Macro/Micro McGraw Hill Ch: 1-4 Flashcards Definitions

1/70

Earn XP

Description and Tags

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

71 Terms

Economics

A social science and economic wants in society

Economic Perspective

A viewpoint individuals and institutions making rational decisions ( compare marginal benefits and marginal costs )

Scarcity

The limits placed on items available for consumption ( constraints our opportunity costs for marginal analysis )

Opportunity Costs

To obtain one thing, a resource must be sacrificed to produce a unit of a product

Utility

The wants/satisfaction of the good/service

Ex: Tv, Cars, Watch, Computer

Marginal Analysis

“Extra” benefits for extra costs for decision making

Scientific Method

The procedure for systematic, pursuit of knowledge, observation of facts, formulation and testing hypothesis, obtain theories, principals and laws

Aggregate

Collection of units ( Consumers )

Microeconomics

The study of individual consumer, firm, or market

Macroeconomics

The study of the entire economy or a major aggregate of the economy

Economic Principles

Generalize about the economic behavior of individuals or institutions

Ceteris Paribus ( other-things-equal assumption )

Consumer incomes and preferences are factors are considered to be held constant

Positive Economics

Economic statements that are factual

Normative Economics

Economic statements that involve value judgements

The Economizing Problem

Unlimited for goods and services but resources are limited ( scarce )

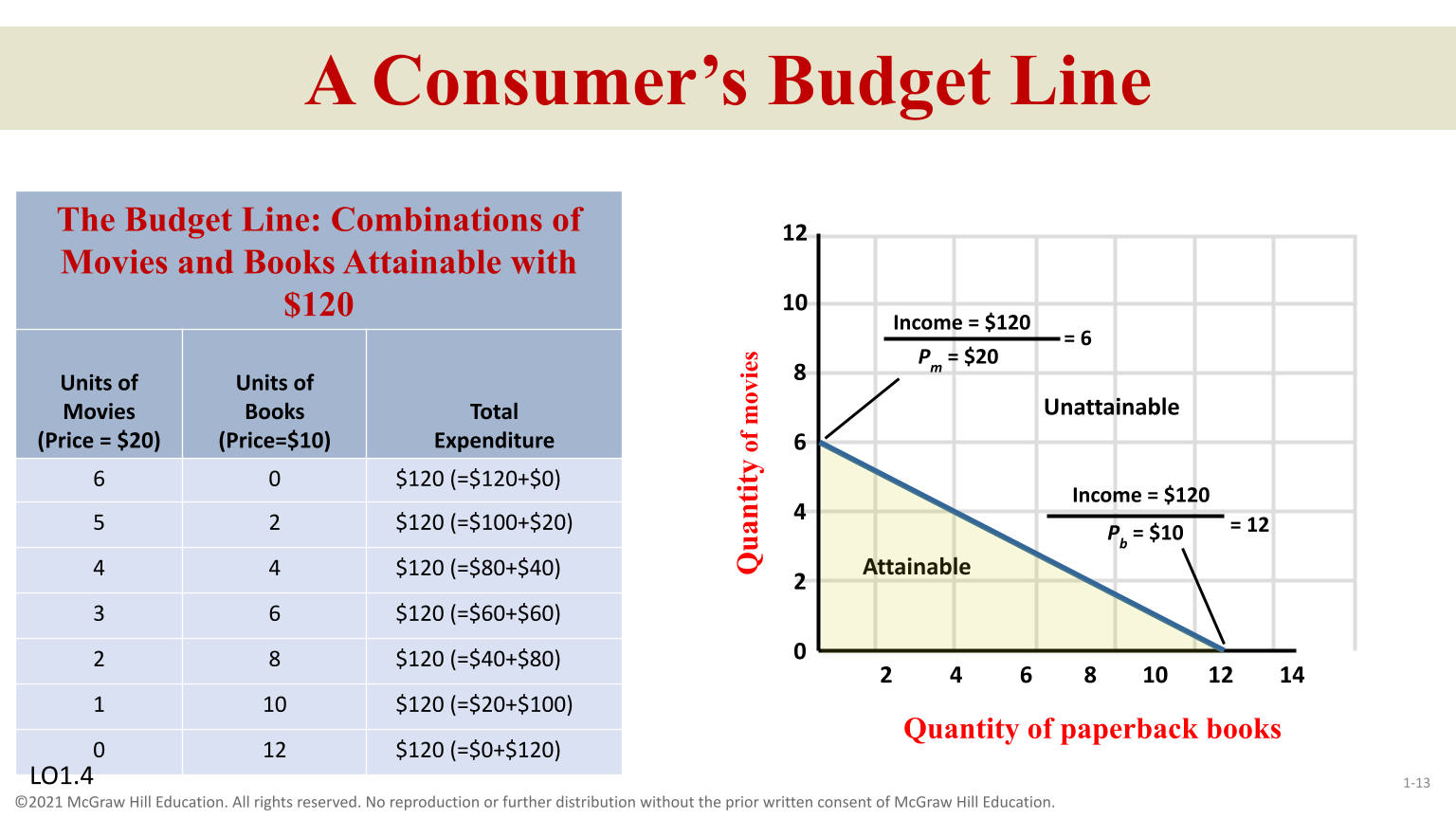

The Consumer Budget Line

Two products consumers buy with specific income by product prices

GDP/Capita =

GDP2Dy24 / Pop2024

Resources

Land: Includes all natural resources used in production prices

Labor: Physical actions and mental activities that people to production

Capital (Investment): All Manufactured aids used in production

Entrepreneurial Ability: Special human resources from labor

Economic Model

Different combinational goods ( Consumer Goods & Capital Goods ) that an economy can produce

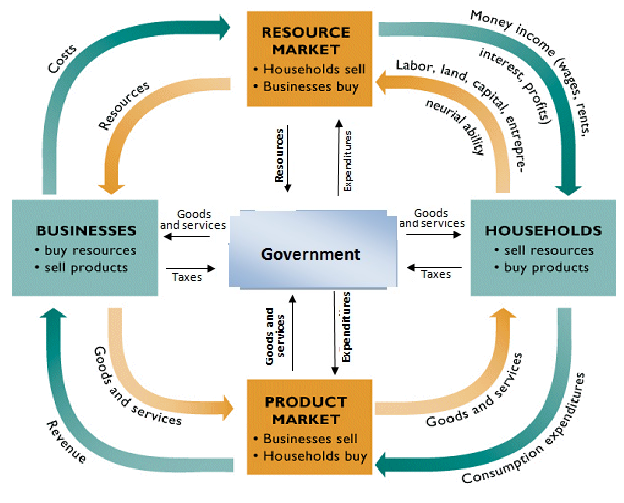

The Circular Flow Model

C=100+0.8yD

C: Consumer Expense

100: Autonomous Spending by Household

0.8: Marginal propensity to consume

yD: Disposable Income

The Market System

A mix of decentralized decision making with some government control

Producers ( Supplies )

Consumers ( Demanders )

The Price System

The most marketized

The most privatized

The most monetized

Active but Limited Government

Government Alleviate market failures

Increase effectiveness of a market system

Possible government failure

Price Gouging

Increase price of goods but for taking advantage of supply

Consumer Sovereignty

“Independence to choose”

“Dollar Votes”

Allow consumers to indicate which goods/services be produced

Determine which products and industries survive or fail

System Changes

Consumer Taste

Technology

Resources Prices

Technological Advance

Creating of new products and production methods destroy the market power of existing monopolies

Capital Accumulation

The market system leads to even greater capital accumulation. Entrepreneurs and business owners are able to purchase more capital goods

Private Closed Economy

Households ( Consumers )

Businesses ( Investments ): Sole proprietorship, partnerships, corporations ( shareholders ),

