RMIN 4000 - Exam 1

1/83

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

84 Terms

Exposures

Things of value (assets) that could be lost

Perils

Things that could happen to these assets

The cause of loss (fire, tornado, burglary)

Risk Management

What do you do to protect these assets and reduce losses

Risk

A calculated possibility of a negative outcome

Calculated Possiblity

A probabilistic outcome that is known or estimated

Ranges from 0 to 1 (0% to 100%)

Negative Outcome

A loss & must be quantifiable ($)

Frequency

How often does a loss occur

Probability of a loss

Frequency Equation

Number of Losses / Number of Exposures

Severity

How much does it cost when a loss does occur

Severity Equation

Incurred Losses($) / Number of Losses

Frequency & Severity Example:

Lannister Insurance Company insures 100,000 homes. In 2024, they incurred a total of $30,000,000 in wind damage

losses to the owners of 5,000 of those homes.

- What was Lannister’s wind loss frequency in 2024?

- What was Lannister’s average wind loss severity in 2024?

Frequency = 0.05

Severity = 6,000

Hazard

Condition that creates or increases the frequency and/or severity of a loss

Does not cause a loss

The Four Types of Hazards

Physical

Moral

Morale (Attitudinal)

Legal

Physical Hazard

A physical condition that increases the frequency and/or severity of a loss

Moral Hazard

The presence of insurance changes the behavior of the insured

Ex: Using a hammer to create “hail“ damage to roof, exaggerating the value of insured property

Morale (Attitudinal) Hazard

Carelessness or indifference to a loss, which increases the frequency and/or severity of a loss

Ex: Leaving car keys in an unlocked car, neglecting a tree limb growing over your roof

Legal Hazard

Characteristics of legal system or regulatory environment that increases the frequency and/or severity of a loss

Ex: Juries in some areas are more sympathetic that other areas, GA requires Diminution in Value to be paid on real property losses (increased severity in GA)

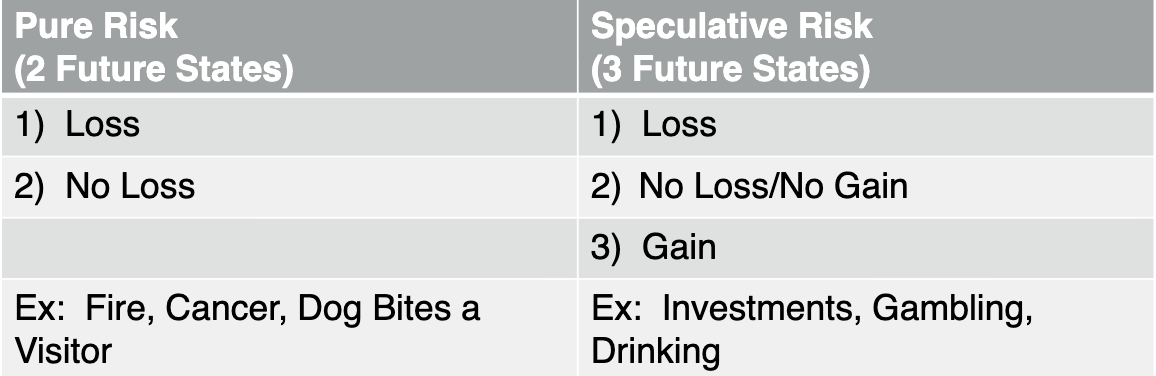

Risk Classifications

Pure v. Speculative Risk

Diversifiable Risk

Nondiversifiable Risk

Systemic Risk

Pure v. Speculative Risk

You can buy insurance for pure risks but not speculative risks

Diversifiable Risk

Affects only individuals or small groups, not entire economy

Can be reduced/eliminated through diversification

Risks aren’t correlated (fire, theft)

Nondiversifiable Risk

Affects the entire economy or large number of groups within the economy

Cannot be reduced through diversification

Government assistance may be needed to insure

Risks are correlated (inflation, unemployment)

Systemic Risk

Risk of collapse of an entire system or entire market due to the failure of a single entity or group of entities that can result in the breakdown of the entire financial system

Instability in the financial system due to the interdependency between players in the market

Millennium Bridge in London Ex.

