managerial accounting exam 1

1/145

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

146 Terms

financial books: audience?

investors, creditors

financial books: objective?

communicate profit, cash flows, and financial position

financial books: rules?

U.S GAAP, IFRS

financial books: rule setter?

in the U.S: SEC/FASB

financial books: example?

annual report

management books: audience?

management

management books: objective?

facilitate management decisions

management books: rules?

none

management books: rule setter?

management

management books: example?

budgets, product profitability

service companies

provide services; do not carry inventory

merchandise companies

buy and resell inventory to customers

manufacturing companies

buy raw material which they convert to a finished product and offer for sale to customers

managerial accounting

provision of accounting information for a company’s internal users of information (managers at all levels)

financial accounting

focuses on EXTERNAL users of financial info (owners, creditors, tax authorities and regulators)

financial accounting

emphasizes past activities (uses historical info)

financial accounting

emphasizes objectivity, precision, and verifiability

financial accounting

emphasizes company wide reports

financial accounting

MUST follow GAAP/IFRS (required formats: financial statements, required timing for reports)

financial accounting

MANDATORY for external reports

managerial accounting

reports to managers INTERNAL To the organization (to assist with planning, control and decision making)

managerial accounting

emphasizes decisions affecting the future

managerial accounting

emphasizes relevance

managerial accounting

emphasizes relevance

managerial accounting

emphasize timeliness — no required timing for reports; provide to managers as needed

managerial accounting

emphasize segment reports (product lines, geographic territories or departments)

managerial accounting

need not follow GAAP/IFRS — NOT mandatory

goal of managerial accounting

helps managers carry out their basic functions

planning

establishing goals and objectives and identifying ways to achieve them (example: preparing budgets)

controlling

monitoring and ensuring the proper implementation of plans (example: performance evaluation)

decision making

selecting the best course of action among competing alternatives (which product lines to offer, what price to charge? who is our target market? how should we execute?)

skills that managers need

big data management skills

an ethical perspective

strategic management skills

enterprise risk management skills

a corporate social responsibility perspective

process management skills

leadership skills

cost object

anything for which cost data are desired, including products, customers, jobs, organizational subunits, etc.

ex: product line, geographic region

cost object

to determine if a cost is indirect or direct, you must identify..

direct cost

costs that can be easily and conveniently traced to a specificed cost object

this cost is CAUSED by the cost object

ex: customer order - materials used to produce the order

indirect cost (“common cost”)

costs that cannot be easily and conveniently traced to a specified cost object (may be allocated)

ex: a CEO’s salary to multiple different divisions or prodcut lines

product cost

includes all costs required to purchase or manufacture inventories

product cost: for a retailer

includes cost of purchasing inventory

product cost: for a manufacturer

includes all costs required to manufacture inventories

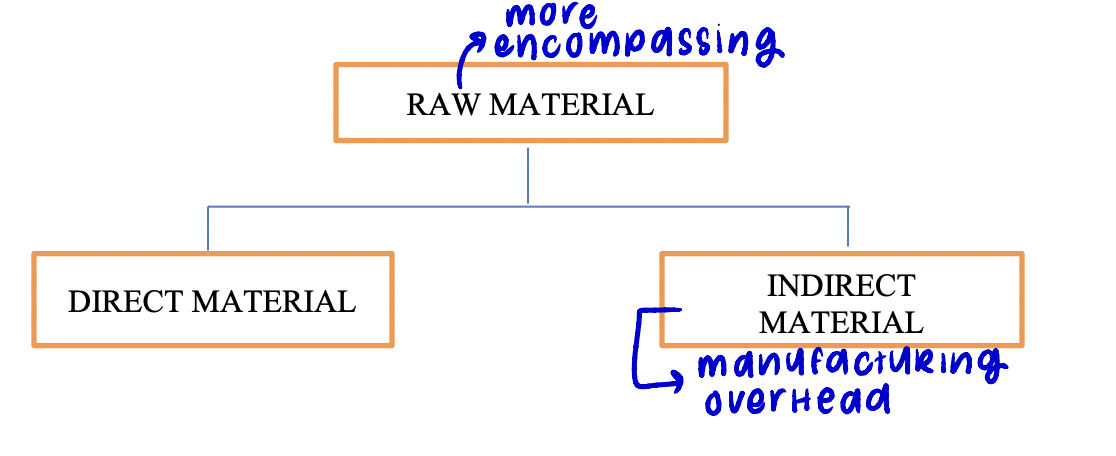

3 broad categories of PRODUCT cost (aka manufacturing costs)

