ECON 3330 Test 1

1/44

Earn XP

Description and Tags

David Bowes

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

45 Terms

Barter

The alternative to money

Trading goods for goods

Double-Coincidence of Wants

Barter requires _______

Makes it difficult to compare values of things; some goods are not easily divisible. are not durable, and/or are difficult to transfer

Money

Any item agreed upon to be acceptable for trade as an alternative to barter

Commodity Money

Early Money

Made of material that was valuable itself

Representative money

Made of material that is not intrinsically valuable, but can be exchanged for some item of value that exists somewhere

Fiat Money

Today’s money – not made of material that is intrinsically valuable

Value comes from faith, trust, and confidence that it will continue to be accepted

Evolution of Money

commodity → representative → fiat → electronic money, making transactions easier but relying more on faith

Factors of deciding which form of money to use

Ease of transport

Durability

Divisibility

Source of value

Easier transactions = more transactions

When transactions are easter their are more of them

3 Functions money serves

Medium of exchange

Store of value

Unit of account

Money Supply

A measure of the quantity of money available in an economy

M1

currency in circulation + demand deposits + other liquid assets

Most important part of M1 for our class

Currency in circulation + demand deposits

M2

M1 + more savings accounts

M2 adds

Adds assets that are less LIQUID

Financial market importance to economy

Moves money from savers (non-productive uses) to borrowers (productive uses)

Liquidity, information, and risk sharing

Good financial markets provide

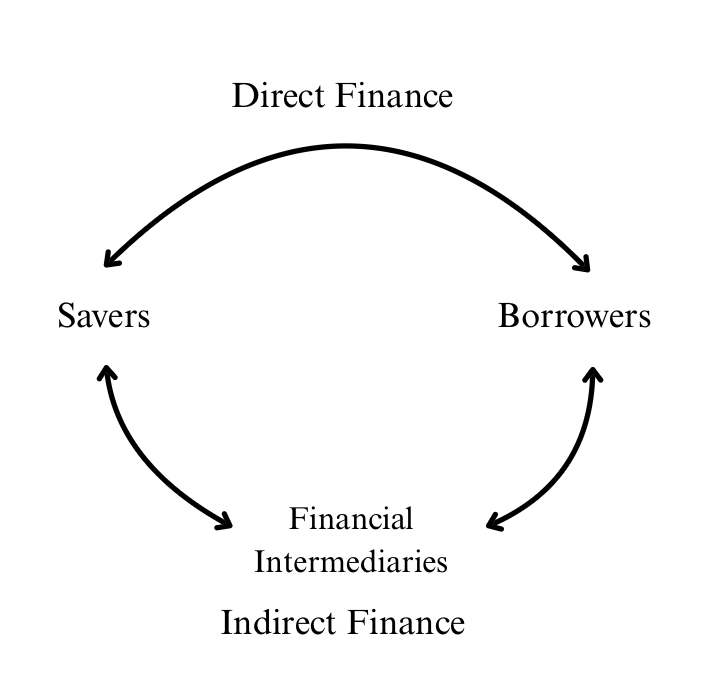

Financial Market Diagram

Financial Intermediaries examples

Depository (commercial banks) and Securities firms (investment banks)

Basic function in the Economy

Move money from savers to borrowers

Savers/Lenders

Have extra money and no productive uses

Borrowers/investors

Have productive uses and not enough money

Financial instruments

Bank CDs, Bank Loans, Bonds, Stock

Why is indirect finance more common?

Indirect finance

Savers → Intermediary → Borrowers

Financial Intermediaries exist and add value because they:

SPREAD RISK among savers

Reduce transaction Costs (time & trouble)

Provide Economies of Scale

Provide Liquidity

Information Services: Reduce problems of asymmetric information, moral hazard, and adverse selection between saver and borrower

Interest rate represents payment to:

Savers for risk

Cost to borrowers

Time value of money

Future value of money lent today:

Amount lent x (1+i)n

Money lent today

More valuable in the future at higher rates

Present value of money received in the future:

Amountn/ (1+i)n

Money received in the future

Less valuable today at higher rates

Discount factor

(1+i)n

money received in the future must be discounted by time (n) and risk of non-payment (i)

Discount bond

Buy the bond for less than its face value

Discount bond easy calculation

[(face value - price)/price]/maturity

![<p>[(face value - price)/price]/maturity</p>](https://knowt-user-attachments.s3.amazonaws.com/3111b298-dad1-4bd7-91f8-15b929f264bb.png)

Discount bond correct calculation

Price = Face Value/ (1+i)n

More than

You will never pay ___ ___ face value for a discount bond

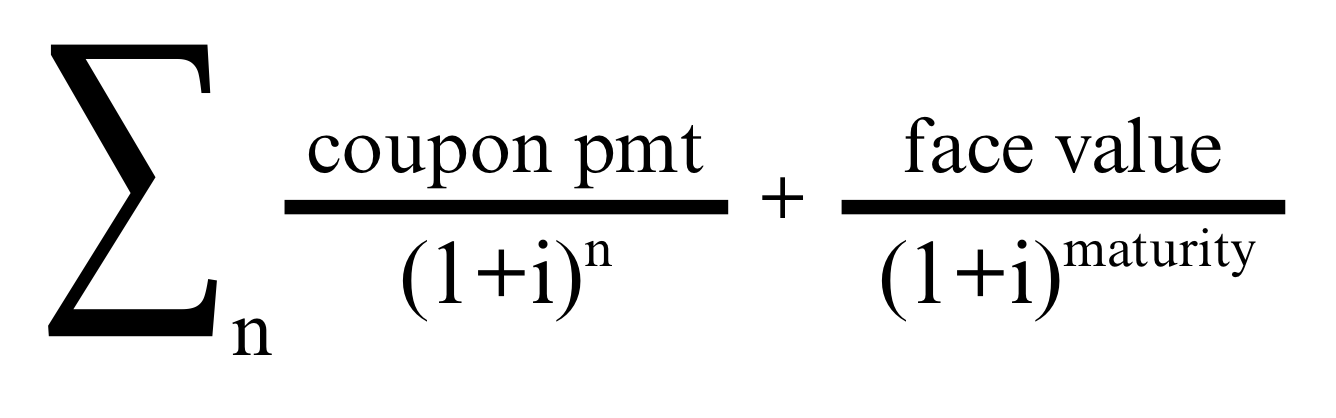

Coupon bond

Use of present value bond to determine interest rate

Coupon rate

% of face value as periodic payment

Bond price

i = coupon rate

If you buy a coupon bond at face value

i < coupon rate

If you pay more than face value

i > coupon rate

If you pay less than face value

Fisher equation

Nominal rate = real rate + expected inflation

Real rate = nominal rate - inflation

Borrowers

Inflation is good for

Savers

Inflation is bad for