BUSN1001 End of semester Exam

1/120

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

121 Terms

Accrual accounting

a system in which transactions and events are recorded in the periods they occur, rather than in the periods the cash is received or paid. - Accounting standards require financial statements to be prepared on the basis of accrual accounting.

A cash accounting system

determine the performance as the difference between the cash received in relation to income items and the cash paid for expenses

Impairment loss

the overstatement of the carrying amount of an asset over its recoverable amount (i.e. the highest of the value in use and the net selling price). It does represent the loss in the asset's value during the reporting period.

Limitations of ratio analysis

1. Ratio comparisons between years for the same company can be misleading if company changes structure over time or if the companies use different accounting methods or operate in different industries or are substantially different.

the purpose of a statement of cash flow

To give additional information to assist decision makers in assessing an entity's ability to generate cash flows, meet financial commitments as they fall due, fund changes in scope and/or nature of activities or to obtain external finance.

The usefulness of a statement of cash flows:

1. To supplement the income statement in assessing company performance 2. To help identify problems of liquidity and solvency before they become apparent in the income statement. 3. To assist managers in managing the company's cash flows. 4. To understand how the company is investing its cash to sustain its growth, or how the company is obtaining cash by selling its non-current assets. 5. To reveal the sources of financing used to support the growth, and the use of cash to pay dividends and retire debt or equity

Operating activities

Activities relating to the provision of goods and services and other activities that are neither investing nor financing activities.

Examples of operating activities (inflows and outflows)

cash inflow: cash sales, receipts of interest or dividends or from customers. Cash outflow: payments to inventory suppliers, rent, electricity, salaries and wages, tax and interest

Investing activities

Activities that relate to the acquisition and/or disposal of non-current assets and investments that do not fall within the definition of cash.

examples of investing activities (inflows and outflows)

inflows; sale of PPE, investments, land, collection of sales. Outflows: purchase of PPE, investments such as stocks or securities, lending of money to other entities

Financing activities:

Activities that relate to changing the size and/or composition of the financial structure of the entity and borrowings that do not fall within the definition of cash.

examples of financing activities (inflows and outflows)

inflows: cash received from issuing of equity (shares), cash received from issuing of debt. Outflows: dividends, repayment of shares from shareholders the repayment of debt

The process of decision making

1. Identify all current available investment alternatives. 2. Select a decision-support tool and set the decision rule. 3. Collect the data necessary to make the decision. 4. Analyse the data. 5. Interpret the results in relation to the decision rule. 6. Make the decision.

Decision rule for ARR

accept the investment with the highest ARR at the time

advantages of ARR

simple to calculate, easy to understand consistent with the return on assets (ROA) measure

6 disadvantages of ARR

1. Importance of cash is ignored (businesses cannot survive without this) 2. Profits and costs may be measured in different ways for two project. Same ARR for two projects but with different timing of the profits 3. Time value of money is ignored 4. ARR can be increased artificially by considering the residual value of the project as 0 5. ARR may not be useful when considering and comparing competing projects of different sizes

Decision rule for payback period

The longer the payback period, the greater the risk

3 advantages of PP

1. Simple to calculate. 2. Easy to understand. 3. A crude measure of incorporating awareness of risk into the decision.

4 disadvantages of PP

1. Ignores all cash inflows after payback has occurred. 2. Less-profitable short-term investments may get approved. 3. Like ARR, PP is too simple to use as a decision support tool by itself. 4. Time value of money is ignored as it treats all cash inflows equally.

Decision rule for NPV

Invest in projects that have a positive NPV i.e. where PV of net cash flows > initial investment.

Factors in determining the discount rate

1. Inflation 2. Risk 3. Opportunity cost

3. Advantages of NPV

1. All of the expected cash flows are considered. 2. The timing of expected cash flows is considered: cash flows received sooner being more beneficial to the entity. 3. It is based on cash flows only, so is not subject to changing accounting rules and standards as profit figures are.

Practical issues in making decisions

1. collecting data 2/ taxation effects 3. finance 4. human resources 5. goodwill and future opportunities 6. social responsibility and care of the natural environment

3. Disadvantages of NPV

1. The method relies on the use of an appropriate discount factor for the circumstances. 2. The actual return in terms of the percentage of the investment outlay is not revealed. 3. Ranking of projects in terms of highest NPVs may not lead to optimum outcomes when capital is rationed.

current assets and three examples

the assets an entity expects to be able to convert into cash in the normal course of business within the next 12 months. E.g. cash, accounts receivable, inventory

Net Working capital

Current assets minus current liabilities.

