simplified midterm diagrams

1/21

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

22 Terms

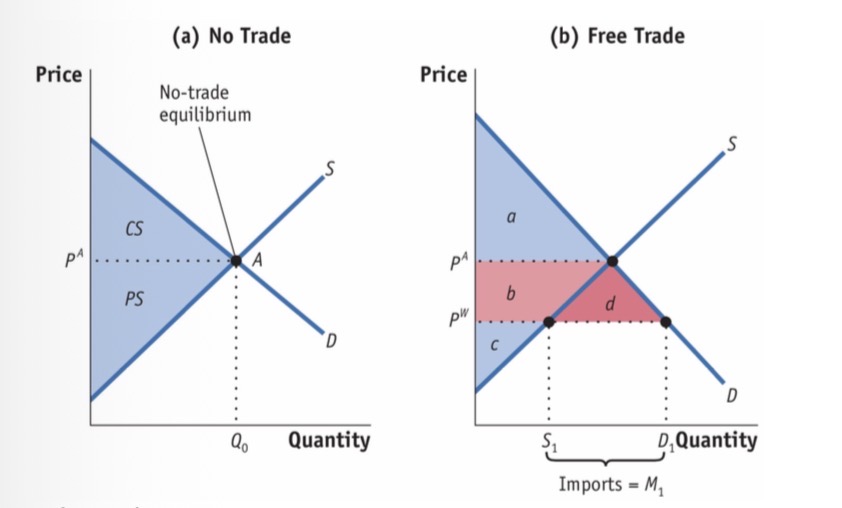

Basic gains of trade

CS: a+b+d

PS: c

HW: a+b+c+d

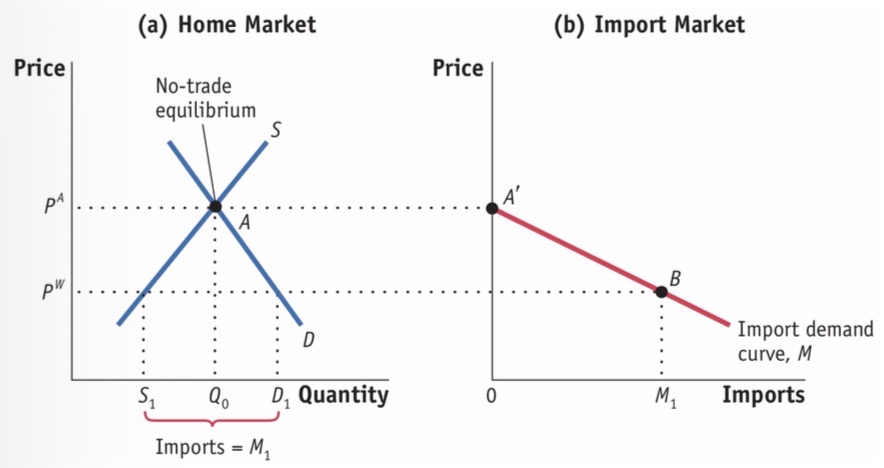

import demand curve

Determined by home market (small OR the other country) ‘s no trade equilibrium and the (D1-S1=M1)

