Macro unit 1-3

1/32

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

33 Terms

Factors of production

Land

2. Labor

3. Physical Capital

4. Entrepreneurship

PPC

production probabilities curve; max combos of 2 different goods that can be produced with fixed resources

what does a straight ppc instead of a curved one mean?

the products adapt to each other

absolute advantage

the ability of an individual or group to carry out a particular economic activity more efficiently than another individual or group.

produce more or using fewer resources

comparative advantage

produce at lower opportunity cost

input opportunity cost

the amount of one good that must be forgone to produce an additional unit of another good.

“it over”

output opportunity cost

the amount of output lost from producing an additional unit of a different good.

“other over”

Demand shifters

Tastes & preferences

Market size

Prices of related goods

Changes in income

expectation

price changes…

quantity, not demand

Prices of related goods types

substitudes and complements

changes in income

normal goods - people income rise, demand rise

inferior goods - income rise, so demand dec (ex: instant noodles)

product market

businesses r providing households with goods and resources

households are providing money to those businesses in the form of sales

factor market

resources (land labor capital entrepren) r going from households to the businesses

businesses provide households with wages, rent, internet, and profit

GDP + ways to calculate

Gross Domestic Product

Total value of all final goods and services produced within a country in a calendar year

-value added approach (adds contrib a countrys firms make to the final goods… ex. get for $8 sell for $15)

-income approach (rent, wages, interest, and profit with some adjustments)

-OUTPUT EXPENDITURE MODEL

Output Expenditure Model

look at sales that are in the product market —money that goes from households to businesses

C+I+G+Xn

C= Consumption ; I= Gross Investment (bus); G=Gov purchases; Xn = Net Exports (Exports - imports)

Per capita GDP

GDP divided by the pop of a country

used to determine a country’s standard of living

Unemployment rate formula

(Unemployed/Labor Force) x 100

Labor force formula

unemployed +employed

labor force participation rate formula

(Labor Force/Working age civilian pop) x 100

types of unemployment

frictional - in btwn jobs or looking for first

structural - changes in econ led to skills mismatch

cyclical - caused by overall economic downturn

NRU

natural rate of unemployment = frictional + structural

zero cyclical unemployment

CPI

tracks price changes in a market basket of products

(calc inflation)

GDP Deflator

tracks price changes in all products

first calculate nominal gdp (value of current year’s goods using current year’s prices so q x p )

(nominal/real) x 100

spending multiplier

formula to find out how much money the initial change in consumption can impact GDP

1/MPS or 1/(1-MPC)

ex: initial cost = $800

MPS = 0.2 so 1/0.2 =5 so

there is up to $4000 inc in GDP

tax multiplier

when the gov inc or dec taxes, and it changes the amount of disposable income consumers have

-MPC/MPS or -MPC/(1-MPC)

-0.8/0.2 = -4

10 million tax dec in taxes —> $40 million GDP inc

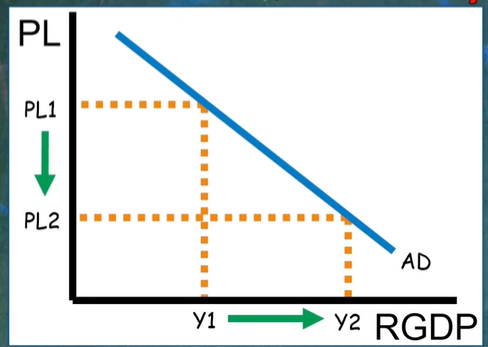

aggregate demand

the demand for all goods and services in the economy

reasons for downward sloping aggregate demand

Wealth Effect (as prices fall, real wealth is inc —> cons inc consuming)

interest rate effect (as price levels fall interest rates also fall—> gross investment inc)

Net Exports Effect (lower price levels exports are cheaper for foregin countries—>exports will inc)

AGGREGATE DEMAND SHIFTERS

Consumer Spending

Gross Investment

Government Purchases

Net Exports

C + I + G + Xn

AGGREGATE SUPPLY SHIFTERS

Resource Prices (wages)

Productivity

Inflation Expectations

Business Taxes

Business Regulations

LRAS

long run aggregate supply

in the long run wages are flexible

LRAS SHIFTERS

Quantity of resources

Quality of resources

Productivity

Technology

Anything that shifts the PPC will shift the LRAS

Expansionary fiscal policy

fight unemployment by: inc gov spending and/or dec taxes

inc budget deficit or dec surplus

Contractionary Fiscal Policy

Fight Inflation By: Dec gov spending and/or inc taxes

dec budget deficit or inc surplus