310 - Binomial Trees

1/17

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

18 Terms

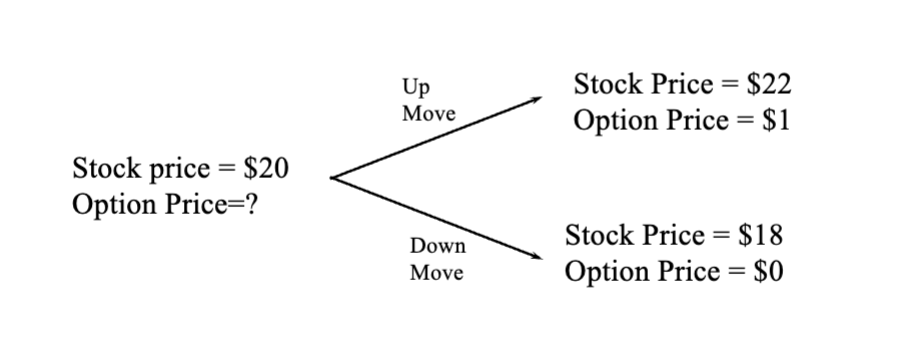

Generalized simple binomial tree

u is larger than 1

d is smaller than 1

payoff function is a function of the derivative, whether call, put, or to the power of x, where x is any variable, generally speaking, f is a function of S(T)

This allows us to construct a risk free portfolio

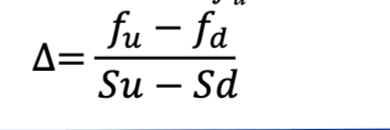

Delta formula for risk free portfolio

risk free in binomial context

no matter what happen, value of portfolio will always be constant.

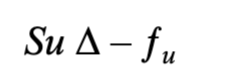

Value of portfolio at time T

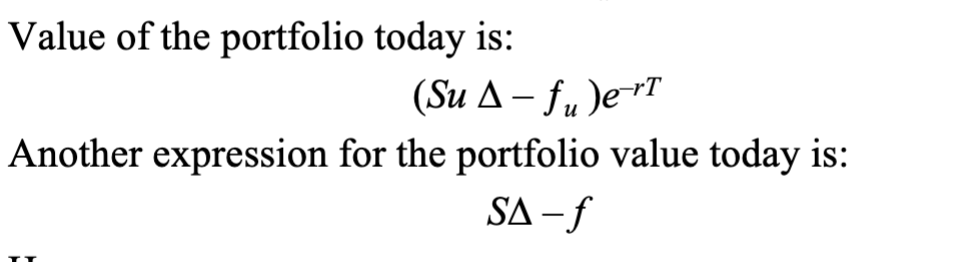

Value of portfolio today

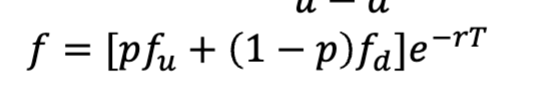

Derivative price discounted back to todays date at maturity

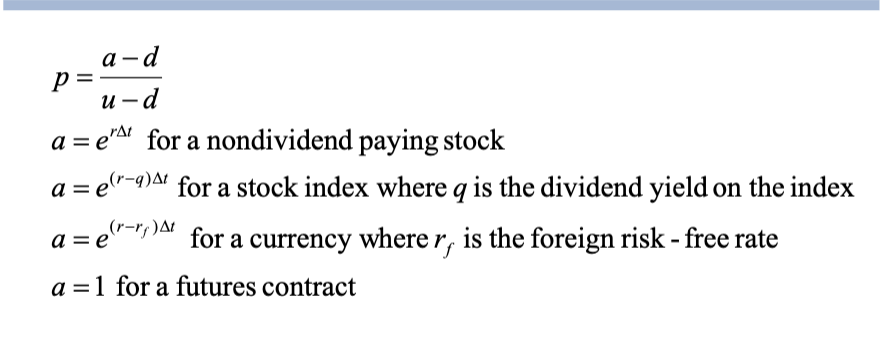

probability

Irrelevance of stock’s expected return

When we are valuing an option in terms of the underlying stock the expected return on the stock is irrelevant.