Markets

Local ex: Farm Market

National ex: supermarket

International ex: New York Exchange

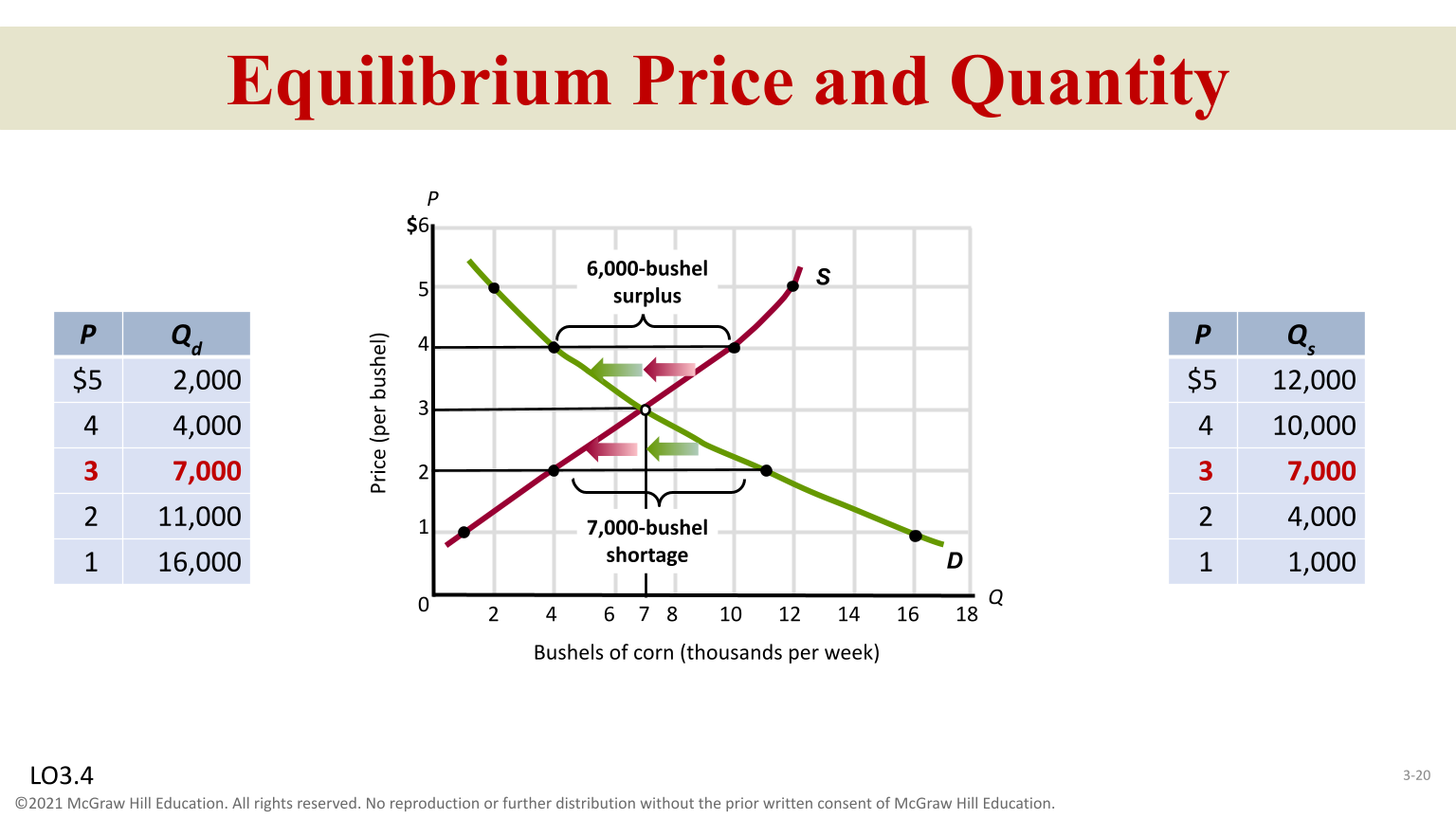

ESD

E=Equilibrium

S=Supply

D=Demand

Formula: Q5=QD=?

