43 Lesson 2: Trade and Capital Flows: Restrictions and Agreements

1/25

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

26 Terms

Why do countries stablish trade restrictions?

Protect domestic industries from foreign competition.

Shelter infant industries until they mature.

Safeguard employment within the country.

Generate revenue through tariffs.

Enable retaliation against trading partners' restrictions.

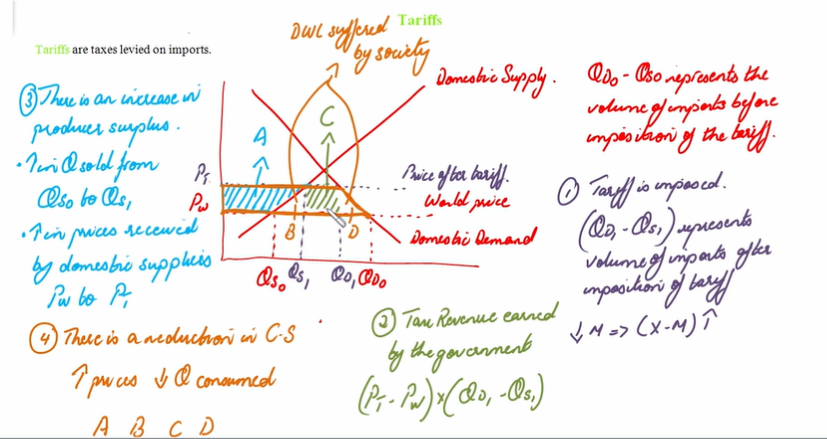

Explain the tariffs trade restriction

This are taxes imposed on imports.

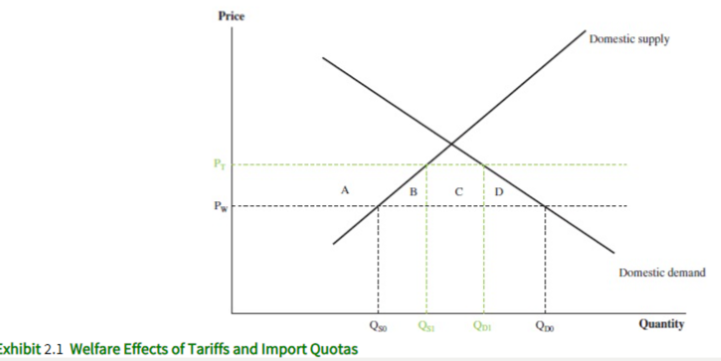

With free trade, the supply-demand equilibrium is at world price (PW) with domestic demand and supply QD0 and QS0 respectively. → QD0-QS0: volume of imports without the tariff

Imposing a tariff raise price to PT → demand and supply decreases to QD1 and QS1 respectively. → QD1-QS1: volume of imports after the tariff

The reduction in imports makes a positive change in net exports. So not only has the current account balance been improved, but also the government has been able to earn some tax revenue.

The government earns less revenue (from region B,C,D to C only)

Producer surplus increases (region A) → domestic suppliers now get a higher price (PT vs PW)

Consumers surplus falls (regions B,C,D) → consumers pay higher price and consume lower quantities

Overall effect: net decrease in welfare equal to the area of Regions B and D. → deadweight losses on consumption and production fronts.

On the production front, inefficient domestic producers whose cost of production is greater than PW (but less than PT) are also allowed to operate.

On the consumption front, buyers who are willing to pay more than PW but less than PT are no longer able to consume.

Explain the quotas trade restriction

This are restrictions on import quantity → imposed by the importing country.

Each firm gets an import license specifying quantity.

Quotas don’t generate revenue for the government like tariffs. Quotas rents can go to the exporting or importing country.

Foreign producers can raise prices to earn quota rents.

The quota equals QD1 – QS1: max import quantity, the price after quota would equal PT (which is the same as the after-tariff price). However, Region C (previously government revenue from the tariff) is now more likely to be captured by foreign producers (quota rents), increasing the welfare loss for the importing country to Regions B + C + D (relative to just Regions B + D under a tariff).

If the importing country can generate an amount equal to Area C by auctioning import licenses for a fee, then its welfare loss can be limited to just Regions B + D (as is the case with tariffs).

The exporting country can capture this area by trying to raise its prices. The importing country can capture this area by auctioning off import licenses. So under a quota, the resulting quota rents may be kept by the exporting country or the importing country.

Explain the voluntary export restraints (VERs) trade restriction

Export quantity restrictions imposed by exporting country.

Exporting country captures quota rent (Region C).

Welfare loss to importing country (Regions B, C, D).

Explain the export subsidies trade restriction

Payments to domestic exporters by the government.

Aim to stimulate exports but may disrupt comparative advantage.

May lead to divergent trade patterns.

If exporting country is a large one, world price declines → less supply, welfare impact varies.

If exporting country is small, domestic price rises by subsidy amount.