Risk Neutral valuation

When the probability of an up and down movement are p and 1-p the expected stock price at time T is SerT

This shows that the stock price earns the risk free rate

Binomial trees illustrate the general result that to value a derivative we can assume that the expected return on the underlying asset is the risk free rate and discount at the risk-free rate.

This is know as using risk neutral valuation

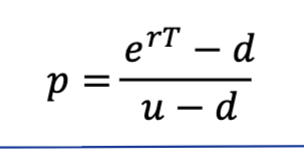

Generalisation of two step binomial tree

delta t referes to the length of one time step

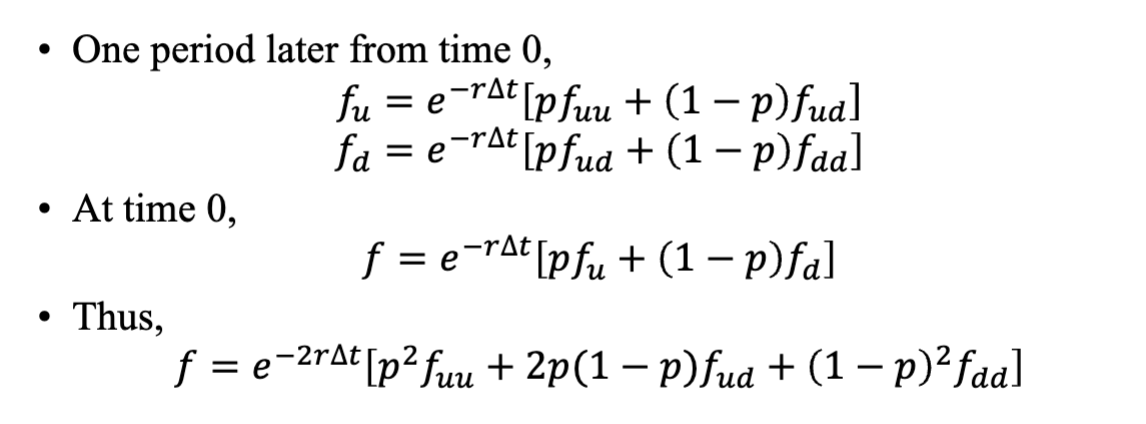

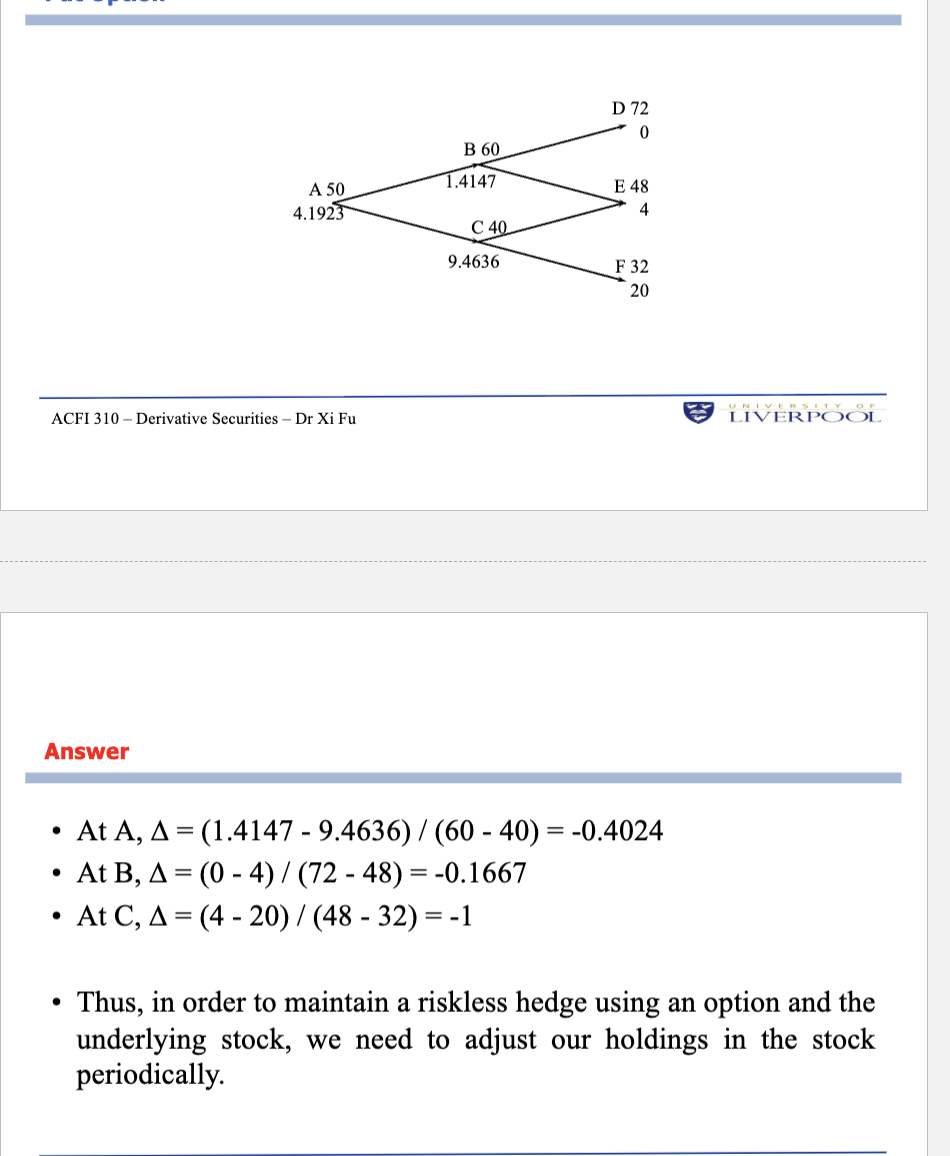

Delta hedging

Buy High, Sell Low

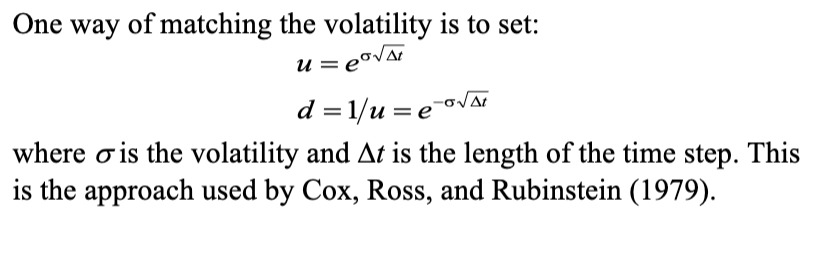

Choosing u and d

Probability of an up move for non-dividend paying stocks

Increasing time steps

Advantages of Binomial Tree

Primary advantage of binomial trees is that American options become much easier to price

Can factor in dividends;

No calculus needed;

Easy to make a spreadsheet to find option values

American option pricing

For an American option, the value of the option at any given point is the maximum of two values:

- The payoff if the option were exercised now;

- The pullback formula’s output

Note: The pullback formula takes into account American option values at future points

Disadvantages of binomial tree model

Speed:

In order to have accurate results, we want to maximize the number of time periods, but this means creating a lot of nodes which can be slow to calculate even with today’s computers.

For some extreme options, like a cash or nothing, pricing can be inaccurate until a very large number of time intervals is used.

Pros and cons of binomial option pricing

• Pros:

− It uses relatively simple Mathematics.

− It can be used to price American and Bermudan options.

− It can be implemented in computer programs.

− It can be adapted to various kinds of stock features (like dividends).

• Cons:

− Being discrete, it does not produce exact answers.

− By hand, it would take a long time to price an option using a lot of time intervals.

− At least with the Cox-Ross-Rubinstein Model, it must use a constant volatility, a downside

that the Black-Scholes PDE has as well.