Chapter 8: Internal returns to scale

0.0(0)

Card Sorting

1/36

Earn XP

Description and Tags

Last updated 4:05 PM on 10/15/22

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

37 Terms

1

New cards

Marginal Cost (MC)

The cost of producing one more unit, c

2

New cards

Improved competitive environment

More productive firms will stay in the market, and the less productive firms will exit the market

→ Surviving firms are more productive

→ Surviving firms are more productive

3

New cards

Market share

The amount of the market that one firm covers

4

New cards

Monopolistic competition

1) differentiated goods

2) technology exhibits increasing returns to scale (e.g., a firms needs a factory to produce)

3) many producers in the market

2) technology exhibits increasing returns to scale (e.g., a firms needs a factory to produce)

3) many producers in the market

5

New cards

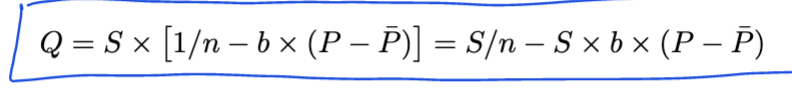

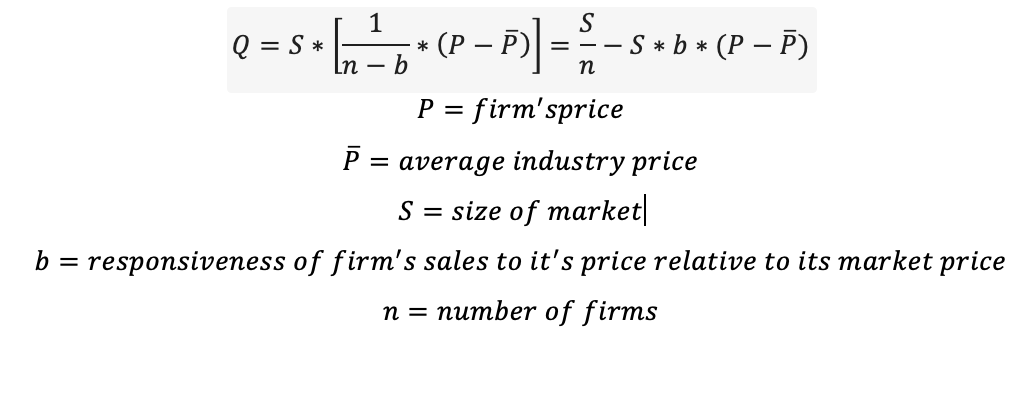

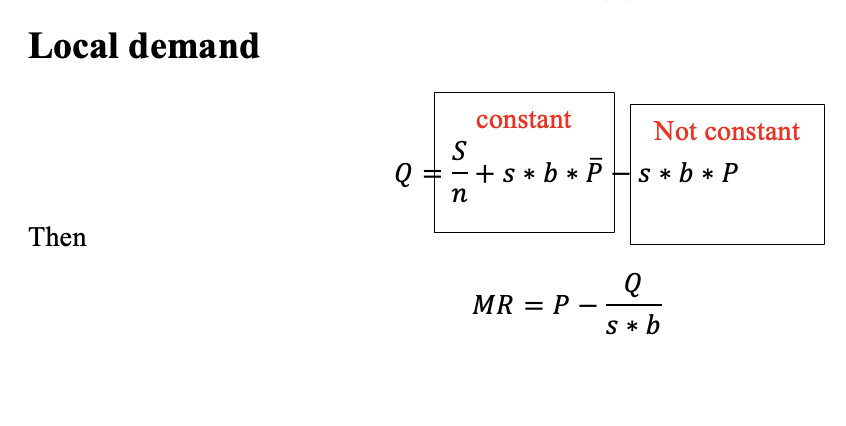

Demand Curve

6

New cards

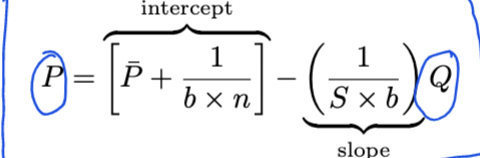

