the financial sector

0.0(0)

0.0(0)

Card Sorting

1/134

Earn XP

Description and Tags

Study Analytics

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

135 Terms

1

New cards

define financial markets

any place or system that provides buyers and sellers the means to exchange goods/services and trade financial instruments

2

New cards

define capital markets

financial markets which provide long-term borrowing and lending

3

New cards

define commercial banks

banks that provide services to businesses

4

New cards

define derivatives

financial instruments based on the values of other financial instruments

5

New cards

define equity

in a company, is the value of assets owned by the shareholders

6

New cards

define investment banks

banks that engage in a variety of activities in different financial markets, such as the foreign exchange market, the money markets, the capital markets and the derivatives markets

7

New cards

define money market

financial markets that provide short-term borrowing and lending, usually defined as up to one year

8

New cards

define retail banks

banks that provide services to individuals

9

New cards

define global financial crisis

period of negative economic growth that lasts for two successive quarters globally.

a severe worldwide economic crisis that occurred 2007-08 due to excessive lending of subprime mortgages

a severe worldwide economic crisis that occurred 2007-08 due to excessive lending of subprime mortgages

10

New cards

define speculation

prediction on what the financial market will look like in the future.

a financial transaction that has a high risk of losses but also with the expectation of substantial gain

a financial transaction that has a high risk of losses but also with the expectation of substantial gain

11

New cards

define market rigging

a group of individuals/institutions collide to fix prices or exchange info that will lead to gains for themselves at the expense of other participants in the market

12

New cards

define market bubble

when the price of an asset is driven to an excessive high and then collapses.

exponential growth

exponential growth

13

New cards

define commodities

shares in agricultural, energy products and mental (also soft commodities - sugar, cotton, coffee)

14

New cards

define assets

any resource that can provide future economic benefits (e.g. paintings, property, shares, limited edition Nikes?)

15

New cards

define futures/forwards market

an agreement to buy a share or a commodity at an agreed future date and price.

16

New cards

define negative equity

when your property becomes worth less than the remaining value of your mortgage

17

New cards

define financial market failure

a misallocation of resources resulting in the under or over consumption and supply of financial products such as loans and shares.

This may be due to market rigging, market bubble, asymmetric information and moral hazard

This may be due to market rigging, market bubble, asymmetric information and moral hazard

18

New cards

define central bank

A central bank is a financial institution in a country, typically responsible for printing and issuing notes and coins.

it also holds gold

it also holds gold

19

New cards

define lender of last resort

usually a function of central banks, it occurs when financial institutions can obtain money from the central bank to balance their accounts when they are unable to do this from the financial markets in which they operate

20

New cards

define shadow banking

parts of the financial market that are either much less regulated than the norm or are completely unregulated

21

New cards

define systematic risk

in the context of financial markets, the danger that the failure of parts of the financial system will lead to the collapse of the whole financial system

22

New cards

what are financial markets?

* any convenient set of arrangements where buyers and sellers can buy or trade a range of services or assets that are fundamentally monetary in nature

* they’re different from product markets or factor markets

* they’re different from product markets or factor markets

23

New cards

why do financial markets exist?

1. provide services demanded by households, firms and govt

2. allow participants to speculate and realise financial gains

1. eg foreign exchange traders betting on which way a currency might move in the next few seconds

24

New cards

why are financial markets prone to regular crises?

the combination of speculation and provision of services means financial markets are prone to regular crises which cause damage to the real economy

25

New cards

name some financial products

* crypto

* premium bonds

* housing market

* shares

* premium bonds

* housing market

* shares

26

New cards

what is crypto?

* Bitcoin (BTC) is a cryptocurrency, a virtual currency designed to act as money and a form of payment outside the control of any one person, group, or entity, thus removing the need for third-party involvement in financial transactions.

* It is rewarded to blockchain miners for the work done to verify transactions and can be purchased on several exchanges.

* It is rewarded to blockchain miners for the work done to verify transactions and can be purchased on several exchanges.

27

New cards

what are the advantages of crypto?

