Public Sector Final

1/35

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

36 Terms

Two Principle of Taxation

Positive principles of taxation concerns the effects of taxations

Tax policy (normative questions)

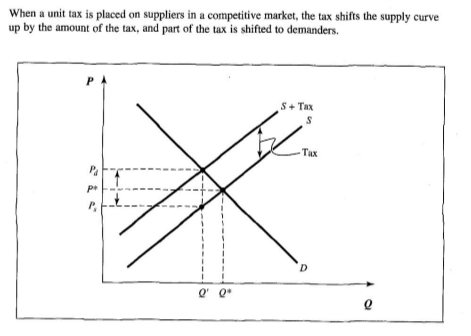

Unit Tax on Suppliers

Creates effect known as tax shifting, as although taxes are placed on suppliers, some of the burden is shifted to demanders.

Arrow drawn up from P* is proportion of tax home by demanders, arrow drawn down is the proportion of tax home by suppliers.

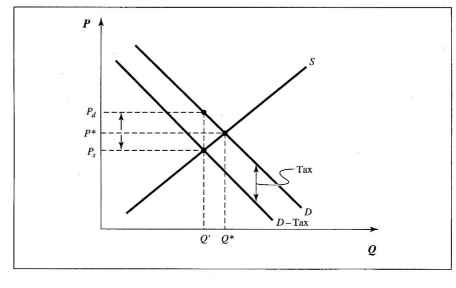

Unit Tax on Demanders

Creates effect known as tax shifting, as although taxes are placed on suppliers, some of the burden is shifted to demanders.

Arrow drawn up from P* is proportion of tax home by demanders, arrow drawn down is the proportion of tax home by suppliers.

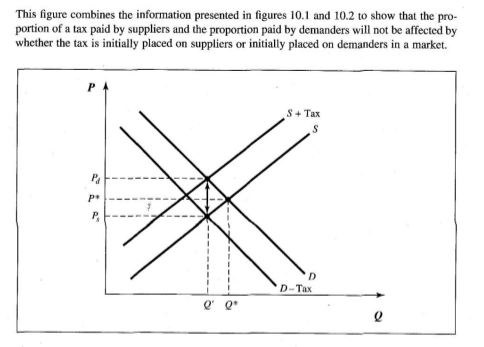

Unit Tax on Both Demanders and Suppliers

The actual burden of a tax can be different from the legal assignment of a tax

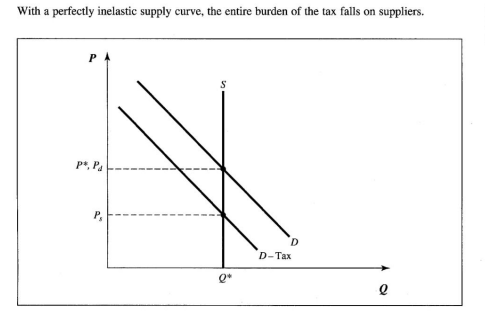

Elasticities and Tax Incidence

The more elastic the schedule, the more the burden of the tax will fall on the other side of the market.

If perfectly elastic, the entire burden falls on demanders

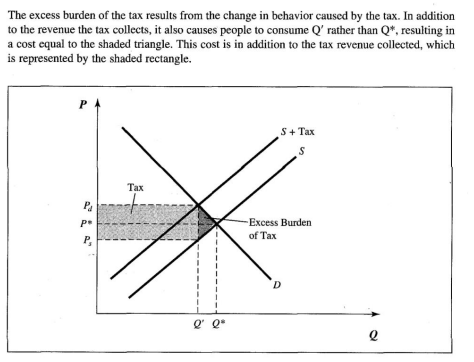

Welfare Cost of Taxation

Excess Burden / Deadweight loss of taxation

Occurs because taxpayers not only must pay the tax but will also alter their behavior in response to avoid the tax.

For example, if gas is taxed, they must pay the tax but will also reduce their consumption of gas.

Excess burden of taxes can be reduced with goods with either very inelastic demand or supply.

Lump Sum Tax

A certain amount everyone has to pay at the time the tax is announced.