Inverse demand curve

7

New cards

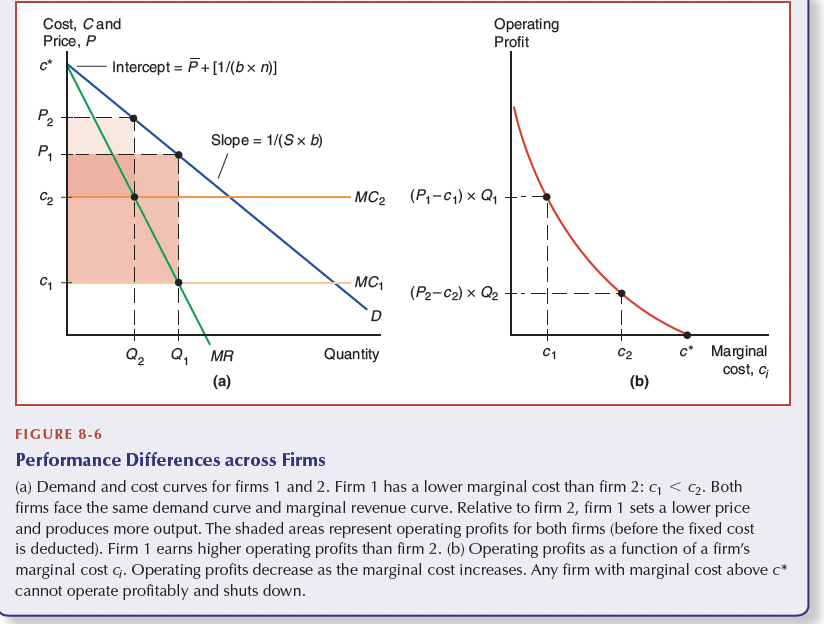

Operating profit

(P-c)*Q

8

New cards

Equilibrium

MR=MC

9

New cards

Firms optimal behaviour

10

New cards

Who will exit the market?

Firms with c>c*

11

New cards

Who will stay in the market?

Firms with c*≥c

12

New cards

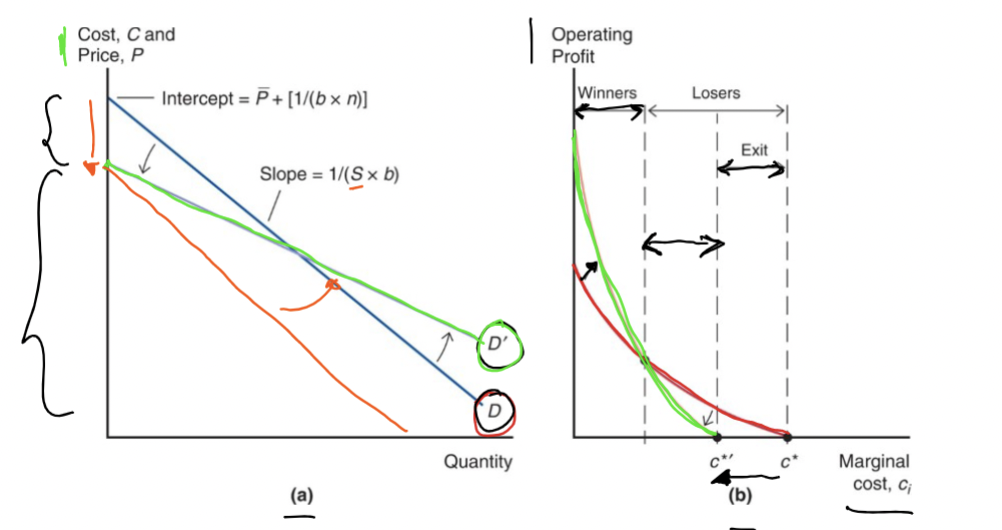

What happens when the market increases?

S increases → flatter slope

The Demand curve flattens. The intersect will be lower.

There will be more demand for any price.

n and p-bar changes

b stays the same

The operating profit curve will be steeper. Fewer firms will stay in the market as it pushes high-cost firms out

The Demand curve flattens. The intersect will be lower.

There will be more demand for any price.

n and p-bar changes

b stays the same

The operating profit curve will be steeper. Fewer firms will stay in the market as it pushes high-cost firms out

13

New cards

Slope

Slope=-1/(s*b)

14

New cards

Trade cost

a cost added to the cost of the product when exporting it to another market. Only the more effective firm will export.

