acct 2301 unit 2 ratios

1/17

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

18 Terms

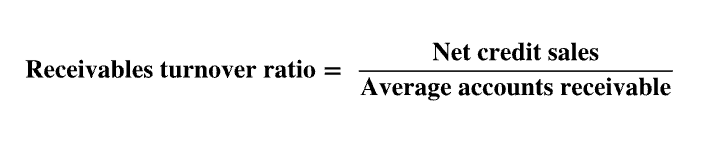

receivables turnover ratio

# times per year the average accounts receivable balance is collected

how quickly can u collect cash from accounts receivables

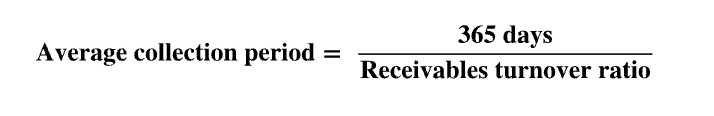

avg collection period

approximate days average accounts receivable balance is outstanding

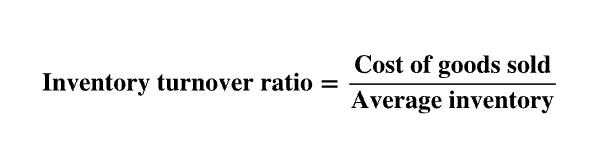

inventory turnover ratio

# times firm sells its average inventory balance during reporting period

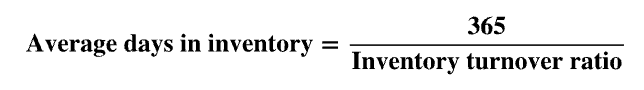

avg days in inventory

# of days average inventory is held

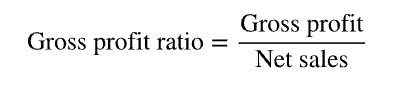

gross profit ratio/percentage

amount by which sale of inventory exceeds its cost per dollar of sales

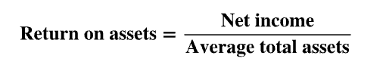

return on assets

amount of net income generated for each dollar invested in assets

profit margin

earnings per dollar of sales

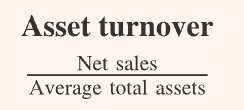

asset turnover

sales per dollar of assets invested

net credit sales/avg accts receivable

receivables turnover ratio

365/receivables turnover ratio

avg collection period

COGS/avg inventory

inventory turnover ratio

365/inventory turnover ratio

avg days in inventory

gross profit/net sales

gross profit ratio

net income/avg total assets

return on assets

net income/net sales

profit margin

sales rev-COGS

gross profit

gross profit- operating expenses

net income

beginning inventory + purchases-purchase returns-ending inventory

COGS (one way, the other is thru sales rev-gross profit)