HDFS 4062 Family Finance and Consumer Law Final

1/164

Earn XP

Description and Tags

Dr. Plauche final for family finance and consumer law. Do not worry about Chapter 2. Mostly multiple choice, but some written. Chapters 8-19.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

165 Terms

Chapter 9: Housing

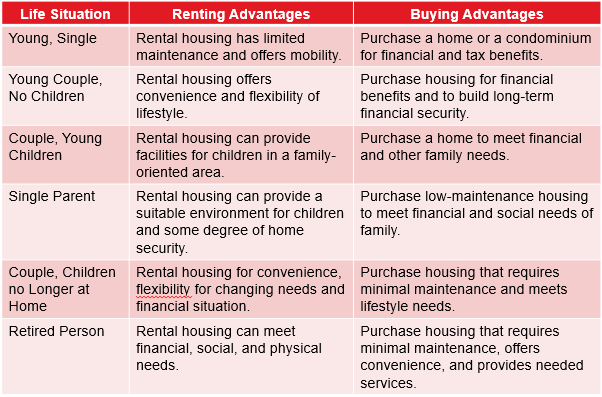

employment, children, spouse, maintenance costs, loss of mobility, house expenses, stability, space for family members, and wealth building

What impacts a person’s selection of housing?

lose tax advantages, equity growth, and interest on a security deposit

What are the opportunity costs of renting?

time and cost of commuting to work

What are the opportunity costs of living in an area that offers less expensive housing or more space?

time and money spent repairing/improving a lower-priced home, and interest earnings on money for down payment

What are the opportunity costs of buying/owning a house?

time and effort of building

What are the opportunity costs of building a home to your specifications?

ease of mobility, fewer responsibilities for maintenance, minimal financial commitment, lower initial costs, and more amenities

What are the advantages of renting?

few financial benefits, no tax benefits, restricted lifestyle (remodeling, privacy, pets, activities), lease agreements, and security deposits

What are the disadvantages of renting?

protected from rent increases unless stated otherwise, can’t be locked out or evicted without a court hearing, and right to sublet

What protections does a lease offer to a renter?

pride of ownership, tax deductions (mortgage interest and real estate tax), property value increase, borrow against the equity of your home, and lifestyle flexibility

What are the advantages of owning a home?

financial uncertainty, money for down payment, qualifying for mortgage financing, changing property values, limited mobility, and higher living costs

What are the disadvantages of owning a home?

mortgage

What is a long-term loan on a specific piece of property such as a home or other real estate?

decades long

sources include banks, savings and loan associations, credit unions, mortgage companies

home is collateral

how much you can afford (down payment, income, and current living expenses), current mortgage rates, potential future value of property, ability to make monthly payments (mortgage, tax, and insurance), and what you can afford verses what you want

What guidelines might determine the amount to spend for a home?

strengthen property values

A high quality school system can _________, which benefits homeowners in a community who do not have school-age children?

real estate agents

Who provides these services to home buyers?

Showing homes in many areas based on your needs and preapproved mortgage amount

Presenting your offer to the seller based on a market analysis

Negotiating a purchase price

Assisting you in obtaining financing

Representing you at the closing

Recommendations for lawyers, insurance agents, home inspectors, and mortgage companies

personal savings, investments, assets, and assistance from relatives

What are the main sources of money for a down payment?

income, debts, credit score, down payment amount, loan length, and current mortgage rates

What factors affect a person’s ability to qualify for a mortgage?

larger; smaller

When interest rates are lower, banks will allow for ______ mortgages, increasing buying power and lowering payments. As interest rates rise, banks will give out _____ mortgages, increasing monthly payments and decreasing the amount of people who can afford the loan.

when interests rates drop at least 1% less than your current rate

When might refinancing a mortgage be advisable?

benefits occur faster with larger mortgages

want a lower rate and payment

adds several thousand dollars to the upfront cost

How do closing costs affect a person’s ability to afford a home purchase?

