Commodity

1/17

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

18 Terms

Short hedgers buy or sell future

sell future. meaning they are the people who long in spot markt

speculators

aims to predict the direction of the market and they provide liquidity

basis is

spot price - future price

calendar spread

march maturity contract - June maturity contract

contango

spot < future price ; therefore negative basis and calendar spread

backwardation

spot > future

if future market is dominated by long hedger, the market is probably in

contango

insurance theory is also called

normal backwardation

insurance theory believes that

commodity futures are driven by producers to lower price risk. meaning future price is lower than spot price. Market does not match this theory

hedging pressure hypothesis

If market is in Contango then it is this theory. short hedgers (producers/sellers) dominate the market. They sell futures contracts to lock in a price for their product (e.g., a farmer selling wheat futures).

theory of storage

level of inventory shapes commodity future curve. If convenience yield > cost , in backwardation

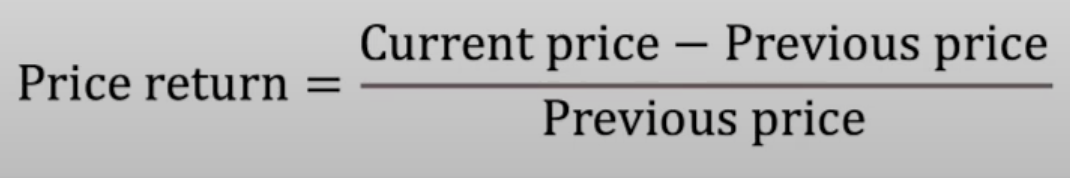

price return

collateral return

yeild(interest rate) to bond or cash used to maintain the future position

roll return is positive when we are in

backwardation

commodity swap

offers risk management and risk transfer

An arbitrageur

ability to inventory physical commodities and the attempt to capitalize on mispricing between the commodity

sell or buy future to maximize roll return when market is in contango

sell( take short position so you have positive roll return)

How to calculate return on total return swap and excess return swap

1)total return is based on swap price, REMEMBER to use the price since last settlement date NOT INITIATION