Started swaying from a large gust of wind that made everyone react to it and start walking the same way

"Individually you do what's right for you, but when everyone does it collectively that's what creates systemic risk"

Major Types of Pure Risks

Personal Risk

Property Risk

Liability Risk

Loss of Business Income

Cyber-Security

All are relevant to individuals & families and businesses

Personal Risk

Directly affects and individual or family; involves the possibility of loss of incomes, extra expenses, depletion of financial assets

What perils might be involved

Death, unemployment, disability, inadequate retirement income

Rule of 72: 72 / % = years it will take to double

Property Risk

The possibility of losses associated with the destruction or theft of property

Direct Loss: Cost or repair to replace property damaged by a peril

Indirect Loss

Financial loss resulting as a consequence of a direct loss

Ex: After fire damages your home, you have to pay to live elsewhere while it's repaired

Liability Risk

Legal Liability (financial consequences) resulting from injuries or damages you caused to someone else

No upper limit

Liens can be placed on income, assets seized

Defense Costs - lawyers are expensive

Loss of Business Income

If a business has to shutdown for a period of time due to a physical damage loss, it is unable to generate an income

Indirect loss

Techniques for Managing Risks

Risk Control & Risk Financing

Risk Control

Techniques to reduce the frequency or severity of losses

Loss Prevention

Reduces frequency

Airport security, safety training programs

Loss Reduction

Reduces severity (fire sprinklers)

Can occur pre-loss or post-loss

Duplication, Separation, & Diversification

Avoidance

A certain loss exposure is never acquired (proactive)

An existing loss exposure is abandoned (reactive)

Risk Financing

Techniques for funding losses

Retention (if occurs, pay for out of pocket)

Retaining part or all of losses that can occur from a given risk

Active: Deliberately retaining risk (choosing a high deductible)

Passive: Unknowingly retaining risk (not purchasing disability risk)

Noninsurance Transfer

By contract

Incorporation

Insurance

Textbook Definition of Risk Management

Process that identifies loss exposures faced by an organization and selects the most appropriate techniques for treating such exposures

Loss Exposure

Any situation or circumstance in which a loss is possible, regardless of whether a loss actually occurs

Steps in the Risk Management Process

Identify loss exposures

Measure and analyze the loss exposures

Consider and select the appropriate risk management techniques

Implement and monitor the chosen techniques

Step 1: Identify Loss Exposures

What assets need to be protected?

What perils are those assets exposed to?

Most important step

If you haven't identified the loss exposure, then you're stuck paying for it

(passive retention)

Sources for Identifying Loss Exposures: Loss history, financial statements, other firms/competitors, risk managers consultants, surveys, inspections, contract analysis

Step 2: Measure and Analyze the Loss Exposures

Measure

Estimate the frequency and severity of loss exposures

Frequency (probability) - how often does it occur

Severity (outcome) - how much does it cost when a loss does occur

Analyze

Rank loss exposures according to relative importance

Severity is more important

Maximum Possible Loss - the worst loss that could happen to the firm during its lifetime

Probable Maximum Loss (PML) - the worst loss that is likely to happen

Step 3: Consider and Select the Appropriate Risk Management Techniques

Risk Control

Avoidance, Loss Prevention, Loss Reduction, Duplication, Separation, Diversification

Risk Financing

Avoidance

A certain loss exposure is never acquired (proactive), or an existing loss exposure is abandoned (reactive)

Advantage - Frequency is reduced to 0

Disadvantages - May not be possible, usually has an opportunity cost, avoiding one loss exposure may create another

Loss Prevention

Measures that reduce the frequency of a particular loss

Does not completely eliminate risk

Loss Reduction

Measures that reduce the severity of a loss

No effect on the frequency of a loss

Duplication

Having back-ups or copies of important documents or property available in case a loss occurs

Separation

Physically separating something, dividing the assets exposed to loss to minimize the harm from a single event

Ex: Firewalls in buildings, companies with multiple warehouses, president and VP can't fly on the same plane

Diversification

Spreading the risk across multiple parties, securities, or transactions

Ex: Nike branching out from just shoes

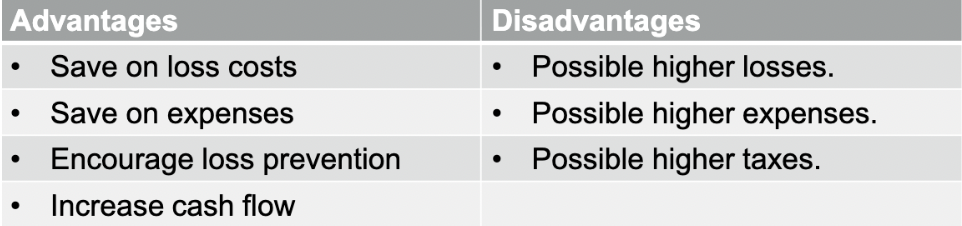

Retention

Deductible means retention

A firm or individual retains part or all of losses that can occur from a given risk

Retention level - the dollar amount of losses that the individual/firm will retain

Active - Deliberately retaining risk

Passive - Unknowingly retaining risk

When should risk be retained?