Fees for:

loan application

appraisal

home inspection

title insurance

property taxes

attorney fees

prepare home for selling by repairing and staging, determine the selling price, and sell by owner or list with real-estate agent

What actions are recommended when planning to sell your home?

recent selling prices of the surrounding area, current housing market demand, available finance options, mortgage interest rates, economic conditions, the home’s condition, curb appeal, level of maintenance, and housing features

What factors affect the selling price of a home?

selling you own home

What are these advantages and disadvantages of?

saves money on commission

you set price, marketing, advertising, showings, and paperwork

requires more personal effort, time, and negotiation skills

should hire a lawyer or title company for legal aid and closing help

selling your home through a real estate agent

What are these advantages and disadvantages of?

expert help in pricing, marketing, negotiations, and closing

handle open houses, advertising, and coordinating with buyers

access to networks, resources, and experience

comes with commission costs about 6%

saves time and effort

Chapter 10: Home and Auto Insurance

insurance

The purpose of ______ is to provide protection against risk of financial uncertainty and unexpected losses.

give you piece of mind that comes from knowing money will be available to meet the needs of your survivors, pay medical expenses, protect your home and belongings, and cover personal or property damage caused by you when driving.

shares the risk of multiple people

risk

What is uncertainty or lack of predictability, such as the loss that a person or property covered by insurance faces?

peril

What is the cause of a possible loss?

ex. fire, windstorms, explosions, robbery, accidents, and premature death

hazard

What increases the likelihood of a loss?

ex. defective house wiring

personal, property, and liability risks

personal risks, property risks, and liability risks

How are the most common risks classified?

liability

What is the legal responsibility for the financial cost of another person’s losses or injuries?

pure risk

What risk guarantees a chance of loss if specified events occur and are insurable?

only you have the potential for loss

insurable loss → chance of loss not gain

accidental and unintentional risks

classified as either personal, property, or liability

nature and financial cost of the loss can be predicted

speculative risk

What type of risk is the chance of either loss or gain?

ex. starting a small business or gambling

uninsurable risk

risk avoidance, risk reduction, risk assumption, and risk shifting

What are the four methods of managing risk?

self-insurance

_______ is a form of risk assumption and is the process of establishing funds to cover the cost of loss.

put away money to cover the losses if you need to

risk shifting

Paying an insurance company to assume your expenses if you cannot is a form of what?

deductible

What is the set amount that the policyholder must pay per loss on an insurance policy?

set insurance goals on what to cover, develop a plan to reach your goals, put your plan into action, and evaluate insurance plan every 2-3 years

What are the steps in planning your personal insurance coverage?

physical damage caused by weather, loss of use, negligence, and vicarious liability of having a child hurt another person

What property and liability risks might some people overlook?

expensive assets need more insurance and higher premiums, insurance for family and children, and ability to afford coverage

How could a person’s life situation influence the need for certain types of property and liability insurance?

building you live in, any structures on the property, additional living expenses, personal property, personal liability and related coverage, and specialized coverage purchased separately

What main coverage is included in home insurance policies?

liability coverage

The purpose of ___________ is to protect you from financial losses resulting from legal action or claims against you or your family members due to damages to the property of others.

include cost of legal defense

protects your personal property, additional living expenses, personal liability and related coverage, but not buildings or other structures

How does renter’s insurance differ from other home insurance policies?

location of home (weather and place with more claims), type of structure (age, style, and building materials), and coverage amount and type of policy (comprehensive and deductible)

What major factors influence the cost of home insurance?

reduce home insurance costs

These actions help to do what?

gain discounts

smoke detectors or a fire extinguisher

Burglar deterrents (alarm system and dead-bolt locks)

Nonsmoker discounts

“Claim-free” for a few years discount

Insure your car with the same company

company differences

coverage, service

how they settle claims

price differences

check consumer satisfaction index

contact company and independent agents

state insurance commissions, government agencies, and consumer organizations

bodily injury liability, medical payments coverage, uninsured motorist protection, no-fault insurance, property damage liability, collision insurance, comprehensive physical damage

What are the main coverages included in most automobiles insurance policies?

includes bodily injury and property damage coverages, namely wage loss insurance, towing services, accidental death, and care rental while vehicle goes through repairs

no-fault insurance

____________ system says that drivers involved in accidents collect medical expenses, lost wages, and related injury costs from their own insurance companies. This is to provide smooth methods of payment without taking legal action to determine fault.

collision; comprehensive physical damage

__________ coverage pays for damage to your car resulting from an accident with another vehicle or object, regardless of who is a fault. In contrast, ____________________ coverage protects against non-collision-related losses, such as theft, fire, vandalism, natural disasters, or hitting an animal. Essentially, the first covers crash-related incidents, while the second covers other unexpected damage.

type and value of vehicle, selected coverage, where you live, age of driver, gender, marital status, driving record, and credit history

What factors influence how much a person pays for automobile insurance?

reduce cost of automobile insurance

These actions help to do what?

maintain a clean driving record

compare rates among different companies

increase deductibles

install security devices

take advantage of discounts for good grades, drivers education courses, or insuring multiple vehicles

choose a care with low insurance costs

maintain a good credit score

update company with changes like marriage and carpooling to reduce premiums

Chapter 11: Health Insurance

rising healthcare expenditures

What are these reasons for? (could be essay question)

