4.3 - tariffs and quotas

1/14

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

15 Terms

trade protection definition

government intervention in international trade through setting trade barriers

forms of trade protection

tariffs

quotas

production subsidies

export subsidies

administrative barriers

embargo

tariffs definition

taxes on imported goods

quotas definition

legal limit to the quantity of good that can be imported

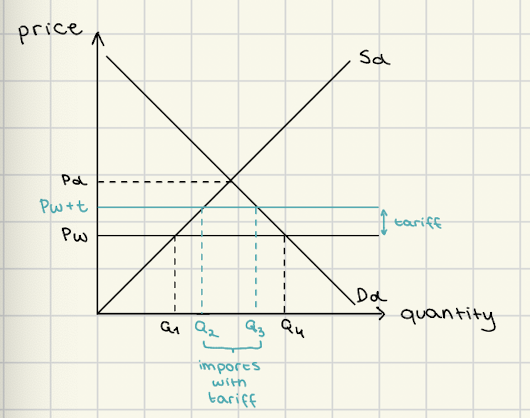

tariff graph

tariff surplus and loss graph

winning tariff stakeholders

domestic producers

receive protection and higher price Pw+t

sell larger quantity Q2 rather than Q1

increased domestic employment in the protected industry

government gains tariff revenue

loosing tariff stakeholders

domestic consumers

pay higher prices Pw+t

get smaller quantity Q3 rather than Q4

domestic income distribution worsens

increased inefficiency in production

foreign producers

loss of revenue

receive Pw but for smaller quantity

global misallocation of resources

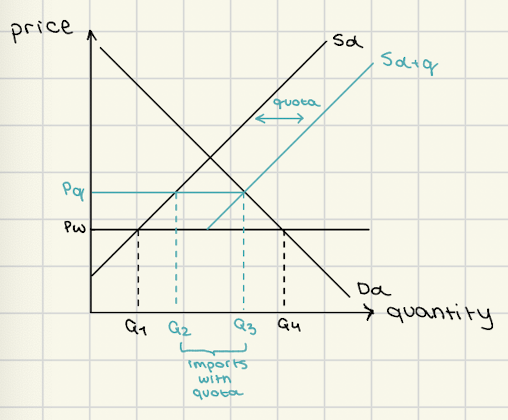

quotas graph

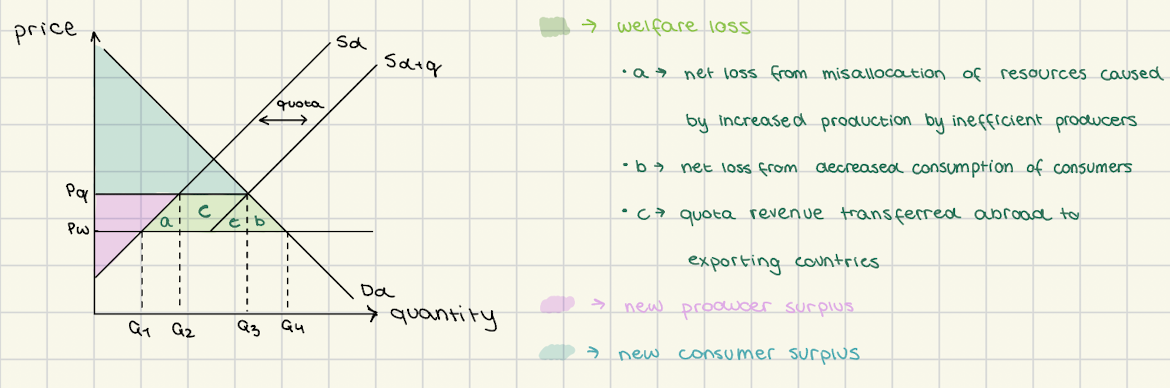

quota surplus and loss graph

winning quota stakeholders

domestic producers

receive higher price Pq

sell larger quantity Q2 rather than Q1

domestic employment increases

neutral quota stakeholder

government

budget is not affected

loosing quota stakeholders

domestic consumers

pay higher price Pq

get smaller quantity Q3 rather than Q4

domestic income distribution worsens

increased inefficiency in production

global misallocation of resources

quotas vs tariffs

quotas:

restricting quantity of imports

allow S&D arrive at higher price of imports

tariffs

increasing price of imports

allow S&D to arrive at lower quantity of imports

goal of tariffs and quotas

lower quantity of imports

higher domestic price