CFA Level 2: Reading 11: Multinational Company Financial Statement

1/76

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

77 Terms

US GAAP transaction cost disclosure requirements

Disclose the aggregate transaction gain or loss included in determining net income

IFRS transaction cost disclosure requirements

disclose the amount of exchange rate differences recognized in profit or loss

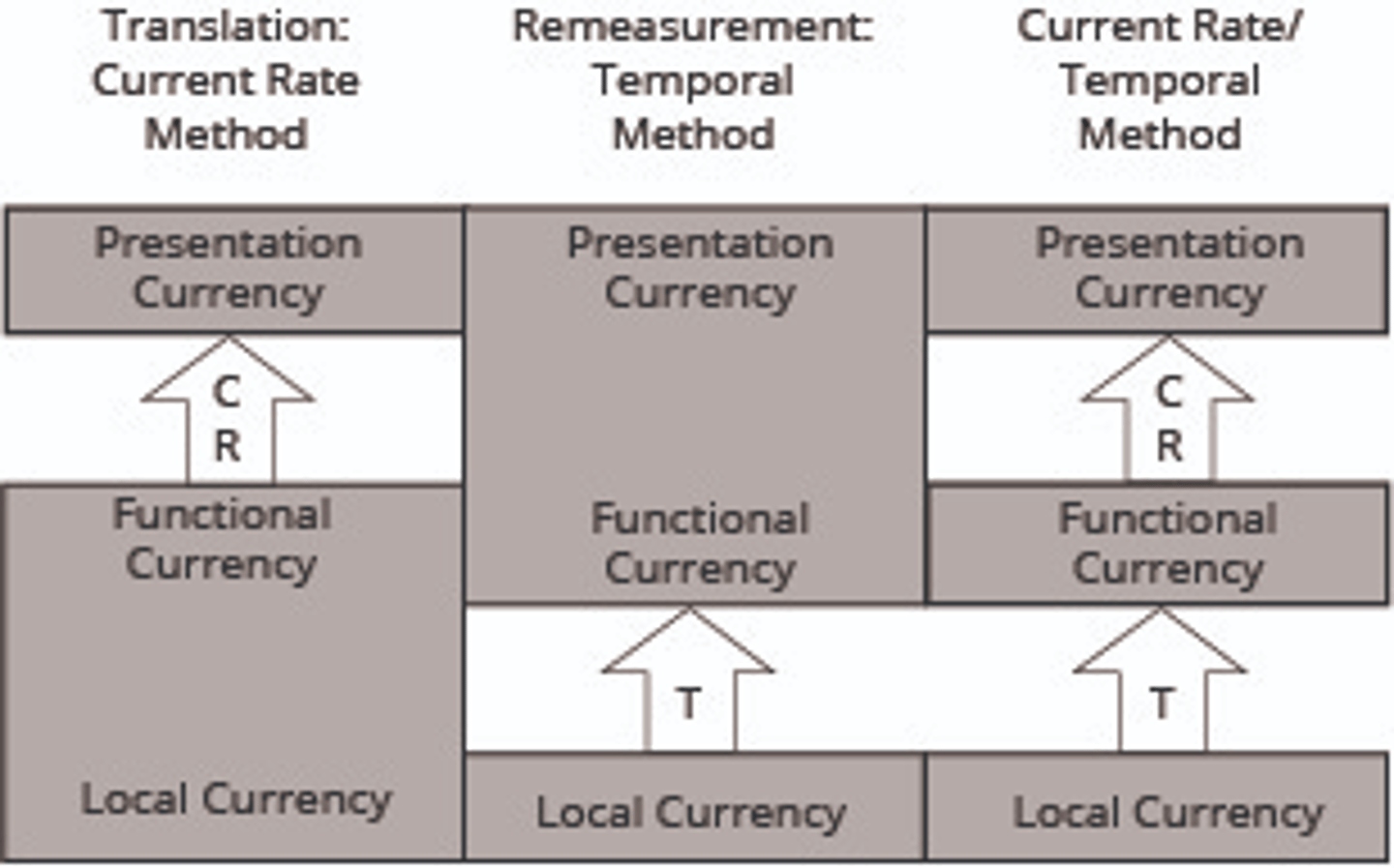

Remeasurement (currency method)

converting local currency into functional currency using the temporal method

Translation (currency method)

converting the functional currency into the parent's presentation (reporting) currency using the current rate method (all-current method)

