Economics Definitions Unit 3 & 4 Year 12 2022

0.0(0)

Card Sorting

1/156

Last updated 2:37 PM on 11/10/22

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

157 Terms

1

New cards

Absolute Advantage

When a country / producer can provide a good or service in greater quantity for the same cost than its competitors

2

New cards

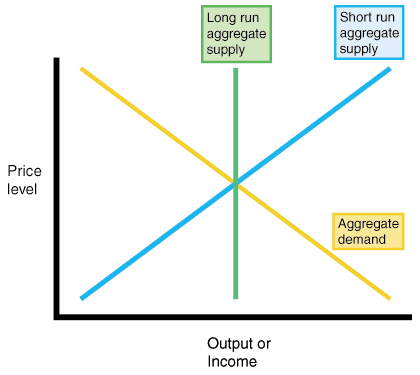

AD / AS model

3

New cards

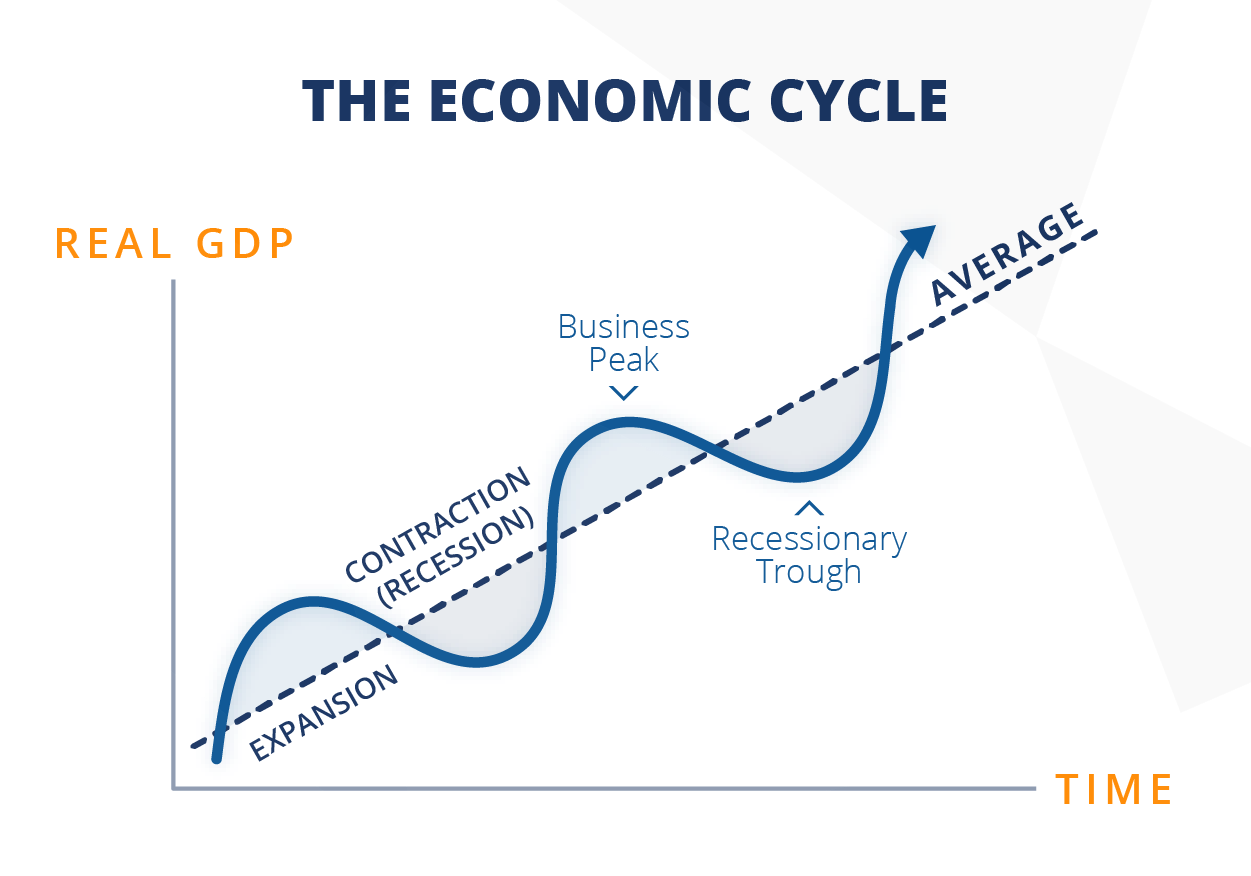

Business cycle

The circular movement of an economy as it moves from expansion to contraction and back again

