externalities and public goods

1/21

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

22 Terms

externalities

an action affects bystanders but those effects aren’t priced

negative externality → too much activity

positive externality → too little activity

goal: make private optimal equal social optimal

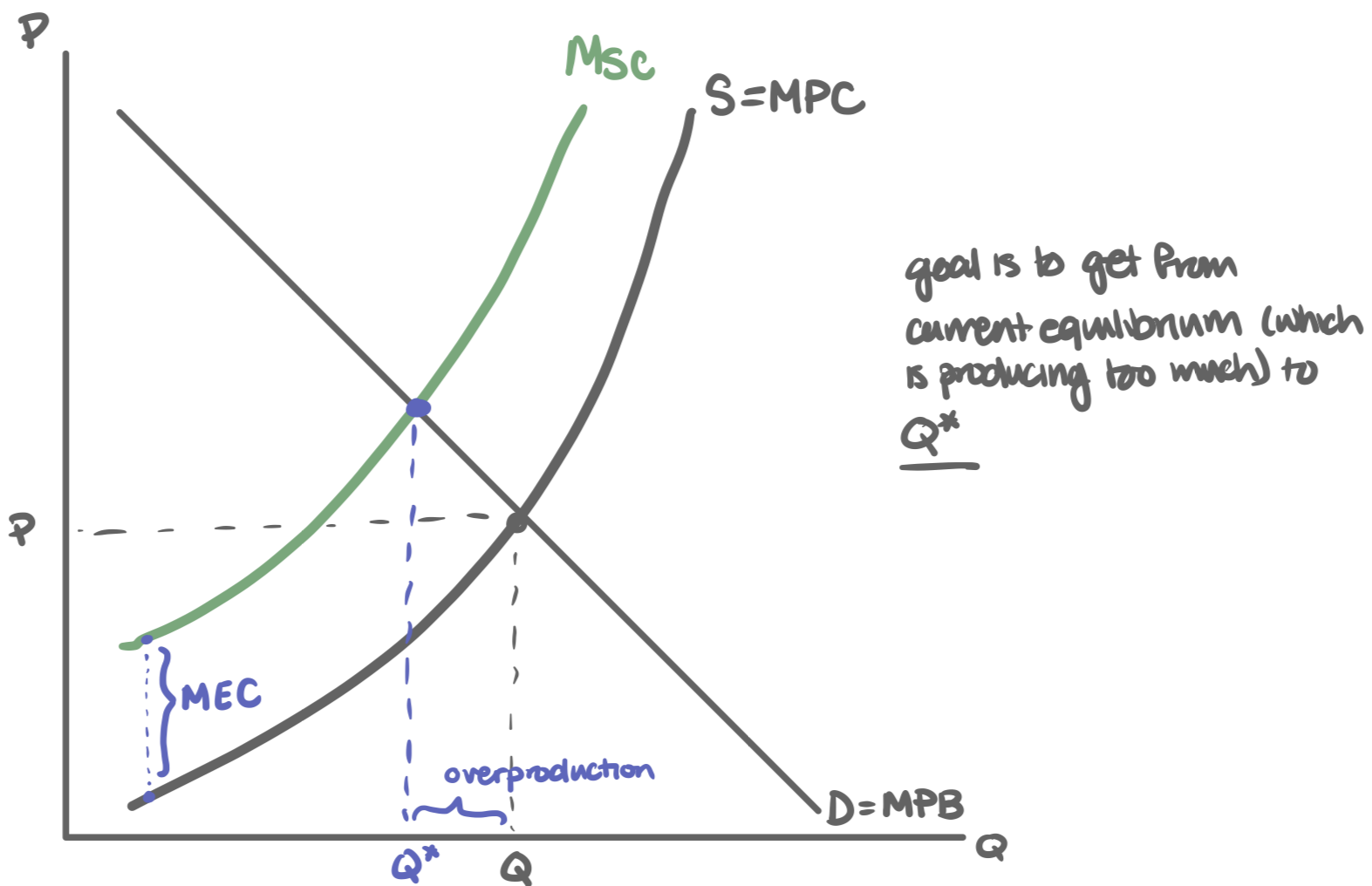

negative externality - costs

marginal private cost (MPC): my cost (supply)

