Firms and Decisions

1/24

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

25 Terms

Outline the characteristics of perfect competition firms, BTE and number and size of firms

There is freedom of entry, new firms can enter without barriers and existing firms can cease production and leave easily too. There is a large number of sellers, making the output of each firm insignificant, each firm holds insignificant market share and hence all sellers are price takers

Outline the nature of products and market knowledge for perfect competition firms

Products are all perfect substitutes and no firm will adjust prices for their goods and quantity demanded will fall to zero. There is also perfect information

Outline the BTEs and number and size of firms for monopolistic firms

They have very high barriers to entry, this is due to high startup costs and R&D costs before production can take place. Banks may not loan such large capital funds without proper credibility. The interest rates of their loans also act as BTEs too. Monopolistic firms can also control supply chain to limit the distribution of key FOPs to new entrants. There is only one dominant firm in monopolies.

Outline the nature of products and market knowledge of monopolistic firms

There is no close substitute products and consumers can only obtain the good from one firm and must accept the price set. There is imperfect information in the monopoly

Outline the characteristics of oligopolies, excluding BTEs(similar to monopoly)

There are only a few dominant firms that are mutually interdependent, each firm’s profit maximising decisions regarding output and price all affect rival firms that will make corresponding decisions. Their products are either differentiated or homogenous, like banking services or petrol companies. There is imperfect information in the market.

Outline the BTE and number and size of firms for monopolistic competitive markets

There is freedom of entry and exit as start up costs are low with little governmental restrictions. Costs forfeited are also low if firms exit. There are many firms with no dominant producers. Hence the price and output decisions of one firm is unlikely to affect the other. However, each firm is still price setters as the firms have their own differentiated product

Outline the nature of products and market knowledge for monopolistic competitive market

The products are slightly differentiated as they differ slightly in terms of workmanship and quality, which are real differences, and also in terms of branding and advertising, which are perceived differences. There is imperfect information in the market

Outline why perfect competitive firms are price takers and how they make their price and output decisions

They will not engage in pricing strategies as their goods are perfectly inelastic and all goods in the market are perfect substitutes. Hence, an increase in price will lead to quantity demanded falling to zero and consumers will buy identical product from other firms. A price reduction will lead to all consumers choosing to buy their products, however, given the perfect knowledge of the market, all firms will reduce cost equally too, the temporary increase in revenue will be lost to a permanently lower price, making it irrational

