IA Week 11

1/11

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

12 Terms

What happens to the price of the bond as YTM increases?

It decreases

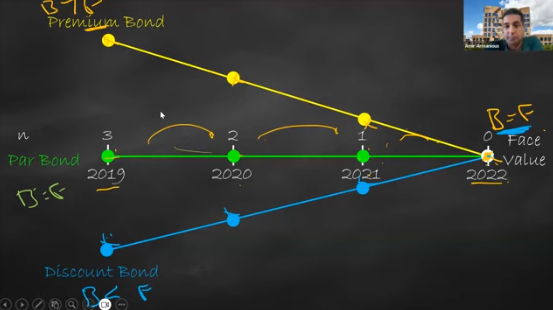

What is a premium bond?

Bond price is bigger than face value. YTM < Coupon rate

What is a discount bond?

Bond price is lower than face value, Coupon rate < YTM

What is a par bond?

Bond price is equal to face value. YTM = Coupon rate

How do the prices of the three types of bonds change as they mature?

The premium bonds decrease, the par bonds stay the same and the discount bonds increase

What will a zero coupon bond always be?

Discount bond because Bond price and CR are < FV and YTM

What is flat price of a bond?

The pv of just the fv

What does par value mean for a bond?

fv

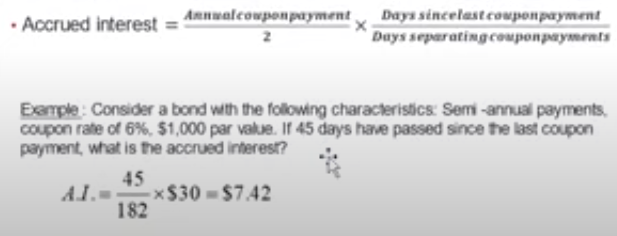

What is accrued interest for a bond?

the interest that has accumulated on a bond since the last interest payment but has not yet been paid to the bondholder

What is the accrued interest formula?

Note: the equation divides it by two because the coupon payments are semi annual

Why is YTM higher for a longer term bond?

Because the risk of default from the creditor is high so it riskier