What do capital restrictions refer to?

Capital restrictions are controls on foreigners' ability to own domestic assets and citizens' ability to own foreign assets.

What are some common objectives in capital restriction?

Limit inward investment by foreigners (investment amount, industries).

Impose ownership restrictions on strategic industries (defense, telecom).

Forbid foreign investment in certain industries to protect domestic firms and jobs.

Restrict capital outflows (repatriation, interest, profits, royalty payments) and foreign investments by citizens to conserve foreign exchange reserves.

Used with other tools (e.g., exchange rate peg) for macroeconomic crisis management.

What are some forms of capital controls related to taxation?

Forms of capital controls related to taxation include special taxes on international investment returns and transaction taxes.

What are mandatory reserve requirements for foreign deposits an example of?

Mandatory reserve requirements for foreign deposits are an example of capital controls.

What are some quantity controls that can be imposed as part of capital restrictions?

Quantity controls can include ceilings on foreign borrowings, government approval for transactions, and asset trade prohibitions

What are some benefits of allowing the free movement of financial capital?

Benefits include optimal return on investment, higher economic growth beyond domestic savings, and the introduction of competition by foreign firms, improving quality, prices, and technology.

What challenges are associated with effective controls on capital inflows?

Effective controls on capital inflows involve significant administrative costs.

What are the results of imposing controls on capital outflows during crises?

Controls on capital outflows during crises have mixed results, providing temporary relief to some countries and time to restructure for others.

What are some costs associated with implementing capital controls?

Costs include administrative costs to implement, negative market perceptions, and potentially increased foreign borrowing costs. Additionally, protecting domestic financial markets can hinder policy adjustments and private-sector adaptation to global changes.

Define Regional Trading Agreements (RTAs)

In RTAs, the members agree to eliminate trade barriers and allow factor movement.

State the 4 types of Trade Agreements

Free Trade Area (FTA): Members eliminate barriers among themselves, maintain own policies for nonmembers.

Customs Union: Like FTA but members have similar nonmember trade policies.

Common Market: Combines customs union provisions with factor movement.

Economic Union: Includes common market aspects, joint economic institutions, and policy coordination, can adopt a common currency (monetary union). Ex: EU.

What are some reasons for preferring regional integration over multilateral negotiations like the WTO?

Reasons include that regional integration is easier to achieve, less time-consuming, and involves lower political contention.

What are the two potential outcomes of regional integration regarding trade, and what do they entail?

Regional integration may lead to trade creation (replacing high-cost domestic production with lower-cost imports from members) or trade diversion (replacing low-cost imports from nonmembers with higher-cost imports from members).

When does regional integration have a positive welfare effect?

Regional integration has a positive welfare effect when trade creation exceeds trade diversion.

What is the main advantage of trade blocs related to trade?

Trade blocs offer advantages such as specialization, reduced monopoly power, economies of scale, learning, knowledge spillovers, technology transfer, and access to quality inputs.

Besides trade-related benefits, what additional advantages do trade blocs provide?

Trade blocs offer additional benefits, including conflict reduction (decreasing potential conflicts among members), enhanced bargaining power (increasing members' global bargaining strength through unity), new trade and investment opportunities, and spillover growth (where the growth of one member country often benefits others within the bloc).

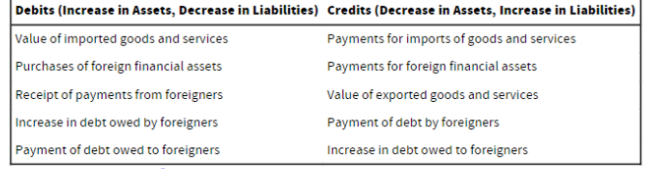

Define the balance of payments (BOP)

Is a double entry bookkeeping system that summarizes a country’s economic transactions with the rest of the world over a period of time → it is expected that the BOP balance entries to equal 0 but this never happens.

What are the main accounts in the balance of payments?

Current Account Balance: Primarily deals with goods and services trade.

Capital Account Balance: Mainly covers capital transfers and net sales of nonproduced, nonfinancial assets.

Financial Account: Measures net capital flows involving domestic and foreign financial assets.

What are the subaccounts of the Current Account?

Merchandise Trade: Includes goods and manufactured goods trade.

Services: Encompasses tourism, transportation, and various services.

Income Receipts: Comprises income from foreign asset ownership.

Unilateral Transfers: Represents one-way asset transfers like remittances, foreign aid, and gifts.

What are the subaccounts of the Capital Account?

Capital Transfers: Covers debt forgiveness, migrants' transfers, and ownership/funds transfer.

Nonproduced Assets: Includes rights to natural resources and intangible assets like patents.

What are the subaccounts of the Financial Account?

Domestic Financial Assets Abroad: Includes official reserve assets, government and private assets.

Foreign Owned Financial Assets Locally: Comprises official assets, foreign securities, and foreign liabilities.