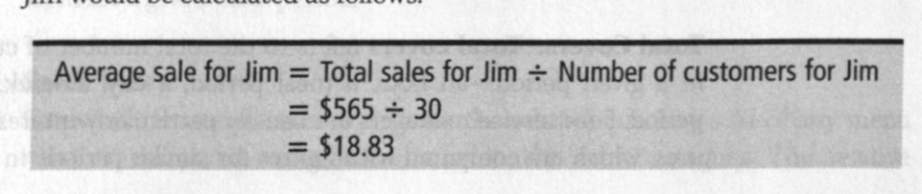

Calculated sales per server

average sale for server = total sales for server/number of customers for server

Variable costs vs. fixed costs and their differences and characteristics

Fixed costs:

normally unaffected by changes in sales volume. little direct relationship to the business volume

examples: insurance premiums, real estate taxes, depreciation on equipment

these should never be taken to mean static or unchanging but merely to indicate that any changes that may occur in such costs are related only indirectly or distinctly to changes in volume

Variable costs:

clearly related to business volume

As business volume increases, variable costs will increase, as volume decreases, variable costs should decrease as well

Directly variable costs: directly linked to vomule of business, so that every increase and decrease in volume brings a corresponding increase or decrease in cost

Examples: payroll costs, food, beverages

Semivariable cost:

A portion of it should change with short-term changes in business volume and another portion should not

salaries + wages

Controllable costs

can be changed in the short term

food + beverages (controlled through changing portion sizes)

Variable costs

Normally controllable

Uncontrollable costs

cannot normally be changed in the short term

rent, interest on mortgage, real estate taxes, license fees + depreciation

Average check

average check = total dollar sales/total number of covers

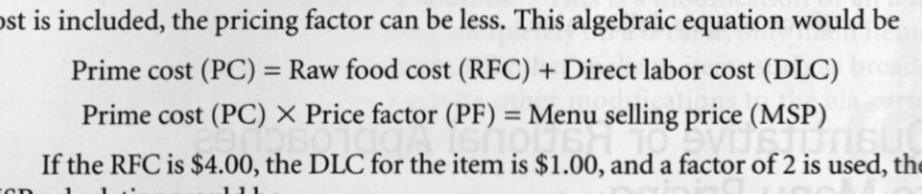

Prime cost

refers to the costs of materials + labor: food, beverages and payroll

Sales mix

the relative quantity sold of any menu item as compared with other items in the same category

Formula: take the number sold of that item and divide it by the total amount sold of all the items. Then multiply that answer by 100

Menu pricing factors and concepts. How to calculate menu sales price (prime cost method)

Raw food cost (also labeled as entree cost or food cost)

Direct labor cost (labor all together)

Prime factor (also called prime-cost factor)

Prime cost: the cost of food, beverages, and direct labor (all labor together) added together

Basic terminology and definitions from each chapter and lecture

Menu engineering- the difference between star, plowhorse, puzzle, and dog; be able to conduct menu engineering analysis including menu mix %, CM, categorization, and classification.

Menu engineering takes a look at every item and sees if it is profitable

Star

H/H

High contribution margin compared to normal and high volume compared to normal item percentage

Dog

L/L

Low contribution margin compared to normal and low volume compared to normal item percentage

Puzzle

H/L

High contribution margin compared to normal and low volume compared to normal item percentage

Plowhorse

L/H

Low contribution margin compared to normal and high volume compared to normal item percentage

Menu mix %

CM

To get the CM for an item you take the sales price and minus the food cost price

Sales price-food cost= CM

Menu cost

to get the menu cost of an item you take the portions of the item sold and times it by the food cost price

portion amount (amount sold) x food cost (cost of ingredients) = menu cost

Menu revenues

to get menu revenues you take the amount sol of an item and multiply that by the sales price of it

amount sold (portion amount) x sales price = menu revenue

Menu CM

the menu CM is the amount sold times the CM

amount sold x CM of item = menu CM

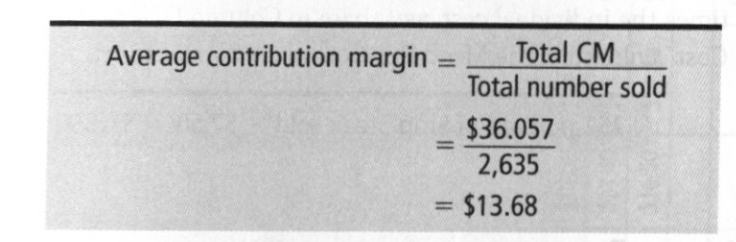

Average contribution margin (CM)

you take the total CM (all of the item CM added together) and divide it by the total number of items sold

Item percentage

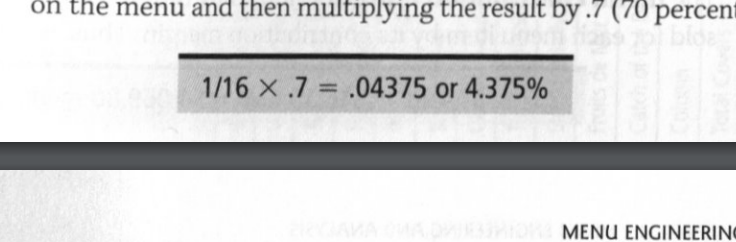

this is the amount of item you have on the menu divided by one. This is then multiplied by .7