This would not change the behavior of people other than getting the money to get the tax, thus limited excess burden of taxation.

Main issue is necessities have inelastic demands, luxuries have elastic demands, but equity gets in the way of efficiency.

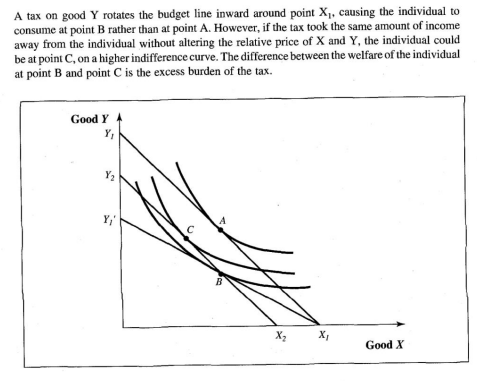

Excess Burden on the Individual

For the tax to have no excess burden, there must be no substitution effect that causes individuals to substitute away from the taxed good due to its higher relative price. Therefore, indifference curves would have to be 90 degrees.

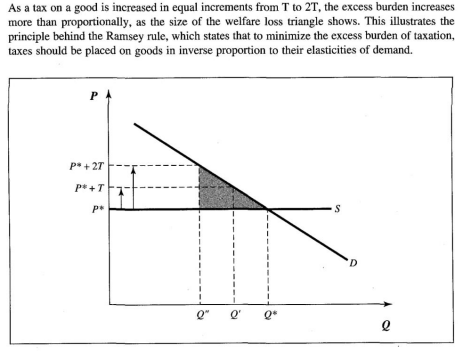

Ramsey Rule

To minimize the excess burden of taxation, taxes should be placed on goods in inverse proportion to the elasticity of demand of the goods.

If taxes on goods are represented by T and the elasticity of demand of that good is E, then: T1/T2 = E2/E1

Simplifications: Not considered the elasticity of supply of goods (evident it works here as well) and goods aren’t complements / substitutes. Of course, the principle still largely applies.

An important note is that this implies a project that might be justified based on a comparison of of the costs vs benefits should also take excess burden into account, meaning it may no longer be justifiable.

Other Costs of Tax System

Compliance Costs - Collecting and keeping records as well as filling out tax forms and filing taxes. All the paperwork that originates from taxes

Administrative Costs - Costs for the government to collect taxes (such as the IRS).

Political Costs - Since taxes are laws, taxpayers will always want the tax laws to change in their favor, and will work towards this goal (and not produce)

Earmarked Taxes

Taxes whose revenues are designated to a particular spending activity. The taxes often correlate to their usage, for example a toll bridge’s taxes going to maintenance of the bridge. Most common at the local level

Compared to general fund financing, where taxes are placed ina general fund to fund any program.

Advantages: In a political environment can manipulate the budget under general fund financing to increase spending for political clout in nonoptimal ways. Also makes it clear how much they pay for particular government activities.

Disadvantages: It’s inflexible, meaning if a particular tax base is too small, the program may not have the needed funds. If it’s too large, too much may be spent on a particular area than is optimal, or funds may not be used.

The Benefit Principle of Tax Policy

People who benefit from the government’s expenditures should be the ones who pay for them.

Example: Gasoline tax helps fund highway maintenance. Can also help keep highways less congested. Admissions fees for parks.

Advantages: Seems equitable (people who benefit pay and vice versa). Minimizes excess burden of taxation when placed on a public sector output or of a user charge.

Disadvantages: Difficult to identify beneficiaries of government activities perceived to be in the public good. Doesn’t work with welfare.

Ability to Pay Principle of Taxation

Individuals should pay taxes in proportion to their abilities to pay

Example: Income Tax

Advantages: In some cases, like the court system and national defenses, where the good is distributed fairly evenly. Redistributive programs. Adam Smith argues that benefits from a government are in proportion to the income of an individual (ability to pay and benefit end up similar).

Disadvantages: Is it fair? How do you compare individuals’ ability to pay (equal incomes, one has a family, different incomes)?