DM, DL, OH (direct material, direct labor, manufacturing overhead)

direct material

raw material that becomes an integral part of the finished product and whose costs can be conveniently traced to it

can be natural resources or parts purchased from another company

ex: t-shirt manufacturer: fabric, cotton

raw material

refers to any materials that go into the final product and includes both DIRECT and INDIRECT materials

direct labor

labor costs that can be easily traced to individual units of product (aka “touch labor”)

ex: t shirt manufacturer: swing machine operators, “assembly line”

factory labor includes..

direct and indirect labor

manufacturing overhead

includes all manufacturing costs EXCEPT direct materials and direct labor; these costs can NOT be easily traced to specific units produced (also called indirect manufacturing cost, factory overhead, and factory burden)

manufacturing overhead

includes INDIRECT MATERIAL used in production - materials that are relatively insignificant to the product, not worth tracing to each unit so are treated as part of manufacturing overhead

ex of INDIRECT MATERIAL: t shirt manufacturing: dye, needles, thimbles, thread

manufacturing overhead

includes INDIRECT LABOR - factory labor that is difficult to trace to each unit so it is included as part of manufacturing overhead

ex of INDIRECT LABOR: factory maintenance, factory supervisors, factory janitors

other examples of manufacturing overhead

maintenance and repairs on production equipment, heat and light, property taxes, depreciation, insurance, on manufacturing facilities (that are related to operating the factory)

treatment of product costs

assign to inventory as incurred; expense through COGS when inventory is sold (i.e, in accordance with the matching principle)

period costs (“nonmanufacturing costs” or “selling + administrative costs”)

includes selling costs, administrative costs

selling cost (period cost)

includes all costs necessary to secure customer orders and get the finished product into the hands of the customer

ex: shipping to the customer, price tags, advertising, sales salaries

administrative cost (period cost)

includes all executive, organizational, and clerical costs associated with the general management of an organization

ex: clerical wages, CEO’s salary, VP’s salaries

other selling, general & administrative expenses

such as rent, insurance, depreciation, property taxes, etc. on selling and administrative facilities (R+D costs)

treatment of perid costs

EXPENSED in the period incurred (or allocated among periods benefitted for costs such as prepaid rent, supplies or depreciation)

cost structure

refers to the relative proportion of each type of cost in an organization

cost behavior

refers to how a cost will react to changes in the level of activity — understanding cost behavior facilitates planning and controlling

activity base (cost driver)

measure of what causes variable costs to change (such as units produced, units sold, labor hours, number of customers, etc)

relevant range

operating range over which a firm finds it practical to operate in the short run (more practical)

it is the range of activity within which the assumptions made about cost behavior are valid