Use of sophisticated, expensive technologies

Duplication of tests and technologies

Increases in the variety and frequency of treatments

Increasing number of longevity of elderly people

Regulations that result in cost shifting rather than cost reduction

Increasing number of accidents and crimes that require medical services

Limited competition and restrictive work rules in the health care delivery system

Labor intensiveness and rapid average earnings growth for healthcare professionals

Using more expensive medical care than necessary

Built-in inflation in health care delivery system

Aging baby boomers

Other major factors

Fraud, administrative waste, malpractice insurance, excessive surgical procedures, a wide range of prices for similar services, and double health coverage

Fraud and abuse counted for nearly 10% of all dollars spent on healthcare

15 to 30%

What percent of health care dollars in the US are consumed by high administrative costs, while it only consumes 1% under Canada’s socialized system?

groups, employers, health insurers, healthcare professionals, and consumers

______ can take these actions to reduce healthcare costs.

Employing generative AI to improve the efficiency of patient interactions

Careful review of fees and charges

Establish incentives for preventative care and services provided out of the hospital where medically acceptable

Become involved in community health planning

Encourage prepaid group practices

Offer community health education programs so people take better care of themselves

Encourage patients to pay cash for routine care and lab tests

individuals

______ can do these things to reduce healthcare costs.

Consider participating in a flexible spending account

Consider a high-deductible health plan

Ask for less expensive generic drugs

Use a mail-order or legitimate online pharmacy

Review free or low-cost coverage for uninsured children through state

Review state plans for prescription drug assistance

Follow up with doctor by phone if allowed

Investigate nonurgent procedures recommended by doctor

Review billing statements for errors

Appeal unfair decisions by your health plan

Practice preventative care and stay healthy

Eat balanced diet and control weight

Avoid smoking and drinking in excess

Get rest, relaxation, and exercise

Maintain healthy lifestyle at work and home

Drive carefully and avoid accidents and fire hazards

Get health screenings and manage chronic conditions

Consider care options:

Nurse line

Virtual visits (Telehealth)

Retail clinics

Urgent care

health insurance

The purpose of _________ is to reduce your financial liabilities when you have to receive medical care and safeguards your family’s economic security.

a form of protection to alleviate the financial burdens individuals suffer from illness or injury

You pay premiums or fees to insurer → they pay most medical costs or reimburse your for hospital stays, doctor visits, medication, and sometime vision and dental care

group health insurance

What type of health insurance is typically employer sponsored (they pay most of the cost)?

Tax Cuts and Jobs Act of 2017 requires employers with 50+ to provide health insurance to all employees

small businesses also have this opportunity through Association Health Plans

covers you and your immediate family members for most needs

Health Insurance Portability and Accountability Act 1996 (HIPAA)

Can move from one plan to another without lapses in health insurance and without paying more than other employees

individual health insurance

What type of health insurance is a policy tailored to your particular needs from the company of your choice?

can use as a supplement to other insurances

basic coverage for hospital and doctor bills, 120 days’ hospital room and board in full, pay 80% out-of-hospital expenses, no unreasonable exclusions, and limit out-of-pocket expenses to $9,100 for individual and $18,200 for family

What should a good health insurance plan include?

basic health insurance coverage

What type of coverage is a combination of hospital expense insurance, surgical expense insurance, and physician expense insurance?

Hospital expense insurance: hospital room, board, and other charges

Surgical expense insurance: surgeon’s fee for an operation

Physician expense insurance: pays for physician’s care such as office visits, lab testes, and x-rays

Does not include surgery

major medical expense insurance

What type of coverage covers expenses for a serious injury or long-term illness?

has a deductible, coinsurance, and a stop-loss provision

deductible

What is a provision that requires policy holders to pay a base amount before the policy benefits begin?

coinsurance

What is it called when both the insured and the insurer share the covered losses beyond the deductible amount?

Hospital indemnity policies: pay cash benefit when hospitalized

Critical illness insurance: pays more for certain major health events

Dental expense insurance: covers exams, cleaning, x-rays, fillings, root canals, oral surgery, etc.