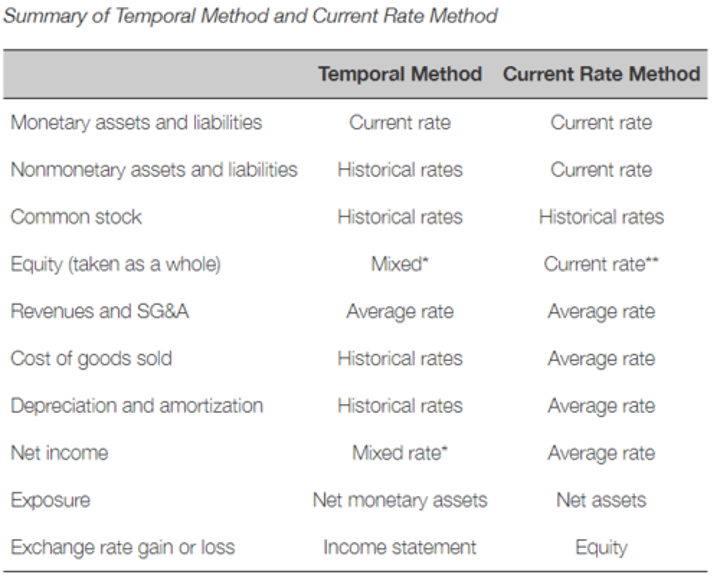

Summary of Temporal Method and Current Rate Method (Accounts - picture )

(*Net income is remeasured at a "mixed rate" (i.e., a mix of the average rate and the historical rate) under the temporal method because (1) the FX gain or loss is shown in the income statement, and (2) revenues and SG&A are remeasured at the average rate while COGS, depreciation, and amortization are remeasured at the historical rate. Equity is "mixed" because the change in retained earnings (which includes net income) is mixed.

** Under the current rate method, total assets and liabilities are translated at the current rate. The total equity (equity taken as a whole) would then have to be translated at the current rate for the balance sheet to balance.)

Three key points regarding the original versus the translated financial statements and ratios

1. Pure balance sheet and pure income statement ratios will be the same.

2. If the foreign currency is depreciating, translated mixed ratios (with an income statement item in the numerator and an end-of-period balance sheet item in the denominator) will be larger than the original ratio.

3. If the foreign currency is appreciating, translated mixed ratios (with an income statement item in the numerator and an end-of-period balance sheet item in the denominator) will be smaller than the original ratio.

IFRS Hyperinflationary method (6)

1. Non-monetary assets and liabilities are restated using price index (original cost * change in index). Not necessary to restate monetary assets and liabilities.

2. Shareholders equity restated by using change in price index

3. Retained earnings is the plug figure to balance the balance sheet

4. In the statement of retained earnings, net income is the plug feature

5. IS items are restated by multiplying change in price index

6. Net purchasing power gain or loss recognized on IS based on exposure. Holding monetary assets results in loss.

Similarities of adjusting financial statements for inflation and remeasuring the financial statements using the temporal method (3)

1. Under the temporal method, the monetary assets and liabilities are exposed to changing exchange rates. Similarly, it is the monetary assets and liabilities that are exposed to the risk of inflation.

2. Purchasing power gains and losses are analogous to exchange rate gains and losses when the foreign currency is depreciating. (For example, if a subsidiary has net monetary liability exposure in a depreciating environment, a gain is recognized under the temporal method. Likewise, a purchasing power gain is recognized when a net monetary liability exposure is adjusted for the effects of inflation.)

3. The gain or loss from remeasurement is recognized in the income statement as is the net purchasing power gain or loss that results from inflation.

dirty-surplus accounting

Gains and losses are reported in shareholders' equity.

