Foreign exchange market (FOREX)

1/19

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

20 Terms

Exchange rate

the value of a currency in one country compared with the value in another

Balance of payments

Measures all the monetary exchanges between one nation and all other nations. Includes the current account and the capital account.

Balance of trade

Net exports= Exports-Imports

Trade surplus

when a country exports more than it imports

trade deficit

when a country imports more than it exports

Interest rates and capital flow

Interest rates increase= Inflow increases, outflow decreases

net capital outflow

the difference between the purchases of foreign assets by domestic residents and the purchases of domestic assets by foreign residents

net capital inflow

the total flow of funds into a country minus the total flow of funds out of a country

Current account

net exports, investment incomes, net transfers

Financial (capital) account

stocks & bonds, Foreign Direct Investment, net capital outflow

Deapreciation

the loss of value of a country's currency with respect to the foreign currency

Appreciation

The increase of value of a country's currency with respect to a foreign currency

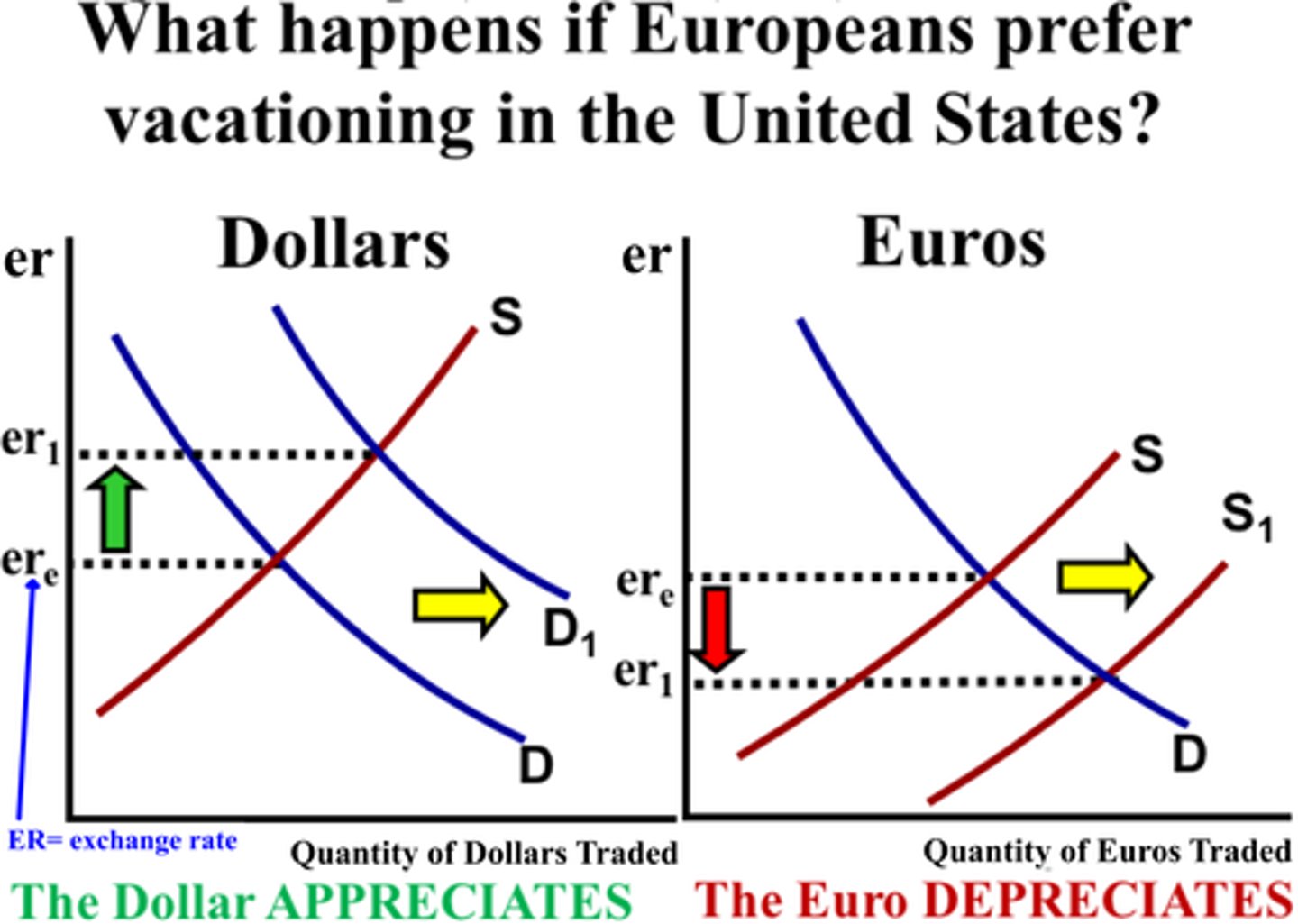

FOREX graph

Foreign exchange shifters

1. Change in taste (ex: British flock to U.S.)

2. Change in relative income, (resulting in more imports) ex: U.S. growth increases U.S. increases

3. Change in relative price levels (resulting in more imports) ex: U.S. prices increase relative to Britain.

4. Change in relative interest rates, ex: if the U.S. has a higher interest rate than Britain.

fiscal policy

Government policy that attempts to manage the economy by controlling taxing and govt spending.

monetary policy

Government policy that attempts to manage the economy by controlling the money supply and thus interest rates.

expansionary fiscal policy

An increase in government purchases of goods and services, a decrease in net taxes to increase aggregate demand and expand real output (during periods of recession)

contractionary fiscal policy

Fiscal policy is used to decrease aggregate demand or supply—deliberate measures to decrease government expenditures, increase taxes, or both during periods of inflation.

expansionary monetary policy

Federal Reserve system actions to increase the money supply, lower interest rates, and expand real GDP (increase aggregate demand)

contractionary monetary policy

the Federal Reserve's policy of increasing interest rates and decreasing supply of money to reduce inflation