It is difficult to insure

Worst possible losses are not serious (low severity)

Losses are predictable (high frequency)

*Risk Manager needs to evaluate all potential costs before choosing retention as a risk management technique

Unfunded Retention

Don’t have money aside

Funded Reserve

Actively putting money to the side

Deductible

The amount that you are responsible for in the event of a loss when you have insurance

Captive Insurer

A business creates its own insurance company

A single-parent captive is owned by only one parent

Association/Group captive is an insurer owned by several parents

Advantages of Captive Insurer

When insurance is expensive or difficult to obtain

Lower Costs

No agent or broker commissions

Interest earned on invested premium

Easier access to reinsurance market

Possibility of lower tax rate

Possibility of favorable regulatory environment

Self-Insurance

A special form of planned retention by which part or all of a given loss exposure is retained by the firm

Risk Retention Group

Form of a group captive that can write any type of liability coverage except employers' liability, workers compensation, and personal lines

Exempt from many state insurance laws

Many physicians form a risk retention group

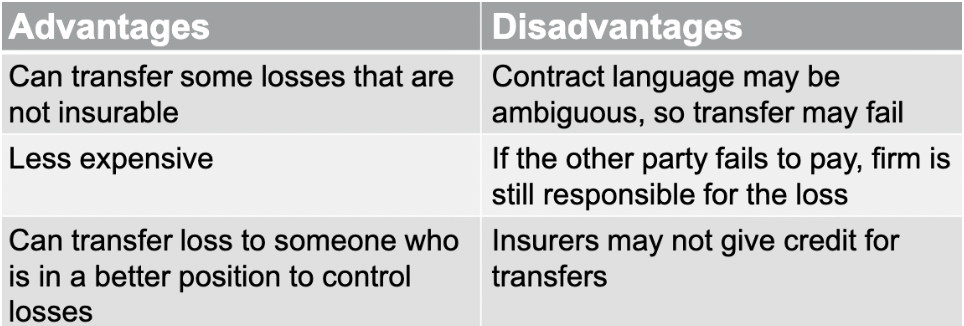

Noninsurance Transfer

Methods other than insurance by which a pure risk and its potential financial consequences are transferred to another party

Ex. Contracts, leases, hold-harmless agreements (if a 3rd party files a suit against the tenant and the landlord, the tenant assumes the risk)

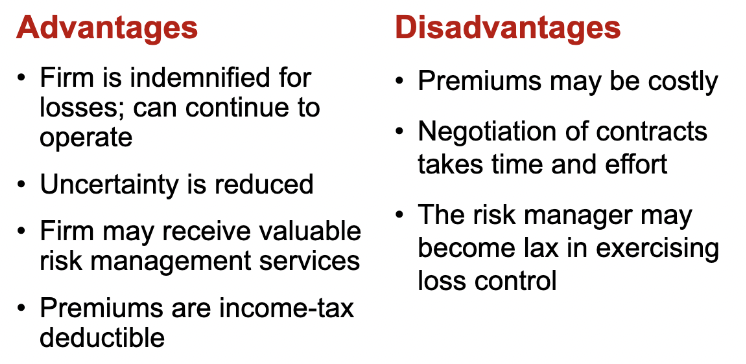

Insurance

Appropriate for low-frequency, high-severity loss exposures

These areas must be emphasized

Selection of insurance coverages

Selection of an insurer

Negotiation of terms

Dissemination of information concerning insurance coverages

Periodic review of the insurance program

Excess Insurance

A plan in which the insurer pays only if the actual loss exceeds the amount a firm has decided to retain

Have a general liability (primary) limit & can have an umbrella liability (excess)