Effective management of net working capital involves

maintaining liquidity, the need to earn the required rate of return on assets/ equity investors, monitoring the cost and risk of short-term funding

The hedging principle

means matching the maturity of funding with its use or cash flows. Used to achieve an appropriate level of net working capital

3 sources of funding

permanent, temporary, spontaneous

Why do entities manage cash (4 reasons)

1. the need to have sufficient cash to meet financial obligations 2. the timing of cash flows 3. the cost of cash 4. the cost of not having enough cash

Benefits of granting credit

increasing sales, reducing the cost of making sales e.g. counter staff

Costs of granting credit

opportunity of funds being tied up, cost of slow payers, bad debts, specialist collection services, cost of administering the system

3 Determinants of the level of accounts receivable

1. total sales 2. credit policies 3. Collection policies

Types of inventories

1. raw materials 2. Work in progress 3. finished goods

2 benefits of holding inventories

1. Sales and cross-sales are made and profits gained 2. goodwill built up and no-stock costs are avoided

Costs of holding inventories

1. ordering costs 2. holding costs

6 Most common sources of short-term finance for entities

1. accrued wages and taxes 2. Trade credit 3. Bank overdrafts 4. Commercial bills and promissory notes 5. Factoring or debtor/invoice/trade finance 6. Inventory loans or floor-plan finance

Novated leases

Involves a three-party agreement between an employee, an employer and a financial institution to provide a motor vehicle to the employee as part of a salary package.

Hire-purchase agreements

Involves a financial institution buying the equipment required by the customer then hiring it to the customer for use during the agreed period in return for hire/rental payments.

4 Leasing options and products

1. novated leases 2. hire-purchase agreements 3. finance leases 4. operating leases

finance leases

Non-cancellable contractual obligations to make payments in return for the use of an asset for the majority of its useful life.

Operating leases

contractual agreements that are cancellable upon given notice and tend to be of much shorter term than the useful life of the asset.

Ordinary shares

No fixed maturity date - but they can be consolidated or split.

Payments attached to ordinary shares are called dividends -

decided by directors out of profits. Ranked last in the event of the company winding up.

Preference shares

Hybrid form of capital but leans more towards equity than debt. Usually have a fixed rate of return in the form of dividends. Rank ahead of ordinary shares if company winds up.

2 Types of rights

1. Renounceable (investors are free to sell their rights to subscribe on the market). 2. Non-renounceable (cannot sell their rights)

Options vs rights

Rights issue: issue of new shares to existing shareholders. Options: confer the right to subscribe to shares in the future at a price and time which are pre-determined.

Hybrid debt securities and types

securities that have characteristics of both debt and equity. Convertible notes and convertible preference shares

Convertible notes

The notes are normally issued with conditions that are acceptable to the ATO under the legislation. The interest rate is fixed, note-holders, not issuers, decide when to convert notes to ordinary shares, conversion must take place between two and ten years from date of issue, so long as the note maturity is not less than two years.

Convertible preference shares

Preference shares that the owner can exchange for a certain number of ordinary shares. CPS generally do not convert to ordinary shares in a fixed ratio, such as one for one, or one for two, as was the case with convertible notes.

Direct investment

Capital invested in an enterprise by an investor that has significant influence over the key policies of the enterprise.

Portfolio investment

Break-even formula

total revenue-total costs= zero profit

Break-even units formula

fixed costs/ (revenue per unit- variable costs per unit)

contribution margin

total revenue- variable costs

Contribution margin ratio

Contribution margin per unit / Selling price per unit or Total contribution margin / Total sales

How to calculate units required to be sold to achieve a particular profit

Units = (fixed costs + desired profit) / Contribution margin per unit

sales mix formula

sales units of a product / total sales units

weighted average contribution margin per unit formula

Weighted average contribution margin per unit = (contribution margin per unit) x (sales mix)

Total break even units formula

fixed costs / total weighted average contribution margin per unit

Break even units for each product formula

total break-even units x sales mix

Margin of safety in units formula

Actual units of activity- units at break-even point

Margin of safety in revenues formula

Actual revenues- revenues at break-even point

Operating gearing/ leverage

relationship between the total fixed and the total variable costs for some activity or the total costs

An activity with relatively high fixed costs compared with its variable costs is said to have high operating gearing. More highly operating leveraged= more risky

What is relevant information for decision-making (3)

1. relevant costs and relevant income 2. incremental costs and incremental income 3. opportunity cost