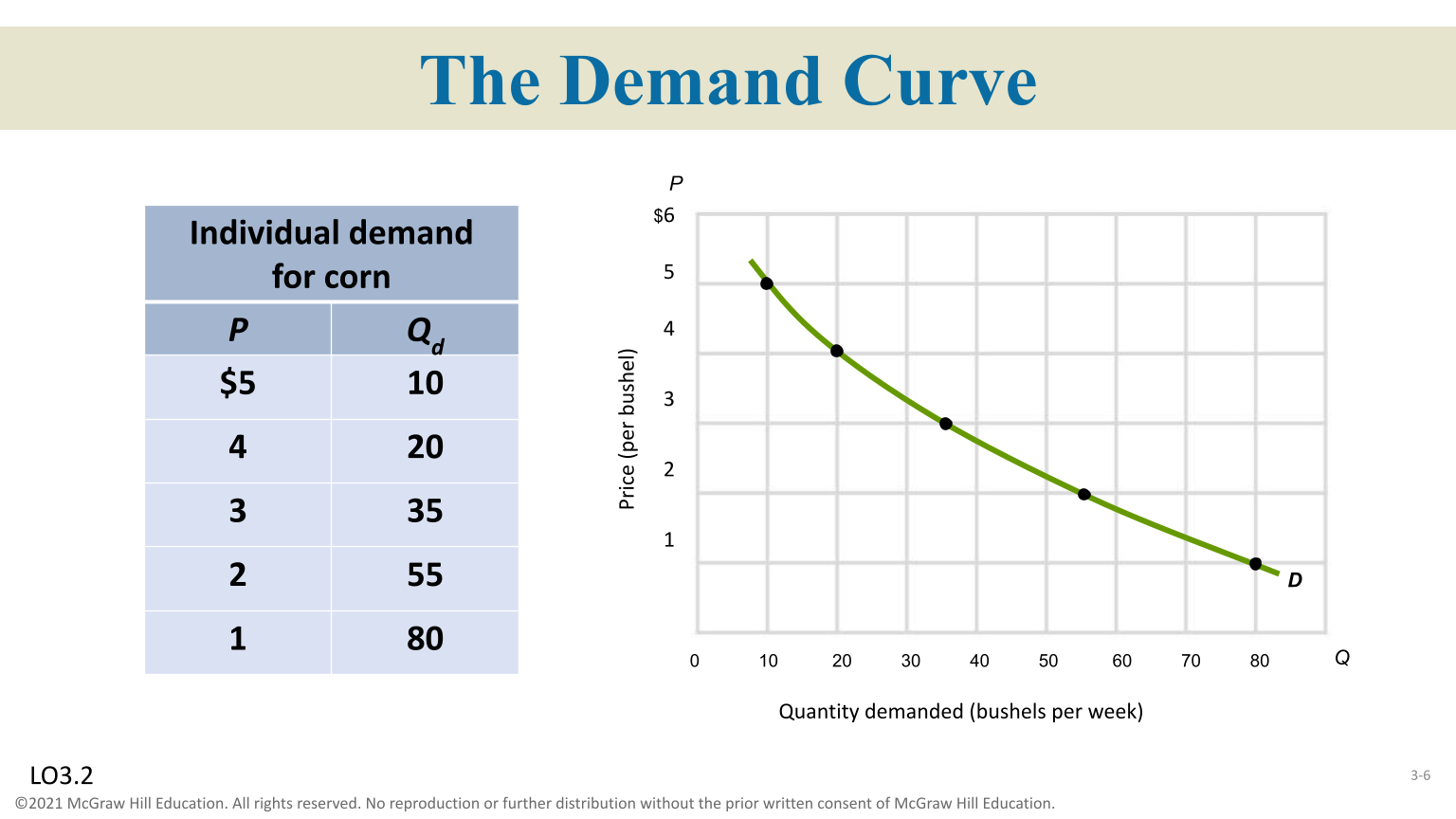

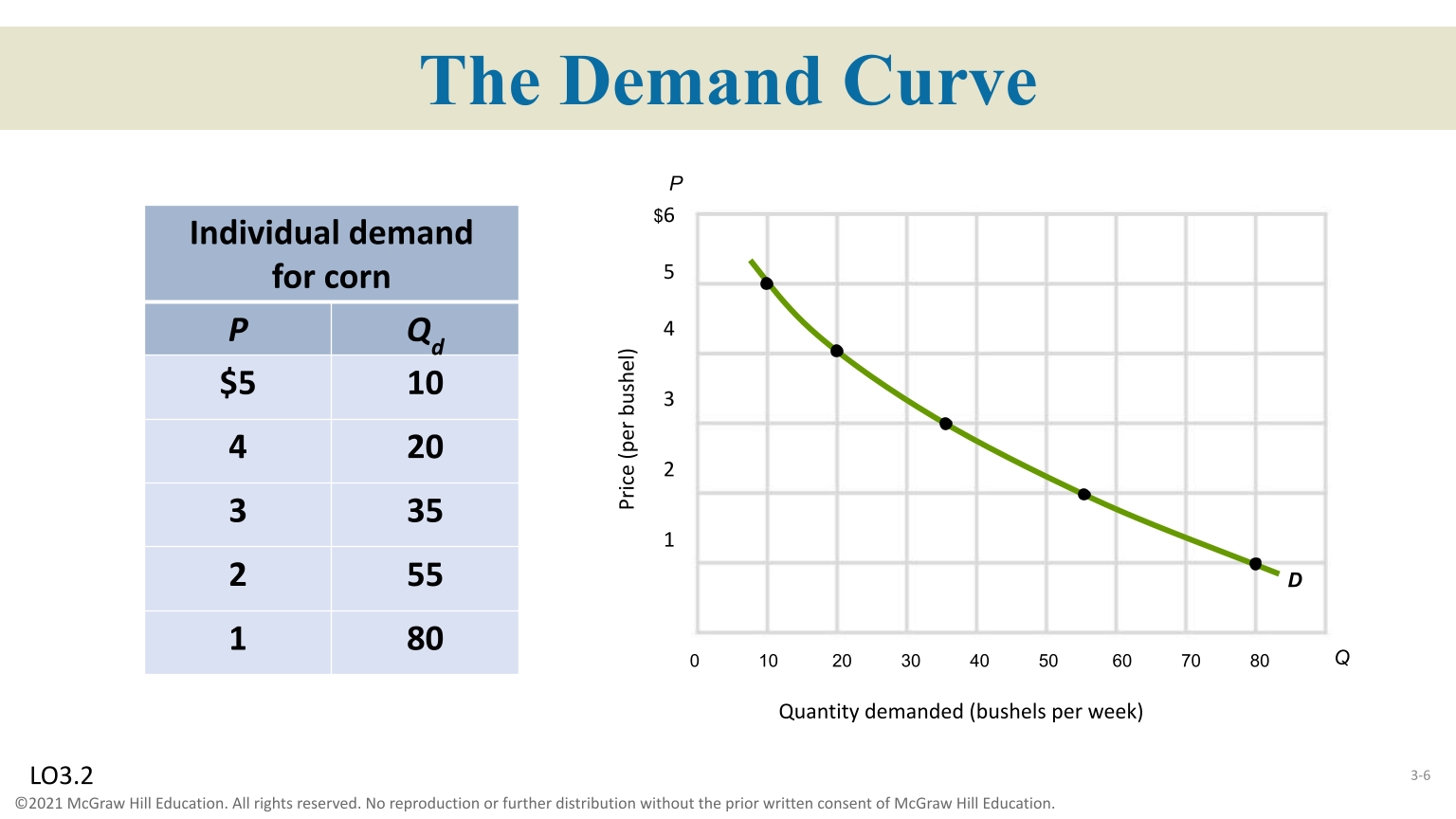

Demand

A schedule or curve showing the amount of a product consumers are willing to buy ( Demand Title ) ( Demand Curve Graph )

Law of Demand

Others things-equal, as price falls, quantity demand rises, and as prices rises, quantity demanded falls

Determinants

Change in consumer tastes and preferences, change in the number of buyers, change in income: Normal Goods & Inferior Goods

Complementary Goods

Change in prices of related goods

We consume together ( cause & effect )

Substitute goods we use in place for another ( without loss of satisfaction )

Change in Consumer Expectations

Future Prices: Product High ( Increase Demand ) Product Low ( Decrease Demand )

Future Income: If consumers think their income shall rise they will buy more purchases now. If less their income will be reduced in their demand for products