* cheaper transfers

* faster transfers

* don’t collapse

* greater liquidity as more companies accept it as payment for goods eg tesla

* protection from payment fraud

* faster transfers

* don’t collapse

* greater liquidity as more companies accept it as payment for goods eg tesla

* protection from payment fraud

28

New cards

what are the disadvantages of crypto?

* no government regulation

* irreversible (no returns)

* limited use

* volatility in prices

* irreversible (no returns)

* limited use

* volatility in prices

29

New cards

what are the advantages of premium bonds?

* backed up by the treasury

* reducing risk of losses

* reducing risk of losses

30

New cards

what are the disadvantages of premium bonds?

* no interest earnt

* growth in competition for bonds

* growth in competition for bonds

31

New cards

what are the advantages of the housing market?

* wealth effect

32

New cards

what are the disadvantages of the housing market

* high costs including stamp duty and renovations

33

New cards

what are the advantages of shares?

* can appreciate in value, particularly when economic growth is high and businesses are experiencing high profits

34

New cards

what are the disadvantages of shares?

* volatile prices which fluctuate regularly

* high risk as share values can depreciate and potentially be less than what you paid for them

* high risk as share values can depreciate and potentially be less than what you paid for them

35

New cards

what are the 6 roles of financial markets

1. saving

2. spending / facilitating the exchange of goods and services

3. borrowing

4. provide forward markets

5. provide a market for equities

6. provide insurance

36

New cards

how do financial markets allow people to keep savings?

* storing money for future use is essential for households & firms. Provides a pool of money that financial institutions can lend.

* financial assets, eg money or stocks and shares, are a way of transferring spending from the present into the future

* financial assets, eg money or stocks and shares, are a way of transferring spending from the present into the future

37

New cards

how do financial markets allow for spending /facilitating the exchange of goods and services?

* Google Pay, debit cards, credit cards, bank transfers and exchanging currency.

* financial institutions play a vital role in creating payments systems for goods and services

* eg central banks, mint coins and print paper money

* more hidden from view are institutions which process trillions of cheque transactions per year

* firms might use a factor which is a company that offers a variety of services, most important being paying now for goods and services which have been delivered to another company and where the payment is only due in the future

* financial institutions play a vital role in creating payments systems for goods and services

* eg central banks, mint coins and print paper money

* more hidden from view are institutions which process trillions of cheque transactions per year

* firms might use a factor which is a company that offers a variety of services, most important being paying now for goods and services which have been delivered to another company and where the payment is only due in the future

38

New cards

how do financial markets allow for borrowing?

* access to credit is a key requirement for economic growth & development.

* Purchase assets and repay over a long period of time (e.g. mortgages).

* households, firms and govts all borrow

* Purchase assets and repay over a long period of time (e.g. mortgages).

* households, firms and govts all borrow

39

New cards

how do financial markets provide forwards markets?

* in currencies & commodities: forward markets are also called futures markets.

* They provide some price stability in commodity markets & enable investors to make a profit by speculating on future price.

* foreign exchange such as dollars or euros can be bought and sold forward too

* They provide some price stability in commodity markets & enable investors to make a profit by speculating on future price.

* foreign exchange such as dollars or euros can be bought and sold forward too

40

New cards

how do financial markets provide a market for equities?

* equities are shares in public companies that are listed on stock exchanges around the world.

* Financial markets facilitate both long term investment & speculation by providing platforms which connect buyers & sellers e.g. E-Trade

* issuing shares, or equity finance, can be an important way in which growing companies can finance their expansion

* those buying new shares will get a share of profits made by the company

* few would buy new shares if they could never sell them again as locking up money forever in shares would be a great risk

* not being able to sell means shares would be completely illiquid

* stock markets provide a way to sell shares to other in order to create liquidity

* they greater the number of shares issued, and the more buyers and sellers in the market, the greater the liquidity

* having markets for second-hand shares encourages buyers to purchase new shares when they become available

* Financial markets facilitate both long term investment & speculation by providing platforms which connect buyers & sellers e.g. E-Trade

* issuing shares, or equity finance, can be an important way in which growing companies can finance their expansion

* those buying new shares will get a share of profits made by the company

* few would buy new shares if they could never sell them again as locking up money forever in shares would be a great risk

* not being able to sell means shares would be completely illiquid

* stock markets provide a way to sell shares to other in order to create liquidity

* they greater the number of shares issued, and the more buyers and sellers in the market, the greater the liquidity

* having markets for second-hand shares encourages buyers to purchase new shares when they become available

41

New cards

how do financial markets provide insurance?