the relevant range of activity pertains to fixed cost as well as variable costs

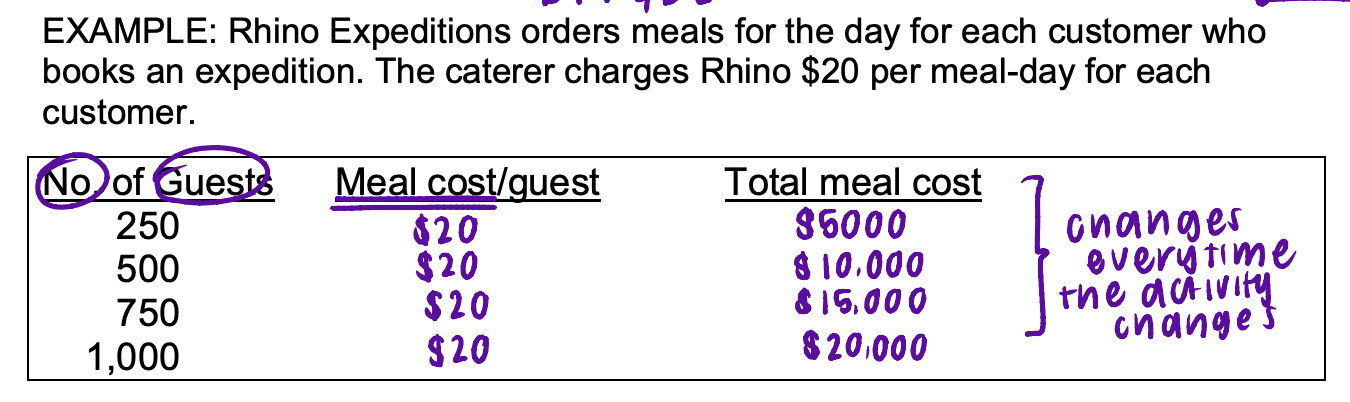

variable cost (VC)

a cost that varies, in total, directly and proportionally to changes in the level of activity

IN TOTAL: varies in direct proportion to activity

PER UNIT: remains constant

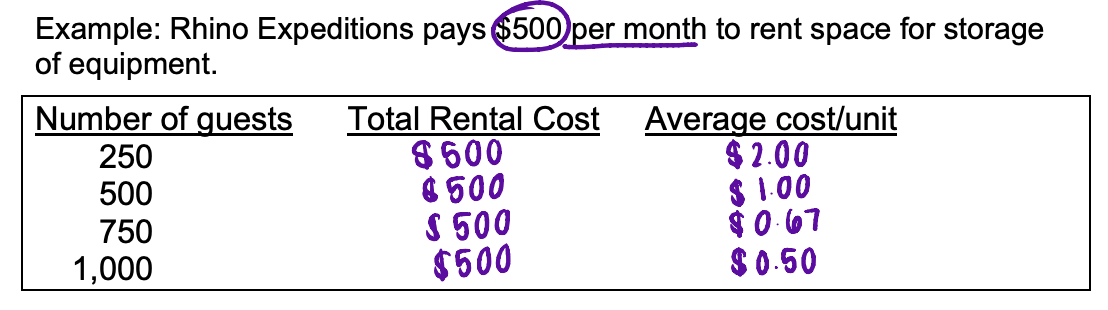

fixed cost

a cost that remains constant, in total, regardless of changes in the level of activity

total fixed cost REMAINS constant as activity changes

the fixed cost PER UNIT varies inversely with changes in activity

committed fixed costs

represent investments with a multi-year planning horizon that cannot be easily adjusted in the short term

ex: CEO’s salary, production manager, rent insurance, etc (facilities)

discretionary fixed costs

usually arise from annual decisions by management and they can be easily reduced in the short term

ex: R + D, advertising, training programs

mixed costs

a cost that contains both variable and fixed elements (also called “semi-variable costs”)

mixed cost

the fixed portion is constant (in total) regardless of the level of activity and the variable portion will vary in direct proportion to activity

equation: y = mx + b

total cost = [VC/unit of activity * activity] + FC

![<p>the fixed portion is constant (in total) regardless of the level of activity and the variable portion will vary in direct proportion to activity</p><p>equation: y = mx + b</p><p>total cost = [VC/unit of activity * activity] + FC</p>](https://knowt-user-attachments.s3.amazonaws.com/714bd2ed-3d04-43b8-9e0a-7c14488d20a9.png)

the traditional approach

separates product costs from selling and administrative expenses as required for external reporting purposes

traditional format

Sales

Less: COGS (product costs)

= Gross Margin

Less: Selling & Administrative Expenses (period costs/operating expenses)

Net Operating Income (NOI)

two ways to compute COGS

(1) number of units sold * unit cost

(2) COGS = beginning inventory + purchases - ending inventory

problem with the traditional format

required to be used for external reporting purposes

method does not distinguish between variable and fixed costs

contribution margin approach

separates costs into FIXED and VARIABLE categories and computes a contribution margin, emphasizes cost behavior which is important to managers

contribution appraoch is used as..