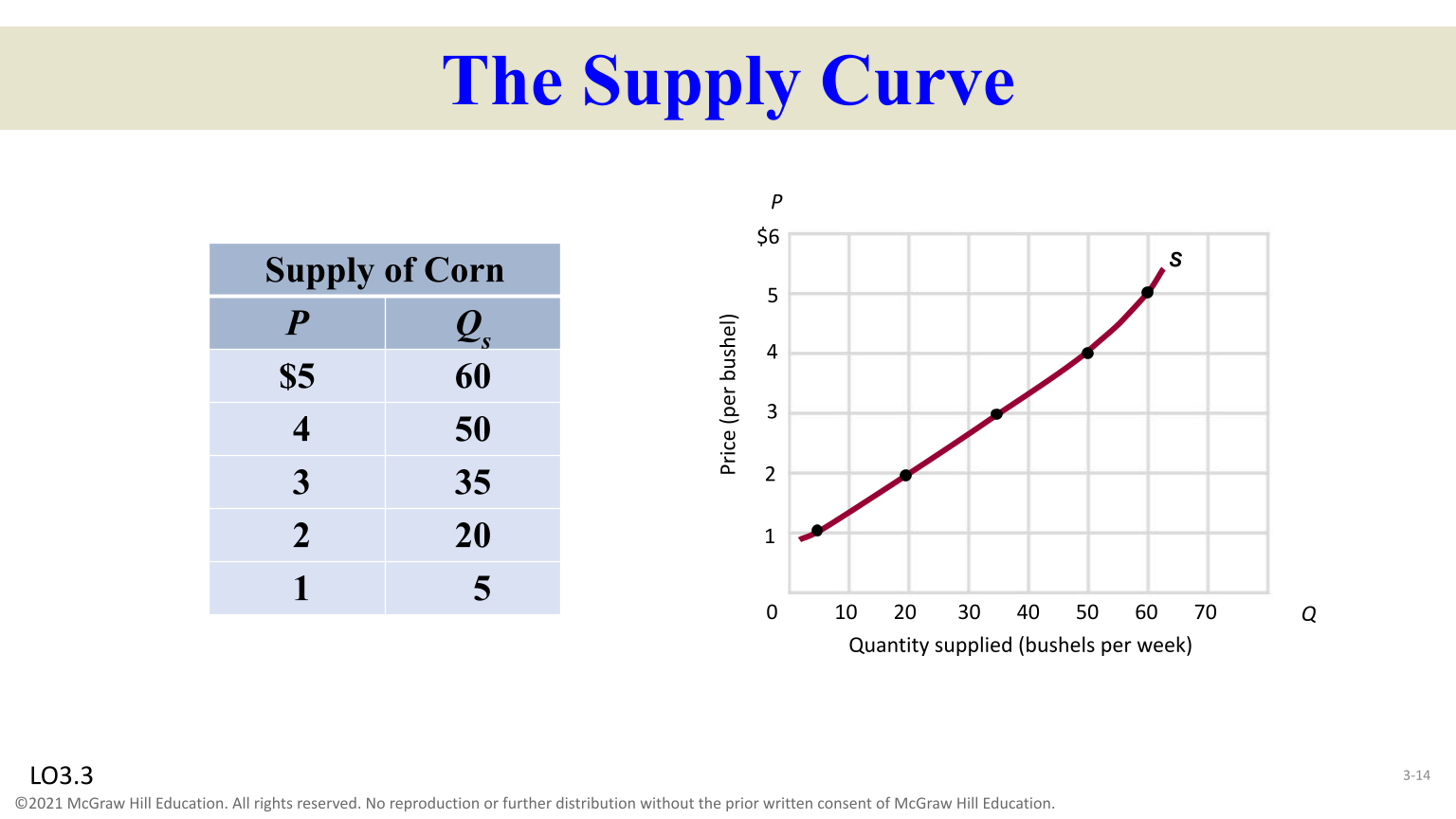

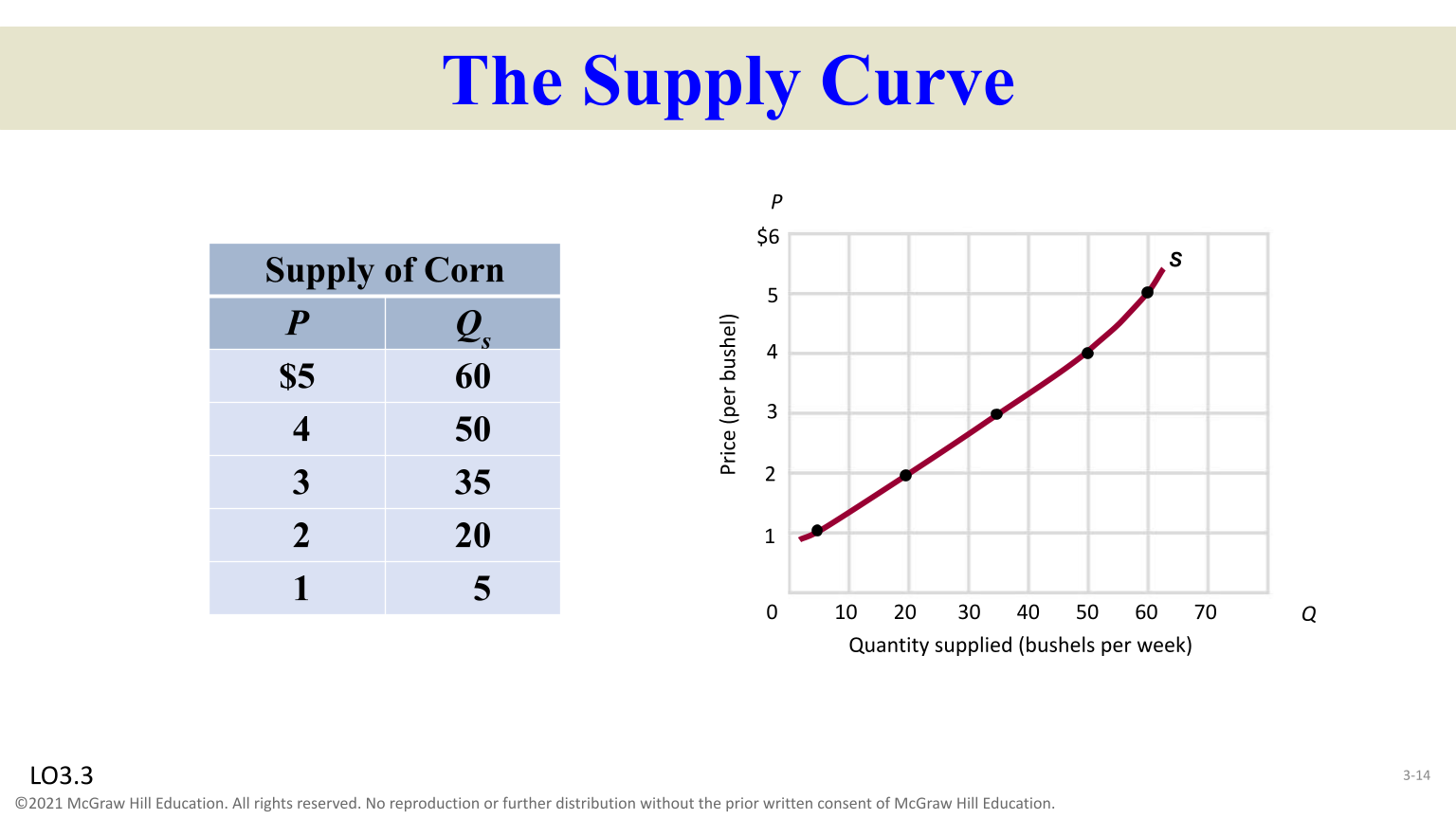

Supply

A schedule or curve of the amount of product made available for sale ( because price and quantity supplied are directly related, the supply curve graphs as an upsloping curve. )

Incentive

Motivate for potential gain or reward

Law of Supply

Others-things equal, as prices rises the quantity supplies rises and when prices fall, quantity supply falls

Determinants of Supply

Change in Resource Prices

Change in Technology

Change in Number of Sellers

Change in Taxes and Subsidies

Change in Prices Of Other Goods

Change in Producer Expectations

Equilibrium

When Demand and Supply market intersect

Surplus

( Prices above equilibrium makes it excess and quantity supplied )

Shortage

( Prices below equilibrium makes it excess quantity demanded )

Productive Efficiency

Producing goods in less cost, best technology, mixing right resources ( competitive markets )