* in return for a premium, an insurance company will pay out the cost of damage if the event takes place

42

New cards

what types of financial institutions are there?

* in the UK, Europe and US, the largest banks are combined retail, commercial and investment banks

* there are also independent ones too

* there are also independent ones too

43

New cards

what are retail banks?

* banks which provide a variety of services to individuals

* wages or benefits are paid into the account

* withdrawals can be made in cash

* regular bills can be paid using standing orders and direct debits

* a variety of saving accounts will be offered giving interest

* wages or benefits are paid into the account

* withdrawals can be made in cash

* regular bills can be paid using standing orders and direct debits

* a variety of saving accounts will be offered giving interest

44

New cards

what services do retail banks offer?

they provide services from overdrafts, loans and mortgages to credit cards, foreign exchange and insurance

45

New cards

how do retail banks make a profit?

* they make a profit out of borrowing money at low rates of interest or zero rates of interest and lending it out again at higher rates of interests

* they also charge for their services

* eg building societies traditionally offer a narrow range of services, taking in money from savers and lending it out again purely to purchase a house through a mortgage

* they also charge for their services

* eg building societies traditionally offer a narrow range of services, taking in money from savers and lending it out again purely to purchase a house through a mortgage

46

New cards

what do commercial banks do?

* provide services to businesses

* they borrow from businesses, allowing hem a secure place to put their funds

* they provide ways for firms to receive money

* firms can borrow money on overdraft or by taking out a loan

* they borrow from businesses, allowing hem a secure place to put their funds

* they provide ways for firms to receive money

* firms can borrow money on overdraft or by taking out a loan

47

New cards

what do investment banks do?

* trade in foreign exchange, commodities, bonds and shares

* trade in derivatives

* eg a forward contract to buy a commodity

* in the run up to the 2007-08 financial crisis, investment banks created a range of derivative products that contained risks that were little understood by some key buyers

* they advise companies on how to raise money, including the issuing of new shares

* they advise on mergers and takeovers of companies

* trade in derivatives

* eg a forward contract to buy a commodity

* in the run up to the 2007-08 financial crisis, investment banks created a range of derivative products that contained risks that were little understood by some key buyers

* they advise companies on how to raise money, including the issuing of new shares

* they advise on mergers and takeovers of companies

48

New cards

what do saving vehicles do?

* help individuals make a return on their savings

* pension funds organise long-term saving and provide an annuity in return for a cash sum

* assurance companies provide long-term saving, getting savers to save in regular amounts each month

* unit trust and investment trust companies invest savers’ money mainly in shares

* private equity and hedge funds specialise in riskier investments including stocks, shares, currency and commodity markets

* pension funds organise long-term saving and provide an annuity in return for a cash sum

* assurance companies provide long-term saving, getting savers to save in regular amounts each month

* unit trust and investment trust companies invest savers’ money mainly in shares

* private equity and hedge funds specialise in riskier investments including stocks, shares, currency and commodity markets

49

New cards

who work as speculators?

* primary purpose of an investment bank is to speculate

* smaller firms / sole traders whose sole purpose is to speculate on financial markets

* eg hedgers, day traders, margin traders, arbitrageurs and dealers

* smaller firms / sole traders whose sole purpose is to speculate on financial markets

* eg hedgers, day traders, margin traders, arbitrageurs and dealers

50

New cards

what do insurance companies do?

* provide insurance against risks by charging customers a premium

51

New cards

what are the six types of markets?

1. money markets

2. capital markets

3. foreign exchange markets

4. commodity markets

5. derivatives markets

6. insurance markets

52

New cards

how do money markets work?

* provides short-term (

53

New cards

how do capital markets work?