marginal external cost (MEC): harm to others

marginal social cost (MSC) = MPC + MEC

marginal private benefit (MPB) = my benefit (demand)

market picks MPB = MPC → quantity too high if MEC > 0

negative externality graph

goal is to get from current equilibrium (which is producing too much) to Q*

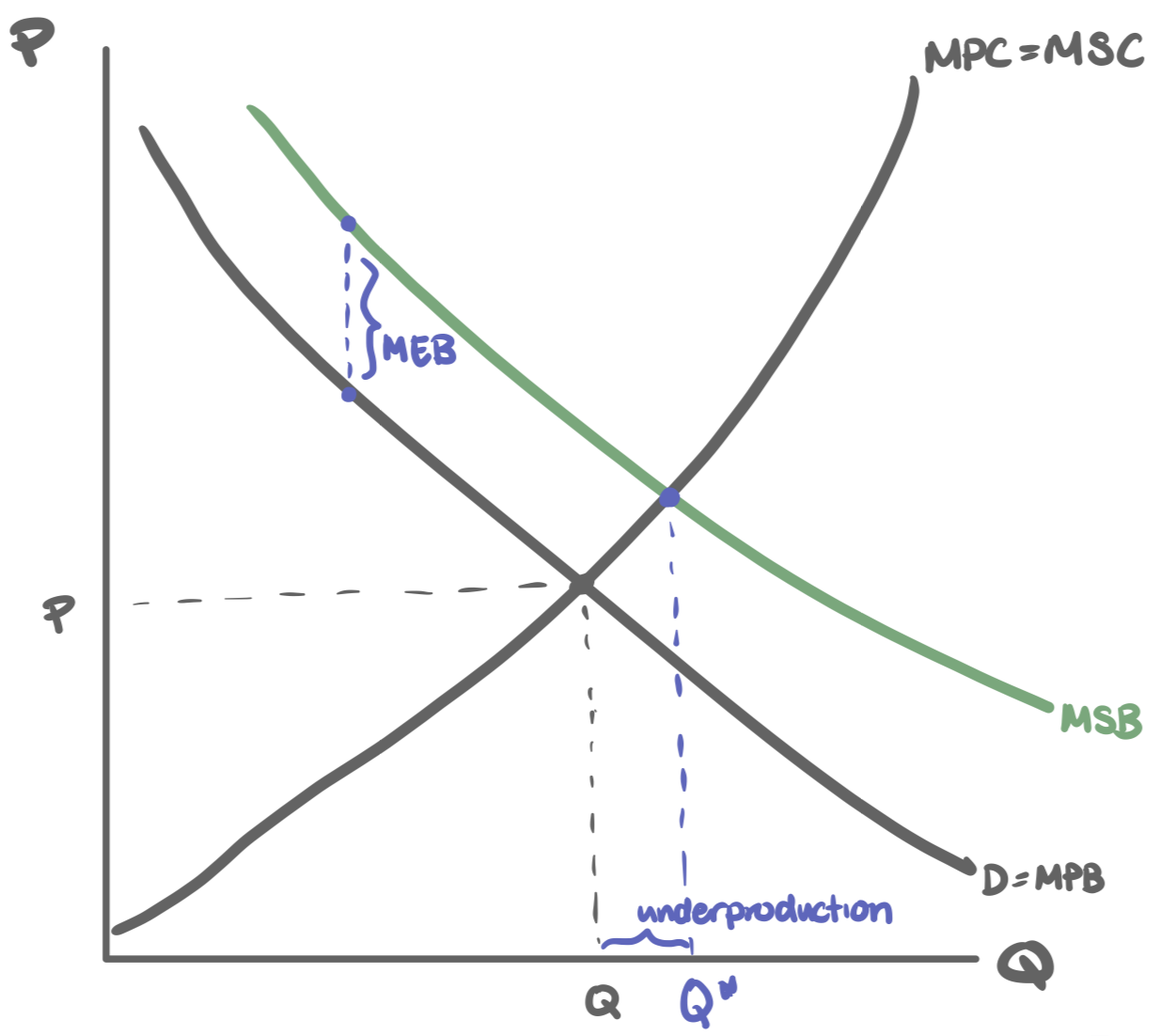

positive externality - benefits

marginal private benefit (MPB): my benefit

marginal external benefit (MEB): benefit to others

marginal social benefit (MSB) = MPB + MEB

market picks MPB = MPC → quantity too low if MEB > 0