Allocative Efficiency

Producing right mix of goods, combination of goods that are valued by society

Rationing Function of Prices

The ability of the competitive force demand and supply

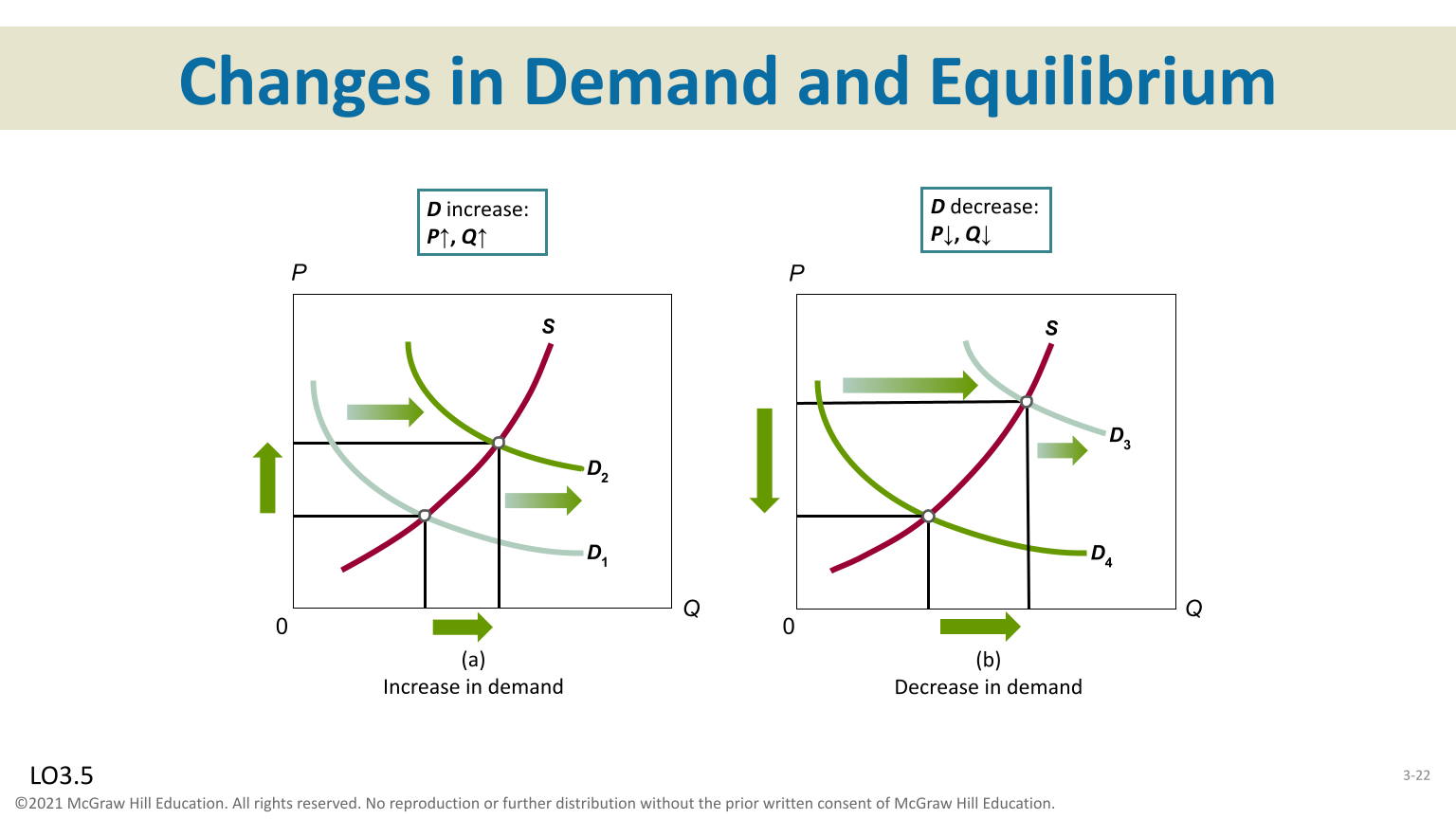

Demand and Equilibrium

Increase in demand results in a increase in price and increase in quantity

Decrease in demand results decrease in price and decrease in quantity exchanged

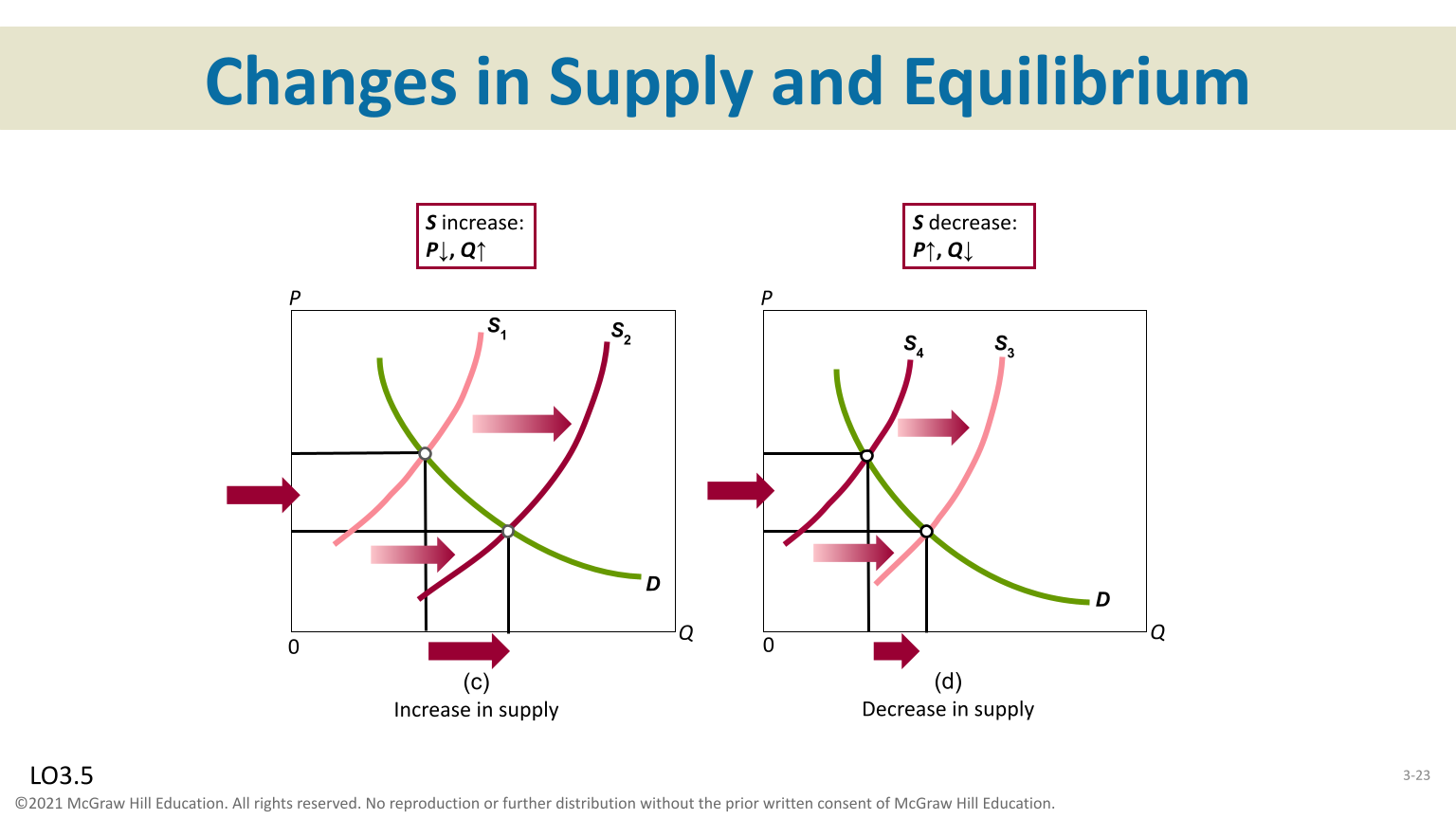

Supply and Equilibrium

Increase in demand results in a increase in price and an increase in quantity exchanged

Decrease in demand results in increase in price and decrease in quantity exchanged