* provide longer-term (1yr>) financing

* main assets traded are bonds (stocks) and shares

* bonds are long-term loans issued by firms and govt

* the UK National Debt is mostly made up of bonds

* they can be traded second hand on bond markets and they can therefore sell their bonds before the date when the issuer will repay the money

* stock markets can list companies which means their second hand shares are traded there

* over past 20yrs, bonds and shares have been traded more outside official stock markets like LSEG or NYSE

*

* main assets traded are bonds (stocks) and shares

* bonds are long-term loans issued by firms and govt

* the UK National Debt is mostly made up of bonds

* they can be traded second hand on bond markets and they can therefore sell their bonds before the date when the issuer will repay the money

* stock markets can list companies which means their second hand shares are traded there

* over past 20yrs, bonds and shares have been traded more outside official stock markets like LSEG or NYSE

*

54

New cards

how do foreign exchange markets work?

* where different currencies are traded

* could be spot markets where currency is traded now or forward markets where currencies contracts are made for some time in the future

* a small fraction of trades represent demand and supply for currency arising from physical transactions eg from going on holiday

* there are transactions that relate to transfers of money between countries eg foreign direct investment

* almost all dealings on foreign exchange markets are speculative with financial institutions trying to make short-term profit

* could be spot markets where currency is traded now or forward markets where currencies contracts are made for some time in the future

* a small fraction of trades represent demand and supply for currency arising from physical transactions eg from going on holiday

* there are transactions that relate to transfers of money between countries eg foreign direct investment

* almost all dealings on foreign exchange markets are speculative with financial institutions trying to make short-term profit

55

New cards

what do commodity markets do?

* eg London Metal Exchange

* contracts may be spot or futures contracts

* some contracts are for delivery of real commodities

* other contracts are simply bets on future prices

* most contracts are speculative

* contracts may be spot or futures contracts

* some contracts are for delivery of real commodities

* other contracts are simply bets on future prices

* most contracts are speculative

56

New cards

what do derivatives markets do?

* markets which trade financial instruments based on the values of other financial instruments

* many capital market, foreign exchange and commodity market transactions are derivatives

* they can reduce financial risks in markets

* many capital market, foreign exchange and commodity market transactions are derivatives

* they can reduce financial risks in markets

57

New cards

how did derivatives market cause the 2008 financial crisis?

* 2007-08 financial crisis showed they can be destabilising

* clients of investment banks were being sold derivatives they thought were low risk when they were actually high risk

* investment banks were creating new derivatives without fully understanding the risks they could create for markets

* clients of investment banks were being sold derivatives they thought were low risk when they were actually high risk

* investment banks were creating new derivatives without fully understanding the risks they could create for markets

58

New cards

what do insurance markets do?

* reinsurance market is where an insurer reduces its risk on the insurance it has sold by itself taking out insurance on this risk

* eg an insurer may sell 20% of all house insurance policies in Jamaica which is a risk as Jamaica is prone to natural disaster, so the insurer sells 3/4 of the insurance liability to another 15 insurance companies

* no insurance company now carries too much risk in case of disaster

* eg an insurer may sell 20% of all house insurance policies in Jamaica which is a risk as Jamaica is prone to natural disaster, so the insurer sells 3/4 of the insurance liability to another 15 insurance companies

* no insurance company now carries too much risk in case of disaster

59

New cards

give examples of market failure

* financial crashes

* financial institutions defrauding customers

* overpricing products

* selling products to customers that they don’t need

* rigging markets in their favour

* without government intervention, consumption and/or supply may be too high or too little

* financial institutions defrauding customers

* overpricing products

* selling products to customers that they don’t need

* rigging markets in their favour

* without government intervention, consumption and/or supply may be too high or too little

60

New cards

what is asymmetric information?

* when financial institutions have more knowledge than their customers or more knowledge compared to rival financial institutions

* financial institutions and regulations can have different amounts of information

* financial institutions have little incentive to help regulators understand their businesses as it’s in their interests to get regulators to see their business from their POV

* financial institutions have proved to be very powerful and successful political lobbyists to ensure the power of regulators is minimised

* financial institutions and regulations can have different amounts of information

* financial institutions have little incentive to help regulators understand their businesses as it’s in their interests to get regulators to see their business from their POV

* financial institutions have proved to be very powerful and successful political lobbyists to ensure the power of regulators is minimised

61

New cards

how was asymmetric information used in the UK between 1990s-2000s?