Steps for accepting/ rejecting special ordered

1. enough capacity 2. expected profit if not accepting this offer (total contribution market- fixed costs) 2. Expected profit if accepting this offer (does it add incremental profit)

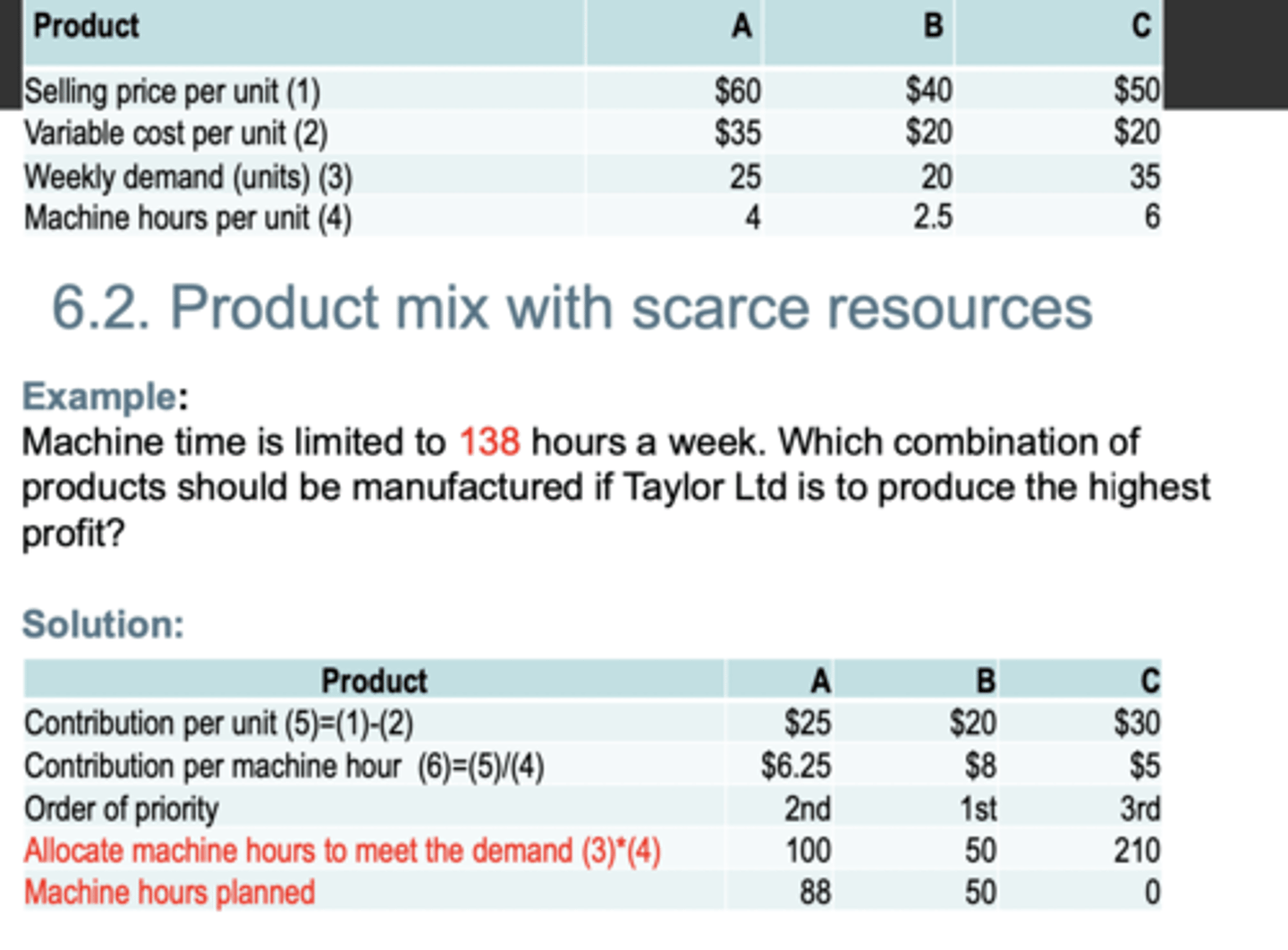

How to work out product mix with scare resources

1. find contribution per unit for each product 2. find contribution per hour 3. order from highest to lowest

contribution margin per unit formula

selling price per unit- variable cost per unit

financial accounting 3 characteristics

Prepared for outside users, Governed by accounting standards, Historical data/ Past transactions

Management accounting 3 characteristics

Prepared for internal users, No need to follow any rules/standards, Future oriented

Strategic planning (time span and 3 characteristics)

concerns longer term planning (typically, 3-5 years): Defines the general direction of the business over next five or so years. It is usually carried out by senior management. It commonly relates to broader issues such as business takeovers, expansion plans, deletion of business segments, and radical product/service development

Budgeting defintion

a process that focuses on the short term, commonly one year, and results in the production of budgets that set the financial framework for that period.