4

New cards

Aggregate Demand

The total demand for goods and services within a particular market

5

New cards

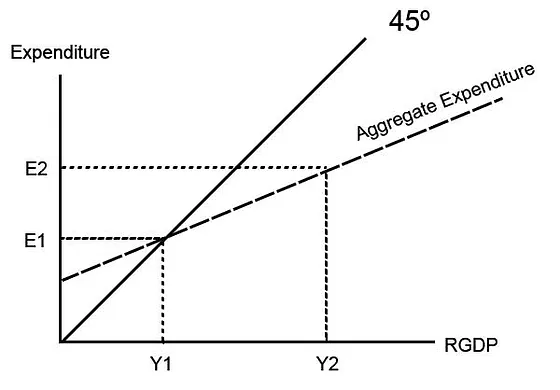

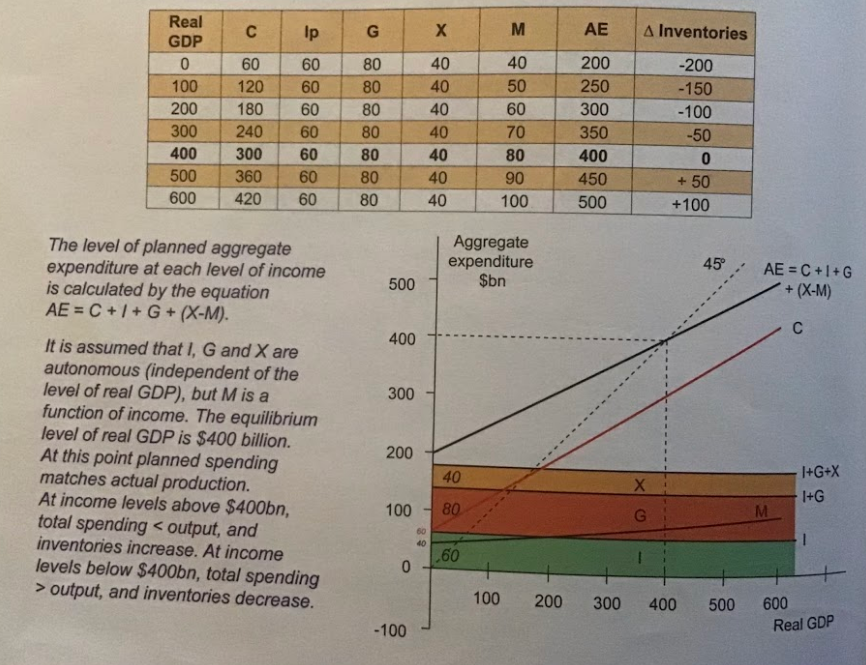

AD and AE Formula

Consumption + Investment + Government Expenditure + Net Exports

6

New cards

Aggregate demand management

Monetary or Fiscal policies that aim to stabilise the business cycle; it manages Aggregate ______ in the short term

7

New cards

AE model

8

New cards

Consumption Function Formula

Total Consumption = Basic Consumption + (Marginal Propensity to Spend x Income)

9

New cards

AE determinants

Interest rates, expectations, fiscal policy, wealth and exchange rates are the determinants of what?

10

New cards

Keynesian Model

11

New cards

Aggregate supply

The total supply of goods and services produced within an economy at a given overall price in a given period

12

New cards

SRAS and LRAS

The positive relationship between aggregate price and amount of aggregate output supplied in an economy vs The relationship between price level and real GDP that shows that output will be optimal in the long run and is independent to price level

13

New cards

Appreciation and Depreciation

The rise in value of a country's currency due to high demand, low supply vs the fall in value of a country's currency due to low demand, high supply

14

New cards

Trade Protection

Policies that protects domestic industries from foreign competition.

E.g: tariffs, subsidies, quotas, and currency manipulation

E.g: tariffs, subsidies, quotas, and currency manipulation

15

New cards

Trade liberalisation

The removal or reduction of restrictions or barriers on the free exchange of goods between nations.