15

New cards

Horizontal FDI

when firms expand their sales horizontally → located and sell their products in more markets

To sell abroad

- produce at home and pay trade costs, t, to ship the goods

- start production abroad by paying a fixed cost, F, to open a factory

To sell abroad

- produce at home and pay trade costs, t, to ship the goods

- start production abroad by paying a fixed cost, F, to open a factory

16

New cards

Vertical FDI

Invest in developing countries to lower their production costs by moving some parts of production from home to foreign

scale-fixed cost tradeoff

The most productive firms are more likely to do Vertical FDI, as they produce more and can therefore lower their MC

scale-fixed cost tradeoff

The most productive firms are more likely to do Vertical FDI, as they produce more and can therefore lower their MC

17

New cards

Price dumping

When a firms sells a product at a lower price (net trade cost) on a foreign market

18

New cards

Who will export with trade cost?

the firms with c+t

19

New cards

Who will no longer export with trade cost?

the firms with c+t>c*

20

New cards

Imperfect competition

Firms can influence the prices

21

New cards

Marginal revenue

The demand curve with double the slope

(demand curve equation)*Q and take first order derivative

MR=P-(Q/B)

P-MR=Q/B

(demand curve equation)*Q and take first order derivative

MR=P-(Q/B)

P-MR=Q/B

22

New cards

Slope parameter

B (will be given)

23

New cards

Firms total cost

C=F+c*Q

24

New cards

AC

AC=C/Q=F/Q+c

25

New cards

c

Marginal cost, cost of producing one extra unit

26

New cards

F

Fixed cost, the intersect of the supply curve

27

New cards

Demand in monopolistic competition

The larger the Q, the larger the S

When P increases, quantity increases

when "P-bar" increases, the quantity increases (if the price of other firms increases, more people will buy our product)

When P increases, quantity increases

when "P-bar" increases, the quantity increases (if the price of other firms increases, more people will buy our product)

28

New cards

Competitive market

More competition from other firms will lower the sales from any firm at any price (given a fixed market size)

29

New cards

Assumptions for the model

1) firms are symmetric

a) Produce differentiated goods

b) They have the same demand directed at their product

c) They operate with the same technology

2) properties of firms' demand

3) properties of firms' technology

a) Produce differentiated goods

b) They have the same demand directed at their product

c) They operate with the same technology

2) properties of firms' demand

3) properties of firms' technology

30

New cards

The CC-curve

When there's firm symmetry (Q=S/n, P=P-bar)

AC=(n*f)/S +c

AC increases with number of firms

S is fixed, when n increases, AC increases as each firm produces less

AC=(n*f)/S +c

AC increases with number of firms

S is fixed, when n increases, AC increases as each firm produces less

31

New cards

PP-curve

Firm acts as local monopolies

32

New cards

mark-up

P-c=1/(n*b)

measures a firms market power

measures a firms market power

33

New cards

International trade

In market with economies of scale, the market size (S) constraints:

1) number of operating firms,n, i.e., the number of product varieties

2) The quantity produced bt each firm S/n which affects AC

1) number of operating firms,n, i.e., the number of product varieties

2) The quantity produced bt each firm S/n which affects AC

34

New cards

Integrated market

1) each country can produce less variaties → lower AC

2) consumers enjoy greater variety

2) consumers enjoy greater variety

35

New cards

The effect of market size

CC: When S increases, AC decreases

PP: Nothing happens

mark-ups will not change directly with market size

Reward low-cost firms → expand demand = more consumers

Penalise high-cost firms

PP: Nothing happens

mark-ups will not change directly with market size

Reward low-cost firms → expand demand = more consumers

Penalise high-cost firms

36

New cards

Optimal behaviour

In the long run firms produce up until the point where Profit=0

37

New cards

International trade with external economies to scale

→ Trade increases market size, which lowers

→ intersept of inverse demand (and decreases marginal cost cutoff, c*)

→ Slope of the inverse demand (increase demand for each price level)

→ intersept of inverse demand (and decreases marginal cost cutoff, c*)

→ Slope of the inverse demand (increase demand for each price level)