an internal planning and decision making tool (aids cost-volume profit analysis, performance evaluation, and budgeting)

contribution margin format

Sales

Less: Variable Costs (Product & Period)

= Contribution Margin

Less: Fixed Costs (Product & Period)

= Net Operating Income

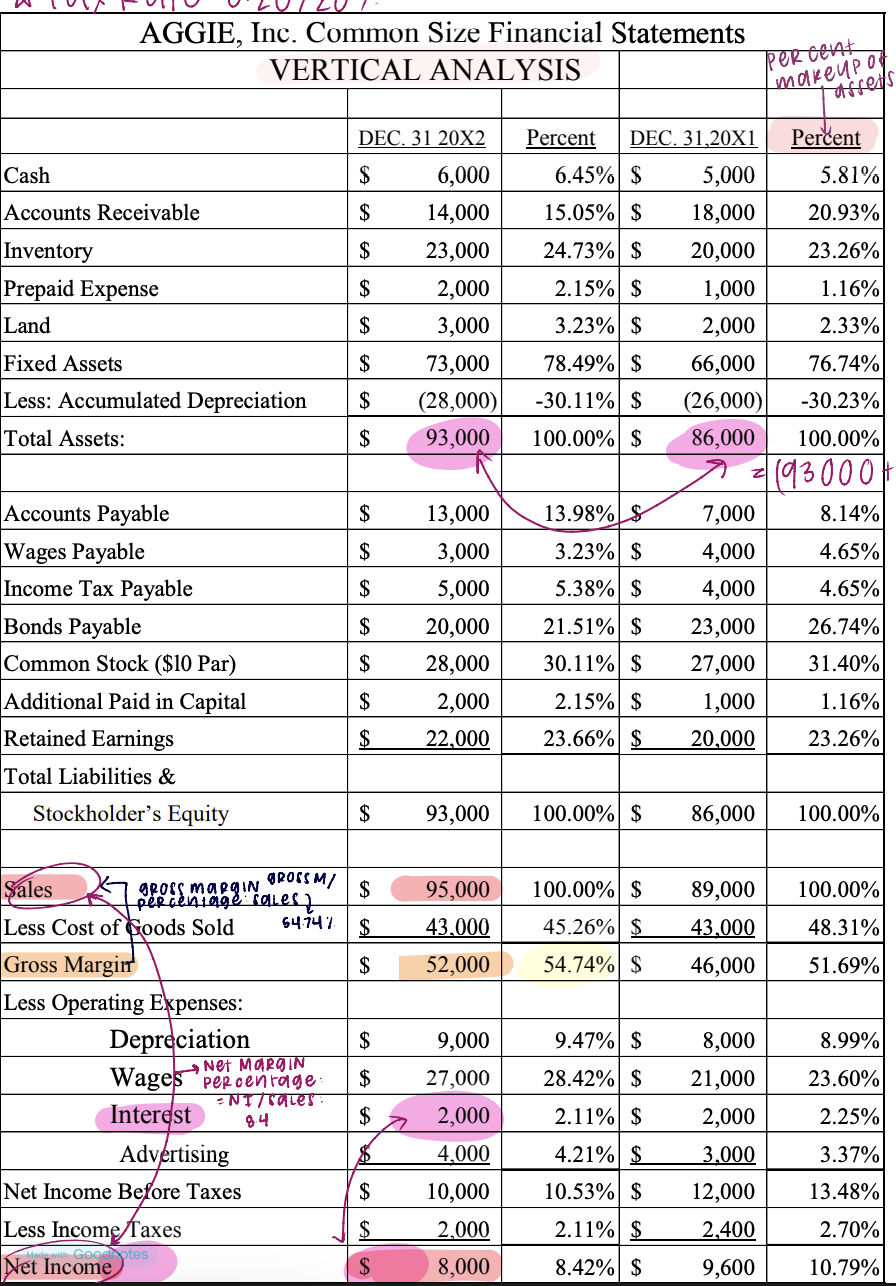

financial statement analysis

a set of tools used to make the general purpose financial statements more useful to varied users of financial information

