Monopoly

1/33

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

34 Terms

When does monopoly occur?

Monopoly occurs when there is one large seller of a particular good or service. There is no competition whatsoever in a monopoly.

Few firms are pure monopolists in the real world. This often results from regulation.

However, we can find near-examples such as Amazon, Google, and Facebook.

What is market concentration?

Market concentration describes the degree to which a small number of firms dominate a market.

High market concentration often results in reduced competition.

Describe the market structure of monoploy

Number of sellers = one large seller

Barriers to entry = high

Product substitutability = differentiated

Explain a firm’s revenue

A firm’s revenue is: R = pq

A firm’s marginal revenue, MR, is the change in its revenue from selling one more unit. MR = DR / Dq

If the firm sells exactly one more unit,

Dq = 1, its marginal revenue is MR DR .

We know that for a competitive firm, MR = ΔTR = P* - does this hold for a monopolist?

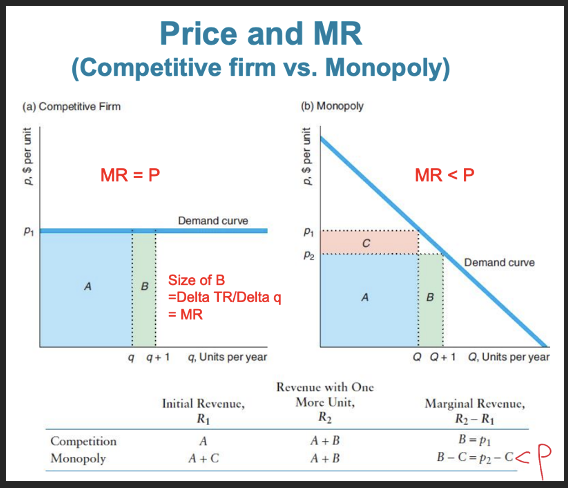

Explain how marginal revenue and price differs from a competitive firm

The marginal revenue of a monopoly differs from that of a competitive firm because the monopoly faces a downward-sloping demand curve unlike the competitive firm.

Thus, the monopoly’s marginal revenue curve lies below the demand curve at every positive quantity.

For a competitive firm, P=MR (both are represented by a horizontal line).

For a monopoly, P>MR (represented by two separate downward-sloping lines).

How do you derive the marginal revenue curve as a function of P?

Decompose the change in TR due to selling one more unit into 2 parts:

1) For a monopoly to increase its output by ΔQ, the monopoly lowers its price per unit by (the slope of the demand curve).

By lowering its price, the monopoly loses: (change in p/change in Q) x Q

on the Q units it originally sold at the higher price,

2) But it earns an additional p on the extra output.

Thus, the monopoly’s marginal revenue is: MR = p + change in p/change in Q x Q

Demand curve slopes downward

Delta P/Delta Q < 0

The second term of the RHS < 0

MR<P

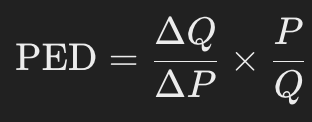

What is the basic definition of Price Elasticity of Demand (PED)?

Price Elasticity of Demand (PED) measures the percentage change in quantity demanded in response to a percentage change in price. It indicates how sensitive consumers are to price changes.

What is the definition-based formula for calculating PED?

PED = (% Change in Quantity Demanded) ÷ (% Change in Price)

What are the two components of the transformed formula for PED?

ΔQ / ΔP — This is the inverse of the slope of the demand curve.

P / Q — This is the price-to-quantity ratio, which adjusts for the relative size of price and quantity.

Why is the transformed PED formula useful?

The transformed formula helps break PED into measurable parts:

ΔQ/ΔP reflects how much quantity changes for a given change in price (sensitivity).

P/Q adjusts this change to account for the relative scale of price and quantity, making the elasticity unit-free.