Income before translation gain/loss (temporal vs current)

1. temporal - COGS and depreciation are remeasured at historical rates

2. Current - COGS and depreciation are translated under the average rate (reflecting depreciating or appreciating local currency)

Translation gain/loss different under temporal/current

1. Temporal - monetary liabilities > monetary assets are exposed. Holding net monetary liabilities in a depreciating environment results in a gain

2. Current - assets >liabilities are exposed to the depreciating local currency. Holding net assets in a depreciating environment results in a loss

Restating for inflation involves: 7 Steps

1. Nonmonetary assets/liabilities use price index. Most are at historical cost, simply multiply the original cost by the change in the price index for the period.

2. It is not necessary to restate monetary assets and monetary liabilities.

3. The components of shareholders' equity (other than retained earnings) are restated by applying the change in the price index from the beginning of the period or the date of contribution if later.

4. Retained earnings is the plug figure that balances the balance sheet.

5. In the statement of retained earnings, net income is the plug figure.

6. The income statement items are restated by multiplying by the change in the price index from the date the transactions occur.

7. The net purchasing power gain or loss is recognized in the income statement based on the net monetary asset or liability exposure. Holding monetary assets during inflation results in a purchasing power loss. Conversely, holding monetary liabilities during inflation results in a purchasing power gain. This figure forces the net income to be same as the net income figure that was the plug figure in the statement of retained earnings.

Similarities for adjusting the financial statements for inflation and remeasuring using the temporal method (3)

1. temporal - monetary assets and liabilities are exposed to changing exchange rates. Similarly in Inflation - Monetary assets and liabilities are exposed

2. Purchasing power gains and losses are similar to exchange rate gains and losses when the foreign currency is depreciating.

3. Gain or loss from remeasurement is recognized in the income statement as is the net purchasing power gain or loss that results from inflation

Two ways foreign currency can affect a mulinational firm's financial statements

1. business transactions in another currency

2. subsidiaries that maintain their books in another currency

Local Currency

currency of the country being referred to

Foreign currency denominated transactions (including sales) are measured

- in the presentation (reporting) currency at the spot rate on the transaction date.

- Gain or loss is recognized on settlement date

-BS date before the transaction in settled, then gain or loss is based on exchange rate of BS Date

Foreign currency risk arises when...

the transaction date and the payment date differ

Accounting standards guidance about including transaction gains and losses

recognized in the income statement - no guidance whether they should be within operating or non-operating income

Two methods to remeasure or translate the financial statements of a foreign subsidiary to the parent's presentation currency

1. Remeasurement

2. Translation

Two types of currency translation

1. Current Rate

2. Temporal

Translation method determined by

functional currency relative to the parent's presentation currency

IASB Management Considerations in Deciding Functional Currency (5) (FASB is similar)

1. Influences sales prices

2 Influences ompetitive forces and regulations

3. Influences labor, material, and other costs

4. Funds are generated in

5. Receipts from operating activities are usually retained

If the functional currency and the parent's presentation currency differ the __ method is used

current rate method is used to translate the foreign currency financial statements

Usually self-contained, independent subsidiaries whose operating, investing, and financing activities are separate from the parent

If the functional currency is the same as the parent's presentation currency, the ____ method is used

temporal method is used to remeasure the foreign currency financial statements

subsidiary is well integrated with the parent (i.e., the parent makes the operating, investing, and financing decisions).

In the case where the local currency, the functional currency, and the presentation currency all differ, __ method is used

both temporal method and current rate method

If a subsidiary is operating in a hyperinflationary environment, the functional currency is considered to be the parent's presentation currency, and the ___ method is used under US GAAP

temporal method (Hyperinflationary environment - what accounting standard)

If a subsidiary is operating in a hyperinflationary environment, the functional currency is considered to be the parent's presentation currency, and the ___ method is used under IFRS

restated for inflation and then translated using the current exchange rate (hyperinflationary environment - what accounting standard)

Chart of Three methods for remeasurement/translation of local currencies

Current Rate (exchange rate- definition)

exchange rate on the balance sheet date

Average Rate (exchange rate- definition)

average exchange rate over the reporting period

Historical Rate (exchange rate-defnition)

actual rate that was in effect on the date of transaction

Applying the Temporal Method (6 Steps)