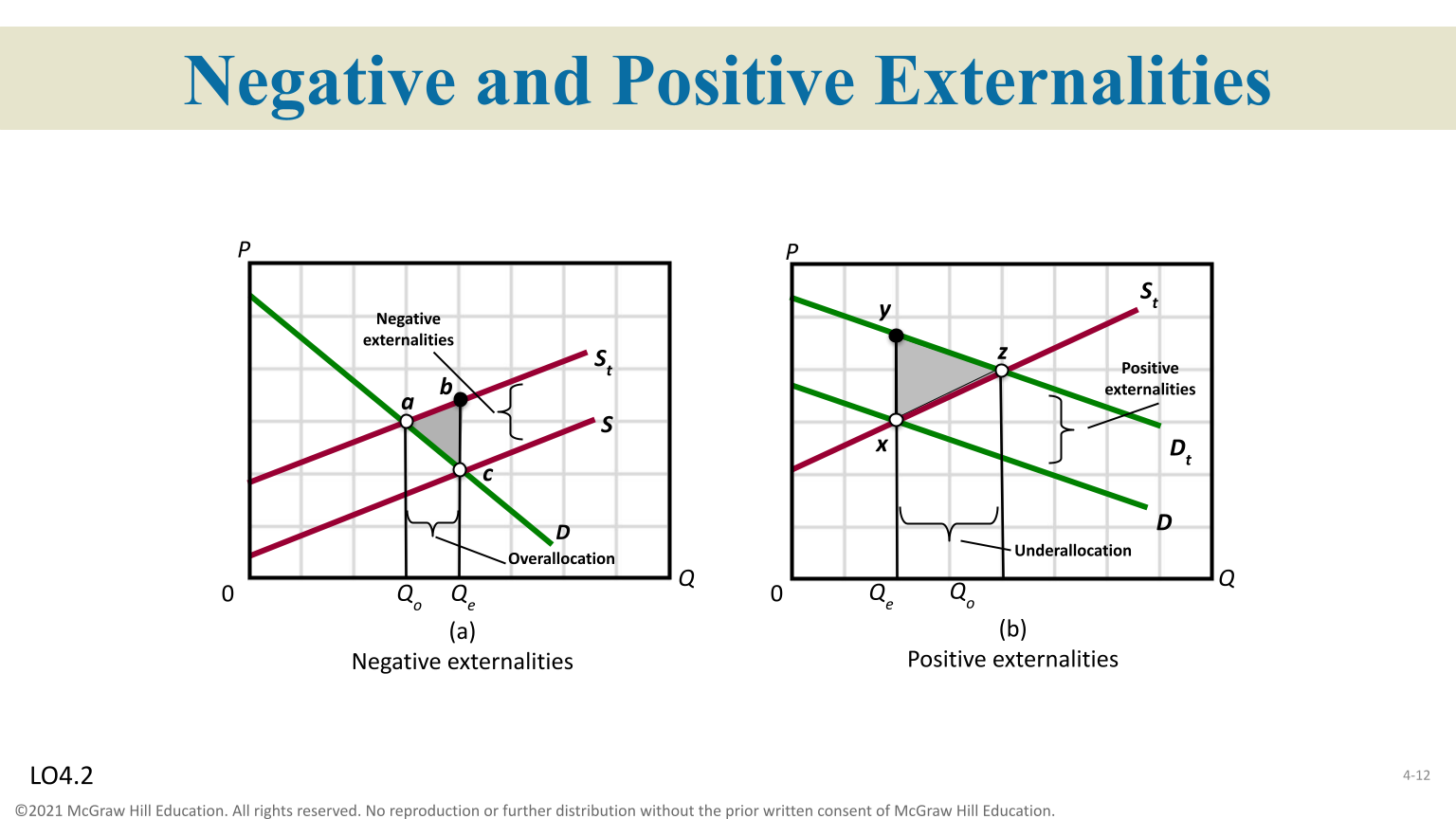

Over-Allocated

Too much resources being produced of the good

Under-Allocated

Few resources being produced of the good

Government Set-Prices

“Price Floor” is the minimum price fixed by government

Market Failures

Market fails to produce the right amount of the product ( either over-allocated or under-allocated )