E.g: removing tariffs, quotas, non-tariff barriers (licenses, embargoes, forex restrictions, and import deposits)

E.g: removing tariffs, quotas, non-tariff barriers (licenses, embargoes, forex restrictions, and import deposits)

16

New cards

Arguments for Protection

- Anti dumping argument - Vital

- Infant industry argument - Vital

- Diversification argument - Vital

- National security argument - Vital

- Increased employment argument

- Cheap foreign labour argument

- Favourable balance of trade argument

- Infant industry argument - Vital

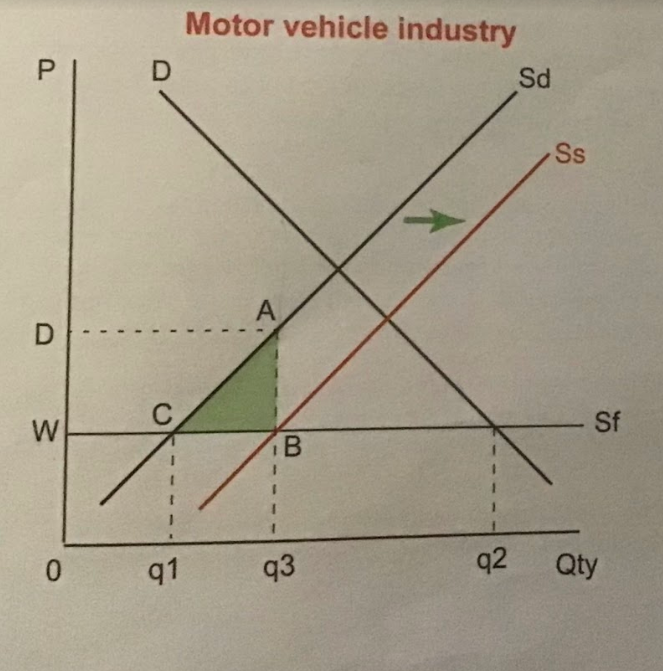

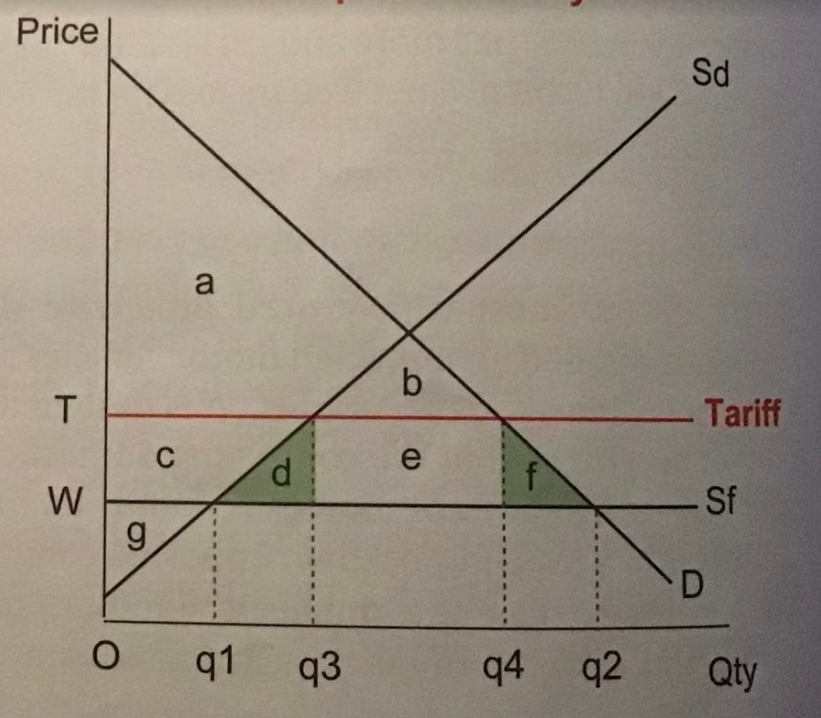

- Diversification argument - Vital

- National security argument - Vital

- Increased employment argument

- Cheap foreign labour argument

- Favourable balance of trade argument

17

New cards

Arguments for Liberalisation

- Increases real incomes and living standards

- Increases efficiency through greater competition

- Increases productivity through efficient resource allocation

- Domestic producers gain through lower input prices

- Enables greater specialisation and economies of scale

- Increases efficiency through greater competition

- Increases productivity through efficient resource allocation

- Domestic producers gain through lower input prices

- Enables greater specialisation and economies of scale

18

New cards

Commodity Currency

A currency that co-moves with the world pries of primary commodity products. In other words, a currency that is heavily dependent on their commodities (e.g: AUD and iron ore)

19

New cards

AUD recent trends

Between 2010 and 2020, the average value of AUD was USD 0.84, which was well above the long term average of USD 0.76 and reached its highest peak at July 2011 due o the mining boom, valued at USD 1.10

20

New cards

Balance of Payments

The summary of all the economic transactions of an economy with the rest of the world.

