Ch 26 - Exchange Rates

An exchange rate is the price of one currency expressed in terms of another currency

- determines how much of one currency has to be given up in order to buy a specific amount of another currency

3 types of exchange rates: fixed, floating, managed

- Fixed exchange rate: value of a currency is fixed to the value of another country

- central bank and the government decides this

- if it increases, revaluation

- if it decreases, devaluation

As supply increases, the price would fall so the government has to do something to bring up the value to that of the dollar → excess demand

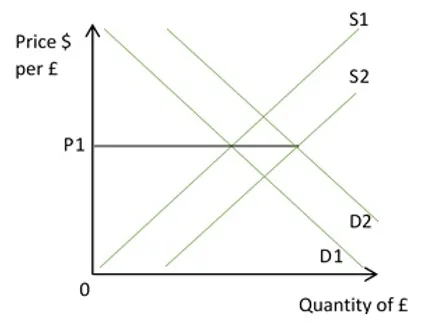

Floating exchange rate: the exchange rate between two currencies is the price of one in terms of the other

- value of currency can appreciate or depreciate

- set by private market through demand and supply

- Changes occur as demand increases of a country’s exports

- Domestic demand for import increases then the domestic currency is more likely to depreciate

Monetary exchange rate: the government usually sets a range between which the exchange rate should remain. It is the currency in which value and exchange rates are influenced by intervention from a central bank

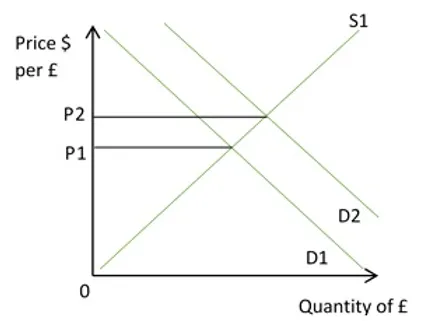

Appreciation: increase in the value of the exchange rate in comparison to other currencies operating within a floating rate system

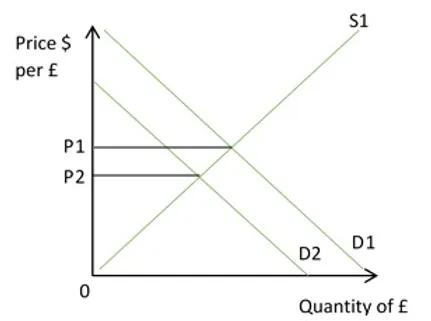

Depreciation: decrease in the value of the exchange rate in comparison to other currencies operating in a floating exchange

Overvaluation: A company is considered overvalued if it trades at a rate that is unjustifiably and significantly in excess of its peers

- imports are cheaper in local currency, so there is downward pressure on the inflation rate

- exports become more expensive so export industries receive more profits

- balance of payments worsens due to fewer exports and greater imports

Balance of payments: the current account balance tends to worsen when the currency appreciates because exports become more expensive in comparison to imports. Therefore, the demand for exports usually falls, whilst the demand for cheaper imports increases

Undervaluation: a security or other type of investment that is selling in the market for a price presumed to be below the investment's true intrinsic value.

- when a currency’s value in foreign exchange is low

- exports become cheaper so export industry grows

- Imports become more expensive, results in imported cost push inflation as raw materials and intermediate goods are more costly

- balance of payments improves so exports increase and imports fall

The effects of exchange rate changes

- Employment: unemployment may increase as a result of appreciation because this would increase the relative price for exports and therefore reduce the demand for exports. In turn, exporters’ profits would deteriorate and the export industry may shrink.

- Inflation: if the currency appreciates and this results in unemployment, then consumption would likely decrease. This may then lead to a reduction in demand pull inflation. In addition, if the economy relies on intermediate goods, like oil, then the higher exchange rate could help to lower cost push inflation.

- Economic growth: as a result of falling exports and higher unemployment, appreciation is likely to lead to lower rates of economic growth in the long run.