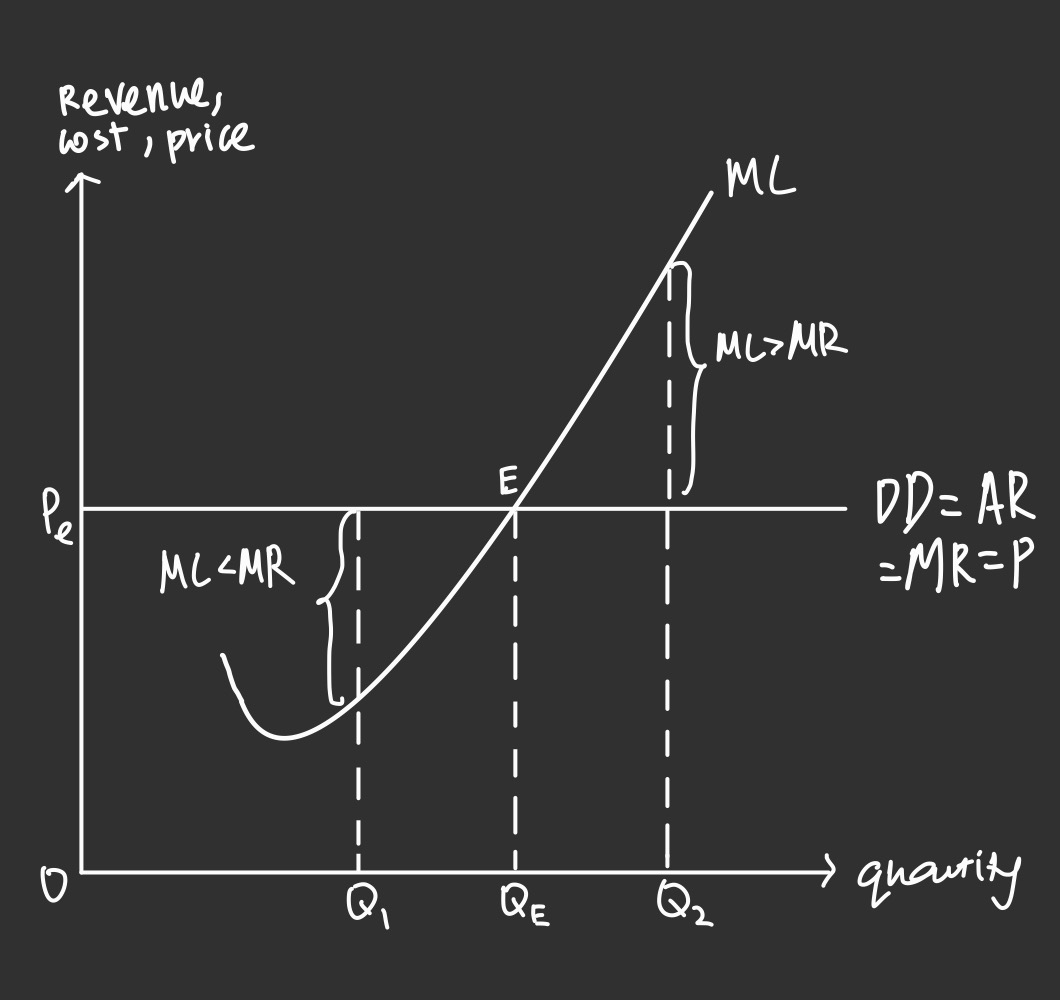

Describe the profit maximisation graph for perfect competitive firms

For MR>MC region, if the firm were to produce at Q1, the MR is greater than MC, which means the extra revenue from selling one more unit is greater than the extra cost of producing that additional unit. Hence, increasing quantity at this point is beneficial. For MC>MR region, if the firm were to produce at Q2, the MC is greater than MR and hence the extra cost of producing one more unit is greater than the extra revenue from selling that one additional unit. hence, increasing quantity will not benefit the firm. They will hence charge price Pe and produce at output Qe where MC=MR

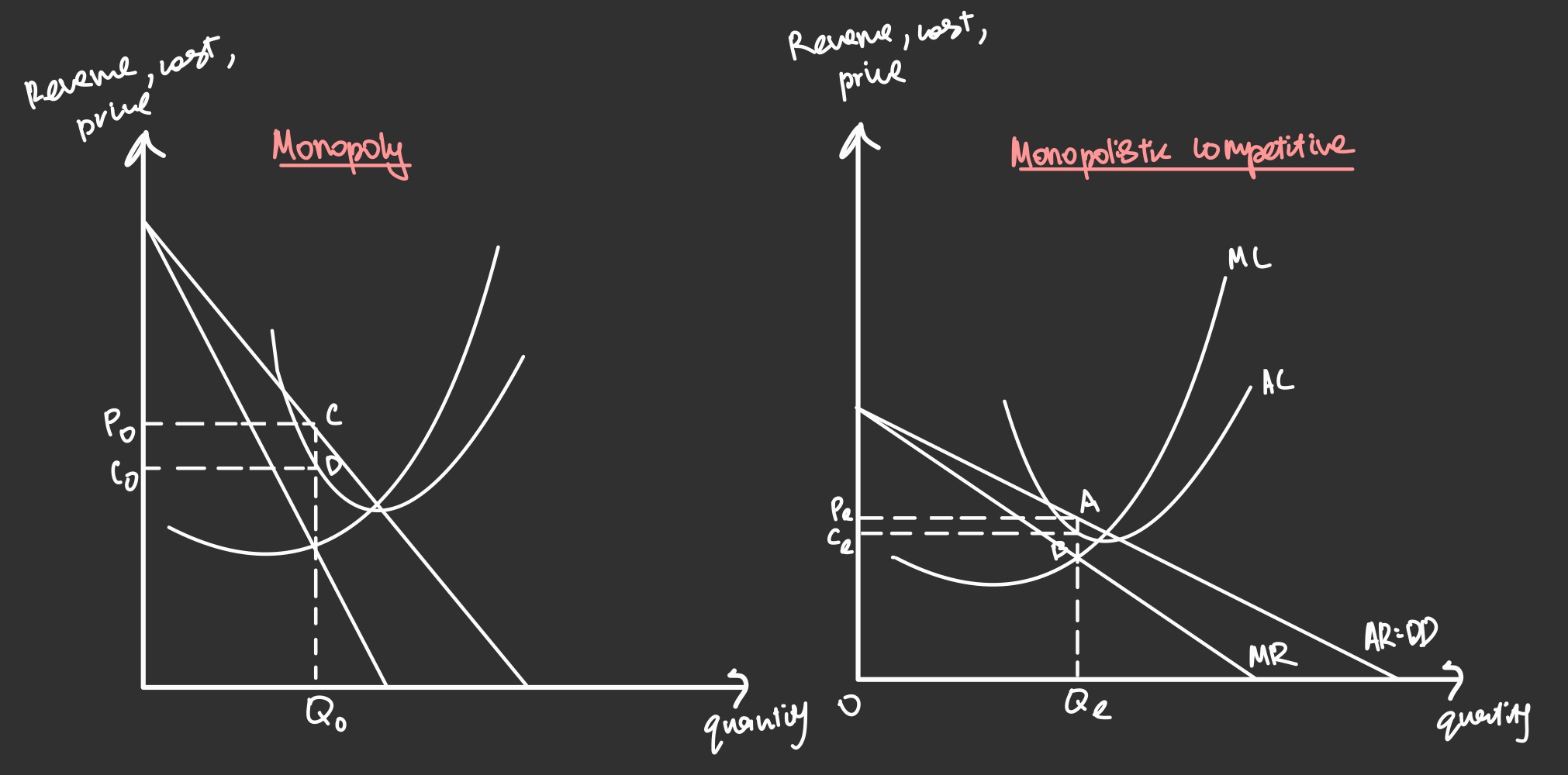

Describe the graphs of monopolies and monopolistic competitive firms

Since monopolies form the entire industry, their demand curve is downward sloping and is relatively price inelastic due to the absence of close substitutes, whereas that of monopolistic competitive markets have a more gentle downward sloping demand curve. This is attributed to the more competitive firms and slightly differentiated products