Foreign export supply curve

Determined by large / foreign country’s no trade equilibrium and the world price

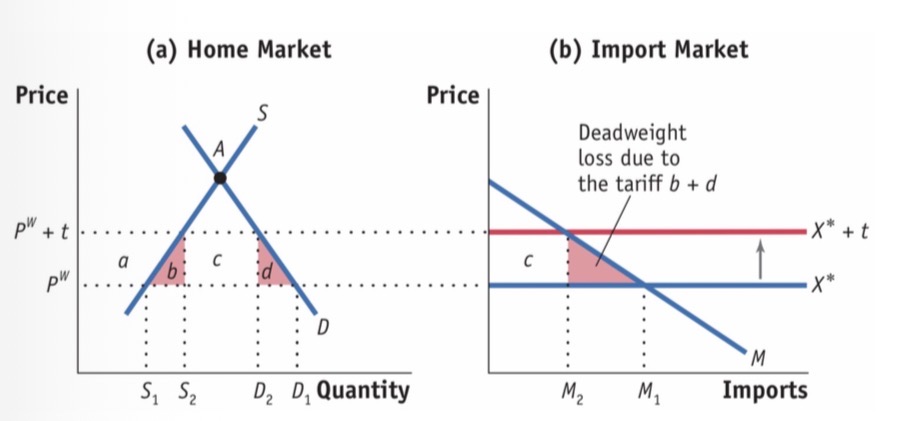

Smal country tariff

Small country so flat export supply curve

X* shifts up to X* + t

CS: - (a+b+c+d)

PS: + a

GR: + c

HW: -(b+d)

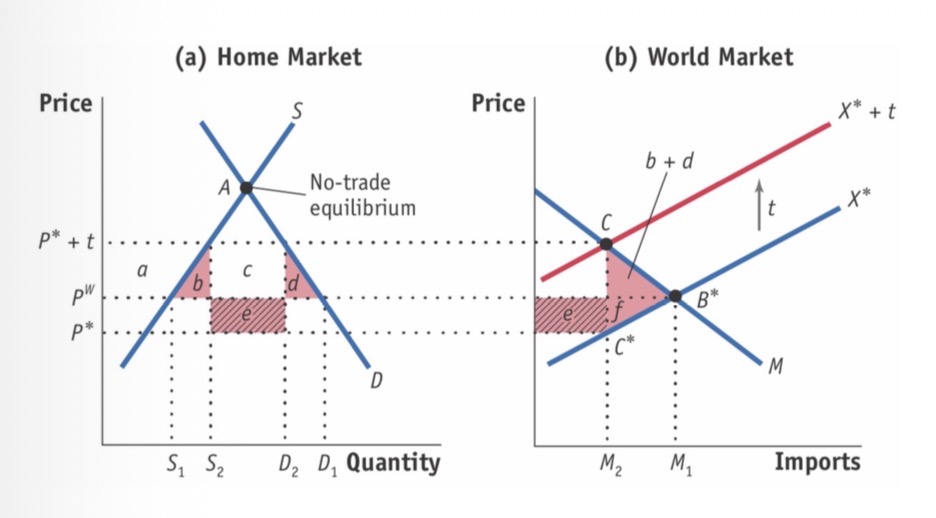

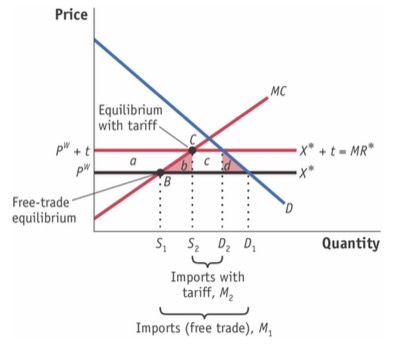

Large country tariffs

Large country so non-flat foreign supply

CS: -(a+b+c+d)

PS: +a

GR: + (c+e)

HW: + e -(b+d) if e>(b+d), benefit.

Optimal tariff

t = 1/E*x

Small country optimal tariff

E*x is infinite hence t must be = 0

Large country optimal tariff

E*x < infinite, as E*x decreases, the optimal tariff is higher. Since low elasticity = low fall in import demand