Vision insurance: exams, contact lenses, and glasses

Stop-loss (out-of-pocket limit) provision

What requires a policy holder to pay up to a certain amount, after which insurance companies pay 100% of all remaining covered expenses?

long-term care insurance

What type of coverage pays for the cost of daily living for long-term illness or disability?

very expensive

includes nursing home car, assisted living, retirement community, adult day care services, and home health and personal care

annual premiums from under $2,000 to $16,000

eligibility, assigned benefits, internal limits, copayment, service benefits, benefit limits, exclusions and limitations, coordination of benefits, guaranteed renewable, and cancellation and termination

What are the major provisions of a health insurance policy?

private insurance companies, hospital and medical service plans (Blue Cross and Blue Shield), managed care organizations, indemnity insurance companies, home health care agencies, employer self-funded health plans, and health care accounts

What are the major sources of health insurance and health care?

Health Maintenance Organizations (HMOs)

What provides health care services in exchange for a fixed, prepaid monthly premium?

contracts with selected care providers

focus is on preventative care

basic and supplemental services

requires referrals to see specialists

typically have the lowest premiums

least flexibility

preferred provider organizations (PPOs)

What is a group of doctors and hospitals that agree to provide health care at rates approved by the insurer?

several providers to choose from

premiums slightly higher than HMO

specified services at predetermined fees to members

if you go to a non provider, you pay more

includes Exclusive Provider Organizations (EPO) and Point-of-Service (POS) plans.

no referrals needed

more provider choice

Exclusive Provider Organizations (EPOs)

What only covers care from in-network providers (except emergencies)?

don’t require referrals

don’t reimburse for out-of-network care,

offer moderate flexibility

lower costs than PPOs

Point-of-Service Plans (POS)

What combines features of HMOs and PPs where members choose a PCP for coordinated care and need referrals for specialists, but they can go out-of-network for a higher cost?

offer a balance between flexibility and affordability

home health care agencies

What provides medical and supportive services in a patient’s home under a doctor’s supervision?

includes preventative care, nursing, therapy, and assistance for the elderly or chronically ill

lower cost than hospital care

Medicare and Medicaid

What are two sources of government health insurance?

Part A

Medicare is a federal program for those age 65+ and disabled persons. What part of Medicare is hospital insurance and covers inpatient hospital care, inpatient skilled nursing facility care, home health care, and hospice care?

paid through social security tax

Part B

What part of Medicare is considered medical insurance and helps pay for doctor’s services and a variety of other medical services and supplies not covered by hospital insurance?

pays for 80% of approved charges

voluntary

doctor’s services not covered in hospital insurance

financed by monthly premiums paid by enrollees and general federal revenues

Medigap/MedSup insurance

What supplements Medicare by filling the gap between Medicare payments and medical costs not covered by Medicare like traveling outside of the U.S.?

Does not cover dental/vision, long-term care, hearing aids, eyeglasses, or private-duty nursing

pay for out of pocket

disability income insurance

What provides payments to replace income when an insured person is unable to work; most neglected form of insurance?

provides regular cash income lost as the result of an accident or illness

employer plan, social security, worker’s compensation, payment income insurance program, and other sources

What are the five sources of disability income?

will available benefits meet your disability income needs, how long will you have to wait before benefits begin, and insurers limit benefits to no more than 70-80% of your take home pay

How can you determine the amount of disability income insurance you need?

Chapter 12 Life Insurance

person joins risk sharing group by purchasing a policy, insurance company promises to pay sum of money at the time of policy holder’s death under policy, and company makes promise in return for person to pay premium

What is the basic process of obtaining life insurance?

life insurance

The purpose of ______ is to use to protect someone who depends on the policyholder from financial losses caused by their death.

pay home mortgage or other debts

payments to children

education for children

medical expenses

funeral costs

charitable donations

retirement income

accumulating savings

income for survivors

estate proceeds

tax payments

do you have people you need to protect financially, life stage, and type of household

How do you evaluate the need for life insurance?

determines your life insurance objectives

What do these do?

What you want your life insurance to do for you and your dependents

How much money do you want to leave to your dependents if you were to die today?

Will you require more or less insurance protection to meet their needs as time goes on?

When would you like to be able to retire?

What amount of income do you believe you and your spouse would need in retirement?

How much are you able to pay for your insurance program?

Are the demands on your family budget for other living expenses likely to be greater or lower as time goes on?

multiple of income method, the easy method, DINK method, nonworking spouse method, family need method, and online calculators

What are the six methods of estimating your life insurance requirements?