Current + Capital + Financial = ______

Current + Capital + Financial = ______

21

New cards

Current Account

The account recording net trade of goods and services, investment income (primary) and transfer payments (secondary).

22

New cards

Capital Account

The account recording capital transfers and acquisitions / disposals of non-produced / non-financial assets (e.g: patents).

23

New cards

Financial Account

The account recording foreign investment into Australia and Australian investment abroad (e.g: Direct investment to Toyota).

24

New cards

Primary Income

The income residents receive through wages and salaries, as well as the income receivable by the owner of a financial asset through dividends interest payments, etc.

25

New cards

Secondary Income

The income where real or financial resources are provided but nothing of economic value is received in return, an example of such would be foreign aid.

26

New cards

Net Exports

The net difference between the export and import of goods and services, X - M

27

New cards

Automatic Stabilisers

Mechanisms, economic policies and programs that automatically help stabilise an economy during a boom or a trough. e.g: unemployment, welfare, tax revenue

28

New cards

MPC vs APC

How much more individuals will spend for every additional dollar of income (ΔC/ΔY) vs The percentage of income that is spent rather than saved (C/Y)

29

New cards

MPS vs APS

How much mroe individuals will save for every additional dollar of income (ΔS/ΔY) vs The percentage of income that is saved rather than spent (S/Y)

30

New cards

Debit vs Credit

Negative entry, imports of goods and services, increase in foreign assets, import of currency vs Positive entry, exports of goods and services, increase in foreign liabilities, export of currency

31

New cards

Deficit vs Surplus

When negative entries have the highest value vs when positive entries have the highest value.

In a budget surplus, the government is receiving more money than it is spending

In a current account deficit, the nation is importing more than it is exporting.

In a budget surplus, the government is receiving more money than it is spending

In a current account deficit, the nation is importing more than it is exporting.

32

New cards

Big Mac Index

An index that measures the purchasing power parity between nations, using the price of a Big Mac in that nation as the benchmark. e.g: Comparing the price of a Big Mac in the US and AU.

33

New cards

Government Budget Balance

The prepared amount money a nation's government has been using during a given period of time, its budget outcomes show the current actions a government is taking

34

New cards

Budget Deficit vs Surplus

When government expenditure exceed revenue vs when government revenue exceeds expenditure

35

New cards

Budget Outcome

The outcome of a government's budget after a period of time or event has occurred, e.g: A budget surplus during levels of high economic activity.

36

New cards

Business and Consumer Confidence

The degree to which consumers and firms feel confident about their financial position and overall state of the economy, affects decisions in consumption, investment, net exports and even government spending due to infrastructure or programs.

37

New cards

International Competitiveness

The degree to which a country's goods and services can meet the test of international markets while simultaneously maintaining and expanding the incomes of its people in the long term. The competitiveness of a nation's goods and services in the global market

38

New cards

Capital Stock

The amount of common and preferred shares that a company is authorised to issue, according to its corporate charter.

39

New cards

Capital Good

The assets used by businesses in the course of producing their products and services, includes buildings, machinery, tools and equipment

40

New cards

Cash Rate

The interest rate which banks pay to borrow funds from other banks in the money market on the overnight basis, generally causes the interest rates throughout an economy to change.

41

New cards

Cash Rate Target

The RBA's current interest rate target that must be achieved to increase or reduce actual GDP in relation to potential GDP

42

New cards

Types of Indicators

Leading (Future Prospects), lagging (Confirmation) and coincident (Current Hints)

43

New cards

Comparative Advantage

An economy's ability to produce a particular good or service at a lower opportunity cost than its trading partners.

44

New cards

Composition of Trade

The makeup of an entire country's international trades regarding the exports and imports.

45

New cards

Trade Weighted Index

An average of foreign exchange rates weighted against the amount of trade conducted with that country.

46

New cards

Consumer Price Index

A measure of the average change overtime in the prices paid by urban consumers for a market basket of consumer goods and services.

47

New cards

Consumer and Producer Surplus

The difference between what a consumer is willing to pay and what they paid for a product vs the difference between the market price and the lowest price a producer is willing to accept to produce / sell a good.

48

New cards

Interest Rates

The proportion of a loan that is charged as interest to the borrower, it is the rate that a borrower is charged for the privilege of borrowing money.