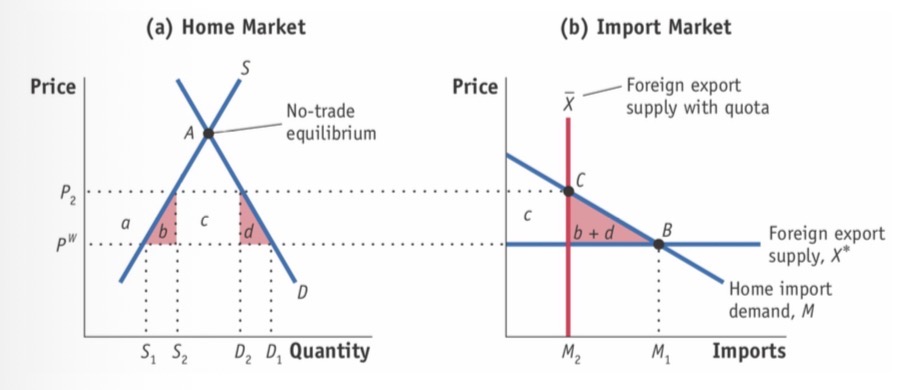

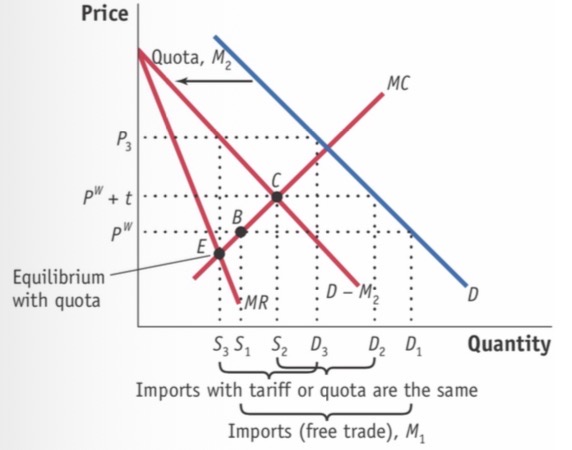

Import quota small & large

Home is assumed small, quota is imposed by world/foreign

Vertical supply curve with quota

CS: - (a+b+c+d)

PS: + a

QR: +c

HW: - (b+d)

Equivalent effect with tariff

Quota rents

Quota licenses can be given to Home firms, which are then able to import at the world price p" and sell locally at P2, earning the differences between these as rents.

Rent seeking

Rent seeking occurs when firms engage in inefficient activities to obtain quota licenses. (e.g. a firm produce more batteries to obtain the import licenses for the chemicals the following years). If rent seeking occurs, the welfare loss due to the quota would be:

Auctioning the quota

when the govt of the importing country auctions off quotas licenses to foreign firms. The revenue collected should equal the value of the rents so that area c is earned by the govt.

VER

Voluntary export restraint

to avoid quota/tariff war

Importer still loses more than exporter but is a political tool

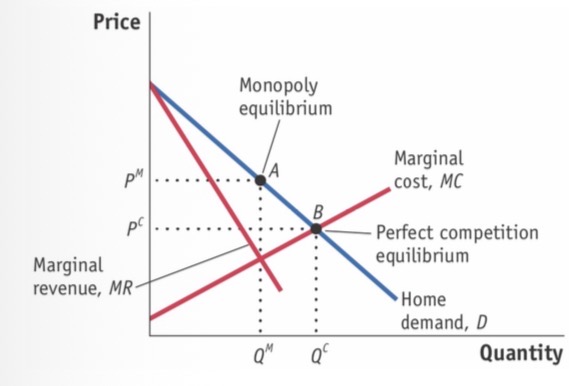

Home monopoly (imperfect) diagram

ME is where MC=MR

PCE is where MC=Dhome

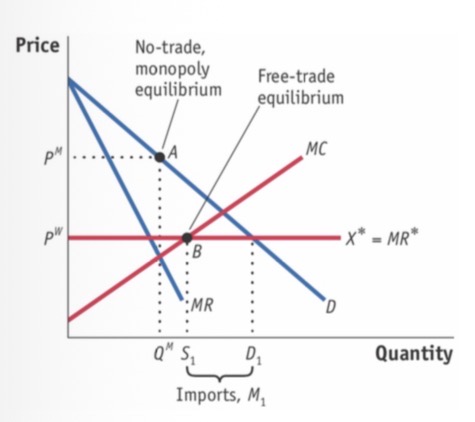

Free trade monopoly equilibrium

F-TE is where MC=X*

Home = small country, hence X* is flat

Monopoly equilibrium + tariff (small country)