* eg in 1990s-2000s, UK banks sold tens of millions of insurance contracts to customers who were taking out a loan, a mortgage or a credit card.

* but failed to find out whether the insurance was appropriate for customers.

* customers didn’t understand what they were being sold and didn’t realise they could buy the same product for a fraction of the price

* PPI

* but failed to find out whether the insurance was appropriate for customers.

* customers didn’t understand what they were being sold and didn’t realise they could buy the same product for a fraction of the price

* PPI

62

New cards

how was asymmetric information used to stimulate the 2008 financial crisis?

* eg in the US, a bank would give a mortgage to a homeowner which would then be sold off to another financial company who would buy other mortgages to create a collection or pool of mortgages.

* the mortgages represented an asset to the financial company since homeowners owed it money and were making regular payments.

* the company could sell the rights to that stream of income.

* some sold subprime mortgages.

* sellers of securities made it difficult for buyers to understand what they were buying

* securitisation in the USA of mortgages

* the mortgages represented an asset to the financial company since homeowners owed it money and were making regular payments.

* the company could sell the rights to that stream of income.

* some sold subprime mortgages.

* sellers of securities made it difficult for buyers to understand what they were buying

* securitisation in the USA of mortgages

63

New cards

how is the asymmetric information for credit cards fixed?

looking at past credit history and evidence of a reliable salary

64

New cards

how is the asymmetric information for loans fixed?

fixed by: job security, rate of interest

65

New cards

what may be consumers be unaware of when trying to take out a loan?

* interest rates

* length of loan

* consequences of not repaying the loan

* length of loan

* consequences of not repaying the loan

66

New cards

what might banks be unaware of when giving out a loan?

* customer’s incomes

* previous credit history

* previous credit history

67

New cards

how does asymmetric information come about in the financial sector?

One problem with the financial sector is that financial institutions often have more knowledge compared to their customers , both consumers and other institutions.

68

New cards

what are the consequences of asymmetric information?

financial institutions can sell consumers and other institutions products that they do not need, are cheaper elsewhere or are riskier than the buyer realises.

69

New cards

what was the asymmetric information involved in the global crisis of 2008?

* This was partially caused by banks selling packages of prime and subprime mortgages, but advertising them as all prime mortgages.

* Impact - Those buying these packages suffered from asymmetric information and it is

* unlikely they would have bought them if they knew the risk involved.

* overconsumption of loans → home repossessions → people having poor credit histories → fall in consumption and investment → fall in AD

* Impact - Those buying these packages suffered from asymmetric information and it is

* unlikely they would have bought them if they knew the risk involved.

* overconsumption of loans → home repossessions → people having poor credit histories → fall in consumption and investment → fall in AD

70

New cards

how do financial institutions and regulators make asymmetric information worse?

* The institutions have little incentive to help regulators understand their business and this causes difficulties

* for the regulators so may allow institutions to undertake harmful activities.

* for the regulators so may allow institutions to undertake harmful activities.

71

New cards

what is moral hazard?

* when an economic agent makes decisions in their own best interest knowing that there are potential adverse risks and that the cost will be partly borne by other economic agents

* Moral hazard can lead to destabilisation of financial markets, as well as to the loss of trust from investors, regulators and the public.

* Moral hazard can lead to destabilisation of financial markets, as well as to the loss of trust from investors, regulators and the public.

72

New cards

what are the three ways of reducing moral hazard?

1. encourage the risk-taking party to act more responsibly by offering incentives

2. institute policies that discourage immoral behaviour by making it punishable

3. regular monitoring allows the at-risk party to remain aware of whether or not the other party is taking advantage of them

73

New cards

what are the four ways moral hazard can occur?

* Too-big-to-fail

* Guaranteed returns

* Complex financial products

* Short term focus

* Guaranteed returns

* Complex financial products

* Short term focus

74

New cards

give an example of how moral hazard can occur in investment banking?

