BUSFIN- WORKING CAPITAL MANAGEMENT

1/28

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

29 Terms

Working capital management

Refers to the set of activities performed by a company to make sure it got enough resources for day-to-day operating expenses while keeping resources invested in a productive way.

Working capital = Current Assets- Current Liabilitites

To measure a company’s short term financial health and ability to cover day to-day operating expenses

Current Assets

Cash, Account Receivable, Inventories

Current Liabilitites

Accounts Payable , Short Term Debt

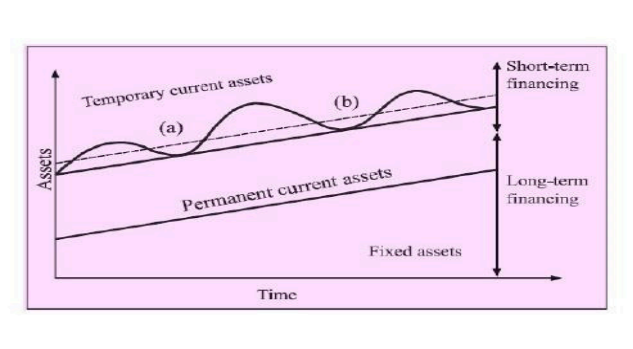

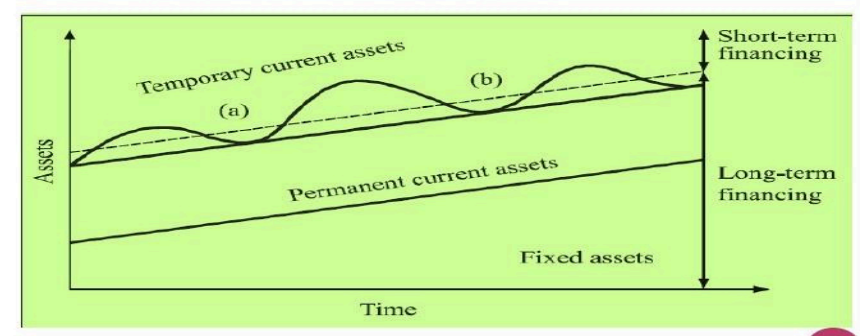

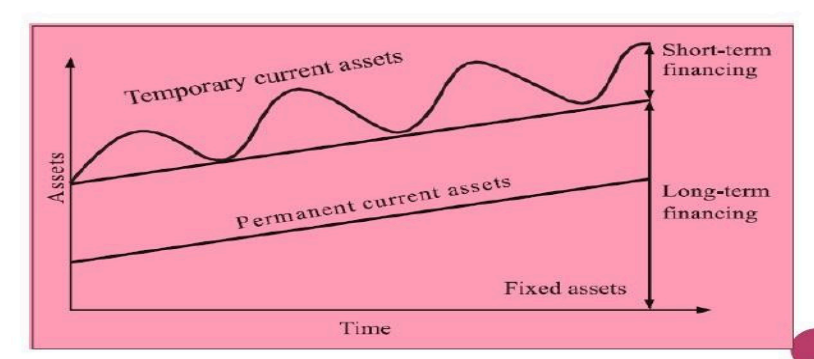

Maturity-matching

Aggressive

Conservative

Three Types of Working Capital Financing Policies Management:

Aggressive Financing

Conservative Approach

Matching Plan (Hedging Approach)

1) Cash

2)Accounts Receivable

3) Inventories

4)Accounts Payable

Management of Working Capital Accounts

Cash

Is the most liquid assets of a company.

•There must be proper controls over cash that need

•The most vulnerable to theft. to be observed to safeguard the asset.

1.Separate cashiering function from the recording or accounting function.

2.Issuing official receipts for collections and report.

3.Depositing collections

4.Adopting the check voucher system for payments.

Internal Controls over cash

Cash Budget

• for a year. Shows the expected cash receipts and disbursements for an accounting period.

•It can be prepared on a monthly or quarterly basis

It allows management to see if there will be funding requirements or excess cash during a budget period and when these are expected to happen.

Cash Reciepts

Cash Disbursements

Net cash flow for the period

Target cash balance

Cumulative excess cash or funding requirements

Parts of a cash budget

Cash Receipts

(receivables,loans,sharesof stocks and advances to stockholders)

Cash Disbursements

suppliers,service providers,loans and cash dividends

Net cash flow for the period

amount of excess cash or cash deficit for the period

Target cash balance

maintain at all times

Cumulative excess cash or funding requirements

can identify the possible sources of cash

For transaction

Compensating balance purposes

Primary Reasons for Holding Cash

For Transaction

A company needs to pay for the ff. such as purchase inventories, salaries, utility services,loans,dividends, and other transactions affecting the business.

Compensating balance purposes

Having deposit accounts and loans with a bank requiring a minimum amount maintained with the bank.

Precautionary Purposes

Speculative Purposes

Secondary Reasons forHolding Cash

Precautionary Purposes

In case of economic crisis, management want to maintain a higher level of cash emergencies and to serve a buffer for any slowdown in business activities.

Character

Capacity

Collateral

Condition

Capital

FIve C’s of Credit

Character

this refers to the integrity and reputation of the customer.

Capacity

This refers to the ability to pay

Capital

This refers to the amount of capital invested by the owner or into his company.

Collateral

This guarantees provided by the customer to support his exposure with the company.

Condition

Describes the environment where the company operates which may affect the ability of a customer to pay.