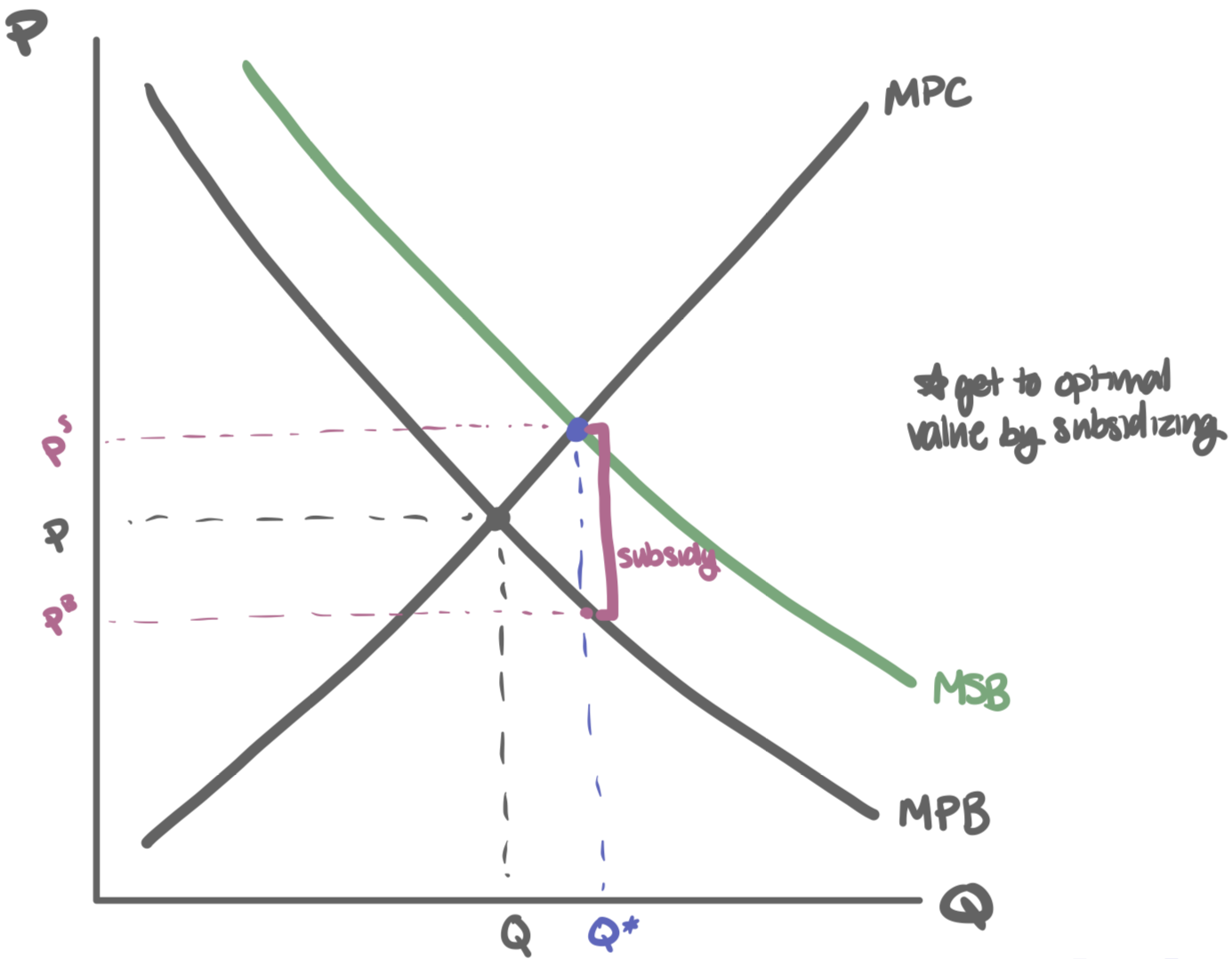

positive externality graph

goal is to get from current equilibrium (which is producing too little) to Q*

the Coase theorem

if property rights are clearly assigned and bargaining is costless, private negotiation between affected parties can lead to the socially efficient outcome, regardless of who holds the initial rights

implications:

with zero transaction costs, parties bargain to Q* → the allocation is efficient either way; the distribution (who pays/gets paid) depends on initial rights

when does bargaining work?