1. Monetary Assets and Liabilities are remeasured using the current exchange rate

2. All other assets and liabilities are considered non-monetary and remeasured at the historical rate. Inventory, fixed assets, and intangible assets (2.a exception being nonmonetary assets and liabilities measured on BS at FAIR VALUE - they use the current rate)

3. Common stock and dividends paid are remeasured at the historical (actual) rate

4. Expenses related to non-monetary assets such as COGS, depreciation expense, and amortization expense are remeasured based on the historical rates

5. Revenues and expenses are translated at the average rate

6. Re-measurement gain or loss is recognized in the income statement.

Results in more volatile net income as compared to the current rate method

FIFO Inventory and COGS under Temporal Method

Inventory:

Ending inventory is the cost of the most recently purchased goods

Thus ending inventory is remeasured based on more recent exchange rates

COGS:

consists of costs that are older; therefore exchange rates used to remeasure COGS are older

LIFO Inventory and COGS under Temporal Method

Inventory:

Ending inventory consists of older costs = older exchange rates

COGS:

COGS consists of costs from the most recently purchased goods, thus remeasured with more recent exchange rates

Applying the Current Rate (4 steps)

1. All income statement accounts are translated at the average rate

2. All balance sheet accounts are translated at the current rate except for common stock, which is translated at the historical (actual) rate that applied when the stock was issued

