Inflation and measures of money

1/14

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

15 Terms

Why is it important to measure the money that is circulating through India?

It is important to control the inflation.

Let’s say that the RBI realises that the supply of money or the money circulating is very high. This means that the value of money will decrease. So here what it does it, it increases the interest rate on loans. And through this the circulating money decreases. And therefore inflation is controlled.

What are the different type of deposits?

Demand deposits

Time deposits

Who has the prerogative to control the inflation?

It is the prerogative of RBI to control the inflation.

What is the difference between demand deposit and time deposit?

Demand deposit can be withdrawn anytime. There is not time of maturity as such.

Time deposit can only be withdrawn after a certain period of time. Once the deposit reaches maturity. If one wishes to withdraw it before maturity, he /she has to has to pay a penalty amount.

Define liquidity. Arrange the following in terms of degree of liquidity. Cash, Debit card, Gold, Land

The ease with which something can be converted into cash.

Cash>Debit card>Gold>Land

Cash is the most liquid.

Land is least liquid.

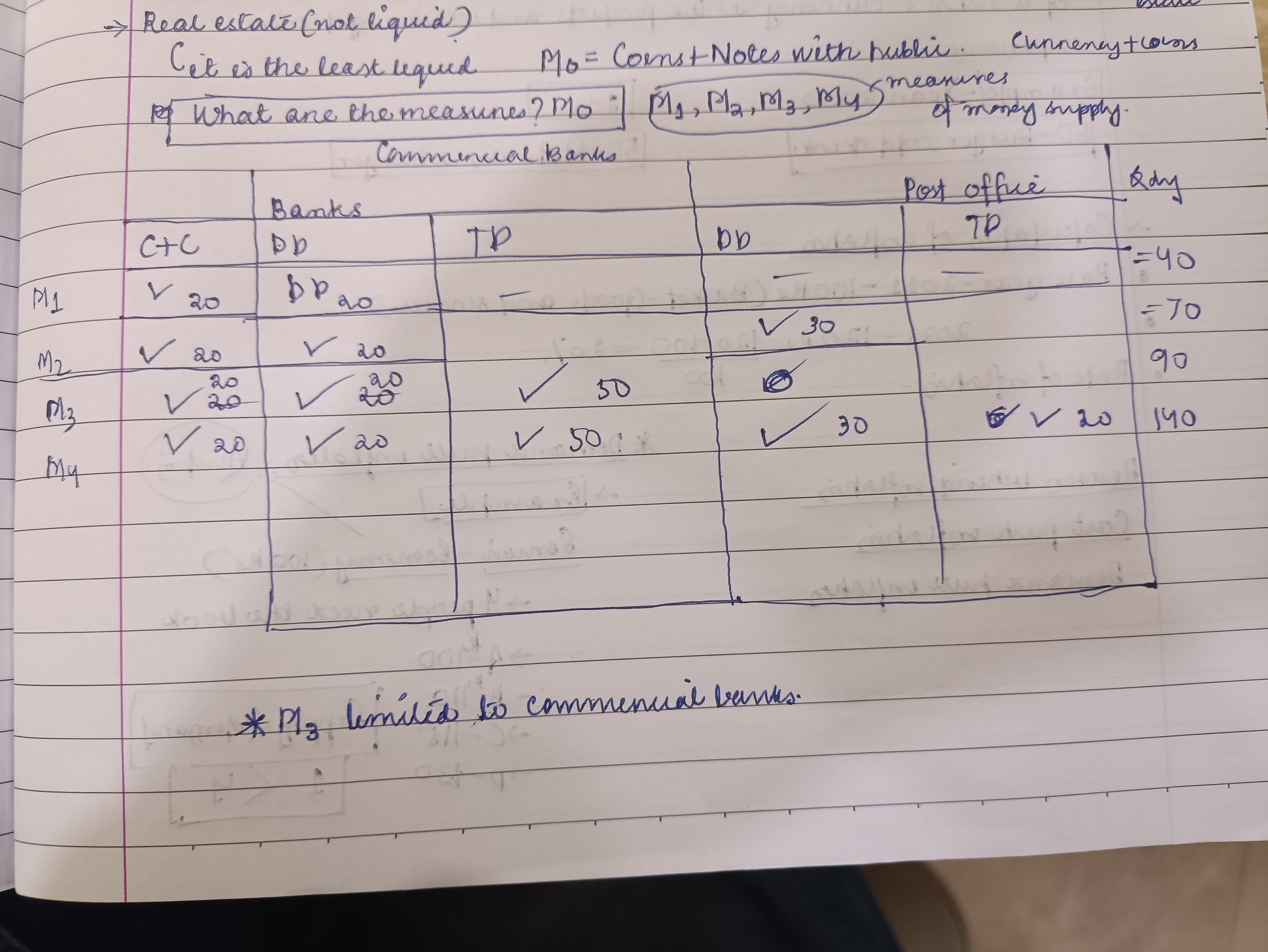

What are the measures of money supply?

M1

M2

M3

M4

Some rules to remember.

Liquidity is more in commercial banks than in post office.

Demand deposit is easily convertible into cash than time deposit.

Out of the four measures of money supply, name the least liquid and most liquid measures?

M1 is the most liquid as it only involves cash and demand deposit of commercial banks.

M4 is the least liquid as time deposits of both, commercial and post office banks are included in that. And in general, the moment post office banks are taken into account the liquidity decreases. Plus time deposits are not liquid at all as they cannot be converted into cash anytime.

Define inflation.

It is the persistent rise in the general price of goods and services of common or daily use-such as clothing, food, fuel

What does inflation indicate?

It indicates a decrease in the purchasing power of a unit of a nations currency as the products and services get more expensive.

Milk example.

What are the two types of inflation?

-Cost push inflation

-Demand pull inflation

Define demand pull inflation.

In certain cases, the sudden rise in demand for a product or service may increase its value, thereby increasing its cost.

Demand increases-Supply decreases-Value increases-Price increases.

Example-Sanitizers and others

Define cost push inflation.

The increase in price of a final good due to increase in cost of production.

Cost of production may increase due to three reasons

Increase in wages

Increase in profit margin

Increase in the price of raw material

Most countries are undergoing inflation. What is the reason in India?

Food for thought.

Time deposit and demand deposit??In which case interest is more?

In case of time deposit interest is more. As there is a sense of commitment from your side to keep the money for extended period of time.

On the other hand, demand deposits can be withdrawn any time . S