49

New cards

Contractionary vs Expansionary Gap

A gap that occurs when the economy's real GDP is lower than its potential GDP (At full employment), also known as recessionary gaps vs a gap that occurs when the economy's real GDP exceeds its potential GDP.

50

New cards

Contractionary vs Expansionary Policy

Fiscal (Taxes) or Monetary (Cash rate) policies that aim to reduce the expansionary gap to avoid hyperinflation vs policies that aim to reduce the contractionary gap to avoid an economic crisis.

51

New cards

Monetary Policy

Policies that aim to change interest rates or the money supply, targeting inflation and is independent from the government. Has side effects on exchange rate and housing market. Suffers impact lag heavily.

52

New cards

Fiscal Policy

Policies that aim to change the tax rates or government spending, targeting the economy at large and depends on government orders. Has side effects on budget and borrowing. Suffers from decision lag heavily.

53

New cards

Countercyclical

Policies that counteract the effects of the economic cycle, aiming to control periods of instability / volatility during a boom or trough.

54

New cards

Exchange Rate

The relative price of one currency expressed in terms of another currency.

55

New cards

Cost-push Inflation

The phenomenon that occurs when overall prices increase due to increases in the cost of wages and raw materials. Occurs when higher costs of production decreases AS in the economy.

56

New cards

Crowding In

When higher government spending results in higher demand, an increase in private investment occurs due to an increase in public investment. E.g: Improvement of infrastructure increases private investment due to higher productivity.

57

New cards

Crowding Out

When higher government spending results in lower demand, a decrease in private investment occurs due to an increase in public investment. E.g: Improvement of infrastructure causes interest rates to increase because government has been borrowing too much.

58

New cards

Supply and Demand of Currency

The supply of currency provided in the forex market and the demand of that currency from foreign countries looking to obtain the currency

59

New cards

Indicators

A piece of economic data that is used by analysts to interpret and determine the current state of the economy and its future prospects.

60

New cards

Income Deficit

When the negative entries in the primary and secondary income accounts exceeds positive entries. Usually occurs due to a high volume of currency importing to pay for imported goods.

61

New cards

Foreign Liability

The stock of domestic assets owned by overseas residents and the total amount of money Australia owes to overseas firms. In other words, the assets that WE have to pay for because they are owned by overseas firms.

62

New cards

Foreign Debt

Money borrowed by a government, corporation or private household from another country's government or private lenders. Private sector debt has the highest share of all foreign debt in AU.

63

New cards

Cyclical Unemployment

Unemployment that occurs due to the changes in economic activity over the business cycle. Peaks during an economic downturn due to the lack of available jobs.

64

New cards

Structural Unemployment

Unemployment that occurs due to shifts in an economy as time goes on. Long-lasting and occurs over time due to new jobs being available and old jobs becoming redundant, or a mismatch between company needs and available workers.

65

New cards

Natural Rate of Unemployment

The minimum employment rate resulting from real or voluntary economic forces. Acts as the target unemployment rate in economies. E.g: Recent uni graduates looking for work.

66

New cards

Cyclical Balance

The changes that occur in the budget balance as the economy moves through the business cycle, following the fluctuations of economic activity, unemployment, etc.

67

New cards

Deadweight Loss

A cost to society created by market inefficiency, which occurs when supply and demand are out of equilibrium. Generally occurs when subsidies, tariffs, price ceilings / floors, etc. are implemented.

68

New cards

Decision Lag

The period between the time when the need for action is recognised and the time when action is taken; a weakness of fiscal policy.

69

New cards

Dirty Float

A floating exchange rate where a country's central bank occasionally intervenes to change the direction or the pace of change of a country's currency value.

70

New cards

Real Float

A floating exchange rate where a country's currency price is determined by the foreign exchange market, depending on the relative supply and demand of other currencies.

71

New cards

Discretionary Fiscal Policy

Fiscal policy that involves changing tax rates or levels of government spending, opposite to automatic stabilisers.

72

New cards

Disposable Income

Income remaining after taxes, available to be spent or saved by the individual.

73

New cards

Multiplier effect

The effect on national income and product of an exogenous increase in demand, formula is 1 / 1 - MPC.

74

New cards

Direct Investment

A long term investment that involves acquiring 10% or more worth of shares of a company, generally done to capitalise on an overseas economy's future prospect.

75

New cards

Portfolio Investment

A short term investment that involves acquiring less than 10% worth of shares of a company, generally done to make money.