3. Dividends are translated at the rate that applied when they were declared (historical rate)

4. Translation gain or loss is reported in shareholders' equity as a part of the cumulative translation adjustment (CTA)

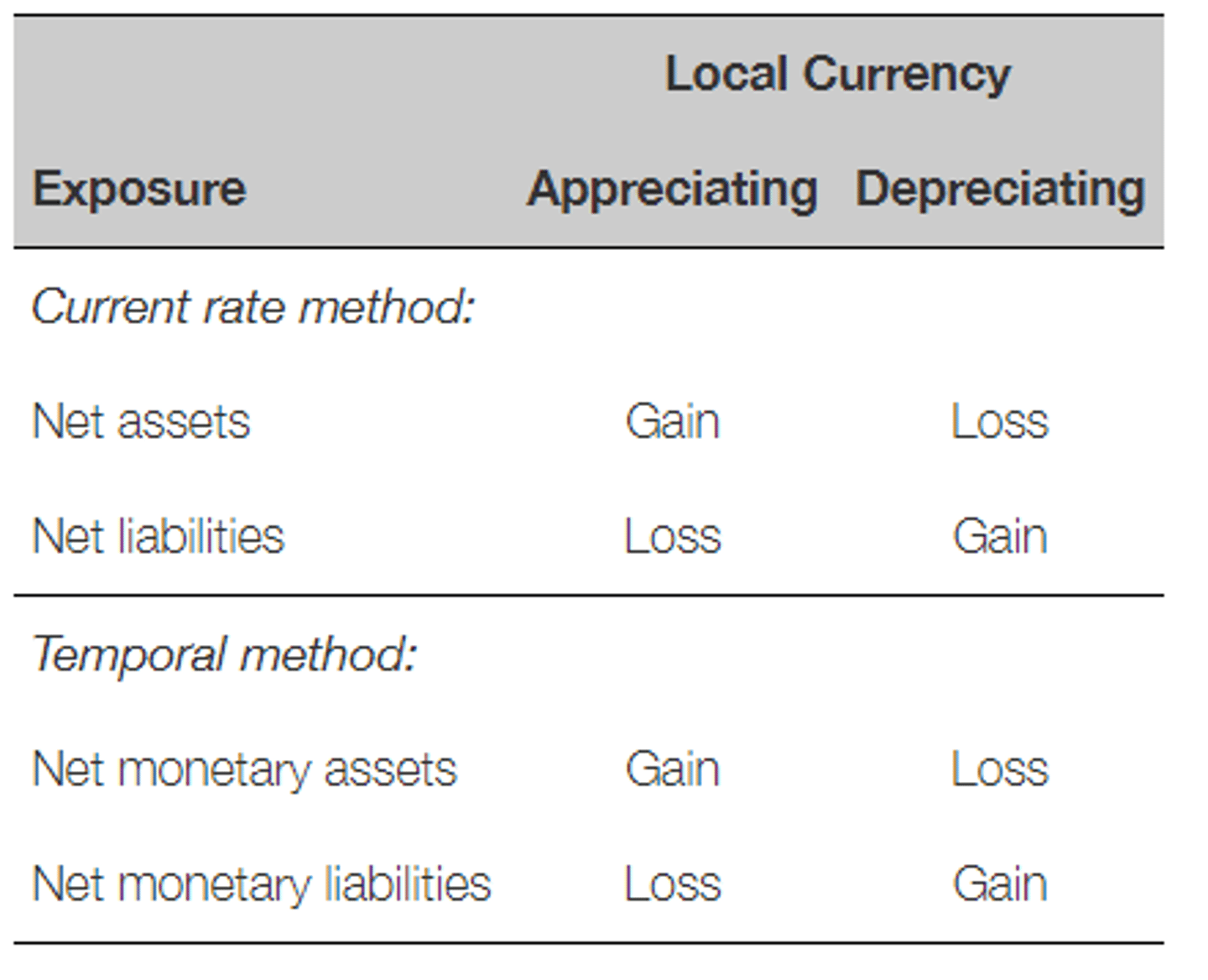

Impact of Changing exchange rates on exposures: Summary of the impact of changing exchanging rates on parent's exposure

Under Current rate method, translation gain or loss is reported in....

Shareholder's equity as a part of CTA

It is necessary to understand _____ under the two methods before calculating the gain or loss that results from changing exchange rates.

exposure (important to calculate before what?)

Under Current Rate Method, Exposure is defined as (2)

net assets or

subsidiary's equity

Under Temporal Rate Method, Exposure is defined as

the subsidary's net monetary asset or net monetary liability position. (Non-monetary assets and liabilities are remeasured at historical rates).

Under temporal method, firms can eliminate their exposure to changing exchange rates by

balancing monetary assets and monetary liabilities

Pure income statement and balance sheet ratios are ----- by the application of the current rate method

unaffected

Mixed ratios and the current rate method

results in small changes in mixed ratios. The numerator and denominator are almost always translated at different exchange rates

Basic steps to analyze the effect on the financial ratios of the choice of accounting method

1. Determine whether the foreign currency is appreciating or depreciating.

2. Determine which rate (historical rate, average rate, or current rate) is used to convert the numerator under both methods. Determine whether the numerator of the ratio will be the same, larger, or smaller under the temporal method versus the current rate method.

3. Determine which rate (historical rate, average rate, or current rate) is used to convert the denominator under both methods. Determine whether the denominator of the ratio will be the same, larger, or smaller under the temporal method versus the current rate method.

4. Determine whether the ratio will increase, decrease, or stay the same based on the direction of change in the numerator and the denominator.

Hyperinflation, using the current rate

to translate the balance sheet accounts will result in much lower assets and liabilities

Under IFRS - adjusting for inflation

permitted under IFRS

How does IFRS and U.S. GAAP differ when dealing with a subsidiary operating in a hyperinflationary environment?

US GAAP:

adjusting the nonmonetary assets and liabilities for inflation not allowed

IFRS:

adjusting for inflation is permitted

Effective Tax Rate

Tax expense in the income statement divided by pretax profit

Statutory Tax Rate

provided by the tax code of the home country

Changes in effective tax rate on account of foreign operations can be due to (2)

1. Changes in the mix of profits from different countries (with varying tax rates).

2. Changes in the tax rates.

Sales growth owing to an increase in volumes or prices is considered ______________ than sales growth due to appreciation of the foreign currencies in which sales were made.