3 basic tools of analysis

1) horizontal analysis

2) vertical analysis

3) ratio analysis

limitations of financial statement analysis

for meaningful analysis, common-size data and the ratios for a company should be compared with a standard:

past history of the company: comparing the value of a ratio over time allows trends to be assessed

similar company

industrial averages

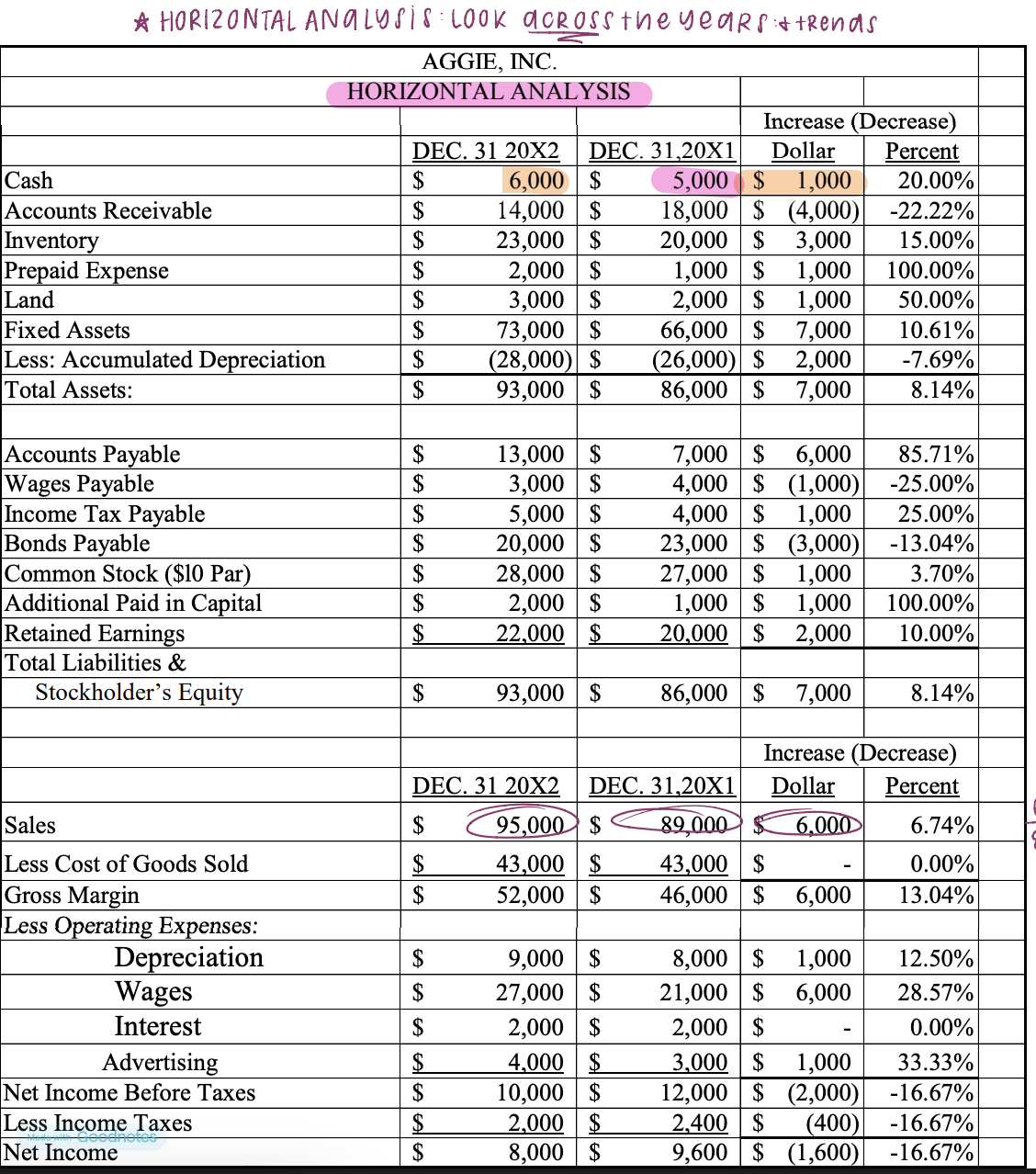

horizontal analysis (dollar & percentage changes)