Manuscript Policy

A policy specifically tailored for the firm

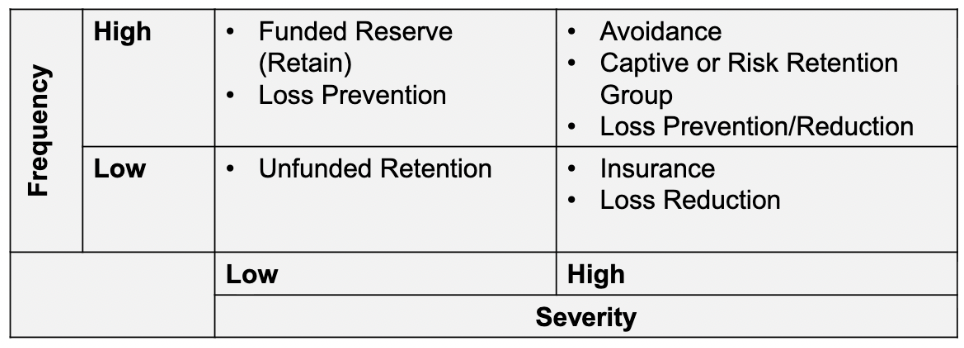

Technique Graph for What Should be Used

Separation, duplication, and diversification may appear in various quadrants depending upon how they are used

Underwriting Cycles

Hard Market - Insurer profitability is declining, underwriting standards are tightened, premiums increase, and insurance is hard to obtain

Soft Market - Profitability is improving, standards are loosened, premiums decline, and insurance become easier to obtain

Step 4: Implement and Monitor the Chosen Techniques

Often requires cooperation among multiple departments

Periodically review to ensure that technique is achieving expected results

If needed, adjust to accommodate changes in loss exposures or the availability of cost-effective risk management techniques

Benefits of Risk Management

Enables a firm to attain its pre-loss and post-loss objectives more easily

Society benefits because both direct and indirect losses are reduced

Can reduce a firm's cost of risk

Textbook Definition of Insurance

The pooling of fortuitous(accidental) losses by transfer of such risks to insurers, who agree to indemnify(compensate) insureds for such losses, to provide other pecuniary(monetary) benefits on their occurrence, or to render services connected with the risk

Law of Large Numbers

The greater the number of exposures, the more closely will actual results approach the probable results expected from an infinite number of exposures

Ex. Consider a coin flip (50/50) - the more you flip it, the closer the percentage gets to 50%

Pooling of Losses

The spreading of losses incurred by a few over the entire group

Purpose is to reduce variation (as measured by standard deviation) which reduces uncertainty (risk)

Think of standard deviation as the average distance from the mean

Payment of Fortuitous Losses

Fortuitous - unforeseen and unexpected by the insured and occurs a result of chance

Hurricane Ex. If you attempt to buy homeowners insurance when a hurricane is approaching, a wind loss is not fortuitous. Insurance company will deny you

An intentional act can result in a fortuitous loss

Risk Transfer

A pure risk is transferred from the insured to the insurer, who typically is in a stronger financial position

Indemnification

The insured is restored to its approximate financial position prior to the occurrence of the loss

Characteristics of an IDEALLY Insurable Risk

Large number of exposure units

Loss must be accidental and unintentional

Loss must be determinable and measurable

Loss should not be catastrophic

Chance of loss must be calculable

Premium must be economically feasible

Large Number of Exposure Units

Enables the insurer to predict average loss based on the Law of Large Numbers

Large numbers of similar exposure units needed

Can an insurance company insure things that they don't insure a large number of?

Yes, but there will probably be a high premium

Loss Must be Accidental and Unintentional

Loss should be outside of insured's control

Why?

Law of Large Numbers is based on randomness

If the insured can deliberately cause a loss that insurer covers, what is increased? Moral Hazard

Loss Must be Determinable and Measurable

Determinable

Can you determine if a loss occurred?

When might this be easy? Hard?

Measurable

Can you determine the amount of the loss?

When might this be easy? Hard?

Loss Should Not be Catastrophic (to the Insurer)

Allows pooling technique to work

Examples of catastrophes - terrorism, flood, earthquake

Why is a catastrophic loss problematic?

Solutions for insurers

Reinsurance

Diversification

Chance of Loss Must be Calculable

Must be able to calculate average frequency and average severity

You multiply them together to calculate expected loss

Premium Must be Economically Feasible

Insured must be able to afford it

Life Insurance Ex. The premium would be more economically feasible for a younger person than a 90 year old

Adverse Selection

Consumers with the greatest possibility of loss, are those that are most likely to purchase insurance

If not controlled by underwriting, results in higher than expected loss levels

Typically results from asymmetric information

Asymmetric Information

Occurs when one party has information that is relevant to a transaction that the other party does not have

Ex. Selling a car when you know there are some issues with it, but the buyer does not