* in investment banking, traders/senior executives can earn large bonuses for generating profits → encourages short-term risks without considering long-term

* there is widespread knowledge of risk, but, incentives encourage the making of short-term profit instead of long term risk

* there is widespread knowledge of risk, but, incentives encourage the making of short-term profit instead of long term risk

75

New cards

give an example of moral hazard in the 2008 financial crisis?

financial institutions were accused of pursuing short-term profit by taking risks bc they knew that if things went wrong, they would be bailed out by their govt

76

New cards

give an example of RBS using moral hazard?

* government became a shareholder when RBS nearly ran out of cash

* Banks over lending and falling below their reserve ratios, knowing the government may bail them out

* Banks over lending and falling below their reserve ratios, knowing the government may bail them out

77

New cards

give an example of moral hazard being used in the underwriting of loans?

* overconsumption of loans as they know another party will cover these losses.

* in some cases loans are underwritten/guaranteed by govts or other bodies

* in some cases loans are underwritten/guaranteed by govts or other bodies

78

New cards

what should banks do instead of moral hazard?

better off running a bank more cautiously but also earning lower yearly profit

79

New cards

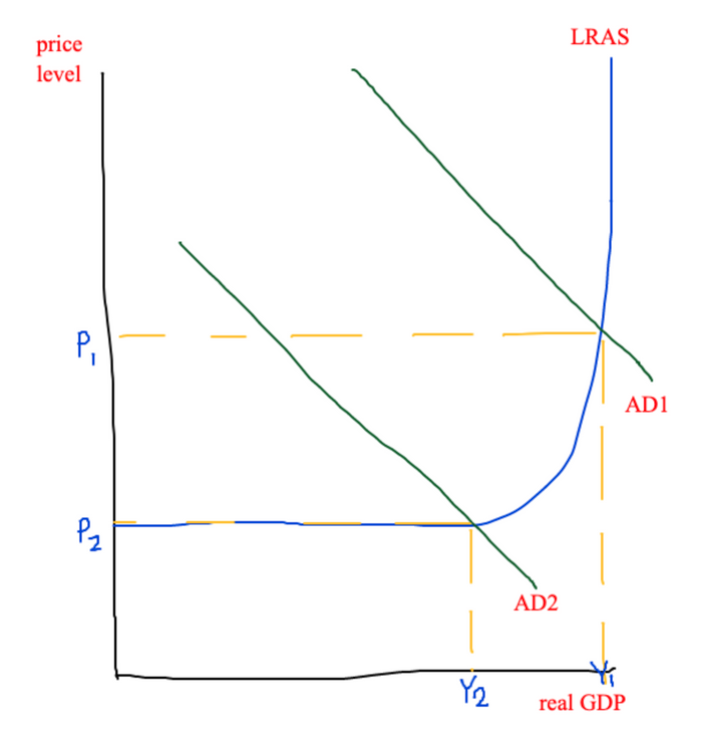

draw an AD-AS diagram of what happens in a market bubble

80

New cards

how does a market bubble occur?

* a market bubble occurs when the price of an asset is driven to an excessive high and then collapses

* they’re often caused by herding behaviour

* This causes panic and investors try and sell their assets. It results in a loss of confidence and it can lead to economic decline or a depression.

* Almost all trading in financial markets is *speculative* and this leads to the creation of market bubbles, where the price of a particular assets rises massively and then falls.

* They tend to occur because investors see the price of an asset is rising and so decide to purchase this asset as they believe the price will continue to rise and will profit them in the future.

* they’re often caused by herding behaviour

* This causes panic and investors try and sell their assets. It results in a loss of confidence and it can lead to economic decline or a depression.

* Almost all trading in financial markets is *speculative* and this leads to the creation of market bubbles, where the price of a particular assets rises massively and then falls.

* They tend to occur because investors see the price of an asset is rising and so decide to purchase this asset as they believe the price will continue to rise and will profit them in the future.

81

New cards

how do market bubbles collapse?