focuses on the dollar and/or percentage changes in accounts on the income statement and/or balance sheet from year to year

facilitates identifying trends over time

can be shown as a percentage of the base year of percentage change

horizontal analysis

looks across the years and trends

vertical analysis

used to evaluate the relationships within a single financial statement, compares to prior years/other companies

exxpresses each item within financial statement as a percent of a selected item on the statement

vertical analysis formula: BALANCE SHEET

expressed as a percentage of total assets.

formula: account balance / total assets

vertical analysis formul

expressed as percentages of net sales

formula: account balance / net sales

ratio analysis

ratios express the mathematical relationship between two or more financial variables

ratios can be used by managers to assess:

1) liquidity

2) profitability

3) debt management

4) asset management

5) market performance

ratio analysis — assessing liquidity

liquidity ratios provide a measure of a company’s ability to meet current obligations in a timely manner (working capital, current ratio, acid-test quick ratio)

working capital

a widely used general measure for evaluating: do we have enough CA to pay for our CL?

= CA - CL

current ratio

a widely used general measure for evaluating a company’s ability to pay short term liabilities with current assets

= CA / CL (better to use when companies are different sizes)

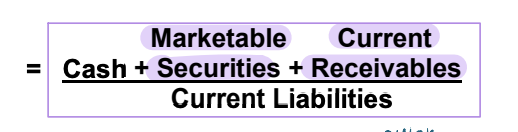

acid-test (quick) ratio

also measures ability to pay short term debt but excludes less liquid current assets

ratio analysis — assessing profitability

provide a measure of the earnings and/or earnings potential of the company (gross margin percentage, net margin percentage, return on total assets, return on equity)

gross margin percentage

provides a measure of the percentage of sales that remain after the cost of inventory is covered

= gross margin / sales

net margin percentage

provides a measure of the percentage of sales that remain after ALL expenses are covered

= net income / sales

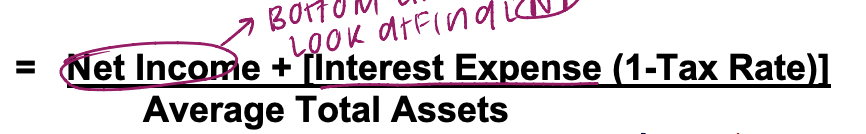

return on total assets

measures the ability of the firm to earn a return on its assets - that is, provides a measure of how efficiently assets are used

return on equity

measures the ability of the company to earn a return on the stockholder’s investment (how did the company owners’ invest to generate income?)

ratio analysis — assessing asset management

asset management ratios assess how well a company has effectively and efficiently utilized its assets (accts receivable turnover, average collection period, inventory turnover, average sale period)

accounts receivable turnover

used to assess the liquidity of the receivables; measures the number of times, on average, receivables are collected during the period

average collection period

a popular variant of the receivables turnover ratio that converts it into an average number of days it takes to collect an account receivable

inventory turnover

measures the number of times, on average, the inventory is sold during the period - it indicates the liquidity of the inventory

average sale period (in days)

a variant of the inventory turnover ratio - copmutes the average days taken to sell the average inventory balance one time

operating cycle

measures the elapsed time from when inventory is received from suppliers to when cash is received from customers

total asset turnover

measures how efficiently a company’s assets are being used to generate sales

financial leverage

results from the difference in the rate of return a company earns on its assets and the rate of return it must pay its creditors (after-tax)

financial leverage is positive if..

the return on assets exceeds return paid to creditors (i.e, higher than the cost of obtaining capital

financial leverage is negative if

the return on assets is less than the return paid to creditors (i.e, is less than the cost of obtaining capital)