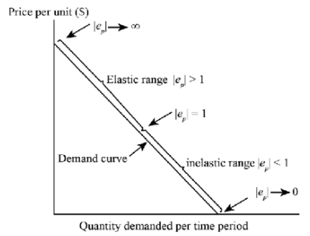

Explain PED along a demand curve

PED varies along a straight line demand curve

Explain Elasticity of Demand and Total, Average, and Marginal Revenue:

add more

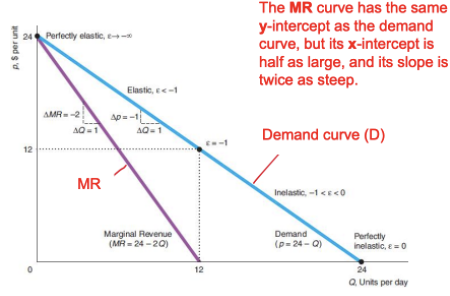

How does the slope of the marginal revenue (MR) curve compare to the slope of the demand curve?

In a market with a linear demand curve, the marginal revenue (MR) curve has the same vertical intercept as the demand curve but is twice as steep.

This means the MR curve falls twice as fast as the demand curve.

For a demand curve defined as P=a−bQ, the corresponding MR curve is MR=a−2bQ.

The MR curve lies below the demand curve at every positive quantity level (except at zero output, where they meet).

How is marginal revenue (MR) related to price and price elasticity of demand (PED)?

Marginal revenue (MR) at a given quantity can be expressed as:

MR = P (1+ 1/PED)

Where:

P is the price

PED is the price elasticity of demand (typically a negative value)

This shows that MR depends on both the current price and the elasticity of demand.

What is the relationship between marginal revenue and elasticity in the formula MR = P + ΔP/ΔQ ⋅ Q?

This formula:

MR = P + ΔP/ΔQ ⋅ Q

represents marginal revenue as the sum of the current price and the change in price per unit times the quantity. This can be rearranged using elasticity to derive:

MR = P(1+ 1/PED)

What happens to marginal revenue as demand becomes more elastic?

As demand becomes more elastic (|PED| increases), the term 1/PED becomes smaller (more negative), so:

Marginal revenue (MR) gets closer to price (P)

In the limit, when demand is perfectly elastic (|PED| → ∞), MR ≈ P

What is the value of marginal revenue when the demand is perfectly elastic (at Q = 0)?

When the demand curve hits the price (vertical) axis at Q = 0, demand is perfectly elastic:

PED → ∞

MR=PMR = PMR=P

What happens to marginal revenue when the price elasticity of demand is unitary (ε = −1)?

When PED = −1 (unitary elasticity), marginal revenue equals zero:

MR = P(1 + 1 − 1) = 0

This occurs at the midpoint of a linear demand curve.

How do both monopolists and competitive firms maximize profit?

Both monopolists and competitive firms maximize profit by producing the quantity where marginal revenue (MR) equals marginal cost (MC):

MR=MC

How does a monopolist differ from a competitive firm in setting price and quantity?

A competitive firm takes price as given (price-taker) and can only choose quantity (Q).

A monopolist has market power and can choose either price or quantity, but not both simultaneously.

This is because the monopolist is constrained by the downward-sloping demand curve—choosing a quantity determines the price, and vice versa.

Why can't a monopolist choose both price and quantity independently?

A monopolist is constrained by the market demand curve, which is downward sloping.

Choosing a higher price leads to a lower quantity demanded.

Choosing a higher quantity requires setting a lower price to sell it.

This trade-off prevents the monopolist from independently selecting both price and quantity.

In most cases, what does a monopolist choose first when maximizing profit?

In standard economic models, a monopolist is typically assumed to choose the quantity (Q) first.

Once the profit-maximizing quantity is determined (where MR = MC), the corresponding price is found by going up to the demand curve.

What are the two rules for profit maximization under monopoly?

Output Rule (MR = MC rule)

The monopolist maximizes profit by producing the quantity q∗ where Marginal Revenue (MR) equals Marginal Cost (MC).

Unlike a competitive firm where P=MCP = MCP=MC, for a monopoly, P > MR.

Shutdown Rule

The monopolist must decide whether to produce the profit-maximizing quantity q∗q^*q∗ or shut down and produce nothing based on whether it can cover its variable costs.

Where is monopoly profit maximised on the demand curve?

Monopoly profit is maximized in the elastic portion of the demand curve.

The demand curve is more elastic at smaller quantities, meaning the monopolist can raise prices without losing too many customers.

A monopoly would never operate in the inelastic portion of its demand curve, as raising prices further would decrease total revenue.