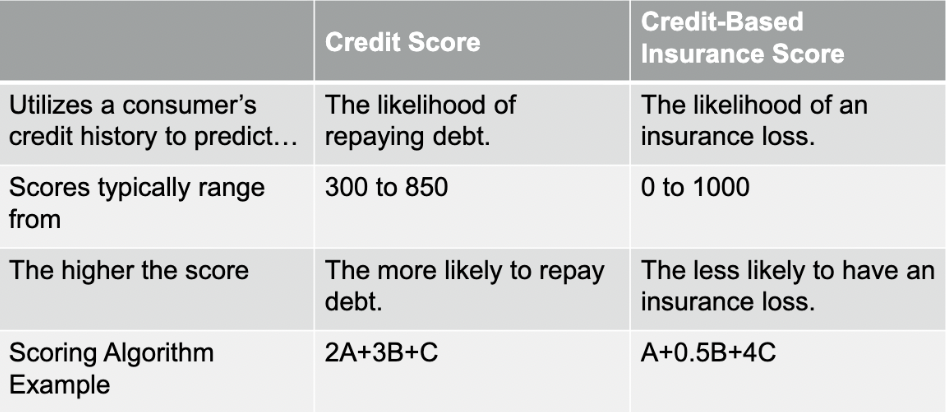

Credit-Based Insurance Score

Utilizes a consumer's credit history to predict the likelihood of future insurance losses

Introduced in the early 1990s

Not the same as credit score

Credit Score v. Credit-Based Insurance Score

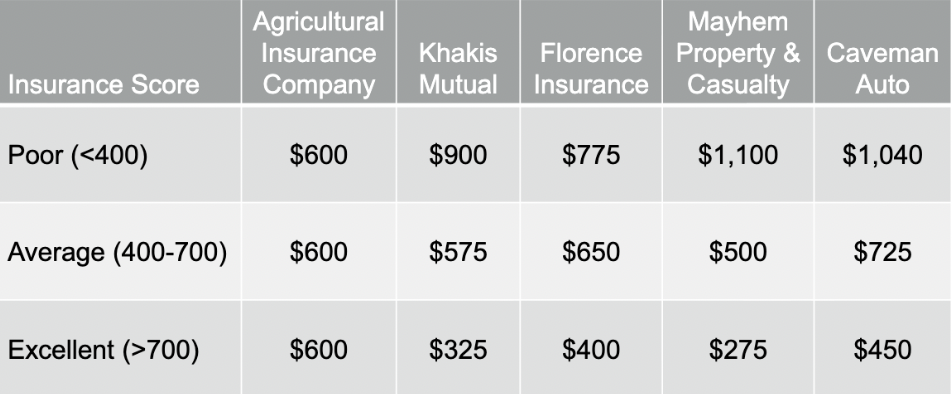

Adverse Selection Pricing Example

AIC is experiencing Adverse Selection

AIC charged an average rate for all risks

High risk individuals had an incentive to buy from AIC because the premium was too low relative to their risk

Because they were high risk, AIC insureds tended to have more accidents and higher claims

AIC's underwriting results deteriorated (low premium and high losses)

Types of Private Insurance

Life & Health

Property & Liability

Life Insurance

Pays death benefits to beneficiaries when the insured dies

Health Insurance

Covers medical expenses because of sickness or injury

Property Insurance

Indemnifies property owners against the loss or damage of real or personal property

Liability Insurance

Covers the insured's legal liability arising out of property damage or bodily injury to others

Casualty Insurance

Refers to insurance that covers whatever is not covered by fire, marine, and life insurance

Government Insurance

Social Insurance Programs

Financed entirely or in large part by contributions from employers and/or employees

Benefits are heavily weighted in favor of low-income groups

Eligibility and benefits are prescribed by statute

Government Insurance Examples

Old-Age, Survivors and Disability Insurance (Social Security) - any government system that provides monetary assistance to people with an inadequate or no income

Unemployment

Medicare

Found at both federal and state level

Federal Deposit Insurance Corporation (FDIC) - Insures banks deposit up to $250,000 per depositor

National Flood Insurance Program (NFIP) - live on coast/ near body of water; provides insurance to help reduce the socio-economic impact of floods

Fair Access to Insurance Requirements Plans (FAIR) - State-mandated, last-resort insurance programs providing essential property coverage to homeowners and businesses unable to secure insurance through the voluntary market

Beach and Windstorm Plans - Designed to provide coverage for wind and hail damage in high-risk coastal areas where private insurers refuse to provide it