Choices under uncertainty

1/14

Earn XP

Description and Tags

finance chap1

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

15 Terms

risk vs uncertainty

risky situations have a probability attached to it which can be estimated, uncertainty cannot be

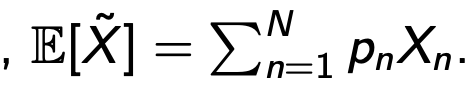

Expected value

average amount one would expect to earn from repeatedly playing the game

St Petersburg Paradox

challenges the idea that people make decisions based only on expected values because E[X] = infinity here

Law of Diminishing Utility

marginal benefit consuming diminishes with each additional unit

How much should you pay to play a classic coin flip game according to expected value

5 (think through the methodology)

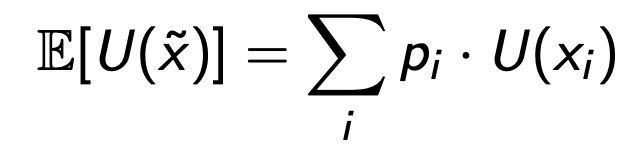

Expected Utility

weighs outcomes by their utility than ,monetary values

fair lottery

where expected value of the outcome is zero, ie price of the game is equal to the expected value

Risk aversion

Additional utility from each extra dollar diminishes across time- concave utility function

Certainty equivalent

it is the level of wealth which gives a person the same utility as the expected utility of the lottery

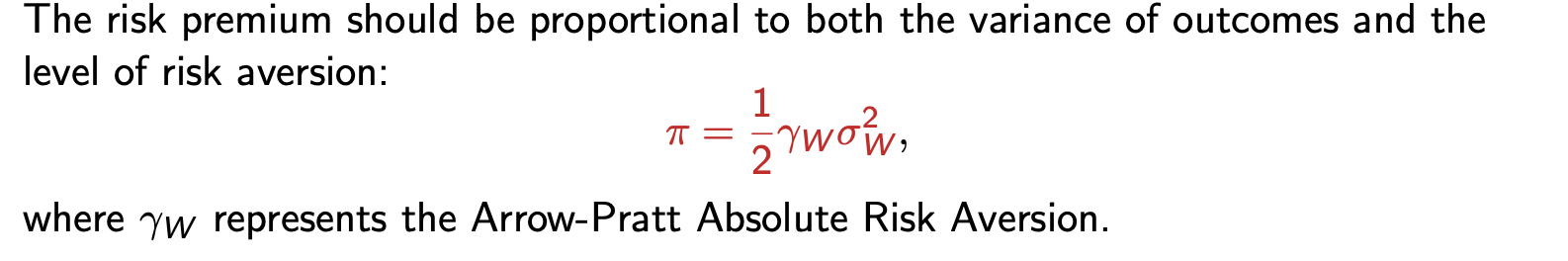

Risk premium (pi)

the amount you are willing to give up to avoid the lottery; pi= expected value of lottery - certainty equivalent

what does the arrow Pratt absolute risk aversion measure

allows systematic determination of compensation for risk aversion

how would risk neutral preferences look

U(W)= W, constant marginal utility over wealth so a linear function

what does a risk neutral person choose

they would choose whatever offers the highest expected value,

how would risk loving preferences look

convex function so arrow pratt would change accordingly

CARA utility function

1-e-cW/ c where c is the arrow Pratt absolute risk aversion