Macroeconomics 2 // Макроикономика АР

5.0(4)

Card Sorting

1/48

Earn XP

Description and Tags

Включено е всичко от втори срок: безработност, БВП, правителството, фирмите, и естествено купувачите! Упражнявай термините!

Last updated 12:22 AM on 3/6/23

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

49 Terms

1

New cards

Gross domestic product (GDP)

The total market value of all *final* goods and services produced annually within an economy (Think gross: total, domestic: within the country, product: production)

2

New cards

Final good

A product purchased for final use and not for resale (i.e. a finished computer, not individual parts)

3

New cards

Intermediate good

A product that is purchased for resale and further manufacturing, not final one (i.e. a restaurant purchases lettuce for its burgers)

4

New cards

Double (multiple) counting

Including the values of intermediate goods in GDP and therefore counting them twice

5

New cards

Consumption

The amount households spend on goods and services

6

New cards

Investment

Spending for the production and accumulation of capital, additions to inventories, and new construction (helpful in the long-run)

7

New cards

Government purchases

The expenditures (spending) of all governments (federal, state, and local) on final goods and services in an economy

8

New cards

Net exports

Value of exports minus value of imports

9

New cards

Nominal rates (GDP, income, interest rate)

Not adjusted for inflation; measured at the current price levels

10

New cards

Real rates (GDP, income, interest rate)

Adjusted for inflation; how much your money is truly buying you

11

New cards

Price index

A number which shows how the weighted average price of a certain set of goods changes through time

12

New cards

Consumer price index (CPI)

A number which measures the prices of a fixed market basket of 300+ carefully selected goods and services a typical consumer will buy in a year

13

New cards

Business cycle

Recurring increase and decreases in the level of economic activity over periods of years, results in recessions and expansions

14

New cards

Recession/Contraction

A period characterized by declining real GDP, lower real income, and higher unemployment, calls for contractionary fiscal policy

15

New cards

Expansion/Recovery

A period characterized by increasing real GDP, higher real income, and lower unemployment, calls for expansionary fiscal policy

16

New cards

Unemployment rate

The percentage of the labor force (number of both unemployed and employed) that is unemployed at any time

17

New cards

Natural rate of unemployment

The full employment/unemployment rate when an economy is achieving potential output, it is measured by frictional and structural unemployment, does not count cyclical

18

New cards

Frictional unemployment

A type of unemployment caused by temporary layoffs and workers voluntarily changing job, may also include returning to school, choosing to quit, etc.

19

New cards

Structural unemployment

The unemployment of workers whose skills are not in demand, lack the skills needed to obtain or retain employment, or are unable to move to places where jobs are available or if an employer relocates

20

New cards

Cyclical unemployment

Unemployment caused by the business cycle; a result of insufficient total spending or a recession

21

New cards

Potential output

The amount a society could produce when it fully employs its available resources (land, labor, capital, entrepreneurship), shown on the PPC curve

22

New cards

Discouraged workers

Employees that have left the labor force because they are unable to find employment

23

New cards

Balance of payments

A statement that summarizes an economy’s transactions with the rest of the world over a specified time period

24

New cards

Current account

The part of the balance of payments that includes exports, imports, dividends and interest, and transfer payments

25

New cards

Financial account

The part of the balance of payments that includes asset purchases of stocks, bonds, real estate, investment in factories, and any given currency

26

New cards

Inflation

A rise in the general level of prices in an economy

27

New cards

Rule of 72

The number of years it will take for some measure to double (i.e. for the price level to double), divide 72 by the annual inflation rate

28

New cards

Demand-pull inflation

Inflation that is caused by there being more demand than there is output at the existing price level

29

New cards

Cost-push (supply) inflation

Inflation that is caused by an increase in the costs of resources and then, in per unit production costs

30

New cards

Anticipated inflation

Increases in the price level which occur at the expected rate

31

New cards

Unanticipated inflation

Increases in the price level which occur at a greater rate than what was expected

32

New cards

Cost-of-living-adjustment (COLA)

An automatic increase in the incomes of workers or in pensions when inflation occurs

33

New cards

Productivity

Output per worker; it must increase for there to be economic growth

34

New cards

Deflation

The opposite of inflation, a reduction in an economy’s price level (different from disinflation)

35

New cards

Factor/Resource market

Where households sell the factors of production and firms buy these inputs

36

New cards

Product market

Where goods and services are sold by the firms and bought by households

37

New cards

Budget deficit

Where government spending is greater than tax revenue

38

New cards

Balanced budget

Where government spending is equal to tax revenue (not necessarily good for an economy in the long-run)

39

New cards

Economic growth

An outwards shift in the PPC shown by an increase in real output or real GDP per capita; caused by increasing employment rates, national income, and real GDP

40

New cards

Calculating nominal/real GDP

The current production in the current year’s prices or the current production in base year prices

41

New cards

National income

It is roughly equal to GDP in the circular flow, how much a nation’s people and businesses can make in a given year

42

New cards

GDP deflator

The ratio of nominal GDP to real GDP in a year times 100

43

New cards

Human capital

The improvement in labor created by education and knowledge of workers

44

New cards

Contractionary fiscal policy

The government cuts spending on goods and services, lowers government transfer, and introduces higher taxes in order to increase the budget balances for that year (may make a surplus bigger or deficit smaller)

45

New cards

Expansionary fiscal policy

The government increases spending on goods and services, raises government transfers, and introduces lower taxes in order to reduce the budget balance for that year (may make a surplus smaller or deficit bigger)

46

New cards

Cyclically adjusted budget balance

An estimate of what the budget balance would be if real GDP were exactly equal to potential output

47

New cards

Debt-GDP ratio

The governments debt as a percentage of GDP, determines the ability of governments to pay back their debt

48

New cards

Implicit liability

Spending promises made by governments that are effectively a debt, despite not being included in the usual debt statistics

49

New cards

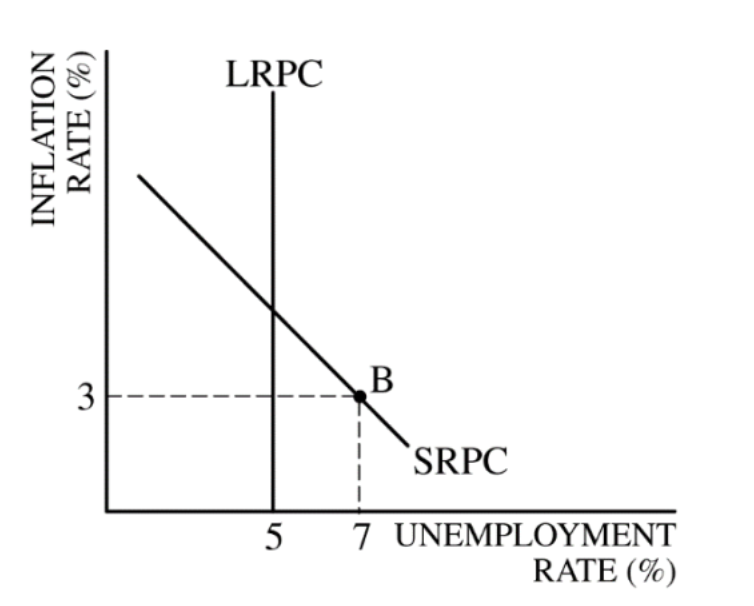

Phillips Curve

Shows the relationship between inflation and unemployment on a graph (alongside the natural rate of unemployment)