clear property rights, few parties, easy to find each other, low transaction & legal costs

common failures:

many parties = holdout/free-riding, high bargaining or enforcement costs, harms across borders or generations

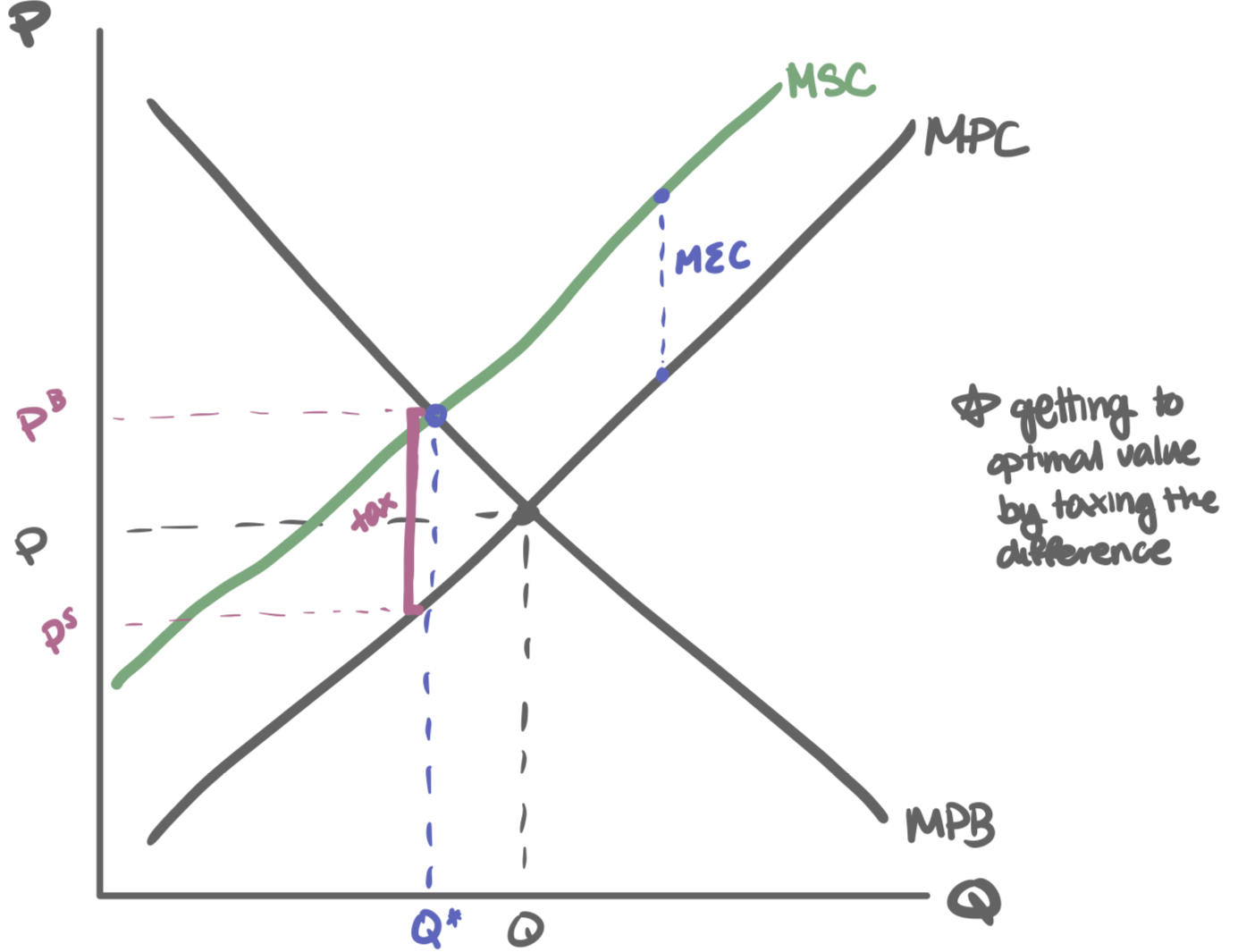

Pigouvian taxes & subsidies

tax for negative externality to drop production

ex. carbon tax, trying to price up the item until it hits Q*

subsidy for positive externality to increase production

aligns private with social margin in order to hit Q*

negative externality tax graph

tax per unit = MEC at Q*

positive externality subsidy graph

subsidy per unit = MEB at Q*

how to pick between Coase & policy (ex. tax/sub)

Coase: few parties, clear rights, low frictions

policy (tax/sub, standards, cap): many/anonymous parties or high frictions

distribution vs efficiency: rights affect who pays; well-designed policy targets Q*

cap-and-trade definition

set total permits = Q* (the optimal quantity in the market)

firms can trade permits → establishes market + price

achieves Q* at the least cost, aka setting a quota for the good

cap = hard limit on total emissions/output → issue exactly Q* permits

each permit = legal right to emit 1 unit; firms must hold permits for emissions

trade = firms buy/sell permits; the permit price emerges in the market

cap-and-trade results

hit the target quantity Q*, with lowest-cost reducers cutting the most (cost-effective)

aka firms with low cutting costs have a financial incentive to invest in clean technologies and efficient practices to reduce emissions below their allocated cap → every extra ton of emissions they reduce can be converted into an allowance to sell for profit

cap-and-trade revenue allocation

depends on allocation of system:

auctions → government gets revenue by auctioning off permits to businesses, bid up prices

free allocation → no revenue, but permits get traded around

how to pick between tax & c&t

price certainty (tax): firms know t; quantity adjusts

good when damage per unit is stable

quantity certainty (cap): society fixes total Q; permit price adjusts

good when total quantity is critical

administration (aka $$): tax raises revenue automatically; cap can auction(revenue) or freely allocate (no revenue)