76

New cards

Dutch Disease

The phenomenon where rapid development of one sector of the economy (usually natural resources) indirectly causes a decline in other sectors. Characterised by a substantial appreciation of the domestic currency making export of other goods and services difficult.

77

New cards

Economic Growth

An increase in the size of a country's economy over a period of time, measured by GDP.

78

New cards

Economic Objectives of Government

Full employment, price stability, sustainable rate of economic growth, and rising standard of living.

79

New cards

Economic Transaction Types

Goods, services, income, financial assets, and financial liabilities are examples of?

80

New cards

Economic Welfare

The level of prosperity in the economy and standard of living of people living in a country. Also defined as the sum of consumer and producer surplus.

81

New cards

Subsidy vs Tariff

A direct or indirect payment to individuals or firms from the government to support their production vs A tax imposed by one country on the imported goods and services from another country.

82

New cards

Effects of Subsidy

Lowers domestic producer's cost so they can compete more favourably against imports. The cost of the subsidy (DABW) exceeds the increase in producer surplus (DACW), resulting in a deadweight loss (ABC).

83

New cards

Effects of Tariff

Increases the price of imports so they compete less favourably against domestic goods. Domestic producers gain by increasing output, but other producers exporters suffer because tariffs increase their costs (resource imports), thus a deadweight loss is created (d + f) between the foreign supply and the tariff.

84

New cards

Elasticity

The degree to which the quantity demanded of a good or service in relation to price movements of that good or service.

85

New cards

Equitable Distribution of Income

An macroeconomic objective of the government that ensures welfare is distributed to ensure fairness and allowing members of the economy to have the same opportunity to accumulate wealth.

86

New cards

External Shocks

An unexpected events that dramatically changes an entire economy's direction.

87

New cards

Hedging

The method of reducing the risk of loss caused by price fluctuation.

88

New cards

Mining Boom

One of the largest shocks to the Australian economy that caused a period of high economic growth, full employment and high inflation due to the discovery and development of the gathering of a natural resource.

89

New cards

GFC of 2008

The period of extreme stress in global financial markets and banking systems between 2007 and 2009, caused by a housing bubble that eventually left bank holding trillions of dollars of worthless investments in mortgages.

90

New cards

Export Price Index

An index that measures the changes in the prices of the domestic goods and services that are exported overseas. Formula = Year 2 Price / Year 1 Price

91

New cards

Fiat Currency

A type of currency that is not backed by a physical commodity, but rather by the government that issued it. E.g: The AUD.

92

New cards

Fiscal Policy Weaknesses

- Suffers from recognition and decision prominently

- Considered inflexible

- Cannot be changed too often

- Can cause crowding out effect

- Considered inflexible

- Cannot be changed too often

- Can cause crowding out effect

93

New cards

Fiscal Policy Strengths

- Impact lag is less prominent

- Considered direct

- More effective in recession

- Encourages employment via government spending and tax cutting

- Considered direct

- More effective in recession

- Encourages employment via government spending and tax cutting

94

New cards

Monetary Policy Weaknesses

- Impact lag is prominent due to the public interest not focusing on interest rates

- Less effective in a contraction or trough

- Considered blunt; it cannot impact a specific sector

- Less effective in a contraction or trough

- Considered blunt; it cannot impact a specific sector

95

New cards

Monetary Policy Strengths

- Recognition and decision lag or less prominent due to independence from the government

- More effective in an upswing or boom

- Affects net exports (Income and financial account)

- Affects exchange rate (interest rate differential)

- The bluntness allows for interest rates to be changed more often because of public disinterest.

- More effective in an upswing or boom

- Affects net exports (Income and financial account)

- Affects exchange rate (interest rate differential)

- The bluntness allows for interest rates to be changed more often because of public disinterest.

96

New cards

Floating vs Fixed Exchange Rate

The exchange rate is determined by supply and demand of the country's currency vs the exchange rate is determined by the country's government.

97

New cards

Problematic Foreign Debt

When foreign debt is used to finance things that do not increase the living standards or welfare of an economy, or when the economy is borrowing the wrong amount.

98

New cards

Foreign Equity

The level of foreign ownership of domestic assets, see foreign asset and direct investment.

99

New cards

Foreign Exchange Market

The global market place that determines the exchange rate for currencies around the world, participants buy, sell and exchange currency to import / export things.

100

New cards

Full Employment

The macroeconomic object where by the unemployment rate equals the (nonaccelerating) inflation rate of unemployment, no cyclical unemployment exists, and GDP is at its potential. Generally achieved during a boom.