________________: assumes you are looking for a basic benchmark to determine your insurance needs

Annual income is the sole factor

Identifies insurance needs as a range between 5 and 10 times your income

Most basic but leaves out family size, current assets, living expenses, and expected additional sources of income are excluded from calculation

________________: assumes your family is “typical” (may need more for 4+ children, above-average debt, family member with poor health, or spouse has poor potential employment)

Multiple of income method with slight modification

Insurance agent’s rule of thumb that a “typical family” will need about 70% of your salary for seven years before they adjust to the financial consequences of your death

Smaller family needs less insurance

_________________(dual income, no kids): assumes spouse continue to work after your death

No dependents, similar income levels → simple insurance needs

Ensure your spouse will not be burdened with debts if you die

Insurance needs to cover one-half the family debt + estimated funeral expenses

Reconsider if spouse suffers poor health or uncertain future for occupation

_________________

Insurance experts estimate extra costs of up to $20,000 a year required to replace services of a homemaker in a family with small children

Cost of housekeeper, child care, more meals out, transportation, laundry services, etc.

Does not include loss of earnings of spouse taking time away to care for family

Multiple the number of years before the youngest child reaches age 18 by $20,000

Teenage children can reduce this number

More than 2 children under 13 then number adjusted up

$20,000 varies based on estimates of duties and proposed wages nearby

_________________

Includes factors such as social security and your liquid assets

What you have now

What your dependents may need

Total of what your dependents may need - total of what you have now = how much estimated life insurance you need

Positive need more life insure

Negative and your estimates are realistic, dependents may be able to manage without additional life insurance

____________

Provide impartial view of your insurance needs versus using an online calculator via an insurance company website

Life insurance estimators on insurance company websites are useful but may provide a higher estimate of insurance needs → higher premium and commission for the agent

There are also apps

stock life insurance companies and mutual life insurance companies

What are the two types of life insurance companies?

stock life insurance companies

What is the most common form of life insurance companies which are owned by shareholders and generally sell nonparticipating (nonpar) policies that don’t pay dividends but also par policies?

Mutual life insurance companies

What type of life insurance company is owned by policyholders, sell participating policies, but have higher premiums?

part of the premium is refunded to the policyholder annually → called the policy dividend

temporary insurance and permanent insurance

What are the major types of life insurance policies?

_________: term, renewable term, convertible term, or decreasing term insurance (premium stays but coverage decreases as you age or debt is repaid)

also includes multiyear term (same premium for life of policy), return of premium (refunds every penny of premiums if you outlive), re-entry term

protection for a specified period of time (you stop paying premiums, coverage stops)

_________: whole life, straight life, ordinary life, or cash value life insurance

you pay specified premium as long as you live

premium depends on your age when you start

provides death benefits and a savings account

includes limited payment, single premium, modified life, variable life, adjustable life, and universal life

group life, endowment life, funeral/burial life, credit life, industrial life

What are the subtypes of life insurance?

Term insurance protects for a specified period of time, whole life insurance covers you till you die, whole life has the same premium the entire time, and term premiums increase with each renewal

What are the main differences between whole life insurance and term life insurance? (could be essay question)

important provisions in a life insurance contract

What are these?

policy reinstatement: Reinstatement of a lapsed policy if it has not been turned in for cash; time limit 1 to 2 years

the grace period: Allows 28-to-31-day late payment without penalty

automatic premium loan: Cash value is used to pay premium if not paid within grace period.

guaranteed insurability option: allows you to buy specified additional amounts of life insurance at stated intervals without proof of insurability; even if not in good health, can increase the amount of insurance as income rises; desirable if you anticipate needing additional life insurance in the future

Nonforfeiture clause- prevents the forfeiture of accrued benefits if you choose to drop the policy

incontestability clause- after the policy has been in force for a specified period of time (about 2 years), the insurance company cannot dispute its validity during the lifetime of the insured for any reason (including fraud)

suicide clause- if the insured dies by suicide during the first two years the policy is in effect, the death benefit will equal the amount of the premium paid; after time elapses, suicide becomes a risk covered by the policy and the beneficiaries receive the same benefits as any other cause of death

beneficiary

What do you call a person who is designated to receive something from the insured?

rider

What is any document that is attached to the policy that modifies its coverage by adding or excluding specified conditions or altering the benefits?

double indemnity

What is a benefit under which the company pays twice the face value of the policy if the insured’s death results from an accident?

underwriting based on characteristics (age, gender, health, occupations, and hobbies), lifestyles choices (smoking), claims history, credit history, and risk profile

How do insurance companies determine your insurability?

before; after

_________ the purchase of a policy, read the contract word for word and as agent for a point-by-point explanation of language in the contract. _______ the purchase, use the 10-day “free look” period and give beneficiaries and lawyer a photocopy of policy.

lump-sum payment, proceeds left with company, limited installment payment, and life income option

What are the 4 most common settlement options?

annuity

What is a financial contract written by an insurance company that provides a regular income to the beneficiary for life?

Chapter 13: Investing Fundamentals