* investors see prices of an asset rising, some decide that this is an indication that prices will rise further and so they buy into the market → more investors become convinced that they must buy → price becomes too high so investors decide to realise their profits and sell for the price to begin falling → panic and lots of investors try selling → price collapse

* investors base their actions on what others are doing rather than looking at the underlying value of an asset

* investors base their actions on what others are doing rather than looking at the underlying value of an asset

82

New cards

give an example of market bubbles collapsing in the housing market

* by lending too much into the property market, financial institutions have created too much demand for houses → unsustainable increases in house prices → bubble burst (eg large interest rates) → more difficult for those with existing mortgages to make repayments → increased defaults on debts → reduces demand for new mortgages → fall in demand for houses → fall in house prices → negative equity → some households default → fall in real spending in the economy

* UK is prone to housing bubbles as too few new houses are built and a high proportion of households own their own houses.

* BUT 1980s-90s Japan experienced a housing bubble due to 20yrs of low economic growth

* UK is prone to housing bubbles as too few new houses are built and a high proportion of households own their own houses.

* BUT 1980s-90s Japan experienced a housing bubble due to 20yrs of low economic growth

83

New cards

what was the dot-com crash? (market bubble)

* 1997-00 dot-com bubble in stock market valuations of new internet companies

* The dot com crash was triggered by the rise and fall of technology stocks.

* The growth of the Internet created a buzz among investors, who were quick to pour money into startup companies.

* These companies were able to raise enough money to go public without a business plan, product, or track record of profits.

* These companies quickly ran through their cash, which caused them to go under.

* The dot com crash was triggered by the rise and fall of technology stocks.

* The growth of the Internet created a buzz among investors, who were quick to pour money into startup companies.

* These companies were able to raise enough money to go public without a business plan, product, or track record of profits.

* These companies quickly ran through their cash, which caused them to go under.

84

New cards

how did stock market bubble burst lead to the wall street crash?

* unsustainable rise in stock market prices in the US led to 1929 Wall Street crash

* The main cause of the Wall Street crash of 1929 was the long period of speculation that preceded it, during which millions of people invested their savings or borrowed money to buy stocks, pushing prices to unsustainable levels.

* The Fed (central bank) raised interest rates and combined with a recession, stock market activity experienced a downturn.

* The main cause of the Wall Street crash of 1929 was the long period of speculation that preceded it, during which millions of people invested their savings or borrowed money to buy stocks, pushing prices to unsustainable levels.

* The Fed (central bank) raised interest rates and combined with a recession, stock market activity experienced a downturn.

85

New cards

what happens when the housing market bubble bursts?

* in the housing market by lending too much in mortgages and increasing demand for houses.

* When this bubble bursts, for example due to a rise in real interest rates, there is a fall in demand for houses and a negative wealth effect, reducing AD, and banks are left with loans that will not be repaid in full.

* When this bubble bursts, for example due to a rise in real interest rates, there is a fall in demand for houses and a negative wealth effect, reducing AD, and banks are left with loans that will not be repaid in full.

86

New cards

what are the outcomes of market bubbles?

* This leads to prices becoming excessively high and eventually enough investors decide that the price will fall, so they sell their assets and panic sets in, causing mass selling.

* This is known as herding behaviour.

* This is known as herding behaviour.

87

New cards

how can bubbles burst?

lack of confidence

88

New cards

how do you prevent market bubbles?

regulating levering

89

New cards

what us market rigging?

* a group of individuals or institutions collide to fix prices or exchange info that will lead to gains for themselves at the expense of other participants in the market

* illegal practice of trying to manipulate financial markets for personal gain

* it’s difficult to detect

* participants have been likely to suffer few penalties if caught

* individuals or institutions fixing the price of commodity, a currency or an asset

* sudden large trades in a currency can shift the value of a currency can shift the value of a currency, the change in value doesn’t need to be much for a trader to benefit by buying or selling related financial derivatives

* illegal practice of trying to manipulate financial markets for personal gain

* it’s difficult to detect

* participants have been likely to suffer few penalties if caught

* individuals or institutions fixing the price of commodity, a currency or an asset

* sudden large trades in a currency can shift the value of a currency can shift the value of a currency, the change in value doesn’t need to be much for a trader to benefit by buying or selling related financial derivatives

90

New cards

how does insider trading use market rigging?

