Fixed Income

1/32

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

33 Terms

Price (%of par) of a T-Period Zero-Coupon Bond

= 1 ÷ (1 + Sₜ)ᵗ

Return from bond credit migration

Forward Price (%of par) (at t = j) of a Zero-Coupon Bond Maturing at (j + k)

= 1 ÷ [1 + f(j,k)]ᵏ

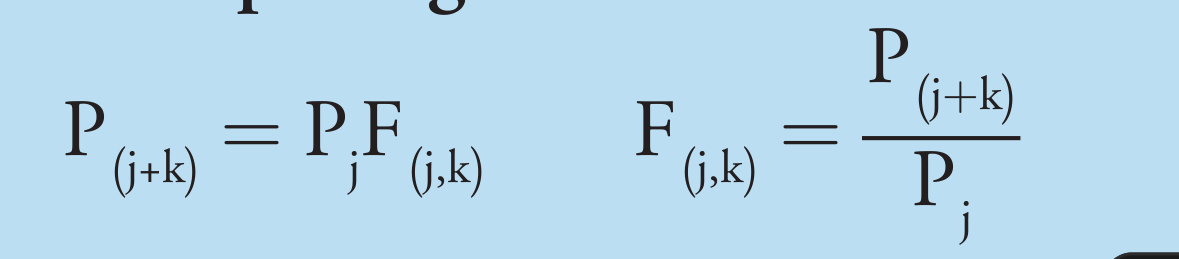

Forward Pricing Model

The price of a forward is equal to the price of the bond at time j \cdot the forward rate

Forward Rate Model

How you derive a forward rate from spot rates. The spot rates at times j and j+k determine it

Swap Spread

= Swap Rateₜ − Treasury Yieldₜ

Represents derivative market credit and liquidity risk (swaps are traded and thus liquid is important)

TED Spread

= 3-Month MRR − 3-Month T-Bill Rate

Represents interbank credit risk only

MRR is unsecured interbank lending

MRR-OIS Spread

= MRR − Overnight Indexed Swap Rate

OIS is the expected Fed policy rate over term of swap

Measure of credit AND liquidity risk in the interbank market

Portfolio Value Change Due to Level, Steepness, and Curvature Movements

= −DᴸΔxᴸ − DˢΔxˢ − DᶜΔxᶜ

Callable Bond Value

= Vₛₜᵣₐᵢgₕₜ − Vcₐₗₗₐbₗₑ

Putable Bond Value

= Vstraight + Vput

Value of Put Option on Bond

= Vputable − Vstraight

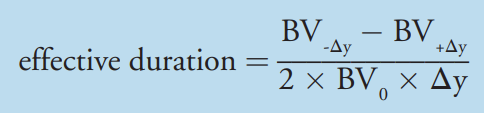

Effective Duration

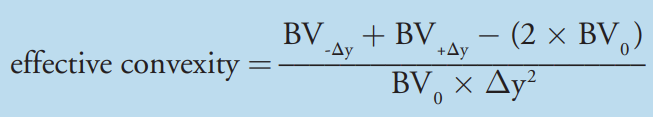

Effective Convexity

Minimum Value of Convertible Bond

= Greater of Conversion Value or Straight Value

Market Conversion Price of a Convertible Bond

= Market Price of Convertible Bond ÷ Conversion Ratio

Market Conversion Premium per Share

= Market Conversion Price − Stock’s Market Price

Market Conversion Premium Ratio

= Market Conversion Premium per Share ÷ Market Price of Common Stock

Premium Over Straight Value

= (Market Price of Convertible Bond ÷ Straight Value) − 1

Callable and Putable Convertible Bond Value

= Straight Value + Value of Call Option on Stock − Value of Call Option on Bond + Value of Put Option on Bond

Recovery Rate

= % of Money Received Upon Default

Loss Given Default (%)

= 100 − Recovery Rate

Expected Loss

= Probability of Default × Loss Given Default

=PoD x e(loss) per $ x Par

Present Value of Expected Loss

= Value of Risk-Free Bond − Value of Credit-Risky Bond

Upfront Premium % (CDS)

≈ (CDS Spread − CDS Coupon) × Duration

Price of CDS (per $100 Notional)

≈ $100 − Upfront Premium (%)

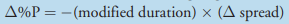

Profit for Protection Buyer

≈ Change in Spread × Duration × Notional Principal

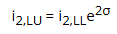

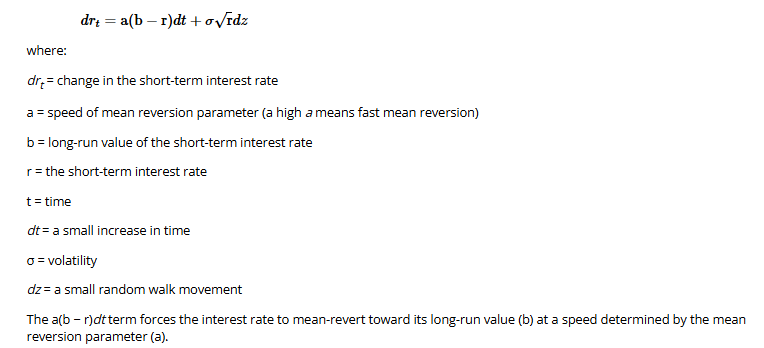

Cox-Ingersoll-Ross model

o Equilibrium model

o Higher rates means higher rate volatility

o Interest rate movements are driven by people deciding whether to consume today or in the future

o Mean reverting

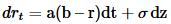

The Vasicek Model

o Equilibrium model

o Mean reverting

o Constant vol, doesn’t increase with rates

o Doesn’t force non-negative rates

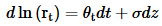

The Ho-Lee Model

o Arb Free Model

o Constant Vol,

o Used to price zero coupon bonds and thus the spot curve

The Kalotay-Williams-Fabozzi (KWF) model

o Arb Free model

o no mean reversion, constant Vol

o ST rates are log normal

Gauss+ Model

o Central bank controls ST, MT rates revert to long term, and LT rates are also mean reverting and depend on macro

o Hump shaped volatility, most in the middle

Finding Nodal Rates