Horizontal Vs Vertical Equity

Horizontal Equity: People with an equal ability to pay are assessed the same amount in taxes.

Has many normative issues (what if someone has medical issues? car issues? family? just wants to travel? etc)

Vertical Equity: Those with greater ability to pay should pay more taxes than those with lower abilities to pay.

Very broad (how do you decide how much they should pay in comparison).

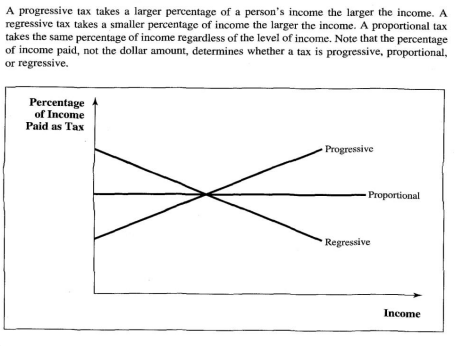

Progressive / Regressive Taxes

Young / old people consumer more than their income, middle aged people consume less than their income. But people also tend to consume more of their lifetime.

This is important to consider suggesting taxes like beer taxes could be considered regressive, as they mainly affect young people. But over the course of the young person’s life they are likely to be rich.

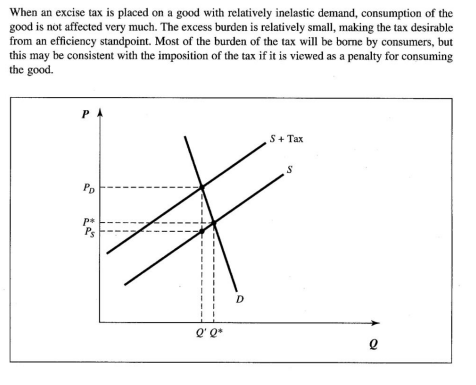

Sumptuary Taxes

Taxes designed to discouraged the consumption of the taxed good.

This can correct an externality, showing the actual cost. It also could be legislating morality through the tax system (or just getting money).

Sin taxes rarely work due to inelastic demand curve. If it is simply to legislate morality / get money, this is still consistent.

Politics and Tax Policy

The federal government makes most of its money from income taxes.

Special interest groups bias the government towards themselves through campaign contributions for favorable tax policy. This is more important on the federal level due to the scale.

State and local taxes tend to due constant rates to a tax base, like property or sales taxes.

In 1986, taxes were reformed to be more efficient through a comprehensive (Rather than one at a time) tax code update. A major overhaul also helps deal with special interests and is more likely to simplify the tax code.

Excise, Unit, and Ad Valorem Taxes

Excise tax: Tax placed on the sale of a specific good or service

Ad Valorem Tax: Tax on the value of a good

Unit Tax: Tax on a good by unit

Due to inflation, ad valorem can often be preferred to a unit tax. However, if a particular product falls in value, it can leave the government with less money.

Unit taxes are more appropriate when the value of a good cannot be easily determined (such as with barrels of oil, where since a company can own all the logistics, it can be easily understated). Hence counting the units will be easier.

Producers want to increase value of units in response to unit taxes. Hence a bias towards larger and higher quality.

Excise taxes on specific goods don’t make up a lot of revenue. Taxes on gas make up the largest portion.

User Charges

Excess burden of taxation is minimized with user charges as it acts as a rationing device in the same way a market price does.

Allows an expenditure to be covered by itself rather than collected taxes from other sectors of economy, being more efficient (even if marginal cost is 0). Capacity can be varied as well, so a user charge can help handle capacity.

Provides feedback on the demand on a good.

Approximated often, such as through gas taxes to help with the highway. Larger families needing bigger house so more property taxes for education.

User charges often don’t cover the entire cost of a good or service, and are not made for profit maximization.

Also applies to utilities, which often match market price; but allow the government to raise more money than by taxing private utilities.

Fees like for waste pick up lose more characteristics of a user charge if it does not account for amount of waste. This cover a third of most local govenrment revenue as well.