How does the price and marginal revenue relationship differ between competitive firms and monopolies?

For an individual competitive firm, P=MR, meaning the price is equal to marginal revenue, and the firm operates where price equals marginal cost.

For a monopoly, P>MR, meaning the price is greater than marginal revenue, and the monopolist maximizes profit by setting MR = MC, but the price is above both MR and MC at the profit-maximizing quantity q∗q^*q∗.

How is the profit-maximizing condition for a competitive firm different from that of a monopoly?

For a competitive firm, profit maximization occurs where P = MR = MC at the quantity q∗.

For a monopoly, profit maximization occurs where MR = MC, but the price at this quantity is higher than both MR and MC, meaning P>MC.

Explain entry barriers in monopoly

A competitive firm won’t be able to maintain positive profits in the long run, but what about a monopoly?

If a monopoly firm is making profits, other firms will want to enter the industry.

However, there could be obstacles that prevent entry, known as entry barriers.

A monopoly’s profits may persist in the LR if there are effective entry barriers that prevent new firms from entering the industry.

Entry barriers disrupt the natural adjustment process that would otherwise drive profits toward zero in the long run.

Give real examples of barriers to entry

1) Natural barriers (natural monopoly), include economies of large-scale production and large fixed costs of entering the market.

o Natural monopolies exist when one firm produces at a lower cost than multiple firms.

o Public utilities (water, gas, electricity) have high start-up costs (e.g., pipelines, grids).

o One provider avoids duplicate costs, ensuring efficiency

2) Artificial barriers include brand proliferation, high levels of advertising and product differentiation.

3) Policy-created barriers (Patents, Government legislation)

4) Control of supplies (De beers in diamond industry)

What is market power and how is it related to price and marginal cost?

Market power is a firm's ability to charge a price above marginal cost and earn positive profits. This markup over marginal cost reflects the firm’s pricing power and depends on how responsive consumers are to price changes (i.e., price elasticity of demand).

How does price elasticity of demand (ε) determine market power through the price-cost ratio?

At the profit-maximising output, marginal revenue equals marginal cost:

MR = p(1 + 1/ε)= MC

Rearranging gives a measure of market power:

p/MC = 1/(1+1/ε)

This ratio depends only on the price elasticity of demand. The less elastic the demand (i.e., smaller |ε|), the higher the markup a firm can charge, indicating greater market power.

What is the Lerner Index and what does it measure about a firm's market power?

The Lerner Index measures a firm's ability to price above marginal cost. It is defined as:

(p−MC) / p

This value ranges from 0 to 1:

A Lerner Index of 0 indicates no market power (perfect competition).

A higher index (closer to 1) indicates greater market power (e.g., monopolies).

It can also be expressed using price elasticity of demand (ε):

(p−MC) / p = - (1/ε)

This shows that less elastic demand (smaller |ε|) gives a firm more power to raise prices above marginal cost.

What is price discrimination, and what are its main types?

Price discrimination occurs when a firm sells the same product at different prices to different customers, not due to cost differences, but based on willingness to pay.

It's not price discrimination if the price difference reflects cost differences.

Types of Price Discrimination:

First-Degree (Perfect): Each customer is charged their maximum willingness to pay (e.g., car dealership negotiations).

Second-Degree: Price varies by quantity bought—bulk discounts or volume pricing.

Third-Degree: Prices vary across identifiable groups (e.g., student or senior discounts, peak vs. off-peak pricing).

What is third-degree price discrimination and what are the conditions for it to work effectively?

Third-degree price discrimination is the most common type. It involves charging different prices to distinct customer groups based on characteristics like age, income, or location.

To be effective, it requires:

Market Segmentation: The ability to separate the market into identifiable groups.

Different Elasticities: Each group must respond differently to price changes, so the firm can tailor prices and maximize profits.

Summarise monopoly

A monopoly is a dominant firm in an industry.

A monopolist faces a downward-sloping demand curve; the marginal revenue curve is below the demand curve.

In a monopoly, it is possible to earn abnormal profits (positive economic profits), even in the long run, due to barriers to entry.

Compared to a competitive firm, a monopoly charges higher prices and produces less output.

When price-discriminating, a higher price is charged where demand is more price inelastic.