What is the role of budgeting

operationalise strategic plans and allow operational areas to understand how their area contributes to the entity's strategic objectives.

How does budgeting assist decision making (5)

1. putting into operation longer term plans

2. assessing the feasibility of strategic plans

3. setting targets for managers

4. identifying resource constraints in budget period

5. identifying periods of expected cash shortages and excess cash holdings

The budgeting process steps 1-4

1. Consideration of past performance

2. Assessment of expected trading and operating conditions

3. Preparation of initial budget estimates

4. Adjustment to estimates based on communication with, and feedback from, managers

The budgeting process steps 5-7

5. Preparation of budgeted reports and sub-budgets

6. Monitoring of actual performance against the budget over the budget period

7. Making any necessary adjustments to the budget during the budget period

what are the 10 different types of budgets

1. sales 2. operating 3. production and inventory budgets 4. purchases budget 5. Manufacturing overhead budget 6. budgeting income statement 7. cash budget 8. budgeted balance sheet 9. capital budgets 10. program budget

Sales (or fees) budget

sets expected levels of activity.

Operating (expense) budget

often departmental expense

budgets

Production and inventory budgets

(for manufacturing entities) —

sub-budgets relating to direct materials, direct labour (if any) and

indirect costs etc.

Purchases budget

sets the required purchases of inventory or

direct materials based on sales budget (and possibly the

production/inventory budgets).

Manufacturing overhead budget

focuses on estimating the

overheads or expenses associated with production activities.

Budgeted income statement

an aggregation of the other sub- budgets such as sales budget and operating expenses budget.

Cash budget

a statement of expected future cash receipts and cash payments.

Budgeted balance sheet

assets and liabilities at end of period

Program budget

a budget form commonly used in the

government and not-for-profit sector, where the focus is on costs associated with a specific program.

The behavioural aspect of budgeting and planning seeks to explore two key areas:

Relates to the 'style' of budgeting process used by the organisation, such as the extent of participation by managers in the annual budget process

Relates to the impact of the budget targets and plans on the behaviour, motivation and decision making of the manager

authoritarian style of budgeting 3 characteristics

1. senior management simply sets the targets and the budget for unit managers

2. unit managers have little say in the targets that are set

3. it may be that the expectations are unrealistic and the targets set by senior management (particularly in an authoritarian style process) are too high.

participative style of budgeting 3 characteristics

1. targets and budgets are arrived at by a process of discussion and negotiation

between senior management and unit managers

2. unit managers are seen to have had a say in the setting of targets and the budget

3. the targets may be set too low.

direct method of preparing the statement of cash flows

1. determine cash flows from operating activities 2. determine cash flows from investing activities 3. determine cash flows from financing activities 4. Calculate net cash flows and ending cash balance for the year

indirect method of preparing the statement of cash flows

step 5. reconcile cash from operating activities with operating profit step 6. complete notes to the statement of cash flows

cash from customers equation (step 1: cash flows from operating activities)

opening accounts receivable +sales - closing accounts receivable

inventory purchases equation (step 1: cash flows from operating activities)

cost of sales + closing inventory- opening inventory

cash paid to employees equation (step 1: cash flows from operating activities)

opening salary payable +salary expense - closing salary payable

cash paid to other suppliers equation (step 1: cash flows from operating activities)

other expense + (closing prepayments - opening prepayments) - (closing accruals - opening accruals)

cash received equation (step 1: cash flows from operating activities)

opening receivable +revenue -closing receivable

cash paid equation (step 1: cash flows from operating activities)

opening payable +expense - closing payable

Cash paid to inventory suppliers equation (step 1: cash flows from operating activities)

opening accounts payable + inventory purchases - closing accounts payable

Proceeds from sale of PPE (step 2: cash flows from investing activities)

Proceeds from sale of PPE = carrying amount of PPE sold + / - Gain/ Loss on sale

closing PPE balance (net) equation (step 2: cash flows from investing activities)

Opening PPE balance (net) + acquisition cost - depreciation expense - carrying amount of PPE sold

closing loans receivable equation (step 2: cash flows from investing activities)

Opening loans receivable + new loans made - collections