Chapter 2 - Investing and Financing Decisions and the Accounting System

1/41

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

42 Terms

primary objective of financial reporting to external users

to provide financial information about the reporting entity that is useful to existing and potential investors, lenders, and other creditors in making decisions about providing resources to the entity

relavant information

information that can influence a decision; it has predictive and/or feedback value

faithful representation

requires that the information be complete, neutral, and free from error

three assumptions for balance sheets

-separate entity assumption

-going concern assumption

-monetary unit assumption

separate entity assumption

states that business transactions are separate from the transactions of the owners

going concern assumotion

states that businesses are assumed to continue to operate into the foreseeable future (also the continuity assumption)

monetary unit assumption

states that accounting information should be measured and reported in the national monetary unit without any adjustment for changes in purchasing power

mixed attribute measurement model

applied to measuring different assets and liabilities of the balance sheet

cost (historical cost)

most balance sheets are recorded at their historical cost- cash equivalent value of an asset on the date of the transaction

assets

probable future economic benefits owned by the entity as a result of past transactions (most companies list assets in order of liquidity)

four financial statements

balance sheet, income statement, statement of stockholders equity, statement of cash flows

current assets

cash and other assets expected to be exchanged for cash or consumed within a year

noncurrent assets

long-term investments, plant assets, intangible assets

liabilities

probable future sacrifices of economic benefits arising from present obligations of a particular entity to transfer assets or provide services to other entities in the future as a result of past transactions or events (usually listed on balance sheet in order of maturity, how soon an obligation is to be paid)

creditors

entities that a company owes money to

current liabilities

liabilities due within a short time, usually within a year

noncurrent liabilities

obligations that a company does not expect to pay within one year

stockholders' equity/shareholders' equity/ owners' equity

the financing provided by the owners and the operations of the business

contributed capital

financing provided by owners (owners invest in the business by providing cash and sometimes other assets, receiving in exchange shares of stock as evidence of ownership)

earned capital/retained earnings

financing provided by operations (portion of profits reinvested in business)

transaction

(1) An exchange between a business and one or more external parties to a business or (2) a measurable internal event such as the use of assets in operations.

what to record on balance sheet

only economic resources and obligations resulting from past transactions

external events

exchanges of assets, goods, or services by one party for assets, services, or promises to pay (liabilities) from one or more other parties

ex. purchasing of a machine from a supplier

internal events

certain events that are not exchanges between the business and other parties but nevertheless have a direct and measurable effect on the entity

Ex. using up insurance paid in advance and using buildings and equipment over several years

is signing a contract considered a transaction?

no

account

a standardized format that organizations use to accumulate the dollar effect of transactions on each financial statement item

chart of accounts

a list of accounts used by a business

transaction analysis

the process of identifying the specific effects of economic events on the accounting equation

two principles underlying the transaction analysis process

-every transaction affects at least two accounts; correctly identifying those accounts and the direction of the effect (whether an increase or a decrease) is critical

-the accounting equation must remain in balance after each transaction

dual effects concept

the idea that every transaction has at least two effects on the basic accounting equation

balancing equation

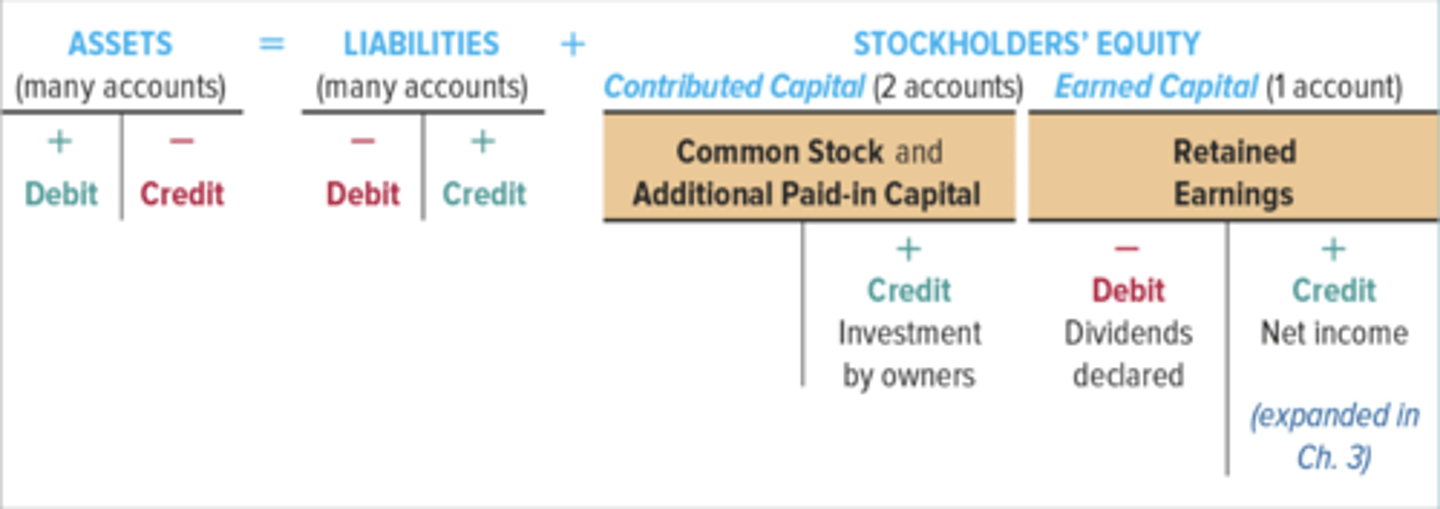

assets = total liabilities + stockholders' equity

investing

company typically buys or sells its noncurrent assets . as well as investments (current or noncurrent)

financing

activities in which the company borrows or repays loans (typically from banks) and sells or repurchases its common stock and pays dividends (activities with stockholders)

par value

a value assigned to a share of stock and printed on the stock certificate

common stock

Term used to describe the total amount paid in by stockholders for the shares they purchase.

additional paid in capital/contributed capital

the excess of amounts paid in over the par or stated value

accounting cycle

process used by entities to analyze and record transactions, adjust the records at the end of the period, prepare financial statements, and prepare the records for the next cycle

general journal

listing in chronological order for each transaction's effects

general ledger

a record or effects to and balances of each amount

T accounts

An accounting device used to analyze transactions. shows direction of . effects. increases in asset accounts are on the left. increases in liabilities and stockholders' equity accounts are on the right.

debt

left side of an account

credit

right side of an account