Chapter 16: Auditing the Financing/Investing Process: Cash and Investments

0.0(0)

Card Sorting

1/7

There's no tags or description

Looks like no tags are added yet.

Last updated 6:31 AM on 10/26/25

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

8 Terms

1

New cards

2

New cards

3

New cards

4

New cards

5

New cards

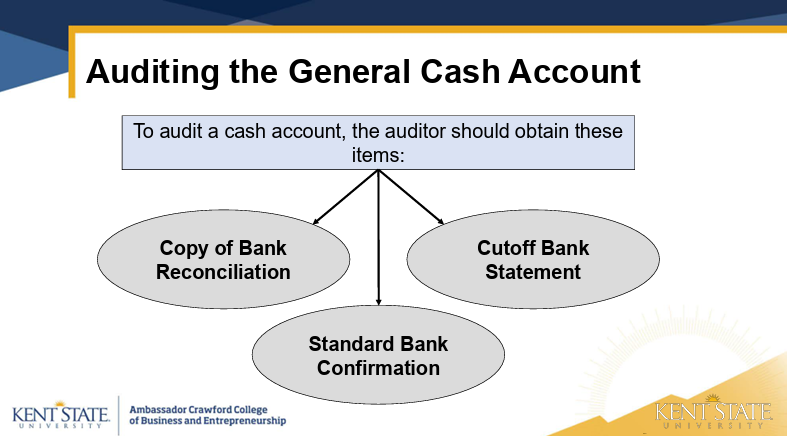

A cutoff bank statement normally covers the _______ day period after the date on which the bank account is reconciled.

7 to 20

6

New cards

7

New cards

what are fraud-related audit procedures

extended bank reconciliation procedures

tests for kiting

8

New cards

Disclosure Issues for Cash (5)

1. Accounting policy for defining cash and cash equivalents

2. Any restrictions on cash such as a sinking fund requirement for funds allocated by the entity’s board of directors for special purposes

3. Contractual obligations to maintain compensating balances

4. Cash balances restricted by foreign exchange controls

5. Letters of Credit