More sustainable

Organic growth in sales (definition)

growth in sales excluding the effects of acquisitions/divestitures and currency effects

Companies often report foreign currency effects on sales in....

the MD&A section of their annual reports (is where this is reported)

Foreign exchange risks reflect...

the effect of changes in currency values on the assets and liabilities of a business as well as on future sales

Temporal rate method results in ....(more)

Results in more volatile net income as compared to the current rate method

Net income is different under temporal/cogs

1. temporal - remeasurment gain reported in income statement - resulting in more volatile net income

2. Current - translation loss/gain is reported in shareholder equity as a part of CTA

Total assets are different undert temporal/cogs

1. Current rate - Inventory and fixed assets translated at the current rate under the current rate method - reflecting depreciating local currency

2. Temporal - historical rate is used - thus inventory and fixed assets do not reflect the depreciating local currency

Temporal vs Current Four Main observations

1. Income before translation gain/loss is different between the two methods

2. Translation gain/loss is different between the two methods

3. Net Income is different between the two methods

4. Total assets are different between the two methods because inventory and net fixed assets are different

Pure Balance Sheet and Pure Income Statement Ratios (Current/Temporal)

unaffected by current rate method

Mixed Ratio

inputs from both the income statement and balance sheet.

current rate method results in (mixed ratios)

mall changes in mixed ratios because the numerator and the denominator are almost always translated at different exchange rates

mixed ratios calculated from financial statements translated using the current rate method _________than the same ratio calculated from the local currency statements before translation.

will be different

Six ratios that will increase under the current rate method if the currency is depreciating

1. Return on Assets

2. Return on Equity

3. Total Asset Turnover

3. Inventory Turnover

4. Accounts receivable turnover

key points regarding the original versus the translated financial statements and ratios (3)

1. Pure balance sheet and pure income statement ratios will be the same

2. If the foreign currency is depreciating, translated mixed ratios (with an income statement item in the numerator and an end-of-period balance sheet item in the denominator) will be larger than the original ratio.

3. If the foreign currency is appreciating, translated mixed ratios (with an income statement item in the numerator and an end-of-period balance sheet item in the denominator) will be smaller than the original ratio

Analyzing the effect on the financial ratios of the choice of accounting method (5 steps)

1. foreign currency is appreciating or depreciating?

2. Which rate (historical rate, average rate, or current rate) is used to convert the numerator

3. Numerator of the ratio will be the same, larger, or smaller under the temporal method versus the current rate method.

4. Which rate (historical rate, average rate, or current rate) is used to convert the denominator under both methods. Will the denominator of the ratio will be the same, larger, or smaller under the temporal method versus the current rate method.

5. Determine whether the ratio will increase, decrease, or stay the same based on the direction of change in the numerator and the denominator.

IFRS and US GAAP differences in inflation adjustments

adjusting the nonmonetary asset and liabilities for inflation is not allowed under U.S. GAAP

adjusting for inflation is permitted under IFRS.

hyperinflationary environment (definition)

Cumulative inflation exceeds 100% over a 3-year period.

One solution for making certain financial statements comparable CTA

adding the change in CTA to firms net income (Change in CTA is equal to the translation gain or loss for the period)

One solution for making certain financial statements comparable Shareholder equity

adding the unrealized gains and losses from fair value through OCI securities to net income would allow an analyst to compare the company to a firm that owns fair value through profit or loss securities

clean-surplus accounting

including the gains and losses (that are reported in shareholders' equity) in net income

Functional Currency

determined by management, is the currency of the primary economic environment. (Usually, the currency in which the entity generates and expends cash. Can be the local currency or some other currency.)

Presentation (reporting) currency

used to prepare the parent company financial statements

Real value of non-monetary assets and liabilities is typically (hyperinflation)

not affected by hyperinflation because the local currency-denominated values increase to offset the impact of inflation

Under US GAAP - adjusting the nonmonetary assets and liabilities for inflation

not allowed under US GAAP

According to FASB a hyperinflationary environment definition

One where cumulative inflation exceeds 100% over a 3-year period.

According to IASB a hyperinflationary environment definition

IASB does not specifically define hyperinflation; however, cumulative inflation of over 100% in a 3-year period is one indication that hyperinflation exists.

Difficult for analyst to get information about _____ because of disclosure requirements

information about the firm's currencies and the specific exposure to the currencies