* an individual or institution has knowledge about something that will happen in the future

* this knowledge isn’t shared with others in the market

* based on that knowledge, an asset is bought or sold to make a profit

* this knowledge isn’t shared with others in the market

* based on that knowledge, an asset is bought or sold to make a profit

91

New cards

give two examples of insider trading using market rigging?

* eg knowing a merger will push up share prices so buying shares today and then will be able to sell them at a profit

* eg director knows their company will announce bad news about profits which will cause share prices to fall so increases the price today

* eg director knows their company will announce bad news about profits which will cause share prices to fall so increases the price today

92

New cards

how did libor use market rigging?

Attempts to influence the interest rate used on markets for lending (loans, derivatives)

93

New cards

what happened to libor after the market rigging?

Fines of $9Bn against traders/firms involved, including lawsuits and damage in trust/confidence.

94

New cards

what were the impacts of libors market rigging?

* Decisions relating to mortgages and borrowing.

* Wealth effect (positive or negative)

* Levels of consumption and investment

* Wealth effect (positive or negative)

* Levels of consumption and investment

95

New cards

how did UK traders Mizuho rig the market?

* provided fake orders for stocks and futures, especially for the Italian bond market

* this inflated prices and they then placed genuine orders

* this inflated prices and they then placed genuine orders

96

New cards

what was the outcome of Mizuho’s market rigging?

* higher cost on loans

* defaults

* more debt

* home repossessions

* defaults

* more debt

* home repossessions

97

New cards

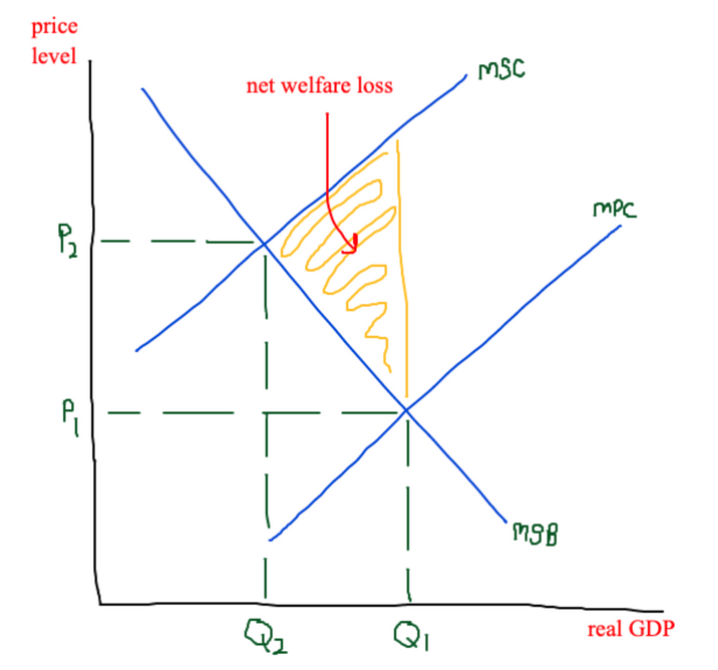

draw an externalities graph?

98

New cards

who bares the marginal social costs of externalities?

costs that are borne by other firms, individuals and govts but not financial markets themselves

99

New cards

who faced the externalities from fixing the 2008 financial crisis?

* the cost to the UK taxpayer of supporting financial institutions during the 07-08 was at a peak of £1.162 trillion

* but most of this was temporary bc it was guarantees given by the UK govt

* the worldwide cost of bailing out financial institutions is a fraction of the cost of the lost output due to the financial crisis

* lost GDP over 7 yrs of £3,811 per person

* BUT, other factors have contributed to slower economic growth and there was a positive output gap in 07

* but most of this was temporary bc it was guarantees given by the UK govt

* the worldwide cost of bailing out financial institutions is a fraction of the cost of the lost output due to the financial crisis

* lost GDP over 7 yrs of £3,811 per person

* BUT, other factors have contributed to slower economic growth and there was a positive output gap in 07

100

New cards

who faced the externalities from nationalising UK banks?

* UK govt spent £133bn nationalising a number of UK banks and building societies

* this money is expected to be repaid as govt sells off its shareholdings in UK banks

* this money is expected to be repaid as govt sells off its shareholdings in UK banks