X* shifts up

CS: -(a+b+c+d)

PS: +a

Auction revenue/quota rents?: +c

HW: -(b+d)

Monopoly equilibrium + quota (small country)

MR becomes non-flat cause quota

Shifts D backwards by quota size

Even when t=quota in terms of import change, quota means less output, means less employment

Dwl quota > dwl tariff as monopolists charge higher p

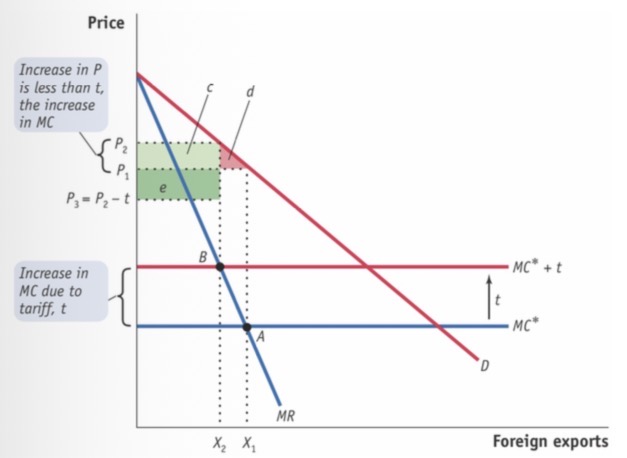

foreign Monopoly equilibrium + tariff

D is entirely supplied by foreign

MC* is the supply curve

MC* shifts upwards

CS: -(c+d)

GR: + (c+e)

HW: +(e-d)

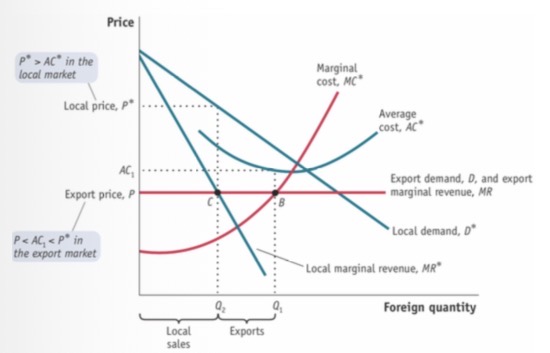

Monopoly equilibrium foreign country

Exports at MC*=MR

Sells locally at local MR & P*

Since AC < P*, but higher than P, dumping

Dumping

If the average cost AC < local price P* but > export price P, must be dumping since they’re selling at a unprofitable price & are hence trying to just get rid/ sell cheap

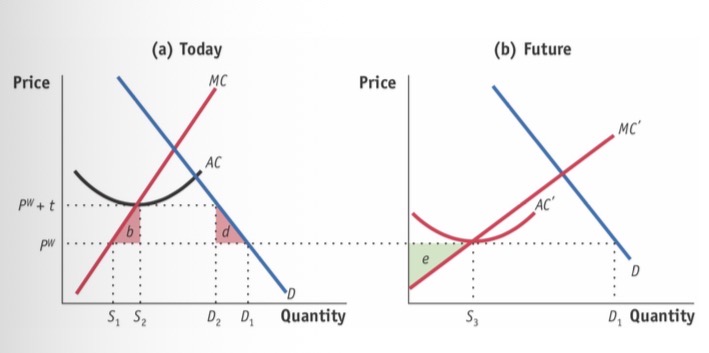

Infant industry protection

Technological advances based:

Set up import tariff (not quota as it would just mean less production and no progress) which allows industry time to advance technologically, hence reduce price and hence minimise/erase shutdown/losses.

Only works if tariff can be removed

PS future must > than current dwl