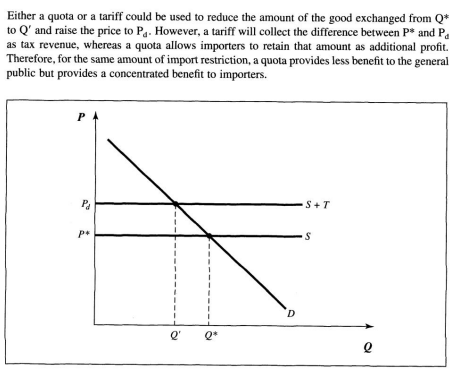

Import / Export Taxes

Done to generate revenue / discourage imports

Done a lot in less developed countries as imports / exports are easier to monitor when people largely produce for themselves.

Firms abroad can be subsidized, like AirBus, making unfair competition for US companies (and their workers). However, tariff protected jobs tend to pay better than import export jobs, meaning the import export can hire more.

It increases world gdp, but can harm individual firms and countries.

A quote restrictrs the quantity of a good than can be imported.

General Sales Tax

Ad valorem tax on all retail sales. In practice, tends to exclude things like haircuts or food / prescriptions. But can also include nonretail, like lumber or concrete for construction.

Ends up approximating a tax on a taxpayer’s level of consumption. This will mainly incur less overall consumption through substitution into non taxed goods / services (or just leisure).

Regressive? Poor people spend more of their income on consumption and save less. However, things like rent and necessities tend to be exempt, so less regressive.

Also increases capital / labor ratio as more money is saved, meaning higher wages.

Turnover Tax

Taxes all transaction as a foxed percentage of the value of a transaction. Since it taxes each transaction, it discourages transactions at all, being very inefficient, even encouraging monopolization to remove transactions.

Value Added Tax

Each producer must pay a tax for the value they add to a product.

Tax paid by producers versus with general sales tax paid by consumers.

Sales tax is easier to collect (And VAT requires more excess burden in the form of calculation from each producer).

However, VAT allows tax to be collected while not distinguishing between retail purposes, meaning they can’t be avoided and are also applied to businesses. It is also more hidden, meaning the political effects are better.

Income Weirdness

In Kind Benefits: When a person is paid in goods or services, the person received income in kind.

Example: Health insurance! Avoids personal incomes taxes (also cheaper to buy in quantity). Even stuff like a nicer office.

Defining income is hard as well. Haig and Simons define it as the “dollar value of the maximum amount one can consume over a given time without reducing one’s wealth”. In this way, if stocks / housing prices increase, your income increases by that amount.

Issues: Not clear what the value is until sold, people who conceive a capital gain may not be able to pay without selling the full asset, which is inequitable.

Fisher defined it as sustainable flow of purchasing power available to a definition. Only increased income from the increased value of wealth would be taxed.

Also fun current issue of renters versus home owners. A renter has their rent money taxed as income to the landlord, while a homeowner doesn’t have to pay tax, even if they could supposedly get rent money.

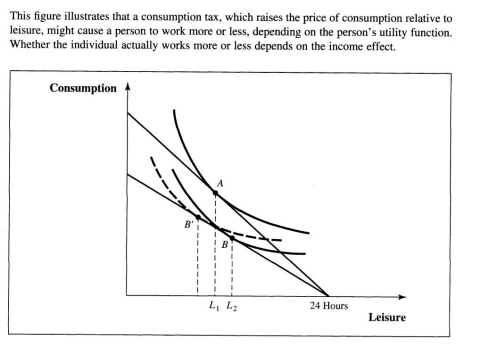

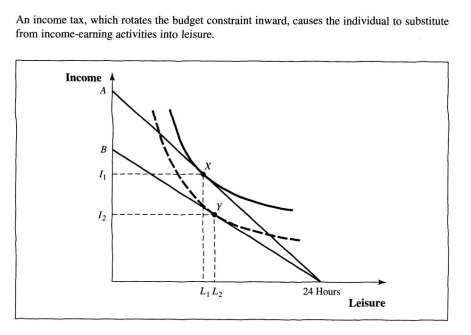

Income VS Leisure

Nontaxed activities = leisure. An income tax gives an incentive to leisure activities, as due to tax you make less hourly.