Demand Curve

Supply Curve

Must reflect full willingness to pay

Must reflect all costs of production

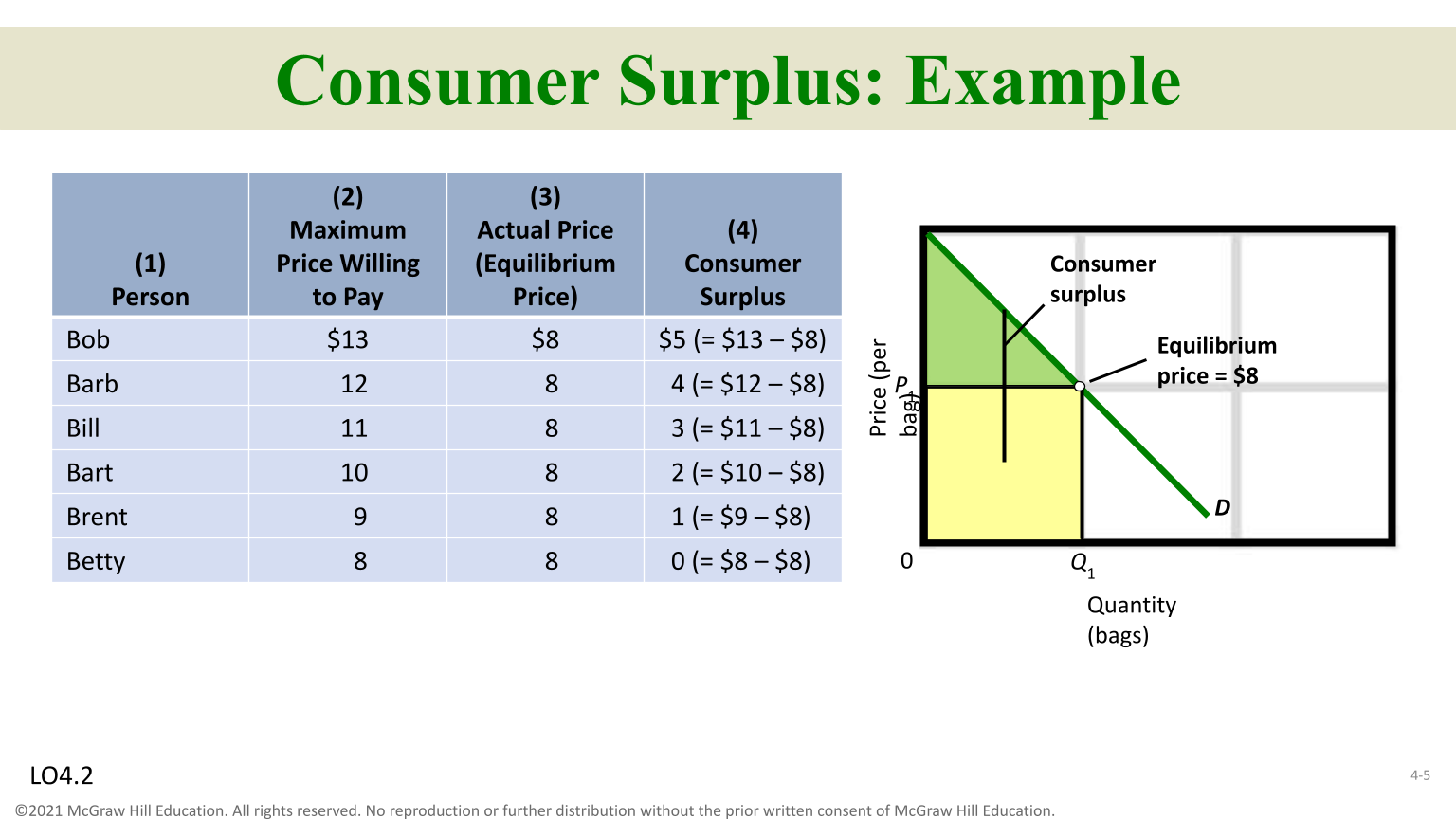

Consumer Surplus

The consumer utility exceeds the price paid, consumer surplus is generated

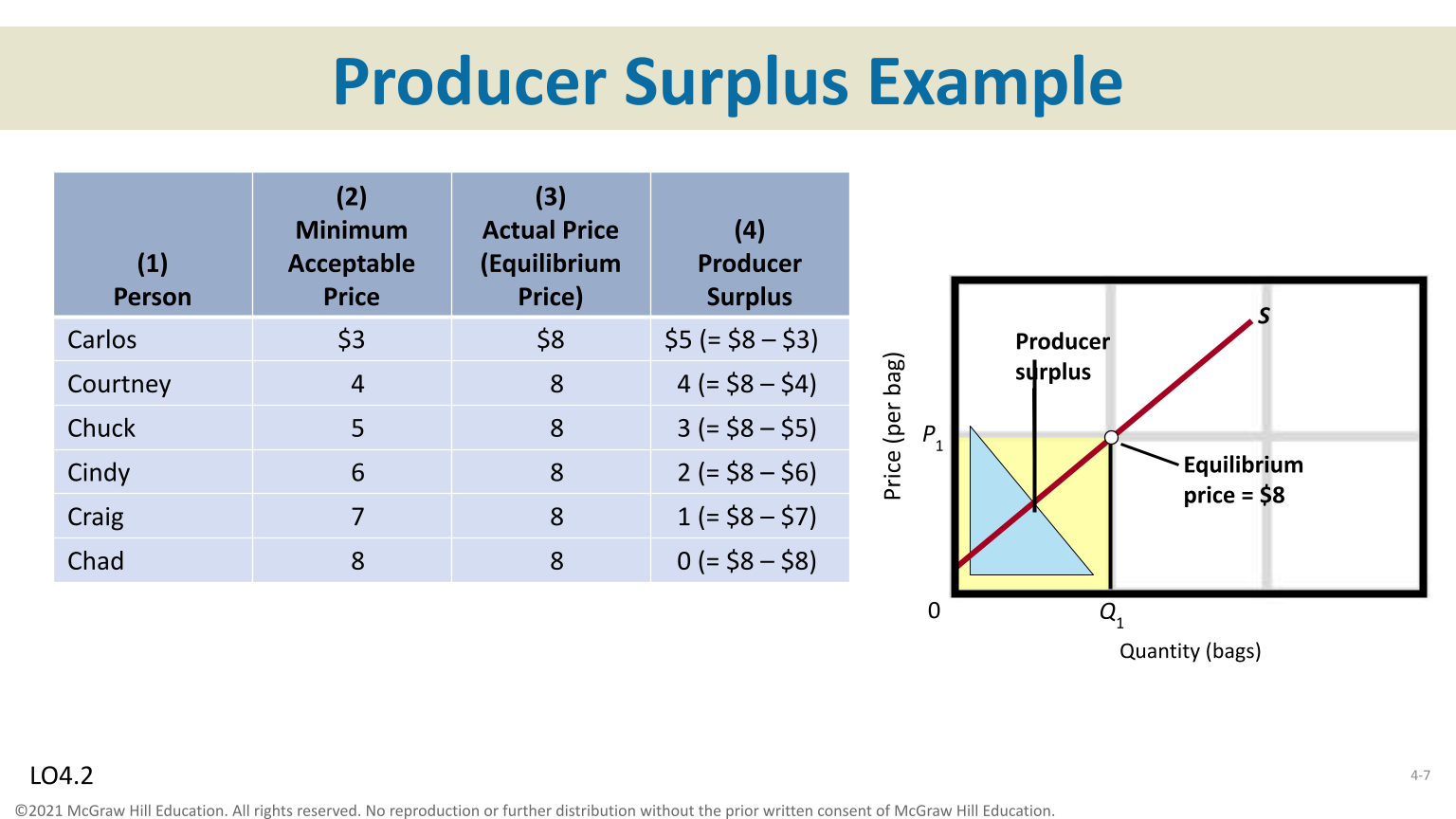

Producer Surplus

The producer receives the price greater than the marginal cost, producer surplus is created

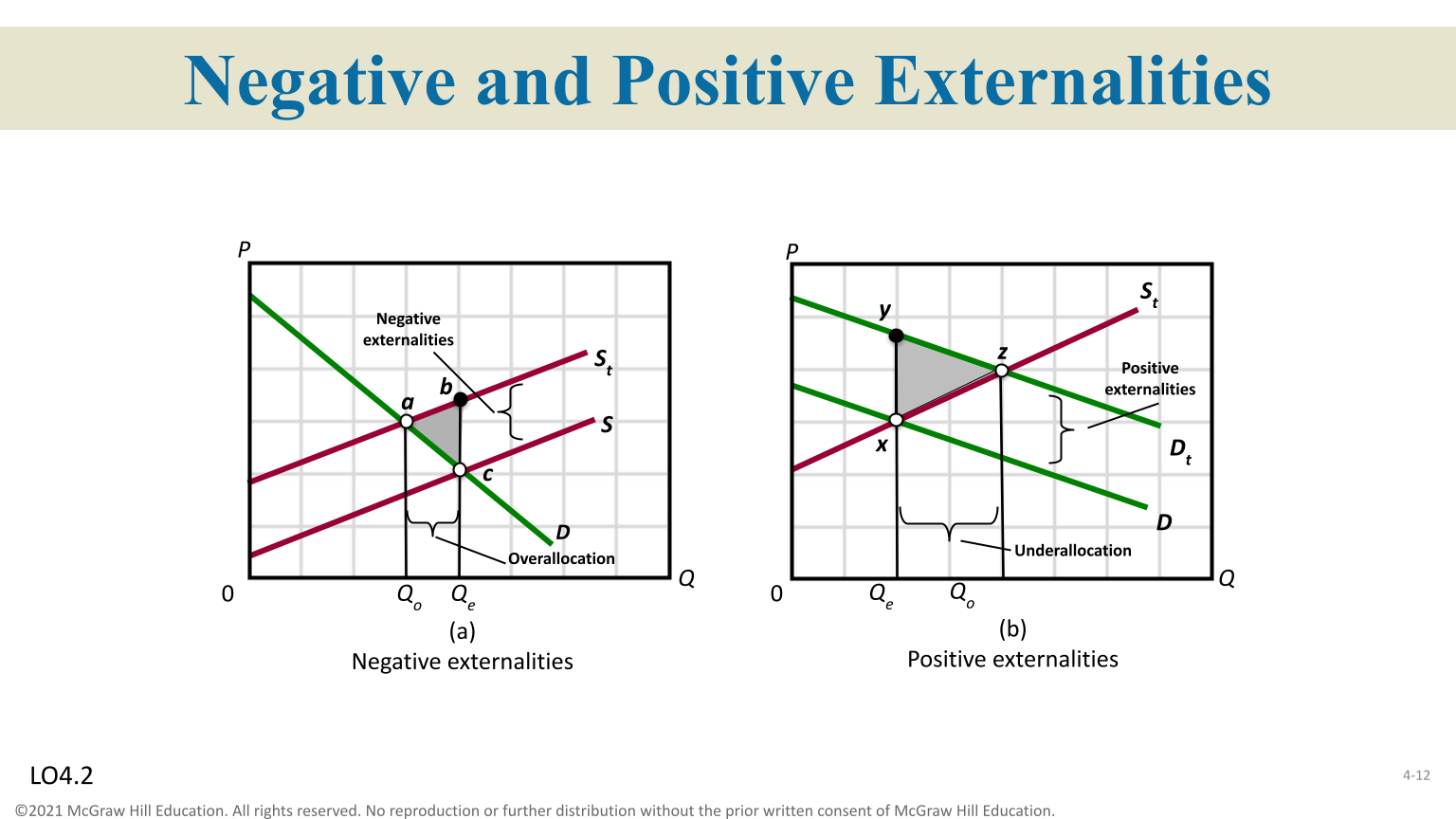

Externalities

A cost or benefit accruing to a third party external to market transaction ( represented as a form of market failure )

