FINAL INCOME TAX

1/14

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

15 Terms

Nature of Final Income Tax

Withholding at Source

Final Tax (wala nang ibabawas pa)

No Income Tax Return (The income taxpayer need not file a tax return to report the income)

Applies only on certain passive income (List)

Applies on Certain Non-Residents’ Income whether active or passive (NRA-NETB and NRFC)

Territorial (earned within) (deduction on income is allowed only if the source of income is the Philippines)

Class of Active Income

Compensation

Business Income

Professional Income

List of Passive Income Subject to FIT:

Interest income from banks

Dividends

Royalties

Prizes

Winnings

Informer’s Reward

Fringe Benefit Tax

Other

General Rule for the tax rate of passive income of NRA-NETB and NRFC:

25%

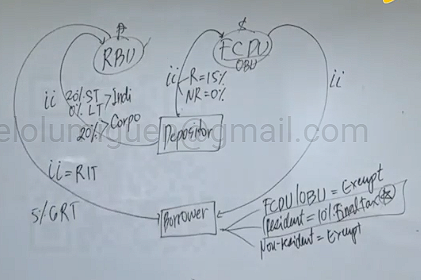

FIT of Interest Income From Banks (ST & LT)

Local Currency:

Individual | Corporation | |

Short-Term < 5 yrs | ||

Long-Term ≥ 5 yrs |

Local Currency:

Individual | Corporation | |

Short-Term < 5 yrs | 20% | 20% |

Long-Term ≥ 5 yrs | Exempt | 20% (RIT for deposit substitute issued by non-banks) |

Pre-termination of Long-term Deposit or Investment:

Individual | Corporation | |

< 3 years held | ||

< 4 years held | ||

< 5 years held |

Individual | Corporation | |

< 3 years held | 20% | 20% |

< 4 years held | 12% | 20% |

< 5 years held | 5% | 20% |

FIT of Interest Income From Banks (Foreign Currency)

Foreign Corporation:

Individual | Corporation | |

Resident | ||

Non-Resident |

Foreign Corporation:

Individual | Corporation | |

Resident | 15% | 15% |

Non-Resident | Exempt | Exempt |

FIT on Dividend Income:

RC, NRC, & RA | NRA-ETB | NRA-NETB | DC & RFC | NRFC | |

From DC | |||||

From FC | |||||

From Business Partnership/Joint Venture |

RC, NRC, & RA | NRA-ETB | NRA-NETB | DC & RFC | NRFC | |

From DC | 10% | 20% | 25% | Exempt | 25%, but can be 15% if subjected by tax-sparring rule |

From FC | RIT | RIT | 25% | RIT (DC - exempt if qualified by predominance or the criteria) | 25% |

From Business Partnership/Joint Venture | 10% | 10% | 25% | Regular Tax | 25% |

FIT on Royalty Income:

Individual | Corporation | |

Book, Musical Composition, Literary Works | ||

General (Others) |

Individual | Corporation | |

Book, Musical Composition, Literary Works | 10% | 20% |

General (Others) | 20% | 20% |

FIT on Prizes (w/ effort):

Awards (Nobel Peace Prize) |

Sports: Philippine Sports Commission Accreditation |

Individual | Corporation | |

10K and Below | ||

Above 10K |

Awards (Nobel Peace Prize) | Exempt |

Sports: Philippine Sports Commission Accreditation | Exempt |

Individual | Corporation | |

10K and Below | RIT | RIT |

Above 10K | 20% | RIT |

FIT on Winnings (w/o effort; chance):

PCSO and Lotto Winning:

Individual | Corporation | |

10K and Below | ||

Above 10K |

Others:

Individual | Corporation | |

Regardless of amount |

PCSO and Lotto Winning:

Individual | Corporation | |

10K and Below | exempt | exempt |

Above 10K | 20% | 20% |

Others:

Individual | Corporation | |

Regardless of amount | 20% | RIT |

Tax Informer’s Reward:

10% of the amount collected or 1M whichever is lower

FIT on Informer’s Reward

10% regardless of the taxpayer

BIR Form to be used and Deadline for Passive Income subject to FIT:

Monthly | Quarterly | Annually | |

Form | |||

Deadline |

Monthly | Quarterly | Annually | |

Form | 0619 - F |

| 1604 - F |

Deadline | 10 days end of month | last day of month counted from the end of quarter | Before Jan 31 next year |

Summary