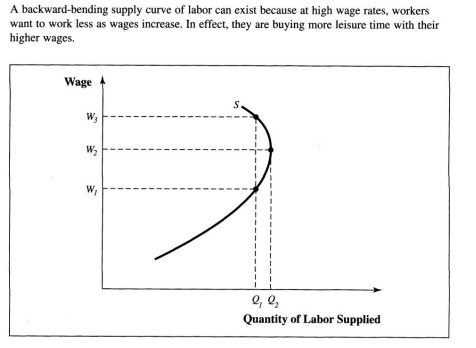

Backward Bending Supply Curve of Labor

Workers buy leisure time with labor effectively.

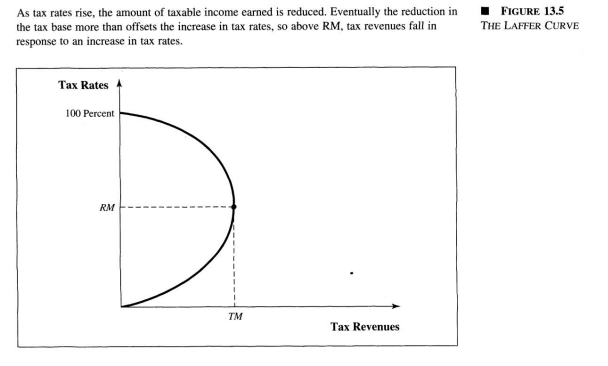

The Laffer Curve

Computation of Income

Capital gains are taxed as regular income, working as a double tax (tax from the income saved and dividend income). Interest on state / local government bonds aren’t taxable.

You can subtract exemptions and deductions from total income for taxable income.

Tax credits can be subtracted from the liability.

Tax Expenditures

Money spent on letting people save money from taxes, such as tax credits.

Indexation of Inflation Taxes

Tying taxes to inflation helps maintain consistent tax brackets. However, bracket creep also allows for an increase in taxes without legislating a tax increase. They have been indexed since 1982, though some aspects are unindexed (we voted on the homestead act!).

Corporate Income Tax

Works similar to perosnal income tax, but the margins decrease at the top end (increase beforehand in each bracket).

Fringe benefits, like health insurance, are deductible from corporate tax. And since individuals also aren’t taxed on it, it is effectively not taxed.

Firms can note depreciation as an expenditure to deduct more from their taxes. The federal government limits how much, and firms want to take as much as soon as possible.

Burden of Corporate Income Tax

In the short run, corporations cannot shift much of the burden since capital is immobile. In the long run they can, since capital can be moved.

They are able to do this by biasing towards markets with relatively inelastic demand, putting the burden on demanders, when before they took a bigger share in a more elastic market.

Taxation of Capital Gains

Do you tax unrealized capital gains? It would be efficient, the US doesn’t though. Especially since it disencitivizes selling capital gains.

However, would be unequitable and has issues with administration. It is also a double tax. Infaltion also increases the value.

Site Value Tax vs Property Tax

Property tax taxes the value of the land and the improvements of the land. It's possible to imagine a tax placed on the value of a site with improvements (such as a fixed tax per acre of land). This is harder to avoid, like lump sum taxes.

A tax on improvements discourages improvement of a piece of property, a per acre tax on land has no disincentives since it’s in fixed supply. However, an increase in either tax decreases the value of property, but the public services it funds increase the value. Suggesting the government succeeds, it should increase more than it decreases.

However, site value can’t handle urban areas due to the density of people and the value of the land make the tax prohibitively expensive.

Severance Taxes

Taxes charged on the extraction of natural resources such as oil, gas, timber, and fish. Since elasticity of supply isn’t inelastic (suppliers can choose when to bring them to market), they can bring some of the excess burden to demanders.

Revenue Neutral Tax Reform

If a govenrment can agree how much a government should raise in revenue, a more efficient tax structure can be created. Specifically, they ignore how much revenue is generated to discuss later, to specifically discuss how to make the tax structure more efficient.