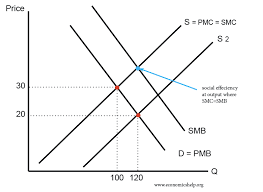

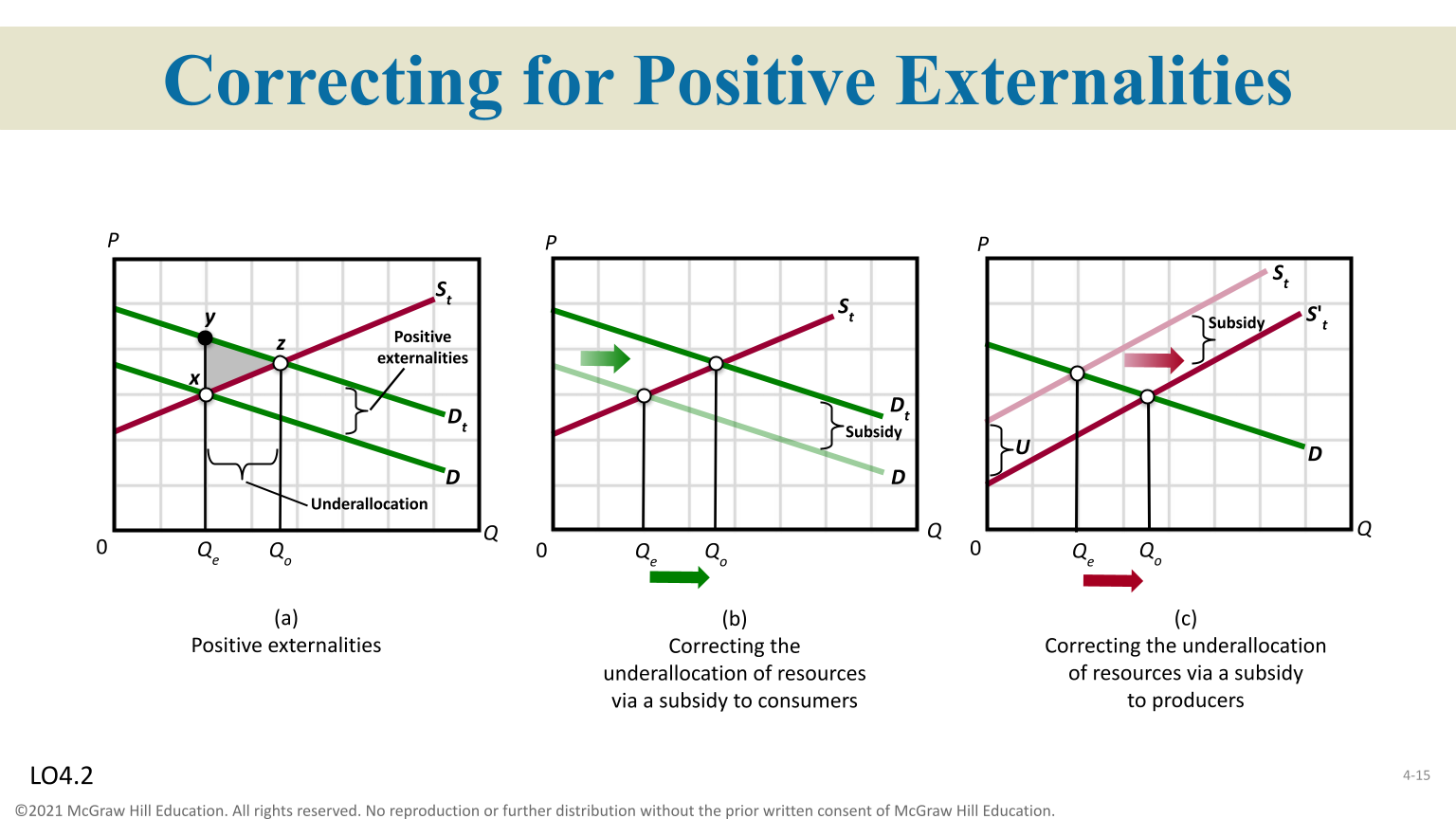

Positive Externalities

Too little is produced, demand side market failures

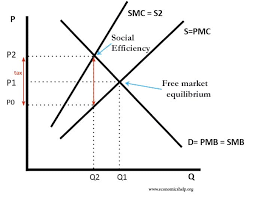

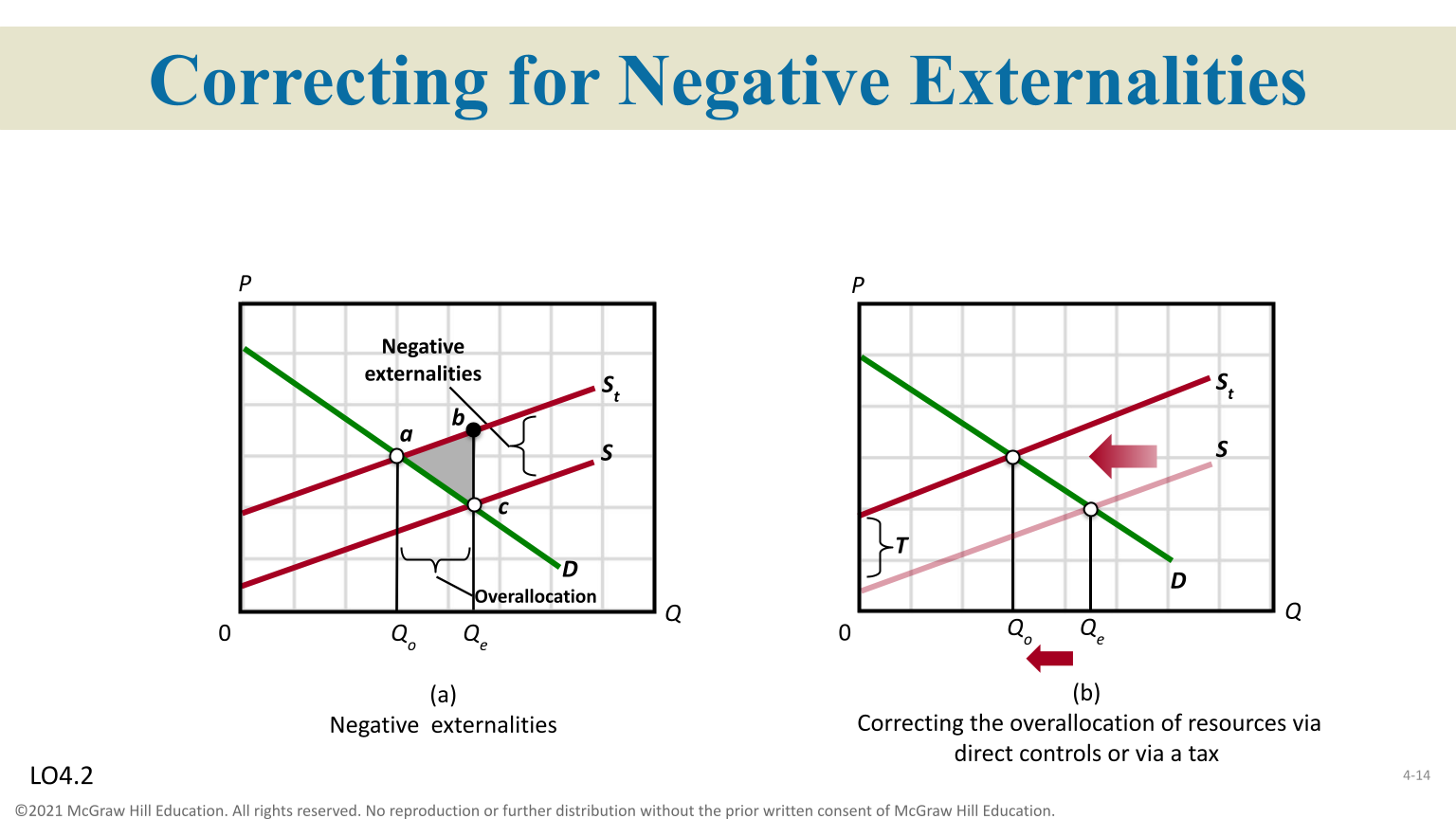

Negative Externalities

Too much is produced, supply-side market failures

Government Intervention

Correct negative externalities/resources

Pigouvian Tax

A specific tax assessment on a related good, to extent the cost of producing the good increases ( will shift left )

Pigouvian Subsidies

If a good has positive externalities then it will be under-consumed in a free market

Ex: Tax on Gas, Tax on sugary drinks

Direct Controls

Reducing supply by driving up costs of production that shifts the supply curve and reduce output

Correct Positive Externalities

Equilibrium output is smaller than efficient output ( consumer will pay a price equal to consumers individual marginal benefit )

Correct Negative Externalities

Over-allocation of resources

Subsidies

Financial Support to disadvantaged groups for economic growth

Government Provision

Government supplies services and goods to the public ( Ex: Needs, Opportunities, Essentials )

The Coase Theorem

Suggests that under the right conditions private bargaining can solve externality problems, thus government intervention may not always be necessary.

Asymmetric Information

Positive and Negative externalities are sources of what market failures can also lead to market failure ( other party to transactional possesses substantially more information than other parts )

Moral Hazard

A situation where a party lacks the incentive to guard against a financial risk due to being protected from any potential consequences