Macroeconomics Chapter 8: The Conduct of Monetary Policy and a bit of the Federal Reserve System

1/7

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

8 Terms

Open market operation

the purchase or sale of government securities by the Fed from or to a commercial bank or public

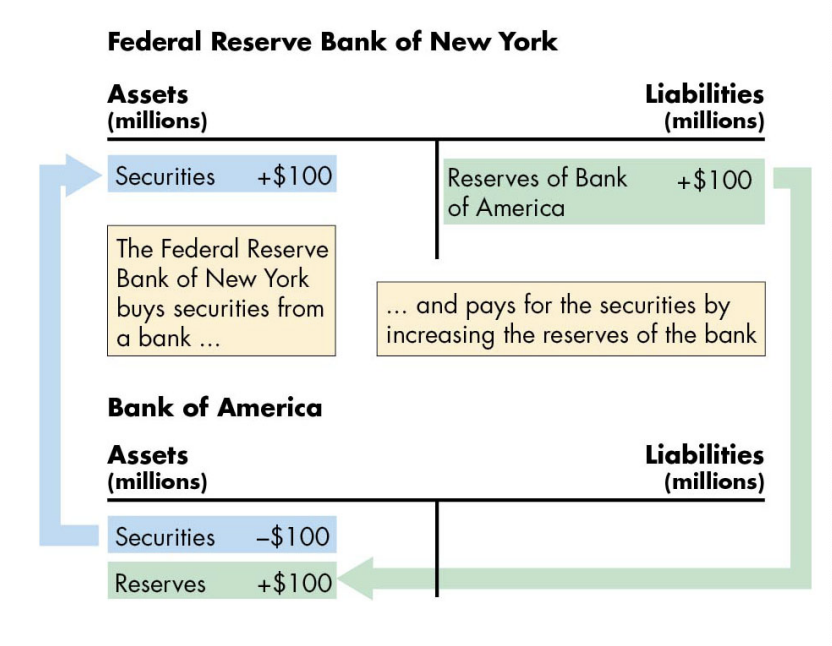

In OMO, when the Fed buys securities,

it pays for them with newly created reserves, which are then held by the banks

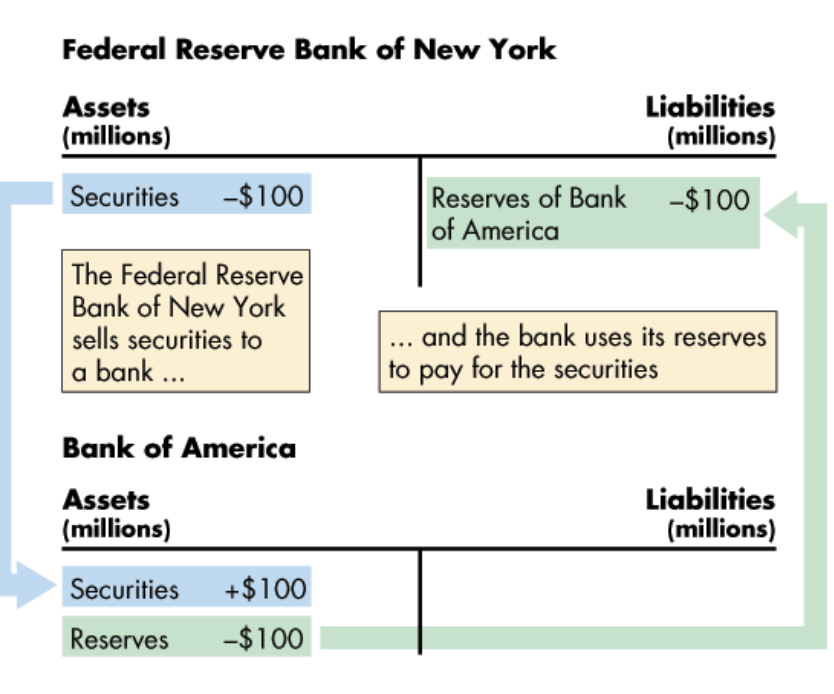

In OMO, when the Fed sells securities

They are paid for with reserves held by banks

Open market operations influence

Banks’ reserves

Example of Open Market purchase

The open market purchase from the Fed increases Bank of America’s reserves

Example of Open Market sale

The open market sale decreases bank reserves

Last resort loans

Fed is the lender of last resort, which means the Fed stands ready to lend reserves to depository institutions that are short of reserves

Required reserve ratio

The Fed sets it, which is the minimum percentage of deposits that a depository institution must hold as reserves, the Fed rarely changes it