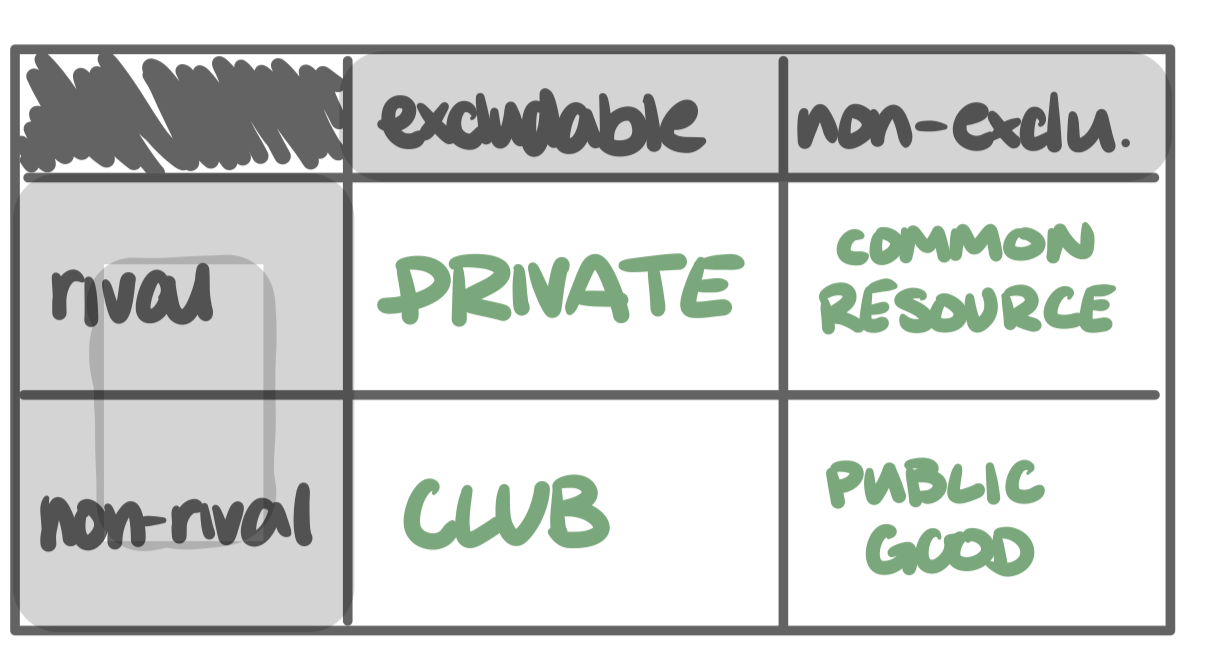

classifying goods:

excludable: feasible to prevent nonpayers from using it (e.g., paywall, turnstile)

nonexcludable: can’t feasibly keep nonpayers out (e.g., street lighting)

rival: one person’s use reduces what’s left for others (e.g., a sandwich)

nonrival: my use doesn’t diminish yours (e.g., a lecture recording)

kinds of goods

goods - private

rival, excludable

basically most goods we’ve talked about so far

goods - club

nonrival, excludable

ex. tennis membership where courts are always available

goods - common resource

rival, nonexcludable

leads to overuse! tragedy of the commons

ex. nonrenewable resources (fisheries)

fixes: quotas, access fees, tradable rights, property rights