Describe the short run and long run equilibrium for monopolies and monopolistic competitive firms if they engage in profit maximisation

The short run equilibrium where MC=MR will differ for each firm, all 3 profits can be earned, but when subnormal profits are earned, firms will have to decide if AR is more or less than AVC to determine whether to shut down. In long run equilibrium, monopolies will likely retain supernormal profits due to their high BTEs, or at least earn normal profits. Whereas for monopolistic competitive firms they are likely to only make normal profits as any supernormal profits will increase number of firms due to low BTEs and subnormal profits will chase competitors out of market

Describe the price rigidity strategy for competitive oligopolies

Since oligopolies are mutually interdependent, they will exhibit price rigidity where prices remain unchanged and price competition is seldomly adopted. This is due to an underlying assumption that rival firms will match price reductions but not price increments. Hence it is not rational to engage in price competition even if there are changes in demand and supply as it will trigger price wars with their extreme rival consciousness

Outline price rigidity for collusive oligopolies(explicit and implicit collusion)

Explicit collusive oligopolies establishes a virtual monopoly by strictly adhering to a set quota and price to sell their output. Since they essentially join together to make a profit maximisation decision, their demand will be similar to that of a monopoly. Implicit oligopolies will depend on a price leader where other firms will follow suit without obvious means of communication

State the example for collusive oligopolies

The organisation of petroleum exporting countries are comprised of 13 major oil exporting nations that coordinate petroleum policies together to set global prices. This is to prevent fluctuations that will affect the economies of both producing and purchasing nations

Outline and explain the two main aims of limit/predatory pricing that only monopolies and oligopolies adopt

The first aim is to deter entry of new competitors(limit) by charging a price below its profit maximising price, in order to deter new entrants, especially if the market is highly contestable. Firms will reduce price till below the new entrants AC curve so they will be unable to make any profits. The second aim is to drive out existing competitors(predatory) by pricing below AC, this is to increase their own demand

State the advantage for limit pricing and for predatory pricing

The inability to make at least normal profits would disincentivise potential entrants, allowing firms to retain their market share and market power. Hence, existing firms will have a more price inelastic demand and allows them to increase total revenue to earn more profits in the long run.

State the limitations of limit/predatory pricing

Firms will likely earn less revenue due to lower price set and this results in lower profits. In extreme cases, subnormal profits may be earned and if they do not have sufficient profits from the past that they can tap into, they may be forced to close down

Define price discrimination and outline its main mechanism

It is defined as charging different prices to different customers for different units of the same product even when there are no difference in costs. The mechanism is that firms will raise its prices in the sub-market where its demand is price inelastic and lower its prices in the sub-market where demand is price elastic. This enable firms to earn higher revenue, assuming cost remains the same. They will enjoy higher profits than if they charged both markets the same price

Why are firms able to exhibit price discrimination and what are the 3 ways they can do so?

Firms are able to exhibit price discrimination only if they have some degree of monopoly power and the markets are effectively segmented to prevent the resale of the good. There must also be different price elasticities for the different markets. They can practice price discrimination through different consumer incomes, different consumer characteristics and time of service

Define mergers and acquisitions

Mergers are defined as when two separate firms amicably join to create a bigger firm. Acquisitions are defined as when a

Outline vertical integration and horizontal integration with an example each

Vertical integration is when a firm integrates with another firm that is involved in an earlier or later stage of production, like when an airline acquires an online travel portal. Horizontal integration is when firms producing the same good in the same stage integrate, like meta and Instagram that allowed for the firms to gain more insights and resources to capture larger market share

Outline conglomerate integration with an example

It is when firms producing unrelated goods come together as one entity in order to diversify goods and spread its presence across different market. Keppel corporation has ties with property, oil and telecommunication markets to boost business opportunities

Outline the effectiveness of mergers and acquisitions in raising profits and revenue

They allow firms to capture more market share and increase their demand. The larger market share will make demand less price elasticities and give them the ability to increase BTEs, by controlling supply chains. They also have more ability to engage in pricing strategies to drive out existing firms too

Outline the effectiveness of mergers and acquisitions in decreasing unit costs

With the ability to increase production, firms can reap more IEOS and enjoy a lower AC and MC of production. This can be done by streamlining sales, operations and marketing, hence the cost is spread out to a larger number of outputs, leading to lower unit costs

Outline the limitations of mergers and acquisitions

The excessive growth may lead to poorer quality products due to more specialisation and insufficient managers. This reduces the demand for the firm’s goods and thus IDOS may occur and raise the average cost of production. These mergers also require costly contracts and long drawn discussions