basically, assign rights to fix this issue → incentivize people to conserve for future profits, make someone the residual claimant for the stock, etc.

ex. congestion/toll pricing, private owned fisheries, etc.

tragedy of the commons

overuse and depletion of resources without rules as common resources are private gains with shared costs

goods - public goods

nonrival, nonexcludable

leads to underproviding! due to free-riding

ex. national defense

fixes to underproviding issue: two part-tariffs, donations with matching, norms

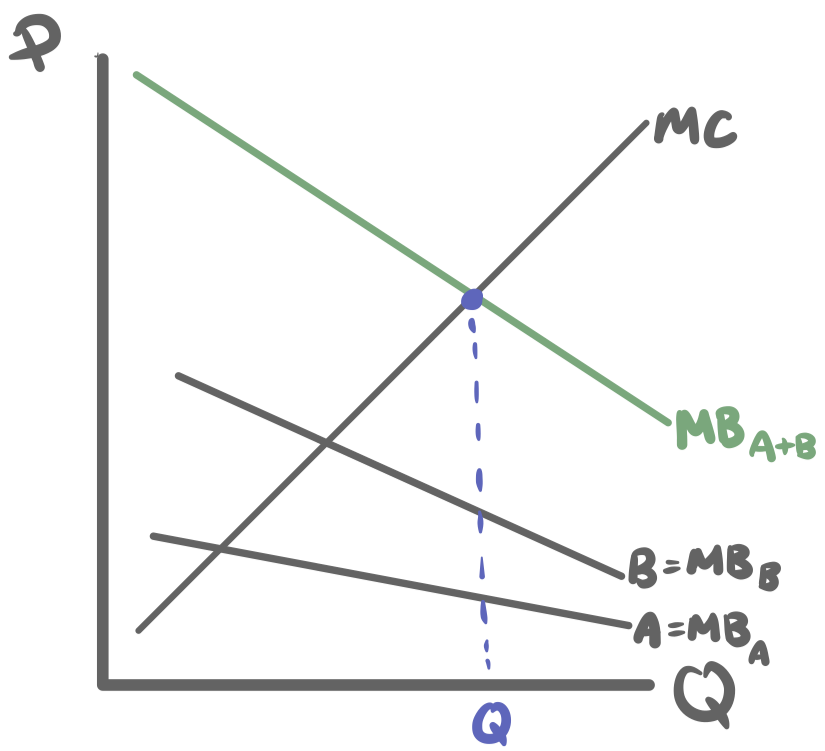

calculating marginal benefit (MB) of public goods

calculate the vertical sum of benefits across all users

works since person A using does not affect person B using

= marginal benefit of society as a whole